Seeking Alpha’s earns a 1.3-star rating from 24 reviews, showing that the majority of investors are dissatisfied with financial insights and analysis.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

Beware of Hidden Charges: My Experience with Seeking Alpha Premium Service

I recently decided to give seekingalpha.com (SA) a try by signing up for their 14-day free trial of their premium service. I was excited to see what they had to offer and was looking forward to exploring their platform. However, my experience with SA was not as smooth as I had hoped.

According to their promotion, I would not be charged if I canceled my subscription on time. So, I canceled my subscription on the same day I signed up. To my surprise, I found out that my credit card had been charged $320.80 for an annual fee. The fee was not charged for the premium service I had signed up for, but for an unknown service called 'The data driven investor' (DDI).

I was confused and frustrated because I had only subscribed to one service, the 14-day premium free trial. I did not click on any button to subscribe to the DDI service, nor did I agree to an annual subscription. The only email I received from SA about DDI was automatically assigned to me, and the trial period was also 14 days. However, SA sent me too many emails a day, and this email did not catch my attention. As a result, I canceled the premium service on time, but I did not cancel the DDI service, which led to the charge on my credit card.

Getting a refund was not an easy process, and it took some effort on my part. However, I will give SA credit for eventually refunding my money. I want to caution others who are considering using SA to be careful when subscribing to their services. They may assign additional services to you without your knowledge, so it's essential to read every email in detail to avoid being charged for services you did not intend to use.

Overall, my experience with SA was not the best, but I appreciate that they eventually refunded my money. I hope that they will improve their communication and make it clearer to users what services they are signing up for.

Review of Seeking Alpha: A Valuable Resource for Investors with Room for Improvement

I've been using Seeking Alpha for a few years now and I've come across a number of authors who have been really helpful. I've continued to subscribe to those authors who have provided me with valuable insights and knowledge about the stock market. However, there have been a few authors who I've canceled my subscription to after the 2 week free trial period. Even though I've canceled my subscription to them, I've still learned a lot from their articles.

One thing that I've noticed about Seeking Alpha is that the comments section can be a bit off-topic at times. I agree with some of the comments that some of the comments are not appropriate and should not be allowed. However, I also believe that restricting freedom of speech is not the solution. Political comments are not appropriate on a website that is used for discussing investments in stocks or bonds.

One of my biggest complaints about Seeking Alpha is that they don't track their authors' results. There are way too many authors for an investor to track their results, but Seeking Alpha should be able to rate an author's results. It would be helpful if they could provide readers with a specific percentage of results for each recommendation.

When I first started using Seeking Alpha, there were a lot more free articles about individual stocks than there are now. I think that Seeking Alpha should establish rules about authors attempting to pump subscriptions. Authors who are releasing their articles for public consumption should be required to release them within a week of their release to subscribers, otherwise their information is outdated.

Overall, I think that Seeking Alpha is a great resource for investors who are looking to learn more about the stock market. However, there are a few things that they could improve on, such as tracking their authors' results and establishing rules about authors attempting to pump subscriptions.

Misleading Cancellation Process and Poor Customer Service: My Experience with Seeking Alpha

I recently had an experience with Seeking Alpha (SA) that left me feeling frustrated and misled. I had heard about SA's premium service and decided to take advantage of their 14-day free trial. However, after signing up, I quickly realized that the service was not for me and decided to cancel my subscription within the free trial period.

To my surprise, two weeks later, I received my credit card statement and saw a charge made by SA. I immediately wrote an email requesting a refund and called their customer service. The representative I spoke with informed me that I had only canceled a service called 'The data driven investor' (DDI) and not the premium service. I was confused because I had subscribed to a 14-day premium free trial and when I clicked on "cancel" under my account setting "paid subscription", I believed I had canceled my premium service.

However, SA was saying that I had canceled DDI and not the premium service. This was very misleading and confusing. I knew that there was a subscription behind the premium service, and I had canceled the premium service, but DDI was canceled instead. The representative was not willing to refund me, and I asked to speak with her manager. She was very unwilling, but eventually, she went to check and came back to inform me that the manager had stepped outside, and she would let the person know.

I had to go through a whole nine yards going back and forth, and I felt like I was getting a scam-like customer service. Finally, I received an email from SA with an open ticket about my issue. I am still waiting for a refund, and until then, I am going to give a zero-star rating to SA.

Overall, my experience with SA was not a positive one. Their cancellation setting is misleading and can trick you into canceling the wrong service. Their customer service was not helpful, and I felt like I was being scammed. I hope that SA can improve their cancellation process and customer service to avoid these types of issues in the future.

Seeking Alpha: A Comprehensive and Reliable Source for Investment Information

I have been using Seeking Alpha for many years now and I must say that I am a very satisfied user. Seeking Alpha provides a great variety of investment information on all types of investments, written by competent authors whose positions are cleverly completed by recommendations of other articles on related subjects and reader's comments, which are generally as interesting as the authors' articles.

