The Federal Savings Bank’s earns a 3.5-star rating from 25 reviews, showing that the majority of customers are satisfied with banking services.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

Disorganized, does not follow up with customers properly

Disorganized, does not follow up with customers properly. *** to reach when needed. Started process in Jan, now its end of May with no *** results. Started out with a 2.25 lock rate, rates have increased and now in order to keep it I must pay over 4K in fees/points. Had a property in forbearance, they said they could help with ***, never saw a loan estimate even when I asked for it. Had me do an appraisal on a streamline *** on my primary loan/home that had equity, dont know why but they did. They wanted me to get a personal loan to pay off a vehicle loan and pay down the mortgage, why, I wanted a rate reduction only at a 100%. My credit score is 750 and I only have a one ***, I dont need or want to incur a personal loan, I asked can you do this or not. Just a long drawn out worthless process. Interesting to note here: during this process I received another mailer from them advertising their product. So I called, got a OH office, explained my experience, go a totally different answer, he stated they could do 100% financing. Couldnt believe I got a different answer from someone else working for the same company. They ask for redundant docs, over and over again. A very wasteful bad experience, This is the way they treat veterans. After 4 months I emailed the corporate office and canceled the process, ccd the agent in ***, *** as well. I do not recommend them at ***!

The complaint has been investigated and resolved to the customer's satisfaction.

We started to do a refinance with this bank

We started to do a refinance with this bank. Little did we know that they use unethical practices and then lie to you about qualifying for a refinance. The process started in February, gave them everything they needed and was told we were good to go. After giving them a few more things they needed to finalize the refinance then they told us that we didn't qualify. When they did the first application and told us we were good to go, they didn't bother telling us that they omitted/k, left out/hid information that should have been used when doing the application. So after we get the all the information that they asked us to get to continue we did that, we gave them everything, and when the final paperwork was suppose to be done, underwriting then decided we didn't qualify. That is when we found out that they omit/left out/hid information and then on the final paperwork they put it in and said we don't qualify. That is unethical in every sense of the word. Then we talk to the vice president who said he would work with it, he asked for more things, we did exactly what he asked and again was told couldn't refinance. This has taken 4 months and all we got were lies, unethical practice by their underwriting department and spent money for a appraisal that we really didn't need because they knew from the beginning that they would not be able to do it for us. Dishonest and unethical company and people."

The complaint has been investigated and resolved to the customer's satisfaction.

Great experience from start to finish. I would Highly recommend Federal Savings Bank. They were wonderful to deal with. They always kept you up to date step by step and worked hard in the whole process. They answered all of our questions and went above and beyond to meet what we needed.

and his team were great from beginning to end with exceptional communication at every step along the way.

good experience from loan officer she was very professional in the whole process

Everyone I worked with was knowledgeable, friendly & quick to respond. Very pleasant experience.

05/24 The Federal Savings Bank constantly sends me solicitations, despite a request for them to stop

05/24 The Federal Savings Bank constantly sends me solicitations, despite a request for them to stop. I called them in in February and asked them to take my name off their list and stop sending me solicitations, while on the phone they were very rude then continued to say they could do better than where i was at, but said they would take me off the list. Since my phone call , I have received at least 2 more solicitations in the mail per day. This is out of control, especially since I requested it to stop. I called them again July 23, I asked them who are they, they said they are "The Federal Bank who works with the VA !" I asked her to repeat what she said, then she hung up. I called back a man answered, then said ma'am what do you want, I told him what the lady said he called me a liar, by this time I was upset, he said if I dont calm down he would hang up, and he did. I called a third time, this guy went straight in, " asking me what is my problem, and was calling me by my first name when I say address me as "Mrs". He said why and that he would call me what he wants because that my name ! While we were on the phone they kept calling me back to back, this man then said " look with all this going on why does junk mail bother you! " He was yelling and very rude. He said i didn't know anything about my rated from the VA, and I didn't have a clue what I was talking about ! ALL I ASK IS TO STOP SENDING THE MAIL ! PLEASE

The complaint has been investigated and resolved to the customer's satisfaction.

Wonderful experience, very professional and extremely helpful and friendly! Thanks again

We feel confident in our decision to refinance with The Federal Savings Bank. Our loan officer was extremely helpful and professional. We were kept informed throughout the entire process. This is the best experience we have had with a refinance, and we don't want to work with any other bank again.

It was a great experience working with ***. I have been through many experiences in the past involving mortgage refinancing and closing but this process has been the smoothest and hassle free for me. Even though I am a legally blind disabled veteran, *** made this a smooth and stress free experience. I was most impressed with his dedication to his profession and making himself available to answer questions even on the weekends. Whenever I needed to speak with him he never came across as if I was inconveniencing him. My son was assisting me in this process because of my physical limitations and even he was impressed with *** cordial mannerism along with his patience. After speaking with *** before I committed to do the refinance he came across as a person with integrity who could be trusted. *** presents himself as someone who is dedicated and fully committed to excellence in his profession. I shall be more than pleased to work with him in the future.

I really appreciate the availability and fast response from my loan Officer. Made the whole process really smooth and easy from beginning to end. Very friendly and professional. Thank you so much!

The Federal savings bank customer service is WORTHLESS!

The Federal savings bank customer service is WORTHLESS! They don't care about us all they care about is their money. I have been trying to close on my loan since June . It still never closed.. i was working with Douglas ***, who told me I needed to lay an appraisal and they would refund me at the end when I closed. Well my loan never closed due to Doug's inability to handle a loan. I have called Douglas ***, his supervisor Dawn and dawn wont do anything nor give me a supervisors name. I just want a full refund for the appraisal because my loan never closed and here are the reasons it was Douglas fault! It was not my fault Douglas pulled the loan 1 day before my year on my FHA, which I had told him since the beginning that I was waiting for the 1 year mark to expire to be able to refinance. Douglas pulled the loan 1 day early and that was not my fault which delayed the process. 2. The appraisal had the wrong address in which I had already mentioned to him and he stated here would correct this which delayed the process even further. 3. Now with all these delays I have been paying my loan when I could have gone with another mortgage company and saved some money on interest. 4. Douglas had to lock me into a second rate, which I noticed had expired by the time they were still trying to close. I just want my refund for the appraisal inpaid, as I am now behind on my mortgage. None of this is my fault its your loan administrator's lack of loan administration.

