LoanCare’s earns a 2.0-star rating from 326 reviews, showing that the majority of borrowers are somewhat dissatisfied with loan servicing.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

loan modification

Started mortgage modification 6/09. Send multiples requests for updated P & L information. Nothing happened until february 2010, on 8/29/10 -- Loan Care said they had us approved for trial modification and that I didn't need to make payment until 10/10. At the end of August 2010, I was only two months behind on mortgage. I waited for documentation, there was a delay, my negotiator's wife had cancer. totally understandable. They needed a couple more bank statements. No problem. My trial modification letter was dated September 30, 2010, and WHOOPEE! I didn't have to start the first payment until 11/1/10, which I did. I also made the 12/10 and 1/11 payments right on time. Eagerly called Loan Care asking what next step would be (I found out that LoanCare had started Foreclosure proceedings on 10/5/10 and that an attorney had my file). To add insult to injury, my loan has now been sold to Cenlar -- do not believe we will get a modification. DON'T TRUST ANYBODY WHO TELLS YOU "YOU DON'T HAVE TO MAKE A PAYMENT UNTIL..." Everytime I call Cenlar, I get a different person with a different story. AND i BASICALLY HAVE TO START OVER WITH MODIFICATION. Loan Care doesn't have my file anymore. I now have pneumonia and colitis from the grieve they have wrought! DON'T TRUST THEM!

The complaint has been investigated and resolved to the customer’s satisfaction.

horrible service

Loan care servicing company is by far the worse service company that I have ever dealt with! My mortgage was taken by them for servicing in early 2010. I have had issues with everything from trying to access mortgage statements (which I requested in may 2010 and have never received) to debit payments for my mortgage loan. What surprises me is the total incompetence of the customer support staff.. Managers included. It seems that everytime I would call with a small issue, I got a different suggestion for resolve from each person I spoke to... When I finally got a manager on the phone (this in itself took about a week) , I had to tell her that I was unhappy with the igonorance of her staff so much so that I was willing to go down to virginia and train them on customer relations etiquette! There is just sooooooo much I could write in complaining about the company but I dont think this space would suffice, nor do I have the strength to do so (trying to avooid carpal tunnel)...

This company is by far the worst.. I wish everyone would write letters demanding they be put out of business!

The complaint has been investigated and resolved to the customer’s satisfaction.

Predator

Is anyone knows how to gather together all people who has financial difficulties and damages from LoanCare. Can we get together and stand up for our rights.

It's been ten months that we are trying for loan modification with this company. It didn't moved, we are still there where we started. I can not find right word how to express myself about this ordeal. THIS IS NOT an AWFUL and DISPEAKBLE! It’s lot worst. Our mortgage was sold by "Lend America" to these fools. Lost money, charges witch I disagreed to pay because it wasn’t my fault but they go in my escrow account and deducted. My request about that money hanging in the air. Last mortgage statement we received on March 2010. Eight times I requested for statements no response. I have so big file I think good for good court case. Is any body knows how to switch servicer on your mortgage? I will really appreciate for advice how to change LoanCare to another servicer who is more honest and dissent.

I would never have hard feelings to person who would heart me. But!

I pray to GOD in this Holiday Season to give to “LoanCare” what company deserves for they do to people. I pray every night for that.

The complaint has been investigated and resolved to the customer’s satisfaction.

Please if anyone know how to bring a class action case. We have a good ground for it. First i had a modification with PHH., It was done and the mortgage was going forward and no arrears, suddenly someone called me to inform me that i owed $12, 000+. I told her a whole year story and since i have been mailing the mortgage payment to LOAN CARE i have been sending the bank certified check, After that she apologized but says we will send you a package and i told her that i have received a package and send it back, again she apologized again and two days later i got another 12, 000 dollar bill. Have been trying to reach them since the but all effort was in vain. THEY DEFINATELY DID NOT KNOW WHAT THEY ARE DOING.

