Fidelity Investments’s earns a 1.6-star rating from 155 reviews, showing that the majority of investors are dissatisfied with financial services.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

This falls under either breach or potential fraud eventually

I gave one star because had to do something to proceed I downloaded this app to potentially research some stocks and to do business with Fidelity I reached a point where I could create an account As I did information didn’t match and directed me to call an 800 number I was then transferred over to a 401(k) department unsure why and everyone was pretty adamant about who my employer was I continuously said it was irrelevant I was just trying to research some stocks I was told that why would I do that without a game plan Was asked my intentions of opening the account NO ONE LISTENS After about 10 different people from that company finally someone spilled the beans and said that my Social Security number was attached to someone that had an employee based plan at Mercy Health Fidelity refused to contact Mercy Health and have their HR department pull the initial paperwork they didn’t believe that there was a breach or any fraudulent activity No one has return any calls another Fidelity representative said I would need to fill out paperwork have my Social Security number out there again and at that point security would research the issue they basically made me feel like I was a stranger off the street trying to access someone else’s account I am disgusted how poorly Ive been treated how much disregard they took for the seriousness of this I was trying to believe it was just human error but now the real human error is that no one wants to follow up with the mistake If someone from fidelity actually cares enough to know I spoke with reach out to me But I have a feeling won’t happen whenever has the same I don’t care lazy attitude

Decent app unless you trade or invest in options

Is not adequate for someone trading everyday. For example it takes a few clicks to get to something time critical like Open Orders. But for a snapshot of where you balances and positions stands and traditional single leg option or stock trades, getting quotes or transferring funds (excluding wires) or just seeing how the stock market is doing, this is a very serviceable application.

It is very impractical to use for multi-leg option trades as the security description field is too short in the Positions view, so you you have open a full quote view for each position to see what your actual positions are, which is especially important if you have a lot of open option strategies you are trying to evaluate or execute trades in. If you have just a handful of outstanding option positions you could memorize their strike prices and expirations and you’d be fine.

The full website Option Summary position view is not available in the app. The wonderful feature logically groups complete description option positions while simultaneously showing where the underlying current security’s trade quote. That same Options Summary position view makes open option positions roll or close out trade formats available in one click, including Covered Call trade close outs of the underlying and the short call position. Full website version also has an excellent option strategy trade set up feature (Iron Condors, Spreads, etc.) not available in the app.

If you are buying or selling one legged option positions, you can get by, but multi-leg trades can be executed easily if you memorize positions and symbol structure and take a long time to enter compared to the full featured website.

Too Many Glitches that are Frustrating

Strange things continue happening on its web based platform without any reason. For example, Fidelity offers all of its customers the ability to generate quarterly (and daily) snapshot reports that analyze the investor’s portfolio. The quarterly reports are supposed to be generated automatically after the end of a calendar quarter. I was able to access these reports for the current quarter and prior quarters. However, the quarterly reports suddenly disappeared and I called Fidelity to ask why. They didn’t know. They submitted a request to enable me to access the next quarter’s report, and it took them two months to re-enable the reports for me. However, the prior quarterly reports could not be retrieved. After receiving the next quarterly report, however, the ability to retrieve that report was again disabled and all I could get was a daily report and I called them again to complain. They couldn’t explain why that happened and I waited a few months to have the quarterly reports restored. But, after they were restored, I couldn’t get the next quarterly report! I’ve given up on this feature and I have a reminder on my calendar to manually generate a daily report on the first day of every month without the ability to save prior month reports in my Fidelity account. In addition, their platforms position page is not customizable and the order of the accounts has suddenly changed. Again, calling Fidelity was a waste of time as they weren’t able to tell me how long, or if they could correct that problem. Their online platform stinks and doesn’t compare to TD Ameritrade or Schwab. I am a major investor and I think it’s time for me to shop around for a new broker.