The customer service at Seeking Alpha is excellent, courteous, and friendly. They are always ready to help and answer quickly to any question or problem. What's more, all of this is available for free with the SA Standard service or at a very affordable price with the Premium service.

Seeking Alpha, both free and Premium, has become my main source of information for my investment decisions. There are so many authors, tools, and sources to choose from, all displayed in an easy-to-use and easy-to-understand way. I have been using the free standard service profitably for many years, and it is very complete by itself.

It took me several years before I considered that I would need the Premium service, but a great promotion price helped me to take the decision. Now, after two years of using the Premium service, the facts are that it has paid for itself easily. I do not consider it anymore as an expense but rather as an irreplaceable knowledge and decision asset to investing.

As a retired individual investor from BC Canada, I highly recommend Seeking Alpha to anyone who is looking for a reliable source of investment information. Whether you are a beginner or an experienced investor, Seeking Alpha has something for everyone. So, if you want to make informed investment decisions, give Seeking Alpha a try. You won't be disappointed!

Seeking Alpha's Moderation Policies: Frustrating Restrictions on Free Speech

Seeking Alpha has been a source of frustration for me lately. I was put into "moderation status" for months, which meant that every comment I made had to be approved by their "moderation team" before it could be published on their site forum. This was a real hassle, and it felt like my right to free speech under the First Amendment of the US Constitution was being violated. I even contacted Trustpilot about Seeking Alpha's selective censorship, and they eventually lifted my moderation status and allowed me to express my opinions without censorship.

However, my freedom was short-lived. Without warning, Seeking Alpha put me back into moderation mode, which means that I have to wait for them to approve my comments before they can be published. I followed their own recommended company policy and sent them an email requesting an explanation of what comment(s) caused me to be put back into moderation status. I was polite and respectful in my request, and I even asked for education so that I could avoid making any "offensive" comments in the future. But they never replied to my email, and I'm still stuck in moderation mode.

I'm really upset about this, and I strongly object to this restriction of my First Amendment rights. It's not fair that other commenters on Seeking Alpha forums can write the most vile and objectionable comments without fear of censorship, but I'm being persecuted for expressing my opinions. It's a classic case of a member of an Internet community being unfairly targeted by the site's moderators.

Despite my frustrations with Seeking Alpha's moderation policies, I still find the site to be a valuable resource for investors. They have a lot of great articles and analysis, and I've learned a lot from reading their content. However, I think they need to be more transparent about their moderation policies and be more consistent in their enforcement. It's not fair to single out certain users for censorship while allowing others to say whatever they want.

Seeking Alpha Review: Uninformed Articles and Possible Stock Manipulation

Seeking Alpha is a website that publishes articles about stocks and investments. While there are some decent articles on the site, the majority of them are not worth reading. Many of the articles are written by college students, and the writing style is often sophomoric. The ideas presented in these articles are usually uninformed and not worth considering.

Of the remaining articles, most are written by people who have a position in the stock, and they are writing to manipulate the stock to benefit their position. These articles are often filled with arguments that are not convincing and are not worth reading. It is rare to find an article on Seeking Alpha that is worth reading, and most of the exceptions are articles that were originally published elsewhere.

My main concern with Seeking Alpha is that the editors and owners may be selective with the articles they publish to benefit their personal positions in the stock. This is a loophole in the SEC guidelines, and it is difficult for legislation to prevent this kind of thing. I believe that Seeking Alpha was created primarily to take advantage of this loophole so that the owners of the site could manipulate individual stocks and get wealthy while doing so, all without breaking any laws.

In conclusion, I would not recommend relying on Seeking Alpha for investment advice. The articles on the site are often not worth reading, and there is a possibility that the editors and owners may be manipulating the stock to benefit their personal positions. It is important to do your own research and not rely on any one source for investment advice.

Review of Seeking Alpha: Good Authors, but Inconsistent Moderation and Misinformation in Comments

Seeking Alpha is a website that has some really good authors like Chris Ciovacco and Taylor Dart, but you have to go through a lot of snake oil salesmen, fear mongers, and just plain incompetent hacks to find them. There is no vetting of authors, so every wannabe "analyst" posts there, and some of them even charge people money to read their garbage analysis. I had one author tell me that fact-checking was too much trouble and would inhibit his productivity LOL. The comments sections are filled with misinformation spread by short-term traders trying to manipulate the gullible investors who also post there. I could live with all of this, I understand it's the internet, but for the incredible hypocrisy of the moderators, who are dumb as a box of rocks. If you dare call somebody a liar or a BS artist and someone complains they will delete your comment and filter all future comments. Thereafter if you try to say anything that sounds even remotely sarcastic, confrontational, or critical of the moderators, your comment will never appear. Dupe gullible investors by spreading misinformation and lies? THAT'S A OK. Call out someone for said behavior? Comment deleted for personal attack/harsh language, and now they will closely monitor your posts, and if in their infinite wisdom they decide that your post doesn't add value then it simply won't appear. Oh and even if it does appear it will often be hours after you submitted the post. Meanwhile some of their popular authors regularly post childish responses to comments and they aren't monitored at all. BTW, if you email the mods to ask why a certain post is not allowed they will simply ignore you. That's right, the site provides an email address to query the moderators, but it is completely useless since they won't respond to it. See also john W.'s review below, he is right on the money.