I need advice anyone please help.

They are crooks and should not be able to get away with this

My Grandparents got stuck with this loan when they bought the home they are living in now. The gentalman that they bought the home through tacked on an exrea $25, 000 in a personal loan and he used this place. The loan became muture and now they want to up the interst on them. The payments are $162.17 and only $.37 cents is going towards the loan. Now they want them (grandparents) to pay $100 more a month.

awful company!!!

I have been dealing with LoanCare Servicing since October 2009, just about 7 months. I have a Balloon Modification that was due Oct. 2010. They never contacted me I contacted them! They were surprized that I didn't recieve any paper work and they said they would get right on it. Well it is now April and I still have not recieved my Ballon Modification and nobody gets back with me. I call them all the time and spend countless time on the phone being put on hold. I really don't know where to turn so I called channel 7 Ruth to the rescue and she has not gotten back to me yet, another phone call to her. So if you can avoid doing any buisness with LoanCare I recommend that you stay away from them, bad news. My home is all I have in this world and I intend to keep it. I have been putting my house payments in the bank and not sending them in because I don't have a mortgage. I have tried very hard to keep my credit on good standing I sure hope that this doesn't affect it!

The complaint has been investigated and resolved to the customer's satisfaction.

I'm selling my house and I need a payoff request form before the buyer gets tired of waiting and backs out!

When clicking on any of the payment options, and error message says:

"Sorry, something happened. Try again later."

See attached screenshot.

This has been going on for several weeks at this point.

I submitted paperwork for a loan assumption in July 2022 and Loancare has not processed the request yet.

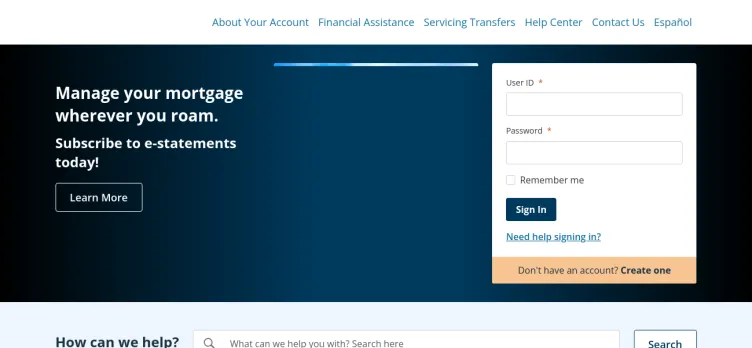

Your website is down again! I am not able to make payment because the login portal is not working. I receive a "can not verify credentials" error message when logging in. I have reset the password numerous times. This happens monthly.

Please fix your website.

Hello,

If your concerns still exist, please reach out to us by email at socialsupport@loancare.net so that we can look into this matter in regards to the error message you are receiving.

I have called this company 7 times, I emailed, sent requestes via web site,

all I need is to pay off my mortgage

I still don't have the information, after all attempts

IT IS ALL DECEPTION

misleading information.

emails that wont work...

robotic responses that is not accurate.

stay away from this company...

I am having issues as well. I just had a meeting with a class action attorney in VA. They are willing to take on the xase and start a class action. If you would like to be part of please contact me

Hello,

We understand your frustrations, please keep our information handy if you would like to elaborate, you can reach out to us by email at socialsupport@loancare.net.

Same they are a criminal corporation.

I would love this information. As Im dealing with them giving me the run around also I've talked to a lawyer, but would love to find one that is already dealing with these complaints

Is it too late to get involved in this? I tried mortgage Modification but the info the bank provided was incorrect locking me out of the process from the start.

This company is a fraud! They have misappropriated moneys, filed false information,

do not always pay taxes from my escrow account. I get a constant run around. Who can take them on? Is it the Banking Oversight Committee?