The complaint has been investigated and resolved to the customer's satisfaction.

marketing practices and high pressure sales, especially towards what should be a protected group of citizens is absolutely despicable. Using the VA and terms like VA authorized dont make you the *** you just did your paper work and got approved as a VA lendercut *** cold calling people and trying to stealing there money.

Excellent service and communication. Highly recommend this bank for any service needs. Start to finish process was flawless.

is truly an expert. Not only does he have an SME (specialized material expert) background in the mortgage banking industry; he is phenomenal with clients. *** made my complicated deal easy to understand. Additionally, *** was extremely courteous and responsive. Whenever I had a question or a bump in the road - *** was there to explain it to me and provide me with a resolution. Compared to my experience with other mortgage bankers, he puts them in the dust! My last interaction with another mortgage banker told me I can only do between 10%-20% down (which I already knew is not true being a banker) and it was a world of difference working with ***. He explained to me all the scenarios between 3% down to paying cash in full. All in all, I would highly recommend *** to everyone and without a question use him again. Thank you *** for everything you have done. For the senior leaders reading this message, please make sure to recognize *** and his team for their efforts. *** is a gem and one-of-a-kind.

I sincerely appreciated the prompt and clear communication by the loan officer. He kept me informed and assisted me through the process throughout. I highly recommend this bank for any mortgage needs.

My husband asked me to call a financial advisor to refinance our home

My husband asked me to call a financial advisor to refinance our home. Initially, I thought it was a recommendation from someone we knew, but he had found the contact in a mailer. I looked up The Federal Savings Bank for credibility and found mixed reviews regarding their service. Despite concerns about hidden fees and approval complications, I reached out to the advisor. He addressed my concerns, explaining the process and setting realistic expectations. His reassurance led us to proceed with the bank. Fortunately, the experience was positive. We closed within the promised timeframe, paid off more debt than planned, and improved our financial situation significantly. The advisor was responsive, knowledgeable, and worked diligently to simplify our requirements. He was always available to answer questions, and if he didn't have the answer, he would find out and get back to us promptly. His professionalism and commitment to his promises earned my trust and gratitude. I would highly recommend him to others for his exceptional service. He deserves recognition and reward for his outstanding work and the positive impact he had on our finances.

I received a letter from this company with an offer to refinance my house

I received a letter from this company with an offer to refinance my house. Just like everyone else in the current economy we were struggling and I'm a veteran. The offer I received was one I could not pass up and that was for a very low interest rate on my current VA loan. I would be saving hundreds of dollars each month. I completed the application and paid the fee that I would get back once the process was completed. After two months of no communication back and no replies to messages (text, voicemails) to my agent I contacted another representative with ***, ***. She informed me that *** no longer worked for the *** and that they had not yet handled any of the filed he worked, but that they would quickly get to those. After many messages back and forth with *** and no progressive and additional month later I requested a refund. I started my application to refinance in March . It was now June 30th. She apologized and informed me she would let her employer know. July 7th I emailed her back and got a response on July 8th that there was no response from her employer yet. On July 9th I'm told they they refund my money back to me, less the fees. So for the $219.00 I placed down that would be fully refunded had they done their job and made an effort to make me matter as a customer was no lowered to $147.50 at no fault of my own. I obviously requested that her employer contact me. on July 10th and received a message back on July 12th stating that she would forward the message. It's now August 31st and nothing received from the ***.If you're looking to refinance or do anything with a bank at all, I'd highly recommend that you protect your money and save time and be appreciated elsewhere. This company lacks professionalism, consideration and I'm surprised to see they rank over 4 stars. If it were possible to leave lower than a 1 star I would.

The complaint has been investigated and resolved to the customer's satisfaction.

I had started to refinance my home with the new low rates for Veterans

I had started to refinance my home with the new low rates for Veterans. This was a case of over promising and under delivering. I had a mortgage officer share I was a strong candidate (Great Credit Score, steady income, and was looking to invest) for the new rates and there would be no issues. They had me pay $575 for a home appraisal (way above the high end of $400 for this service), and pay for termite inspection, ect. typical loan fees but a little on the high end. A couple of weeks went by and I had heard nothing, then I tried to email, call, text multiple times I heard nothing from the two mortgage officers I was working with (mind you, my loan started in late Jan, this was 2nd week in March I started to follow up during the COVID-19 situation, so I figure there was grace in case anything were wrong. I follow up for2 weeks before calling a manager)! 2 weeks went by and I contacted their supervisors and there was NO REPLY! I finally got a hold of a branch manager that said everything has been fully operational on the mortgage side, and nothing was wrong with my mortgage officers that they new of. I was told that I should have been contacted by now. The branch manager said to wait another 24 hrs before they look further into it. Within 24hrs I received a quick and short email that said, "Sorry, your loan did not work out because they have changed requirements for these loans, and that your loan is canceled!" Here is the kicker, IT WAS REGULATIONS THAT CHANGED BEFORE I EVEN STARTED MY LOAN APPLICATION! He had me start and pay for things not knowing the new regulations. I feel like this is the institution you are going to deal with! On top of that, I asked him if I had any other options within the new requirements and rates after that email...of course no response! No response after 2 weeks of texting, emailing, and leaving messges, loan regs changed before I started my application so I lost over $575 starting an application, and they did not try to work out a new application within the new regs! I was treated as a second rate customer, a number, and as long as it is easy for them they are excited to serve, but something like this little hick up and they just moved on!