Despite the issues with the website, there are some really good authors on Seeking Alpha. Chris Ciovacco and Taylor Dart are two examples of authors who provide valuable insights and analysis. However, the problem is that there are many more authors who are not as competent and provide little value to readers. The lack of vetting of authors means that anyone can post on the website, and some even charge money for their analysis, which can be of poor quality.

The comments sections on Seeking Alpha are also problematic. Short-term traders often spread misinformation to manipulate gullible investors who also post there. This can lead to confusion and poor investment decisions.

The moderators on Seeking Alpha are also a source of frustration for many users. They seem to be hypocritical and inconsistent in their moderation. If someone calls out another user for spreading lies or misinformation, their comment may be deleted and future comments filtered. However, if someone spreads lies and misinformation themselves, they may not face any consequences. Additionally, if someone is critical of the moderators, their comment may be deleted or not appear at all.

Despite these issues, some popular authors on Seeking Alpha are not monitored at all and are allowed to post childish responses to comments. This inconsistency in moderation is frustrating for users who are trying to have meaningful discussions about investments.

Overall, Seeking Alpha has some good authors and valuable insights, but it is marred by the lack of vetting of authors, misinformation in the comments sections, and inconsistent moderation.

I too have experienced extreme bias by Seeking Alpha moderators who allow others to attack my posts and will not allow rational responses that refute the misinformation they are spewing. They will not respond or tell me exactly why I am being censored when they allow people to say thing that are clearly stated as against the rules. The bias is to the left politically for sure as they allow attacking of anyone supporting President Trump or the conservative right in general.

Beware of Seeking Alpha: A Biased Stock Website Out to Control Stocks

I have been a member of Seeking Alpha for over five years now and I must say that it is not a trustworthy site. The so-called "moderators" and editors write news articles daily with the intention of swaying stocks their way. In my opinion, most of the authors are not only paid by Seeking Alpha, but they are also being paid by outside brokerage houses to try to sway the stocks in their favor, either positively or negatively.

One of the biggest issues with the site is that anyone can become a member without any kind of bio or way to show that they are a real person. This has led to many new trolls appearing and throwing out one-liners to try to control the threads. These trolls can have your post tossed at will, and the moderators will ban you if you don't follow their thinking. Seeking Alpha undoubtedly has trolls patrolling articles that could have some members banned for not agreeing with their thinking. I have complained countless times about their site being totally biased, but they seem to care less. The moderators are totally biased and definitely have their select authors.

I was very vocal about the stock SDRL, and I was constantly ridiculed by no bio trolls with the names of Million$man, Elvis Level, A Prudent Investor, Sallie DD, and even their prized "author" Stobe Fox Capital berating my posts. Actually, Stone Fox Capital would write an article and then use an assortment of false alias names to respond to members on his article. He even slipped once and admitted that I was indeed actually talking to him through his made-up alias. Then SFC started to hound me on all of my other stocks I follow and started to have my posts pulled on those other stock articles.

In my opinion, Seeking Alpha should be banned from operating as a business on the internet, but lax laws pertain to stock sites. Do yourself a favor and remember that anytime you get "free advice" over the internet, take it with a grain of salt.

SEEKING ALPHA is a totally biased stock website out to control stocks any way they can. Do your own due diligence and trust your gut feelings when buying or selling stocks. Nobody will look after your money interests better than you. The internet is full of scammers, so be careful out there.

Biased and Slanted: A Review of Seeking Alpha's Article on Peabody Coal Company

I recently had an experience with Seeking Alpha that left me feeling frustrated and belittled. I had attempted to correct an article or comment that was claiming to disinvest in any company with a carbon footprint, but instead of being met with collegiality, I was met with hostility and my comment was deleted. It seems that providing real facts is annoying to the alpha moderator.

One particular article that caught my attention was about Peabody coal company. The article claimed that EIA forecasts coal consumption decline of 0.7% through 2050 and that Peabody was identified with possible mine closure in the future. The author suggested that investors should dump Peabody prior to the bankruptcy ruling as it has great market risks. In addition, the author claimed that coal companies may receive government assistance to thwart the forecasted decline. The author went on to compare the management at Peabody to the tobacco industry and claimed that the coral reef is dying. The author also made the assertion that corporations in most of the world have exploited resources of the people (except Norway). The author concluded by stating that CO2 is used today for enhanced oil recovery and CCS will create more CO2 and possibly impact oil production. The author suggested that CCS is not commercially viable and that smart coal executives know this fact. The author also claimed that the Southern Plant intended to demonstrate the next generation of coal gasification that also happened to have a small CCS involving enhanced oil recovery component has failed. The author's final conclusion was to ignore Peabody coming out of bankruptcy as a viable company, ignore EIA forecasts, ignore facts, logic, or common sense, and to dump Peabody.