House burned 5/16. LoanCare received pay off check on or BEFORE 6/14. LoanCare tried to draft our 7/1 payment. We put a stop payment on it an incurred a fee to do so. Called multiple time to get information. No help whatsoever. Called 7/9 stayed on phone for 55+ minutes. NO RESOLUTION. LoanCare will not apply our final payment and send refund.

Lawsuit against Lakeview Loan Servicing, LLC to stop a foreclosure in Alabama

Hope you find this helpful and if we can help you in any way in Alabama, let us know. You can call us at [protected] or fill out our contact form and we’ll get right back with you.

Thanks

John Watts

JURISDICTION AND VENUE

This is an action brought by a consumer for violations of the Fair Debt Collection Practices Act (15 U.S.C. § 1692 et seq. [hereinafter “FDCPA”]), the Real Estate Settlement Procedures Act[1], 12 S.C. § 2605 (“RESPA”), the Truth in Lending Act (“TILA) and state law by the Defendant including an illegally scheduled foreclosure on December 4, 2017.

This lawsuit is also brought under the authority of Plaintiff’s Mortgage – the very paragraph that Defendants seek to use to foreclose expressly gives Plaintiff the right to bring this court action to assert defenses.

Paragraph 22 of the Mortgage allows for this lawsuit.

Venue is proper in this Court as Plaintiff resides in this County and all Defendants do business in this County.

PARTIES

The Plaintiff is a natural person who resides within this County.

Defendant Lakeview Loan Servicing, LLC (“Defendant” or “Lakeview”) in this action is a foreign corporation doing business in this County, and is considered a “servicer” under RESPA and is considered a debt collector under the FDCPA as it was assigned the debt at issue when the debt was allegedly in default and its in the business of collecting defaulted debts owned by others.

Fictitious defendants A-Z are those defendants who caused or are responsible for the harm done to Plaintiff. Any reference to “Defendant” or “Defendants” or “Defendant Lakeview” includes all fictitiously described defendants as well.

FACTS

RESPA and TILA apply to Defendants[2] and to the loan at issue in this case.

The FDCPA is a federal law that applies to debt collectors such as Defendant Lakeview.

It prohibits deceptive conduct of any type as well as harassing or unfair conduct, even on debts that are owed.

Here, Defendants made false statements to and their conduct can only be described as unfair and harassing.

Defendants have repeatedly violated the strict liability FDCPA.

Defendants are collecting on this debt illegally including the fact that the Defendants have scheduled an illegal foreclosure on December 4, 2017.

Defendants Were Never Assigned The Mortgage And Have No Right To Foreclose

For the sake of time, not every fact will be pled but enough will be to show that Defendant Lakeview does not own this debt and has no right to foreclose.

The mortgage – the document that secures the debt to the property – was signed on August 16, 2010.

It did not involve Defendant in any way.

It was between Plaintiff and MERS (Mortgage Electronic Registration Systems, Inc.).

On February 6, 2017, a “Corporate Assignment of Mortgage” was signed.

And filed in Probate Court on the same day.

It clearly shows the date of assignment as “February 6th, 2017”.

“Assignor: PHH Mortgage Corporation at 1 Mortgage Way, Mt. Laurel, NJ 08054”.

“Assignee: Lakeview Loan Servicing, LLC at 4425 Ponce De Leon Blvd, MS 5-251, Coral Gables, FL 33146”.

The February 6, 2017, assignment was signed by “Jacqueline Watkins, Assistant Secretary”.

It was notarized by Regina D. Brundage in the State of New York, County of Erie.

“David Siwa” of “PHH Mortgage Corporation (PHHM) 220 Northpointe Pkwy prepared the document. Amherst, NY 14228”.

So on February 6, 2017, a signed and notarized and filed document clearly indicates PHH assigned the loan to Lakeview.

One problem.

PHH did not own the loan at this time.

A company, such as PHH, cannot assign what it does not own.

While this sounds like a bad joke of someone selling the Brooklyn Bridge, this is par for the course in the deceptive world of modern mortgage companies.