Getting Buggy In Here

This app used to be rock solid, but lately, since about version 3.55 or 3.55.1, it's been a little concerning security-wise. It no longer displays my name when I log in (even though the switch is on), tells me it can't connect to the Glance Network when I start it up (why would I ever need to give someone remote access?), and sometimes even shows I have no accounts, or accounts with no balances/positions when I refresh a page (closing the app and signing in again fixes it, but why would my session time out if Im actively using the app?). The latest version's icons are spaced poorly on my device, and fonts such as those used for 'Accounts' have changed to match the Apple system as opposed to the Fidelity fonts I'm used to. Call me paranoid, but what's stopping an attacker on my home network (via a compromised device/router) from putting my device in a domain and distributing a fake app as part of a group policy? I might I think I'm trading and making gains, but in reality my accounts have been cleaned out. When significant sums of money are involved, little bugs and changes like those above cause big concerns. Furthermore, the app allows you to transfer via paypal, and now allows transferring retirement accounts to other users. Instead of features, you're adding new vectors for clients to get their clocks cleaned by potential attackers. Don't make it easier to withdraw/transfer funds when institutional/device security lags the advancements made by cyber criminals, make it almost impossible to withdraw funds! How about issuing a hardware key fob with NFC, similar to what the real estate database company CoStar uses to protect its data and accounts, to clients with over $250k? Moral of the story, the app feels more vulnerable to malicious activity than in the past.

No contest

I have used fidelity investment accounts for the better part of the past decade. Online, on the app, or on the phone I can’t think of a reasonable way for them to get better. All the interfaces, even through reformatting and updates are extremely user friendly. The experience has always seemed straight forward and non intimidating enough for a novice, but without all the gimmicky nonsense and while maintaining professional feel, execution, and resources needed for professional level investing be it long or short. They have a wealth of resources and educational material for anyone new or just wishing to continue educate themselves. The customer service is and always has been exceptional. It takes less than a couple of minutes to get someone on the phone 24hrs a day. I don’t think I’ve ever been on hold or jumped through the hoops of an automated system. They must treat their employees well, because it always seems like they enjoy what they do, not the typical answer a call, solve a problem, and get you off the line. They have even called back on their own accord to ensure that transfers to and from that account have gone through quickly enough when I’ve been in time sensitive situations. It deserves mention that I’m not moving millions that would merit special privileges, but mostly between $1000 and $30000- a drop in the bucket as far as they’re concerned. They treat the little guys like they’re as important as the super wealthy ones. Barring some tragedy, I can honestly say I never have and never will have a review of this company that’s short of the maximum rating, and the closest second place is miles behind. I’d say you get what you pay for, but the low or nonexistent fees paired with an interest rate that equals or beats most savings accounts, with Fidelity you get way more than you pay for.

Missing Functionality

This is a review of the app only. The brokerage is fine.

The app has some nice features, such as the option to show tickers you are following in varying shades to indicate directional movement and the ability to set up alerts from within the app (one star for each of those features). The best feature for me is the ability to buy fractional shares from a reputable brokerage firm.

My problem with this app is there are no streaming quotes and no setting to add them. You must refresh the screen (swipe down) to update the quotes and by the time they have refreshed on the screen, when the markets are active, the prices would have changed again!

This is the first trading app I have used that hobbles your ability to see real time streaming quotes for your positions and watchlists when you don't have access to a computer. I thought that it was a glitch but after 40 minutes on the phone (mostly on hold), I was informed that only downloading software on your computer gives you streaming quotes. When you want to set up a trade you see a real time bid and ask but to have to do that without knowing where your tickers are at, all at the same time, is cumbersome and inefficient.

Also, not being able to see real time quotes outside of standard market hours, even when extended trading is enabled for your account is inexcusable. Why bother offering extended hours if you can’t see at a glance what you would want to trade from your positions or watch list?!

Because the negatives are a dealbreaker for me, I canceled a request to transfer my account from another brokerage firm to Fidelity. I will use them mostly for fractional shares until their app is at least as functional as my other brokerage firm’s is.

I really hope that the next update either adds streaming quotes or that they add a second app that is more trading focused, with that functionality, to compliment the current app.