While I appreciate the author's passion for the environment, I found their article to be biased and slanted. The author seemed to be more interested in pushing their own agenda than providing unbiased information to investors. As a result, I found the article to be of little value in determining if Peabody is a viable investment.

In conclusion, I believe that investors should do their own research and make their own decisions based on the facts. While it is important to consider the impact of a company's carbon footprint on the environment, it is also important to consider the financial viability of the company. As for me, I have no current investments in coal, but if I do decide to invest in the future, I will not be relying on biased and slanted articles like the one I encountered on Seeking Alpha.

Disappointing Customer Service from High Dividend Opportunities by Rida Morwa and Seeking Alpha

I recently subscribed to High Dividend Opportunities by Rida Morwa and was disappointed to find that after 11 months, I was no longer able to access the service. Despite repeatedly reaching out to support for assistance, I received no response. I even contacted Rida Morwa directly, who promised to authorize a refund for the lost month, but nothing came of it. To make matters worse, my one-year subscription expired without any refund or extension for the lost month. As a paying customer who received only 11 months of service instead of the full 12, I feel cheated and misled.

When I reached out to Seeking Alpha for help, their response was less than satisfactory. They claimed that my subscription was "active" during the 12-month period, but this is meaningless if I couldn't access the service for one of those months. Seeking Alpha also suggested that I reset my password, but this advice came too late and was ultimately ineffective. The link they provided to reset my password was dead, and I was still unable to access my subscription.

I find it disappointing that Seeking Alpha would try to shift the blame onto me, the customer, rather than taking responsibility for their lack of timely customer service. All I wanted was a one-month extension for the month I lost access to the service, but instead, I received nothing but excuses and empty promises. As a result, I have lost faith in Seeking Alpha and will be warning my 7,167 subscribers to avoid this service.

It's a shame that this situation couldn't have been resolved with a simple act of common courtesy and customer service. Seeking Alpha had the opportunity to make things right, but instead, they chose to ignore my requests and offer ineffective solutions. As a paying customer, I deserved better treatment than this.

Seeking Alpha Complaints 14

Disappointing Premium Services: Seeking Alpha's Faulty Chat Software and Lack of Responsibility

THEM!

I have been using Seeking Alpha for a while now and I have to say that I am quite disappointed with their premium services. While the website itself is quite informative and helpful, the chat software that they offer is quite faulty. It keeps freezing during times of significant market volatility, which is usually the best time to take or exit trades. This has resulted in me missing out on trade alerts and incurring financial losses.

What's even more frustrating is that these failures occur on a regular basis, as can be confirmed by monitoring their forums. I have contacted SA support several times to request compensation for my losses, but unfortunately, my requests have been refused. They have taken zero responsibility for their faulty service and have not even offered me a promo code to make up for my losses.

I find it quite disappointing that a company like Seeking Alpha, which prides itself on providing quality financial information, would not take responsibility for their mistakes. It is a shame that they consider it a normal business practice not to compensate for minor outages, especially when those outages result in financial losses for their customers.

Overall, while I still find Seeking Alpha to be a useful resource for financial information, I cannot recommend their premium services due to the faulty chat software and lack of responsibility for their mistakes.

Seeking Alpha Review: Biased Authors and Limited Technical Analysis

Seeking Alpha is a website that has a lot of authors who write about stocks and investing. But, let me tell you, most of these authors have their own agenda. They only write about what they want to write about, and they don't care about anything else. It's like they have blinders on and can't see anything else.

One thing that really bothers me about Seeking Alpha is that they are completely biased against Technical Analysis. Even though many of the authors have good track records, they won't publish anything that has too much TA in it. I remember following Sol Palha and Arvy, and suddenly Sol Palha stopped publishing. I asked him why, and he told me that they wouldn't publish any article unless he included fundamental analysis and kept the TA to a minimum. The ironic part is that this author proved himself over and over again through the articles he had published on other sites, but they wouldn't have it. So Sol left, and then Arvy also left.

Their premium service is now a joke. Who would pay $200 for such a service? I asked someone who used it for two months, and they said they got nothing out of it. It's just a waste of money.

Overall, I think Seeking Alpha is a decent website if you're looking for some basic information about stocks and investing. But, if you're looking for in-depth analysis or technical analysis, you're better off looking somewhere else. The authors on this site have their own agendas, and they won't publish anything that doesn't fit their narrative. So, take everything you read on Seeking Alpha with a grain of salt.