The complaint has been investigated and resolved to the customer's satisfaction.

They called me, I don't know how they got my number

They called me, I don't know how they got my number. After asking to not be contacted the opposite happened. I started getting more calls. Definitely felt like they were not a legit or ethical business. No respect for boundaries. I asked multiple times for them to stop calling and texting me. Felt like I was being harassed. Today was the final straw. I don't know if this person's behavior reflects the company's values. Here is my story. I was called by a person who said they were from a mortgage company. He asked me some financial questions and then connected me to a Senior Mortgage Analyst from the Federal Savings Bank. The Analyst said his name was Aramis. He asked me several questions about my current mortgage. I answered them the best I could. He asked if we wanted to look at our options. I asked my wife, she said no. I told him no, he then asked if it was ok if he could call back next week. I said No. He said he was going to send us texts to our phone numbers with links. He said he would make sure we were not contacted again. That was last week.This prompted us to call our own bank and inquired about refinancing our current mortgage. Trusting our bank of over twenty years we started the refinance application.Still we were getting called everyday. I asked each one to please stop calling me. I started receiving calls more frequently. Then the harassing texts started. I started receiving texts from Aramis. This is after he told me he would make sure we would not be called again. This is exactly what our texts back and forth were.Aramis "Mortgage Rates are Below 2% for military families", "If you do the math and reconsider", "Youll see there is benefit enough to at least review some solutions", My reply "We just refinanced through my current lender USAA with the *** VA. Closes in 45 days. Thank You". Aramis "*** USAA notoriously charges higher rates compared to a Federally *** "If you are lucky it will close in 45 days", "But if you were smart you would compare options". "We are better". My reply "With all do respect, I am asking that you stop calling me. Even if it doesn't close by then, I am happy with USAA. Thank You". Aramis "With all due respect.", "You are making mistake.", "Stop burning money", "Bye.". My reply "Thank you". (Still he continued to text me)Aramis "***% vs the 2.5% you are getting or probably even higher LOL", "I bet you wont tell your wife", "She would say to save more".My reply "She is the one who decided on USAA." "Again, please stop".Aramis "You stop" "Do not respond" "Im done trying to help someone who is not even openminded enough to evaluate better options".End of texts as of 11/06/[protected]@1700 I filed a report with the

The complaint has been investigated and resolved to the customer's satisfaction.

Its ridiculous how they have an A+ rating on here

Its ridiculous how they have an A+ rating on here. We are 800$ down the drain and have wasted 6 weeks of our time trying to refinance with them. I should have noticed the first red flag that the 1800$ charge on our loan assessment was a "refundable rate holding fee" whereas it showed up as a "points payment" on the actual document. I think we dodged a bullet by shutting down the process with them after 6 weeks of anxiety and stress dealing with their incompetent team. Appraisal report worth 500$ came back stating FSB team did not furnish the HOA/co-op finance info. Bank kept repeating that this is not their job. We had submitted all documents on day 1 of the process to the bank's team back in July - nobody on their team took a minute to understand what was submitted to them and here we are in September being asked for the same documents. They used "Nationwide Property and Appraisal Services" which hired a local appraisal company and it took 4 weeks for a half baked appraisal coming back with a bunch of comments in red explaining that lender has not provided necessary financial documentation about the Co-op. When asked about this the underwriting analyst says "I have no idea what he's talking about". I have screenshots of the appraiser's requests and they are very clear requests. Not a single person in the banks team: Robert ***, Gwen *** or Michael *** were competent enough to read an appraisal report and understand that it was incomplete? - why am I the one alerting them to this discrepancy? They claimed that the only person capable of reading an appraisal in its entirety is the underwriter - who may possibly reject it due to comments in red. Very convenient way of setting up for a failure which will result in an increased rate and closing cost down the line? How is the a team comprising of "Underwriting Analyst" or "Senior VP" or "Loan Quality Analyst" not able to fully comprehend requests from an appraisal company OR read the actual report when it has been generated. When I asked this question I was told I am "micro-managing" them. All this goes on while the rate of 2.75% and closing cost terms have expired a month into the process, as stated on the initial loan assessment document. When asked about this, I am also told "we extended that deadline for the rate and closing costs" - shouldn't I be informed of these "extensions"? 2 months in since the first phone call with "Cheval", there was a doubt if our appraisal would be approved by an underwriter (while also stating that the file is in underwriting and the process is complete in the same phone call) AND a doubt if our co-op would be approved for the rate by the co-op approvals teams (while stating that the initial quoted 2.75% was based on an assumption that our co-op would be approved since they are "co-op" specialists) AND a doubt on the closing costs and date (while also stating that our case is a straightforward file): 6 weeks into the process. No signs of an actual rate or closing date while we keep furnishing the same documents, repeatedly. Felt like a classic bait and switch and I wish I had read these reviews earlier. Reviews on FB and Yelp will tell you the same story.

The complaint has been investigated and resolved to the customer's satisfaction.

The Federal Savings Bank Complaints 16

We explored a cash out option at The Federal Savings Bank and was contacted by a representative.

We explored a cash out option at The Federal Savings Bank and were contacted by a bank representative. We paid for an appraisal and did not like the idea of increasing our mortgage. Therefore, we requested to halt the cash out process. Eventually, we found better rates at a different financial institution and chose to proceed with them. I asked for a cancellation letter to present to my current lender to continue with their terms. This request was made on January 21st, and since then, I have been in daily contact with customer service, leaving messages for the representative and their supervisor without receiving a response. I also attempted to reach the consumer loan operations manager to no avail. The representative indicated that they could handle the request, but I urgently needed the letter by Monday to continue with our current loan, and we are now at a standstill until the letter is received.

The complaint has been investigated and resolved to the customer’s satisfaction.