Being personally sabotaged or fidelity has new rules

So for the first time ever in all the years I’ve banked(well the spend account isn’t a bank it’s an investment account) they will remind you when it’s bad times & somehow a gotcha moment here that they are not a bank. So this time my account which was negative $34 or $39. I have always had the same spending habits I have always done mobile check deposits I have alway known how amazing the accounts were. Somehow this time i cash a check that is 100% guaranteed already that I almost always at least get $200. I had called fidelity and was like hey I’m broke I have zero money I don’t have my car and I just became unemployed. So guess what no spending money was available but the -$34 goes away and I can spend $6k on stocks. Which is normal. I call in and spend hours on phone wondering why this is the first time in history and obviously I’m rude but still I’ve never had a grown woman lie to me like she was “talking with the back office” which makes zero sense I know she didn’t go to a back office” or maybe it’s a new saying at fidelity. I needed this money to get a rental so I could drive to the interviews I had lined up and get a hotel and food. Guess what I swear ever since in my account I bought that DWAC stock in my fidelity account I have been intentionally sabotaged. That’s the day weird stuff happened in my account. This tops them all. The girl said since I’m -$34 I have to wait till Tuesday to get money obviously I go off. But now it’s Tuesday and guess what I now have to wait till Saturday which is the weekend to get my money lol what the frig. I’ve never ever ever in my life had it take this long on any check I have ever deposited since I was in college. So how is that not intentional being told when they know your desperate. Then I am told oh no we are not a bank like yes I know but you have never done this. Well I don’t know your history. WHY WOULD YOU LIE TO ME? I could of canceled check even THOUGH YOU FORCE ME TO WRITE DEPOSIT AT FIDELITY ONLY

More Bugs Than Cheap Motel

I have been using this app for many years and they can never get it right. When one issue is fixed, 3 new ones pop up in their places.

About 75% of the app functions well but that other 25% makes me buggy. They are continually boasting about how it’s customizable, but there’s nothing besides a few minor settings that qualify. For instance, they have an “always streaming” feature for quotes and portfolio values, and it can be turned on or off. That IS NOT customizable as they claim.

How’s this for customizable? Allow the user to choose what news organizations he wishes to subscribe to, or to unsubscribe to. Or allow the user to choose which pieces of data he sees in the “customizable” -NOT- portfolio info screen.

However, my #1 & #2 pet peeves are things I’ve been complaining about for over 2 years.

#1. In the portfolio view screen, there are details about each position, like price change today, price change percentage today, total price change, total price change percentage and 52 week high/low. EXCEPT-any REIT positions have most of that missing. I have spoken to numerous reps who acknowledge the problem and promise to send a report. Either they’re not making a report, or they are, and the corporate office is just ignoring it.

#2. Fidelity has decided that there are certain securities that they consider “unsuitable for investors” and this is based on some criteria that they are unwilling to reveal. I’ve asked, and there’s no answer. They simply block investors from opening new positions in “certain securities,” and you discover this only when you try to place an order. I guess Fidelity had decided to play mama to investors, instead of doing their job as a full service brokerage. I have recently filed a complaint with the SEC regarding this issue.

I’ve even written to the CEO, and gotten NOTHING-ZIP-NADA from her.

I have rated the app one star for the reasons stated above. I suggest investors look at other brokerage houses. That’s what I’m doing.

Best platform yet!

I’ve been investing for nearly 20 years now and have tried pretty much every platform there is (Ameritrade, ETrade, first trade, Schwab, vanguard, robinhood, Webull, sofi, IBKR, chase, ally invest, betterment, wealth front, and of course fidelity). So far Fidelity is my favorite platform for several reasons, a few of which I will share. 1. App is easy to use with great research tools and options for customizing your home and investment screen. While the app charts aren’t the best, they are great in the desktop view. 2. My experience with customer service has always been good. They have been friendly, professional, and always work efficiently to answer questions/solve problems. 3. Allows me to trade funds that are transferred from outside accounts immediately. My experience with every other platform I’ve used is that I cannot make a trade with transferred funds until the transfers have cleared which can sometimes take several business days. Fidelity lets me trade the funds immediately after I make the transfer even before it has cleared. 4. Quicker transfers. In my experience, Fidelity has the quickest transfer times of all the platforms I’ve used. When withdrawing funds from my Fidelity account it’s never taken more than 2 business days before the funds are available in my bank. There have even been many times that the funds were available on the next business day after I made the withdrawal! 5. Lots and lots of options. Fidelity has a full range of stocks (including otc as well as foreign stocks) and funds to choose from. Option trading is also available as well as after hours trading. And there are many different account types to choose from as well. These are just a few of the reasons I rank fidelity above the rest. If you are unsure what platform to use I’d just encourage you to try out a few and see which one suits you the best. Just because Fidelity is perfect for me doesn’t mean it will be the same for everyone nor do I expect everyone to have the same experience using the platform as I have.