The Controversy Surrounding Seeking Alpha: Lack of Integrity and Enabling Short Attacks

Seeking Alpha is a newsletter that has been causing a lot of controversy lately. Many people are saying that it lacks integrity and that it is enabling short attacks. There have been a lot of articles on the website that have been written by anonymous authors. This is a big problem because it is hard to know who is writing these articles and what their motives are.

One recent article was written by someone who goes by the name of Night Market research. This is a made-up name, and we don't know anything about this person. They claim to be a trader/investor with credit and equity management who likes sharing investment ideas. But again, we don't know if this is true or not.

In the article, Night Market research quotes opinions from two experts, but they don't name these experts. This is a big problem because it is hard to know if these experts are real or if they are just made up. It is also hard to know if they have any biases or conflicts of interest.

This kind of market manipulation should not be allowed. It is important for people to demand better standards from websites like Seeking Alpha. We should all boycott the website, cancel our subscriptions, and encourage others to do the same. This is the only way to send a message that we will not tolerate this kind of behavior.

In conclusion, Seeking Alpha is a website that has a lot of problems. It lacks integrity, and it is enabling short attacks. We need to demand better standards from websites like this, and we need to hold them accountable for their actions.

Is Seeking Alpha Legit?

Seeking Alpha earns a trustworthiness rating of 91%

Highly recommended, but caution will not hurt.

We found clear and detailed contact information for Seeking Alpha. The company provides a physical address, 2 phone numbers, and 2 emails, as well as 4 social media accounts. This demonstrates a commitment to customer service and transparency, which is a positive sign for building trust with customers.

Seeking Alpha has received 2 positive reviews on our site. This is a good sign and indicates a safe and reliable experience for customers who choose to work with the company.

The age of Seeking Alpha's domain suggests that they have had sufficient time to establish a reputation as a reliable source of information and services. This can provide reassurance to potential customers seeking quality products or services.

Seekingalpha.com has a valid SSL certificate, which indicates that the website is secure and trustworthy. Look for the padlock icon in the browser and the "https" prefix in the URL to confirm that the website is using SSL.

Seekingalpha.com has been deemed safe to visit, as it is protected by a cloud-based cybersecurity solution that uses the Domain Name System (DNS) to help protect networks from online threats.

Seeking Alpha as a website that uses an external review system. While this can provide valuable feedback and insights, it's important to carefully evaluate the source of the reviews and take them with a grain of salt.

We looked up Seeking Alpha and found that the website is receiving a high amount of traffic. This could be a sign of a popular and trustworthy website, but it is still important to exercise caution and verify the legitimacy of the site before sharing any personal or financial information

However ComplaintsBoard has detected that:

- While Seeking Alpha has a high level of trust, our investigation has revealed that the company's complaint resolution process is inadequate and ineffective. As a result, only 0% of 14 complaints are resolved. The support team may have poor customer service skills, lack of training, or not be well-equipped to handle customer complaints.

- Seeking Alpha protects their ownership data, a common and legal practice. However, from our perspective, this lack of transparency can impede trust and accountability, which are essential for establishing a credible and respected business entity.

- The sensitive services provided on this website are hosted on a shared server, which may increase the risk of unauthorized access and data breaches. It is important to ensure that the website has adequate security measures in place to protect user data, such as encryption and secure authentication protocols.

Seeking Alpha: Overpriced and Underwhelming - A Review

I gotta say, I ain't too impressed with Seeking Alpha. Sure, the app works alright, but the info they give ain't nothin' special. You can find the same stuff for free on any ol' trading app. Why anyone would pay for this service is beyond me. I fell for it and paid for a whole year, and let me tell ya, it was a complete waste of money. And to make matters worse, they auto-charged me for another year without my permission! When I asked for a refund, they flat out denied me. I reckon their own stock picks ain't doin' too hot, so they gotta scam folks outta their hard-earned cash. My advice? Stay far away from these jokers. And if you do use 'em, make sure to take your payment method off so they can't rip you off even more.

Seeking Alpha: A Wide Range of Opinions with Some Annoyances

I just read some reviews about Seeking Alpha and I have to say, I disagree with the critics. They seem to be overly angry and therefore, not trustworthy. In my experience, if you follow the advice of writers like Fear and Greed or Jani Ziedins, you can be quite successful. Of course, you have to choose your advisor wisely and be prepared for both losses and profits. But that's the beauty of Seeking Alpha - you get exposed to a wide range of opinions.

However, there is one downside to Seeking Alpha that I find annoying. Once you've used up your two free articles (I'm not a subscriber), you get excluded from reading more. But I've already figured out which writers provide valuable reads, so it's not a big issue for me.

For those who still want to criticize Seeking Alpha, I suggest reading Karl Popper. He was one of the most interesting logicians and philosophers who ever lived, second only to Aristotle. Popper's approach to critiquing others' work is much more sober and rational. In veritate locuti sumus ad iram. (We speak the truth in anger.)