W.A.*** 2/28/2022 I have received and am still receiving contact from The Federal Savings Bank re a loan number *** 2/22/2022 with a hard credit pull and loss of credit score status due to fraudulent activity on their part. I have complained with no response, thus this complaint.This company has a history of false solicitation and lies about We only do a soft credit pull without credit impact. Per records easily found in the complaintsboard.com dated 08/20, 07/12, and 05/12, I find these people to be fraudulently acting against the public interest!

On February 25th I was given a rate that was locked as verbally requested.I was informed that they did not lock the rate to protect me if things got delayed and that they didn't want me to pay fees. Now the rate has changed and everyone is apologizing but not fixing the issues. I have until 4/1 to finish my paperwork for closing and I'm being told that my rate will increase from 3 to 4 percent. I'm not interested in working with *** or *** as they would both rather protect one another and be right than help out in the refinance. I have both my conditional approval and revised offer but that means nothing apparently anymore.

Requested a quote on interest rate for a VA loan on a home mortgage, was quoted *** %, within one week after the quote and hiring them to do the loan they wanted to charge me ***%, then they charged me $494.00 for an appraisal fee when the appraisal was not done, then in the closing cost details they were charging 1.5% of the loan which was $5,399.00 VA lenders charge 1%. Also GARBAGE FEES amounted to *** that are not deemed necessary by other VA lenders including a Disaster Certification and a final inspection and $200. over what I already paid for the Appraisal fee. Thwn told my they were only trying to help me and refused to refund the Appraisal fee, period.

In April , a Federal Savings Bank representative contacted me about refinancing my home.

In April, a representative from Federal Savings Bank reached out to inquire if I was interested in refinancing my home at a low interest rate. I agreed, and they forwarded paperwork for me to complete and return. Additionally, I was required to pay a $625 appraisal fee, which I did using my credit card. After reviewing the documents, I questioned the proposed interest rate and the $4000 cost to secure this rate. Despite returning the signed papers, I reconsidered the next day, especially since I already had a loan with the same bank at a competitive rate. I requested the cancellation of the process and the refund of my $625 fee. Three months passed without any action, but after I lodged a complaint, the representative called to explain the fee was used for the appraisal and other expenses. I demanded a copy of the appraisal. Shortly after, he called back, promising to attempt a refund. Yet, nothing ensued.

The complaint has been investigated and resolved to the customer’s satisfaction.

My consumer loan was reported closed by the credit reporting agencies. My login on account # *** showed zero balance but should be approx $27k.All attempts to reach anyone to solve my problem have been unsuccessful. I've made numerous calls to their number but always hung up on after ringing.

Loan # -[protected] In January 2022 The Federal Savings Bank changed my Customer Loan to a *** In January 2022 I started receiving mortgage statements and the loan shows up on my Credit Report as a *** loan. I have called the Federal Savings Bank several times attempting to resolve this issue. They are very difficult to reach. Normally nobody answers and when I get a call back it is a week later. I emailed them on 21 January, 5 February, 8 February, 11 February. 16 February & 17 February. Sometimes they reply to my emails and sometimes they do not. I am attempting to buy a house and can not have an additional *** Loan on my Credit Report. Additionally the loan is tied to a property that I no longer own.

My mother and I have been struggling with a construction loan process since May with a mortgage banker.

My mother and I have been struggling with what was initially supposed to be a construction loan since May with our mortgage banker. After months of preapproval, securing an architect, and producing drawings, my mother's credit score dropped. We were advised to switch to a 203k loan. The banker's poor communication and unclear expectations regarding timeframes have made it unworthy to continue our loan process with The Federal Savings Bank. We've lost money paid to the architect, city permits, home appraisal, and most importantly, our time. Despite past complaints about the loan's progress and promises of resolution, recent email exchanges show the banker failing to follow up as promised, leaving us waiting for answers.

The complaint has been investigated and resolved to the customer’s satisfaction.

A Representative of Federal Savings Bank named *** attempted to receive my credit information and proceeded to pull a credit report without my permission. I received a credit inquiry alert from experian stating that my credit had been pulled even after the representative had told me that they do not pull credit. I tried to call the representative back to dispute this and they will not take my call and the main office in *** refuses to be of any assistance.

What I, have sent here is a copy of my Credit report from ***. I, have requested by Trying to contact ***. *** and the Federal *** directly with my request and Still I, haven't received anything. Delivery of Documents No response to my request. From anyone. By Law as a letter expressed. to me that I'm intitle to receive upon request within the 30 days after receiving a letter dated on December 22. All recording documents including the a copy of the Application filed. I'm still with in my 30 days I'm requesting for All recordings to the account number *** ( copys of All Including filed application. 1. The application Requesting for credit and 2. The response back from running credit application. Email *** or my address ***. Please would like to look over in the privacy of my home.

Is The Federal Savings Bank Legit?

The Federal Savings Bank earns a trustworthiness rating of 100%

Highly recommended, but caution will not hurt.

We found clear and detailed contact information for The Federal Savings Bank. The company provides a physical address, 3 phone numbers, and email, as well as 3 social media accounts. This demonstrates a commitment to customer service and transparency, which is a positive sign for building trust with customers.

By resolving 87% of 16 negative reviews, The Federal Savings Bank is demonstrating its dedication to customer satisfaction and effectively addressing customer issues. While there may still be some practical problems that need to be addressed, such as long wait times or unhelpful responses.

The Federal Savings Bank has received positive review on our site. This is a good sign and indicates a safe and reliable experience for customers who choose to work with the company.

Thefederalsavingsbank.com has a valid SSL certificate, which indicates that the website is secure and trustworthy. Look for the padlock icon in the browser and the "https" prefix in the URL to confirm that the website is using SSL.

Thefederalsavingsbank.com has been deemed safe to visit, as it is protected by a cloud-based cybersecurity solution that uses the Domain Name System (DNS) to help protect networks from online threats.