Overall the best!

Absolute love Fidelity. You truly make it simple to invest! I plan on making Fidelity the home of all my investments in the foreseeable future, unless another broker comes out with a stunning UI.

The app feels dated overall compared to newer brokers. I do know this app is used by many generations, so Fidelity can’t change a 100% overhaul and keep everyone 100% happy.

There are a few things with the app itself that I would like to see, such as:

- The P&L won’t display on the accounts page in real time. You have to manually update. This is very cumbersome to keep manually refreshing every time you want to see where you’re at. Please give an option of real time in settings.

- You can only see your positions with all the info you scroll through. No customization with positions. Please make the columns you see/don’t see customizable. I usually only look at 3 things and can’t sort them/get rid of the unnecessary information.

-Ability to manage drip in the app would be absolutely awesome!

- Make your graphs and information on quote more user friendly and real time (think Robinhood, Webull, TDA). This can have huge impacts when attempting to active trade/swing trade.

- When opening the app, it takes forever to get to your accounts screen if you have Face ID required. It would be great to make it an option to automatically force Face ID immediately after leaving the app. Also, making it quicker to get to accounts would be great!

-Make an option to allow the widget to have real time account data without needing to turn on quick access in app. It’s annoying to open the app and you either must touch login or touch your screen to just glance at your accounts page. By either giving an option to have a widget on or off separately and requiring Face ID automatically, you can keep your clients secure and give them the option of how they want security handled.

Good work on how the app is smooth though! It’s a decent experience, but definitely could use some more modernized features that are an automatic expectation from younger clients in today’s world.

Great app, but new update broke Day Trend

Two negative issues -- one new and one old -- keep this from achieving a 5-star rating. After using the app for over a year and trading in several accounts, I have been mostly pleased with the rich features, accuracy of data, streaming support, and comprehensive account information exposure with the following two negative caveats.

(1) I really like the iPhone version of the Fidelity App mostly for the dense Accounts -> Positions view including the Day Trend graphical plot. This is preferred over the ipad view and over the website view. Further, Fidelity wrapped Active Trader Pro with WINE to get it running on MacOS, so that is too heavy, slow and clunky to use on a daily basis. Thankfully, the iPhone app is quite elegant.

Unfortunately, the version 3.10.32 on iOS/iPhone released after 2017-06-11 broke the Day Trend plots. The plots flash on screen and immediately disappear to be replaced by two thin, green horizontal lines that look like hyphens. Some of my holdings do actually show a graphical Day Trend plot, but over half of the Day Trends go blank.

(2) Also, only the balance is presented for our annuity account. No other information about our annuity is available in the Fidelity app. I cannot interact with the annuity/account/holdings at all. On my accounts page, the Annuity account appears just to be a placeholder for the balance. Tapping that account does nothing. Annuity holdings are not exposed at all in the Fidelity Investments iPhone app.

Granted, my spouse never should have invested in an annuity, but that is another story. So, shame on us for getting talked into that complex, limited vehicle. Bottom line is that this lack of mobile access is enough for me to bite the 10% and sell out of the annuity to get those funds into a more accessible account if all annuity account features remain broken for another month.

(3) ok... one other minor cosmetic peeve -- the green/red color indicator for +/- net and percent changes in positions often go stale grey, and I have to swipe down to refresh and prompt the colors to update to their correspondingly appropriate color -- green for up ticks, red for down ticks.