Seeking Alpha: A Frustrating Experience with Unethical Design and Spammy Emails

When you visit Seeking Alpha, you'll notice that there are a lot of advertisements on the site. It can be overwhelming at times, but that's just the way it is. What's more, they recently added a modal that asks you to register, and it's impossible to block. If you try to block it, the site becomes unusable, and the developer intentionally made it extremely difficult to get rid of the registration modal, scrolljacking, and other tricks they use to ensure that you never get rid of the registration modal unless you register.

It wouldn't be such a big deal if you could just read their articles in peace and give them clicks and ad revenue, but if you do register, you'll be bombarded with incredibly spammy emails. It's so underhanded and unethical in design that I worry whether the site is safe to use!

Seeking Alpha can be infuriating, especially since they're often the first site that comes up when searching for news on business and the stock market. As far as I can tell, they're run by a team of grey hat hucksters. I would recommend steering clear of this site if you can.

Beware of Biased Investment Advice: A Review of Gefvert's CPST Article on Seeking Alpha

I just read an article on Seeking Alpha by Gefvert on March 26, 2013, and I have to say, I'm not too impressed. He seems to be down on CPST, but when I looked at his profile, I saw that he has a short position in the company. That makes me wonder if he's just trying to drive down the stock so he can cover his position. I mean, I get it, everyone wants to make money, but that seems a little shady to me.

Now, I'm not saying that CPST is a great investment or anything like that. I've made some money trading their stock, and I currently have a small long position, but I'm not going to pretend like I know everything about the company. If you're thinking about investing in them (or any other company), you should definitely do your own research and make your own decisions.

At the end of the day, the market is going to do what it's going to do. There are plenty of stocks out there that are overvalued when you look at their fundamentals, but that doesn't mean they're not worth investing in. It's all about supply and demand, and if people are willing to pay a certain price for a stock, then that's what it's worth.

What bothers me about this article is that it seems totally biased. Gefvert has a short position in CPST, so of course he's going to be negative about the company. I don't think anyone on Seeking Alpha (or any other site) should be able to manipulate a stock like that. It's just not fair to the other investors who are trying to make informed decisions based on the available information.

In conclusion, I think it's important to do your own research and make your own decisions when it comes to investing. Don't just rely on what someone else says, especially if they have a vested interest in the outcome. And always remember that the market is going to do what it's going to do, regardless of what anyone else thinks.

Disappointing Editing and Biased Publishing at Seeking Alpha

I gotta say, I'm not too impressed with Seeking Alpha. Their editing is kinda all over the place, and it seems like they only wanna publish stuff that makes stocks look good.

I wrote an article for them, and it went through a couple rounds of editing. The first two rounds were pretty helpful, and I made all the changes they suggested. But then the third reviewer seemed like they didn't even read my article properly. They brought up issues that had already been cleared in the earlier reviews, and said that I didn't prove that some companies were exaggerating their potential savings. But that was the whole point of my article - to show that the rumors of savings were totally unfounded. I even explained where the misinformation was coming from. Meanwhile, they published an article from someone who clearly didn't know what they were talking about, and who repeated the same false claims that I had debunked.

The worst part is, there's no way to talk to the editors directly. You just have to keep sending in revised versions of your article and hope they'll approve it. It's frustrating, to say the least.

Mixed Bag: My Experience with Seeking Alpha's Writers, Moderation, and Premium Service

I gotta say, Seeking Alpha is a bit of a mixed bag. Some of the writers on there are just plain clueless, and the only thing they seem to be good at is talking a big game. Back in the day, there used to be some really good writers on there that I followed religiously. But they all left, and when I asked them why, they told me that SA was forcing them to focus on garbage and not letting them use technical analysis or express themselves in their own unique way. It's a real shame, because those writers were consistently right, and yet SA found a way to drive them away.

Another thing that really grinds my gears is the way they moderate comments. If you don't toe the line and comment like a good little boy, your comments get taken down faster than you can say "bull market". It's like they don't want any dissenting opinions on there, which is just ridiculous.

And don't even get me started on their premium service. They charge almost $200 a month for what can only be described as "premium crap". I speak from experience, because I took the annual membership (knowing there was a 30-day free cancellation period) and cancelled in less than 9 days. That should tell you everything you need to know about how great their service is. It took me 5 days to get my refund back, which is just ridiculous.

Overall, I think you can do a lot better by paying for subscriptions from other sites that are 5 times cheaper and 10 times better. SA has its moments, but they're few and far between.

The Pitfalls of Relying on Seeking Alpha for Investment Advice

on these sites. It is important to do your own research and not rely solely on the opinions of others.

Seeking Alpha is a popular website for investors looking for information on stocks and other investments. However, readers should be aware that not all articles on the site are unbiased. Many articles are written with the intention of either boosting or lowering the stock price of a particular company. This is often done by short sellers who make money by scaring investors into selling their shares.