Thefederalsavingsbank.com you are considering visiting, which is associated with The Federal Savings Bank, is very old. Longevity often suggests that a website has consistently provided valuable content, products, or services over the years and has maintained a stable user base and a sustained online presence. This could be an indication of a very positive reputation.

A trust mark has been identified for a thefederalsavingsbank.com, but it is important to verify the trust mark and its source to ensure that it is legitimate. Ensure that the trust mark is genuine by clicking on it and verifying its authenticity through the issuing organization's website.

Thefederalsavingsbank.com regularly updates its policies to reflect changes in laws, regulations. These policies are easy to find and understand, and they are written in plain language that is accessible to all customers. This helps customers understand what they are agreeing to and what to expect from The Federal Savings Bank.

However ComplaintsBoard has detected that:

- The Federal Savings Bank protects their ownership data, a common and legal practice. However, from our perspective, this lack of transparency can impede trust and accountability, which are essential for establishing a credible and respected business entity.

- We conducted a search on social media and found several negative reviews related to The Federal Savings Bank. These reviews may indicate issues with the company's products, services, or customer support. It is important to thoroughly research the company and its offerings before making any purchases to avoid any potential risks.

Refinancing issue with a federal savings bank and appraisal payment dispute

I was refinancing my house with a federal savings bank. We were at the point of appraisal, and they requested $275 more on top of the $219 I had already paid. I decided to return to my original lender, Nations Lending, and requested a refund for the unused appraisal fee. Nations Lending completed the appraisal at no extra cost. The bank from which I am demanding a refund has no right to keep the money for a service they did not perform. By law, they are obliged to return the $219, as I suspect I'm being scammed and will not engage with them further. They claim the $219 was for underwriters and analysts who have worked on the file and is non-refundable, only to be credited at closing, but I withdrew my application.

The complaint has been investigated and resolved to the customer’s satisfaction.

On June 25 I completed the closing for the refinance mortgage on my house.The banker with federal savings bank, ***, informed me that they would be handling the loan of the mortgage through the life of the loan.He sympathized with me that I wanted to get away from my current lender, freedom mortgage, and that he heard negative things about them.I started receiving correspondence through the mail from Freedom Mortgage and I was very confused about the whole thing until I finally got through to Federal Savings Bank customer service which informed me that they sold it back to Freedom Mortgage.I had to contact the customer service because the banker, ***, would not answer or return any of my phone calls or emails.I have filed a formal complaint with the federal savings bank. Waiting a reply..

The Federal Savings Bank sends us multiple mailings, 3-5 per week, about "Using available funds" from my home mortgage. They send multiple mailers per week and they are all in different forms. Some are even in the form of a non-cashable checks. I have sent 4 different notices to them with their mailings included, telling them to remove all names and addresses that they have on file associated with the address and to stop selling the names and addresses. I have told them on 4 separate occasions that if they continue this harassment, that I would file a complaint with the complaintsboard.com. Just received 2 more this week and it is only Wednesday. We want our names/addresses and all other information removed from their files and no contact from them what so ever. We also want the above information removed from the lists that they sell to other companies.

I refinanced my home with TFSB, however, within two months TFSB sold my loan to another firm for the full amount of the original loan

I refinanced my home with TFSB, however, within two months TFSB sold my loan to another firm for the full amount of the original loan. At the time they sold the loan I had already made three payments totaling $7,500 and not a single payment had been applied to the loan. I enquired about the payments and TFSB confirmed they received all three and forwarded two of the three to the new mortgage holder to be applied to the balance of the loan. The problem is they never applied the third payment. I enquired about the payment being applied and they send another $852.94 to the new mortgage firm, which left the full amount of the base monthly payment of $1,647.06 missing. I have asked for documentation on how they applied the missing payment to my loan and they have now stopped responding to my requests. They are refusing to provide me with any written information concerning the loan, and how they dealt with the payments. In essence, they have determined they are somehow due the full loan payment, without the requirement to apply any of the money to the principal of the loan.

The complaint has been investigated and resolved to the customer’s satisfaction.

I was charged $695.98 on 2/1/2022, and my Bank (PNC) confirmed to me on this date that the charge was initiated by The Federal Savings Bank

I was charged $695.98 on 2/1/2022, and my Bank (PNC) confirmed to me on this date that the charge was initiated by The Federal Savings Bank. The attached statement from Federal Savings shows I made a payment of $23,148.91 on 12/27 along with a payment of $695.98 on 1/3/2022 in an attempt to pay my balance in full. My statement also shows a balance of $136.98 that I tried to call and ask about, and I left several messages with Federal Savings (between January 15 - 30) requesting a call back to explain the balance, but I was never called back. I also called on 2/1/2022 and left a message to ask about the charge of $695.98 that posted on that date, and the message from Federal Savings said I would be contacted within 48 hours, but I still have not been contacted. I would like to know why I was charged $695.98 on 2/1/2022 when my statement from January shows i have a balance of only $136.98 along with the fact that the statement shows my next due date is 4/1/22...and I would also like to have an explanation of my remaining balance and a confirmation that I will not be charged another $695.98 on 3/1/2022.

The complaint has been investigated and resolved to the customer’s satisfaction.

I was thinking of doing a refinance with this company, instead of my current

I was thinking of doing a refinance with this company, instead of my current. I was asked to pay a refundable $550 appraisal fee. I questioned, before paying, if I decided not to go through with the application, would I get my $550 back. *** told me I would get all of it back. After paying, the company started sending me applications that didn't match what was agreed in terms of the loan. I canceled, there was no appraisal done. I asked *** when I would get my $550 refund and she said they where processing it, it would be a few business days. I ended up receiving $298 and immediately contacted ***. She told me she would check on it. Later in the day, I received an email from her with charges, which I was never made aware of, and told to call Senior VP, ***. I called him and was basically told "People get mad when they are charged and say "Complaintsboard.com" He told me I could file a complaint butI wouldn't get my money, all that would happen is they would have to do a training session on the issue with ***. He was VERY unprofessional and the company is a very shady one. It's hard to believe they are in business

The complaint has been investigated and resolved to the customer’s satisfaction.