The app is fine, but the company is BAD

Beware this awful, lying underhanded company! I am a disable military retiree who recently began working with a company partnered with Fidelity Investments (to provide their insurance). I told them from the beginning that I have insurance through the military. And when a short time later they pressured me again and told me they had automatically sign me up for it, I immediately call them to tell them that I don't want it and that I am not interested. A short time later I noticed that I was having money taken out of my pay check going to Fidelity. And then when the prescription medicines I need for my disability suddenly came with a huge charge (that had NEVER been there in the past), the prescription company said that my new insurance with Fidelity didn't pay it later me the military company, and that they were forced to use them since Fidelity had gone behind my back and told the company that they were my insurance even though I told them flat out that I DIDN'T want them. Well , when I called them today to discuss this they told me that it's too late to cancel the insurance (that I said from day one that I didn't want) and that I was stuck with them until 2018 when I could unenroll at that time. And when I said what if I didn't pay for the insurance, they said I didn't have a choice and that they would just continue to take it out of my check without my permission. Again, I am already insured through my military retirement! So now I'm stuck paying every pay check for something I don't want or need and now I'm forced to shell out a lot of money for prescriptions for combat related disabilities that had been provided for free with my other insurance that now I'm either forced to pay for or just to go without. While I guess I'm stuck in this very bad situation until 2018, but if they think I'm just going to roll over and take it, then Fidelity doesn't know me! I'm going to make sure that EVERYONE I can tell is warned about this DISHONEST sneaky underhanded company (Fidelity) using every source I van find (print and social media) and word of mouth. No one who knows me would ever call me a mean spirited or petty (or even a complainer), but I think Fidelity needs to learn not to mess with U.S. combat veterans and military retirees!

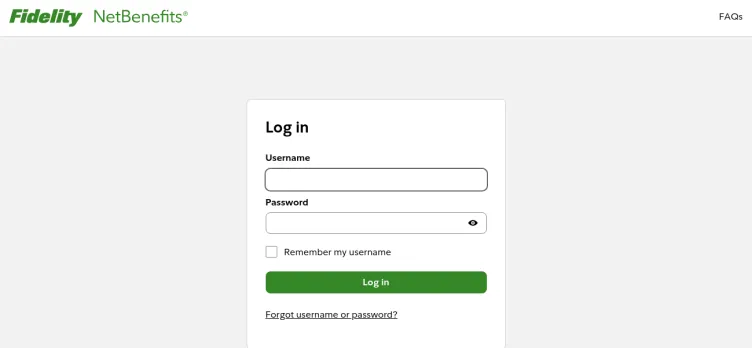

Signing up and creating username and password unfriendly

First, let me start out that I am a Systems Analyst for a Large company and am partially responsible for a website and phone app that receive well over 1million logins per day.

After signing up on my phone to use Fidelity, I created a username and password; so far so good. I need to deposit a check, something that can only be done in the app, so I download the app and attempt this. Apparently my 529 plan that I opened is not eligible for this, or maybe the app is broken? Either way I could not deposit the check. I decide to deal with this later. I run to the bank to deposit it so I can do an EFT transfer. Now I go back to log into the app using Touch ID and select to deposit from a bank account. I don't have a bank account listed, so I need to go to the website to add one. So I now attempt to login on the website using saved credentials in Safari... and it does not recognize my username or password.

I reset my password and it logs me right in. I visit the mobile app and type the same password, and the mobile app won't let me log in and gives a message that the password... THE NEW ONE I JUST CHANGED TO... doesn't meet their requirements... WHAT! You let me change it, presented me a strength meter, and then logged me in automatically after changing the password, but your mobile app has different password requirements?

As a side note, you should never automatically log a user in after they change their password, you should always take them to the login screen to enter the password they just picked.

So I change my password again, making sure to closely read their requirements. No certain special characters, no repeating characters, etc.

Ok, new password accepted! It auto logs me in again, so I log out to try it. This time I replace the saved username with the user name, and type the password. I'm in, finally. Oh wait, it wants me to set up security questions and won't allow access before I set them up... wait, I just had access, you logged me in multiple times after I was forced to change my passwords. Why didn't I set these up during the user name creation process? Is this why the mobile app was blocking me; nothing to do with my password, I just needed questions set up? Horrible experience!

What should have been a 30 second process took 10 minutes. Having doubts that this is a company I want to use for my child's 529 plan.