One example of this is the negative reviews of BPT that were published on Seeking Alpha in the last few years. These articles warned investors that the company was a 'dividend trap' and would be dissolved in 2018. This caused many investors to sell their shares and led to an increase in short selling. However, as the price of oil began to rise, the trust surged and the stock price increased from a low of $15 in 2015 to $28 today.

The problem with relying solely on sites like Seeking Alpha for investment advice is that many of the authors have a stake in the companies they are writing about. Unless the authors are trained investors with no stake in the company, readers are likely to lose money by following their recommendations. It is important to do your own research and not rely solely on the opinions of others.

In conclusion, while Seeking Alpha can be a useful resource for investors, readers should be aware that not all articles on the site are unbiased. It is important to do your own research and not rely solely on the opinions of others.

Subscription

I had a subscription to Value Investors Edge, which was on auto-renewal. According to the government, they have to notify me before it is renewed. Instead, they did not notify me and just charged my credit card.

I did not want to renew. They refuse to give my money back. It is for the next 12 months subscription.

"1. Before a company can auto-renew your subscription, it has to send you a renewal notice. "

They did not do that, and I do not want to renew.

https://consumer.ftc.gov/articles/getting-out-free-trials-auto-renewals-negative-option-subscriptions#auto%20renewals

Desired outcome: Reversal of the $199 charge, as I don not want the subscription.

After 2 days of fighting with them and telling them they are breaking the law, they finally refunded my money. What a huge hassle that was.

Premium

I paid for a premium membership, yet when I log on to SA and click on premium I get another page soliciting my paying for premium membership.

Also, I contacted SA previously stating that SA would not make the connection to my LPL Financial account. I was told that SA would look into the matter and let me know what to do to link the account. So far I have heard nothing back.

I also receive daily e-mails soliciting my purchasing premium. I had already purchased premium.

Is SA a complete rip off?

Desired outcome: Either adequately address the problems shown above or refund my premium fee.

Beware of their automatic billing and "strict 30-day refund" policy

I purchased a Seeking Alpha subscription and in my quick review of the documents I agreed to, I did not notice an automatic renewal policy. Let's be honest, how many of us analytically review every paragraph of these documents? As a consumer, an automatic renewal policy, with a "Strict Policy" of 30 days for a refund, is important and should be highlighted and not buried in the document towards the end. In my case, I was not getting any benefit from my subscription and was unaware of the auto-renew provision. Seeking Alpa made no contact to remind me, their customer, that renewal was coming up and their strict policy against refunds. The subscription charge went through near the beginning of my credit card cycle. Twenty-six days later, at the close of the credit card cycle, the bill was mailed to me. I reviewed the bill several days after receipt and contacted Seeking Alpha promptly by email and wrote their "customer service" department:

In reviewing my credit card statement I saw a charge for $256.93 on November 11, 2022. This charge was not authorized by me as the card holder. Kindly refund the charge and provide a confirmation email to that effect.

Thank you for your prompt attention to this matter.

Donald B. Hallowes

Their response is as follows:

Hi Donald,

Thanks for the message.

Unfortunately, we’d be unable to refund the charge for this service as we have a strict no-refund policy for these services.

Also, the our Cancellation and Refund policy, agreed upon by you at the time of purchase clearly state that the payment is not refundable. In light of the above stated, I am hoping for your understanding and cooperation in this matter.

We truly value your support. Please feel free to contact us if you have any questions or need help with anything else.

Thanks & Regards,

Divyansh Saxena |Customer Service Representative| Seeking Alpha

I could not believe the response from Seeking Alpha. I wrote a more detailed explanation to them as a reply on their software that I cannot access, but explained that due to the running of the billing cycle and my vacation, I had 0 days within the 30 day period to cancel. (Pleae note the charge was made on November 11).

Seeking Alpha replied as follows, which is painfully hilarious for its approach:

Fri, Jan 13, 12:49 AM (1 day ago)

to me

Ticket ID: 300555

Awaiting Customer Reply

Dear Donald Hallowes,

Status has been changed by SA CS Divyansh Saxena.

Click here to open comment

Hi Donald,

Apologies as you had to go through this however It is too late for refund.

Unfortunately, I am still unable to issue a refund as its been more than 2 months since you got charged. I am confirming you have been successfully unsubscribed from Seeking Alpha Premium effective today and your account will no longer be charged for this service.

Hope this helps.

Thanks & Regards,

Divyansh Saxena |Customer Service Representative| Seeking Alpha

Mr. Saxena's reference to over two months includes the time spent emailing back and forth with Seeking Alpha in an effort to secure a refund.

The moral of this long story is simple. Many of us still have credit cards with 25 day payment periods from receipt of the bill. With Seeking Alpha, your time period could well have run by the TIME YOU ARE AWARE THAT YOU HAVE BEEN BILLED. Mr. Saxena will then politely remind you of their "Strict (very self serving) 30 day) refund policy.