I refinanced my mortgage in Nov

I refinanced my mortgage in Nov. 2020 - Loan# [protected]. The loan was sold to Mr ***, effective 12/21. We were instructed to make our Jan 1, 2021 pymt to The Federal Savings Bank, which we did. The total amount of the pymt was $13,414.00 - $2329.01 for the regular pymt and $11,084.99 extra to apply toward paying down the principal. The check was cashed on 12/30. The Federal Savings Bank only applied and forwarded the regular pymt amount of $2329.01 to the new mortgage company Mr.. It is now March 4 and the additional $11,084.99 amount we sent for the additional principal, seems to have vanished. We have tried working with our original banker, Patrick Parks in the Oak Brook, IL office but have not received much assistance. Now he won't return our calls or emails. We have left a voicemail message at The Federal Savings Bank HQ servicing office and used the bank's online contact form - no response. It is as if our $11,084.99 has been stolen from us and there is nothing and nowhere to go for assistance. I am a disabled US Navy submarine veteran and The Federal Savings Bank is a veteran owned bank, so I expected more than to just be ignored and have my money taken from me in this egregious manner.

The complaint has been investigated and resolved to the customer’s satisfaction.

I have had a Mortgage with this company The Federal Savings Bank since July

I have had a Mortgage with this company The Federal Savings Bank since July . I have made 6 payments on time. I have received 3 letters stating that i am behind on my payments. I have called in regards to this matter 3 times. The first 2 times i spoke with customer service with had told me that my payments were put into another account but they did'nt specify where and said i owed money for their mistake. i asked to speak to a supervisor which she researched and found that all my payments were on time and i didn't owe another payment until February . i asked her to send me a letter stating that. I never received the letter. Today January 29,2021 i received another letter stating i was in defaut with my loan.Again I called i was on the phone for 3 hours i was told that my account showed all of my 6 payments were recorded. but that i still owed because one of my payments was sent to another account. he could not tell me whose account that was. i said if i made all 6 payments on time why was i responsible for their employees mistake. he said i had to call the research department to file a complaint. this has effected my credit and i have proof thru my bank i have made every paymnet on time. can someone please help me in this matter.

I continue to receive official looking letters from this company asking me to call them immediately to remove the mortgage insurance on my home

I continue to receive official looking letters from this company asking me to call them immediately to remove the mortgage insurance on my home loan. The company is vague about providing information about how exactly that happens until the consumer (me) finally asks if this offer is a refinance. In conclusion, this is a predatory lender who seeks out people to participate in programs that could result in dangerous correspondence lending practices. If a person refinances with this bank, their loan will be sold to an number of "servicing companies" to manage the mortgage loan. The letter informing home owners they qualify to have the PMI removed from their loan is a "come on." The Federal Savings Bank pulls records to determine the amount that was put down when the consumers current home was purchased, based off that information they inundate people with letters claiming to do something the Federal Savings Bank does not know to in fact be true. The customer service representative for The Federal Savings Bank probes over the phone for information such as name, date of birth, employment, and SS# then they pull a credit report to tentatively see *if you qualify for a refinance program. That is how the PMI is removed from the home owners current loan! I have told this company I do not want to be contacted by them again but I continue to receive letters every other day.

We were supposed to close on a house Feb 29th, 2020

We were supposed to close on a house Feb 29th, 2020. Due to their mistakes (multiple), this was pushed back multiple times to a new closing of March 13th. Which if that was the only issue, I could handle it and while not happy about it, would have just written it off as nature of the business. My problem is that they promised that they could keep my closing costs down and would do so by the use of a downpayment assistant program (DAP). Due to their Error, they never sent me the forms to sign and they didn't think to check to see why they hadn't been signed either. Due to their Error of not checking everything, not only did that mean we could no longer use the DAP, but it also meant that we had to come to a stressful decision of either losing around 4000 dollars and the house we were closing on (and potentially even the ability to look for another house) or Having to pay roughly [protected] more dollars due to THEIR errors. This was money We were planning on using on repairs of the house we can no longer do due to having to put it into closing costs. Not only did I respond to their survey they sent after we closed but I also reached out to their customer service email about a week later and have not gotten a response back in that time (so it has been about a month at least from the email). That is why I am going through this channel as they appear to not care about their customers and only about the money they make on closing a sale. They did very little to fix the issue and did not offer any form of monetary apology or waive of fees due to their Errors. Had it not been so late in the game, we might have had the option of going another route but did not have that option by the point of closing as it would have caused a far longer wait time.

The complaint has been investigated and resolved to the customer’s satisfaction.

I recently went through the process of purchasing a home with the FSB

I recently went through the process of purchasing a home with the FSB. After closing I had to pay $1,150 to the sellers of the home I purchased due to the negligence and unprofessionalism of the loan officers working my file. I had to go through the loan process not once but twice. The first time was put on hold due to defaulted student loans. My realtor and I told them we would work on the problem and still wanted to move forward. They informed us anything we did thus far would only last up to 90 days. My defaulted student loans were taken care of within less than 30 days of finding out about it. My loan officer Bryant Stewart was kept completely up to date on exactly how that processes was going and when it would be completed nothing at that point came to them as a surprise. Once it was handle I immediately informed in and sent any information he needed same day. The second time going through the process took longer than it should have. Because with went through it once already and it was much less than 90 days since the first time, the loan officers had all the information and documents needed to move forward with the mortgage loan. Days and weeks would go by without hearing anything in regards to the loan. The communication to myself, my realtor and the FSB staff was horrible on their end. We would send countless emails and text to which all would receive no reply from anyone on their end. They took extremely long to get the file to USDA and because of that I was financially penalized. At my closing I was informed loan officers receive commission. I have an issue with someone receiving a profit on my behalf while I was put in a financial hardship because of them. This is unacceptable. When finally speaking with the loan officers none of them gave at the least an explanation or any remorse to their wrong doing. I need this issue resolved

The complaint has been investigated and resolved to the customer’s satisfaction.

