Greenlight Kids & Teen Banking’s earns a 3.8-star rating from 38 reviews, showing that the majority of parents and young users are satisfied with financial management tools.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

Great Customer Service!

The first time I heard about Greenlight I immediately ordered my kids each a card and downloaded the app. At the time they were 12 & 6. I really wanted one for my middle schooler who was struggling with other kids asking her to buy them things during field trips. She also was struggling with either being given less or more money than her peers because it was whatever cash I had at the last minute. The greenlight card gave me the ability to quickly just transfer money without worrying about whether or not I had cash in my purse. It also made it so that I could quickly send her more, for instance when the family she went on an activity with suddenly did a sit down restaurant stop instead of fast food for lunch. Thankfully it wasn’t a big deal because she simply texted me and I sent her more lunch money than we had originally budgeted for...

I wasn’t sure about getting my 6 year old a card but since there was no extra charge for him I figured why not. He loved having a card just like Moms and I feel like I spend more time teaching both my kids money management because of Greenlight. It’s been 2 years already and my kids actively promote greenlight to their friends & various adults all the time. They love having their own cards and anytime they earn money, are given birthday money or their grandparents give them money they immediately ask me to put it on their cards. A few times the grandparents have given me money specifically to put in my kids Greenlight savings accounts towards something the kids told them they were working to buy! It’s been neat for the kids to get to actually SEE myself or their grandparents supporting them in their financial goals.

Over the last couple years I’ve needed to call customer service for one reason or another and they’ve always been extremely kind and helpful. I love growing up with this company and seeing the new features added since we started. We don’t use the allowance feature but I love that it’s there and how easy it is to use should I choose to give my kids an allowance. We also haven’t used the new “give” feature yet but I’m glad it’s there, I felt like it was missing and I’m working on incorporating it into their financial learning over the next year.

There are 3 improvements that I would love to see over the next few months:

#1) I would like it to be easier for my kids to “pay ______ back”... when they ask me to buy them something with an “ill pay you back” it’s hard for them to figure out how to “pay mom back”. I’d also like the same to be true for “give sibling money”. My older child is in Scouts and my younger one wanted to support a charity she was working on but couldn’t give her the money directly, they had to ask me to do it for them. We also had my daughter leave her card home on an overnight with their grandparents. When they went to the store my son agreed to loan his sister money... she had her phone and could have given him the money immediately if “give sibling money” was a feature available to them. (A parent on/off switch on each individual child’s ability to give siblings money might be a good idea though since not all kids/families would benefit from this).

#2) I would like my kids to be able to add money to their spend anywhere accounts through making an atm deposit. My 14 year old earned several hundred dollars last month babysitting and wanted it all on her card. She had more cash than I had in my account and our week was so busy there wasn’t time for me to take her cash to the bank then sit and transfer it to her card. This has happened several times over the last two years and I was really excited when I saw the atm feature that it was going to solve this for us. Sadly the atm feature is currently only to withdraw money...

#3) Save the change... Greenlight likes to work in whole dollars which makes it easier for me & my kids and I appreciate that. It would be nice if there was an on/off switch that allowed each child to chose to “round up” to the nearest dollar on a purchase and send the change to their savings. I think it would really teach them how fast small amounts can add up.

Overall Greenlight is an amazing company! It’s really easy to use and my kids are turning into great financial planners. Greenlight brings up financial questions when they are exploring the app and since they were already thinking about money they are more motivated to learn in that moment. My middle schooler was the kid who couldn’t save even a $1 when we started with these cards. 2 years later she’s now very motivated to earn money, sets financial goals for herself and has saved so much over the last year that I got worried and we looked up what the max limit on her card could be ! No worries though because greenlight has it more than high enough for her.

Greenlight Kids & Teen Banking Complaints 0

However, if you have something to share with the others, you can write a complaint

If you represent Greenlight Kids & Teen Banking, take charge of your business profile by claiming it and stay informed about any new reviews or complaints submitted.

About Greenlight Kids & Teen Banking

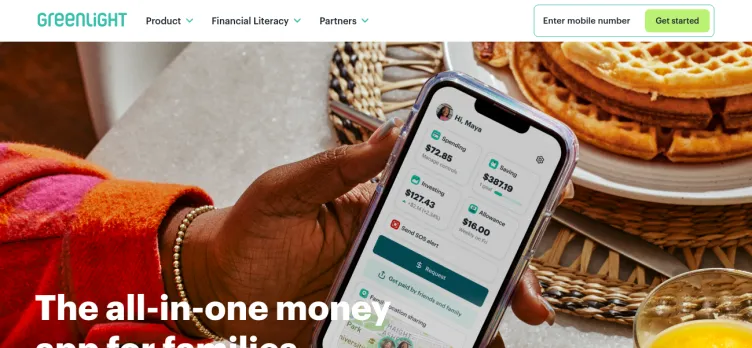

One of the key benefits of Greenlight is that it allows parents to set up a customized allowance system for their children. Parents can set up automatic transfers to their child's account, and can even choose to pay their child for completing certain tasks or chores. This helps children learn the value of money and the importance of earning it through hard work.

Another great feature of Greenlight is the ability to set spending limits and restrictions on the debit card. Parents can choose which stores and categories their child is allowed to spend money on, and can even block certain merchants altogether. This helps parents ensure that their child is spending money responsibly and within their means.

In addition to these features, Greenlight also offers a range of financial education tools to help children learn about budgeting, saving, and investing. These tools are designed to be engaging and interactive, making it easy for children to learn about important financial concepts in a fun and engaging way.

Overall, Greenlight Kids & Teen Banking is an excellent platform for parents who want to teach their children about money management. With its range of features and educational tools, it provides a comprehensive solution for parents who want to help their children develop healthy financial habits that will last a lifetime.

Overview of Greenlight Kids & Teen Banking complaint handling

-

Greenlight Kids & Teen Banking Contacts

-

Greenlight Kids & Teen Banking emailssupport@greenlightcard.com94%Confidence score: 94%Support

-

Greenlight Kids & Teen Banking social media

-

Checked and verified by Michael This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreMay 13, 2024

Checked and verified by Michael This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreMay 13, 2024

Our Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.

We have received your comment. Thank you!