Personally, seeking Alpha and their affiliates will never see another dollar of my money. I believe it is clear that Seeking Alpha is desperate for funds.

Date of experience: January 12, 2023

Desired outcome: Full refund would be appropriate. I would settle for a pro-rata refund.

Don't use them

I want to warn everyone that the website www.seekingalpha.com is crap. The owner makes money on dishonest projects and investments. He offered to invest money in one project, and he showed me the necessary info, but after I transferred money, he simply started to tell me diddle-daddle. No money and no evidence about my future profit or investment. The seller is scammer and liar, who takes money and provides nothing. Please post your comments about this company.

I am 83 year old investor and will not tolerate SA rejecting my replies. Please advise bofore I see my attorney.

Can not sign onto my account and cannnot create new password

I started to use the website www.seekingalpha.com, but I wasn’t happy with that. This website provided a lot of articles about stocks. Other people wrote their opinions about companies, and a lot of the articles were really horrible, because I searched for good one, but I haven’t found anything useful and worthwhile. I wonder if there are other people, who had the same experience. Let’s share views about this website.

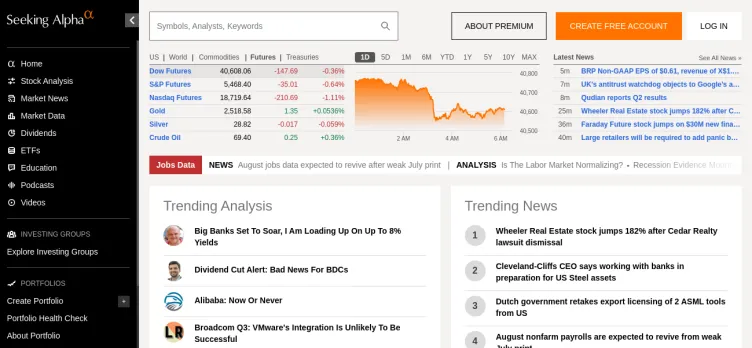

About Seeking Alpha

The platform offers a wide range of content, including articles, podcasts, videos, and market data, that cater to the needs of both novice and experienced investors. Seeking Alpha's articles cover a broad range of topics, from individual stocks and sectors to macroeconomic trends and investment strategies. The platform's contributors provide in-depth analysis and commentary on market trends, company earnings, and other financial news, helping investors make informed investment decisions.

Seeking Alpha's market data section provides investors with real-time stock quotes, charts, and other financial data, allowing them to track the performance of their investments and monitor market trends. The platform also offers a range of tools and resources, such as stock screeners, portfolio trackers, and investment calculators, to help investors manage their portfolios and make better investment decisions.

One of the unique features of Seeking Alpha is its community-driven approach to financial analysis. The platform encourages its users to share their insights and opinions on various financial topics, creating a vibrant and diverse community of investors and analysts. Seeking Alpha's contributors come from a wide range of backgrounds, including finance, academia, and journalism, providing investors with a broad range of perspectives and insights.

Overall, Seeking Alpha is a valuable resource for investors looking to stay informed about the financial markets and make informed investment decisions. With its comprehensive content, real-time market data, and community-driven approach to financial analysis, the platform is a must-visit for anyone interested in the stock market and investing.

Overview of Seeking Alpha complaint handling

-

Seeking Alpha Contacts

-

Seeking Alpha phone numbers+1 (347) 509-6837+1 (347) 509-6837Click up if you have successfully reached Seeking Alpha by calling +1 (347) 509-6837 phone number 0 0 users reported that they have successfully reached Seeking Alpha by calling +1 (347) 509-6837 phone number Click down if you have unsuccessfully reached Seeking Alpha by calling +1 (347) 509-6837 phone number 0 0 users reported that they have UNsuccessfully reached Seeking Alpha by calling +1 (347) 509-6837 phone number+1 (212) 695-7190+1 (212) 695-7190Click up if you have successfully reached Seeking Alpha by calling +1 (212) 695-7190 phone number 0 0 users reported that they have successfully reached Seeking Alpha by calling +1 (212) 695-7190 phone number Click down if you have unsuccessfully reached Seeking Alpha by calling +1 (212) 695-7190 phone number 0 0 users reported that they have UNsuccessfully reached Seeking Alpha by calling +1 (212) 695-7190 phone number

-

Seeking Alpha emailssupport@seekingalpha.com100%Confidence score: 100%Supportzack@seekingalpha.com93%Confidence score: 93%eli@seekingalpha.com93%Confidence score: 93%Executiveacarmel@seekingalpha.com93%Confidence score: 93%Executivegeorge@seekingalpha.com93%Confidence score: 93%Executive

-

Seeking Alpha address52 Vanderbilt Avenue, New York, New York, 10001, United States

-

Seeking Alpha social media

-

Checked and verified by Jenny This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreOct 16, 2024

Checked and verified by Jenny This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreOct 16, 2024

Recent comments about Seeking Alpha company

Don't use themOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.