I received a call from Ryan *** from The Federal Savings Bank on 6/18 asking me to refinance my home with The Federal Savings Bank

I received a call from Ryan *** from The Federal Savings Bank on 6/18 asking me to refinance my home with The Federal Savings Bank. I had previously refinanced my home with The Federal Savings Bank 2 years ago. Mr. was talking to me about the VA streamline loan with the VA Home Loans. He stated that he could reduce my loan rate from 3.8 percent to 2.7 percent. Mr. went over different mortgage terms and payments. I told Mr. I would discuss these rates with my wife once I got home from work. Mr. was persistent that I just go ahead and approve the new loan now and tell my wife how we are saving money once I get home. I told Mr. no that I will discuss this with my wife before we move forward with refinancing. Mr *** asked could he call me at 7:00 pm, I agreed. Once I finished the call with Mr. I received a email alert from Experian. Once I logged onto my Experian account I received a notification that The Federal Savings Bank had made a hard inquiry on my credit. I was shocked that Ryan *** had pulled my credit because at no time during our conversation did he ask for my social security number or permission to pull my credit report. I think he has my information from 2 years ago because again during our conversation Mr. did not ask for my social security number or permission to access my credit report. Mr. called me at 7:00 pm on 6/18 and I asked him did I give you permission to pull my credit report? His response was how else would I be able to discuss and offer a new rate without pulling your credit? I asked him again did I give you permission to pull my credit report? He said I had to to discuss possible rates with you. I terminated the phone call. Mr. emailed me stating "Linwood, I think we got disconnected. At the end of the day these are the lowest rates in history. 2.75% FIXED, 0.0% Points, $0 lender fee, $0 origination. $116,000 interest saved."

The complaint has been investigated and resolved to the customer’s satisfaction.

The issue is I was given a rate to refinance my house and agreed to move forward but at the last minute was told the rate would cost me $8,000

The issue is I was given a rate to refinance my house and agreed to move forward but at the last minute was told the rate would cost me $8,000. This is a bait and switch tactic and should not be allowed. I paid $450 to have an appraisal done and once completed I was told I would need to pay $8000 to get that rate. Had this been disclosed prior to me paying for the appraisal I would not have moved forward. The agent I was working with is : Kinsey *** E Mail showing whe n Kinsey new the rate was denied. FW: ebps: Lock Request DENIED for LN#: [protected] Heine Inbox x Kinsey *** Mon, Mar 23, 8:47 PM to me Initially, it was denied and then I had to request a new lock right with the new pricing adjustments, by the afternoon of the next day, the 2.75 was not even available, it is still great that we can have a 2.75% on a 30 year. The fact that we are debating 2.75-3% like those are high rates, it goes to prove how good of a spot you are in and the rates for the cash out are untouchable, you will save so much more money. The cash will go towards making you more money as well, so it might be worth the utilizing 100% of your equity. From: *** Sent: Monday, March 16 5:30 PM To: Kinsey *** ; Lock Desk Subject: ebps: Lock Request DENIED for LN#: [protected] Heine The lock request for the above mentioned loan has been denied for the following reason(s): investor has pulled pricing. Please resubmit with new pricing REQUEST DETAILS BELOW: Lock Requested By: Kinsey Davis *** Loan Program: The Money Source VA Standard High Balance 30 Yr Fixed

The complaint has been investigated and resolved to the customer’s satisfaction.

7/19- I was contacted by Federal Savings Bank, and Nadia *** offered me an IRRL at a great rate with low closing costs, which we accepted

7/19- I was contacted by Federal Savings Bank, and Nadia *** offered me an IRRL at a great rate with low closing costs, which we accepted. 7/20- We signed initial disclosure statements. 7/29- I was required to fill out a credit card auth form with NO AMOUNT listed. When I asked, I told it was "just a deposit that would be refunded at closing," and I had to sign it. $219 was charged to my credit card, though I was never advised the amount prior to the charge. 9/15- We received final disclosure statements. The term and interest rate had gone up, and the closing costs had doubled, not to mention I had to come up with $5000 out of pocket. 9/17- I asked to cancel our application and refund our deposit. 10/1- I found out Nadia *** no longer worked for the bank and my account was assigned to Steven ***. I spoke with Steven, and he offered to look over the account and try to make a better loan offer. He said if he couldn't fix the package, he would issue a refund of the "remaining deposit" because some of it may have been spent on processing fees. 10/15- Steven gave me terms verbally over the phone and asked if I wanted to proceed. 10/22- I emailed Steven with requested employment verification and told him we wanted to proceed. 10/29- After a week of no communication, I emailed Steven to ask if he had paid a lock extension fee, and if not, to please cancel our application. I was frustrated with the lack of communication from both agents and the IRRL package that seemed to be much more burdensome and costly than other lenders were offering me. 11/4- I had not received a response from Steven about the lock rate, so I requested to cancel and initiate a refund. He replied that he would cancel it and get back to me with a timeline for the refund. I have not heard from him since, though I have emailed and called multiple times. I also called the bank and asked to speak with someone that could help me. I have not received a call back at all.

The complaint has been investigated and resolved to the customer’s satisfaction.