Remarkably, on February 22, 2017, the mortgage companies attempt to demonstrate time travel.

This is when a “Corporate Assignment of Mortgage” was signed, notarized and filed in Probate Court.

“Assignor: Mortgage Electronic Registration Systems, Inc. as nominee for USAA Federal Savings Bank, its successors and assigns at P.O. Box 2026 Flint, MI [protected].”

Who did MERS assign the mortgage to on February 22, 2017?

LoanCare Reviews 0

About LoanCare

Here is a guide on how to file a complaint against LoanCare on www.myloancare.com on ComplaintsBoard.com:

1. Log in or create an account:

- Start by logging into your ComplaintsBoard.com account or create a new one if you don't have an account yet.

2. Navigating to the complaint form:

- Locate and click on the 'File a Complaint' button on the ComplaintsBoard.com website, found at the top right corner.

3. Writing the title:

- Summarize the main issue with LoanCare in the 'Complaint Title' section.

4. Detailing the experience:

- Provide detailed information about key areas of concern.

- Mention relevant transaction details with the company.

- Explain the nature of the issue.

- Describe steps taken to resolve the problem and the company's response.

- Share the personal impact of the issue.

5. Attaching supporting documents:

- Attach any relevant supporting documents but avoid including sensitive personal data.

6. Filing optional fields:

- Use the 'Claimed Loss' field to state any financial losses.

- Specify the desired outcome in the 'Desired Outcome' field.

7. Review before submission:

- Ensure your complaint is clear, accurate, and complete before submitting.

8. Submission process:

- Click the 'Submit' button to submit your complaint.

9. Post-Submission Actions:

- Regularly check for responses or updates related to your complaint on ComplaintsBoard.com.

Make sure to follow these steps to effectively file a complaint against LoanCare on www.myloancare.com.

Overview of LoanCare complaint handling

-

LoanCare Contacts

-

LoanCare phone numbers+1 (800) 274-9900+1 (800) 274-9900Click up if you have successfully reached LoanCare by calling +1 (800) 274-9900 phone number 0 0 users reported that they have successfully reached LoanCare by calling +1 (800) 274-9900 phone number Click down if you have unsuccessfully reached LoanCare by calling +1 (800) 274-9900 phone number 0 0 users reported that they have UNsuccessfully reached LoanCare by calling +1 (800) 274-9900 phone numberHead Office+1 (800) 274-6600+1 (800) 274-6600Click up if you have successfully reached LoanCare by calling +1 (800) 274-6600 phone number 0 0 users reported that they have successfully reached LoanCare by calling +1 (800) 274-6600 phone number Click down if you have unsuccessfully reached LoanCare by calling +1 (800) 274-6600 phone number 0 0 users reported that they have UNsuccessfully reached LoanCare by calling +1 (800) 274-6600 phone number

-

LoanCare emailscustomersupport@myloancare.com100%Confidence score: 100%SupportCustomer.Advocate@myloancare.com100%Confidence score: 100%Supportsocialsupport@loancare.net100%Confidence score: 100%Support

-

LoanCare address3637 Sentara Way, Virginia Beach, Virginia, 23452, United States

-

LoanCare social media

-

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreOct 28, 2024

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreOct 28, 2024

Most discussed complaints

Loancare website/portal to pay your mortgage.Recent comments about LoanCare company

Loancare website/portal to pay your mortgage.Our Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.

My home was totally destroyed by fire. After getting my composure, I called my insurance company. A rep was at the site within an hour of the call, with an immediate hardship check in hand. In route to us he received information that my premium had not been paid. Loan Care was billed in August for premium and the fire was the following January. I had no insurance for four months and Loan Care hadn't even noted it. They set up a replacement policy costing 3x my original premium after 2weeks of phone calls and this policy didn't not have the coverage of my original policy. I have been displaced since January and loan care's policy has no displacement benefits. Where as mind did.