I reached out to The Federal Housing Authority in late June regarding refinancing my home

I reached out to The Federal Housing Authority in late June regarding refinancing my home. A representative contacted me back. I detailed my financial situation to this person, which includes two full-time jobs. I submitted bank statements showing deposits from both jobs and pay stubs as well. I was informed that my debt-to-income ratio was very healthy. They assured me that by completing the process quickly, I could skip mortgage payments for August and September. Due to a busy market, I was advised that appraisals were delayed but could be expedited for $750, a fee that would be refunded at closing. I paid the fee. Come August, I was advised not to pay my mortgage as the refinancing was nearing completion, so I didn't. However, I incurred a late fee, which The Federal Housing Authority promised to refund. This situation repeated in September, resulting in another late fee. After further delays and lack of communication, I escalated the issue. Despite assurances and paying for expedited service, the process dragged on. Ultimately, I discovered my refinancing application was denied without any direct notification. I learned they could only consider one of my incomes. No attempt was made to contact me about resolving the issues that led to the denial. I am now out $1000 for the expedited appraisal and late fees, which I was led to believe would be covered. I am requesting a refund for these expenses. Loan #: [protected]

The complaint has been investigated and resolved to the customer’s satisfaction.

I was raped in interest rates and fees that were not disclosed

Lender "forgot" to order the appraisal which pushed closing back

Then lender charged me for a rush appraisal and refused to refund me the cost

And cherry on top was taking two days to fund the transaction.

Do not work with these clowns!

About The Federal Savings Bank

The bank is well known for its exceptional customer service, high-quality loan products, and competitive rates. They offer a range of mortgage options, including FHA loans, VA loans, jumbo loans, and conventional loans. They also provide personalized banking services for individuals and businesses, including checking accounts, savings accounts, and credit cards.

The website of The Federal Savings Bank is designed to be user-friendly and easy to navigate. You can easily find the information you need, including interest rates, account fees, loan products, and financial calculators. The site also provides access to valuable resources such as videos, webinars, and e-books that can help you make informed financial decisions.

One of the standout features of The Federal Savings Bank's website is their online mortgage application process. You can easily apply for a mortgage online, submit the required documentation, and track the progress of your application from start to finish. This provides a convenient and stress-free way to secure a mortgage without having to visit a bank branch.

Overall, The Federal Savings Bank is a reputable financial institution, and their website is an excellent resource for anyone looking for a reliable banking partner. With a broad range of products and services, competitive rates, and exceptional customer service, The Federal Savings Bank is a top choice for homeowners and businesses alike.

Overview of The Federal Savings Bank complaint handling

-

The Federal Savings Bank Contacts

-

The Federal Savings Bank phone numbers+1 (877) 788-3520+1 (877) 788-3520Click up if you have successfully reached The Federal Savings Bank by calling +1 (877) 788-3520 phone number 0 0 users reported that they have successfully reached The Federal Savings Bank by calling +1 (877) 788-3520 phone number Click down if you have unsuccessfully reached The Federal Savings Bank by calling +1 (877) 788-3520 phone number 0 0 users reported that they have UNsuccessfully reached The Federal Savings Bank by calling +1 (877) 788-3520 phone number+1 (877) 236-7702+1 (877) 236-7702Click up if you have successfully reached The Federal Savings Bank by calling +1 (877) 236-7702 phone number 0 0 users reported that they have successfully reached The Federal Savings Bank by calling +1 (877) 236-7702 phone number Click down if you have unsuccessfully reached The Federal Savings Bank by calling +1 (877) 236-7702 phone number 0 0 users reported that they have UNsuccessfully reached The Federal Savings Bank by calling +1 (877) 236-7702 phone numberUniversity Of Illinois+1 (516) 430-5573+1 (516) 430-5573Click up if you have successfully reached The Federal Savings Bank by calling +1 (516) 430-5573 phone number 0 0 users reported that they have successfully reached The Federal Savings Bank by calling +1 (516) 430-5573 phone number Click down if you have unsuccessfully reached The Federal Savings Bank by calling +1 (516) 430-5573 phone number 0 0 users reported that they have UNsuccessfully reached The Federal Savings Bank by calling +1 (516) 430-5573 phone numberSenior Vice President

-

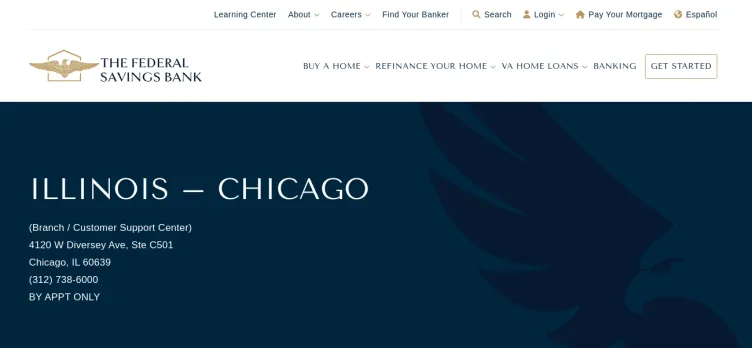

The Federal Savings Bank address4120 W Diversey Ave Ste C501, Chicago, Illinois, 60639-2399, United States

-

The Federal Savings Bank social media

-

Checked and verified by Andrew This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreNov 12, 2024

Checked and verified by Andrew This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreNov 12, 2024

Recent comments about The Federal Savings Bank company

We explored a cash out option at The Federal Savings Bank and was contacted by a representative.Our Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.

Everyone was very professional . Was an easy way to go with them everything went very smoothly. Everyone that worked on our loan new what they were doing. Recommend them to everyone if you need to refinance.

went above and beyond to make sure this was the best option for my financial growth. He is very knowledgeable in his profession and was very understanding of any concerns I had throughout the refinancing process.I greatly appreciate all of the effort you all put in and I will be using your services again when the time is right.

went above and beyond. It was the best banking experience we have ever had. I would recommend this company to anyone who is looking for any aspect of home finance. The customer service provided was the best experience period. They respond quickly and explain the entire process. Everything that was promised was completed end completely explained. Thank you so much!

I would recommend this company to anyone looking for service and a great process, easy as 1 2 3.