Modern look and feel but still lacks critical elements

So I just tried the new interface of the new and improved app and here is my scoop on it. The good-the interface looks, feels nice and modern, definitely a departure from the old app. Most of the functions are the same. The bad: I use fidelity for my brokerage accounts and CMA for my cash management. I have a few Huge complaints that need to be addressed ASAP 1) bill pay-very primitive and takes way too long to post to the account. There is a portion of the day on the day after the payment is initiated (on standard 1-2 day bill pays)where the payment simply vanishes from account. It's not in pending nor is it in posted. I have panicked once and made the payment again during this period, only to realize my original payment posted the next day. I like the chase model the best for Bill pays, the second you initiate the bill pay, the second it should come out of your available balance. Period. Also, the bill pays that have the check sent manually, do not post to the account until the item is cashed by the receiving party. Terrible when trying to balance your account. Also, moving money between the CMA and the brokerage accounts has a minimum threshold of $10.00. Other companies let you move as little as one penny. Also, I would like to see images of items such as checks in the app as well as checks deposited via mobile deposit. Last, when I make a mobile deposit into my CMA account, the funds take 5 business days to clear. Who waits 5 business days to clear anything these days. Until these are fixed, this app gets 2 stars only. Additionally Zelle is not available for the CMA account. Yikes. If they are trying to get people to leave their bank, don’t make it more difficult to move $ electronically. Just saw they linked up with PayPal, but if you want the money moved fast with PayPal, you have to pay a fee. Also, they don’t allow you to pay/receive from/to your own PayPal account. No bueno. All these things are so easy to fix fidelity. Other companies already do all the things I mentioned. Please get to work and I will be sure to give you the 5 stars that you are capable of receiving with just a few slight improvements.. I reviewed this a year ago and to this day, still no improvements. Finally, when a check is cleared through the CMA account, why can’t you guys image on the app. It’s not that hard. Why do I have to take out my lap top to view the check. Fix these items and you can have more of my business

Horrific customer service, app is absolutely worthless

I don’t even know where to begin. I am an ex user of Robinhood and attempted to move to Fidelity. Working with them and their customer service has been the worst I’ve ever dealt with in my life. It took them over two weeks to try to figure out why my linked bank account wasn’t working. They kept making up excuses saying that since my account was previously a 401k acct through another employer, something is screwed up on the back end. So I create a new account(same login) and follow the step by step directives of support. FAIL yet again.

After finally figuring out that debacle, I downloaded this app and started researching my positions that I had held with Robinhood. I wasn’t about to pay RH $75 transfer fee as they are as bad as Fidelity. After a bit, I’d realized that the prices displayed to you indicate that the prices reflected are as of “date and time”. This date and time shows the timestamp of now, yet is actually data FROM YESTERDAY. Who on the planet wants to look at prices and quotes of stocks available this moment as of closing prices from the day before. After contacting customer support, I was told “you obviously have to apply and request that your app to be real time”. Wow, yes, please let me request for me to actually see the real prices and not crap that’s a day old, thanks. Didn’t realize it required special permissions for me wanting something so blatantly obvious. Even after “real-time quotes” are enabled, you open up the app and data is still 15 minutes old.

Then comes the part of enabling options. I apply to trade options(yay, more requesting of me for them to allow me to do what I want with my money) and a few days later, I’m sent an email saying I’ve been approved. Sweet, finally something goes right! I try to purchase some calls and puts and guess what? Error stating I need options enabled. W...T...F... Support tells me I’m enabled and isn’t sure of what’s going on. Finally, they see I was approved for only level 1. Guess what the solution to this issue is? “Feel free to re-apply” is what I was told. I immediately dumped my portfolio right there on the spot and am now waiting for everything to clear so that I can get as far away from these old-timers as possible.

For you folks who want to leave Robinhood, I’m right there with you! Do NOT go to Fidelity thinking you’ll get to do anything that you’d been already doing for years on RH. I’m going to try TD and their app, Think or Swim. Fingers crossed it won’t be a nightmare like Fidelity is.

Cust.Serv. is Outstanding.Infantile App

The customer service is fast, friendly and informative.

When it comes to the App...absolutely terrible. When compared to an App and Brokerage such as Webull, who doesn’t handle nearly as much money and clients as Fidelity, their App shows their lack of concern to provide users with functionality that does not even come close to what Webull offers.

Pros

Fast Friendly Informative Customer Service with a real human.

Will refund wire transfer fees to get money to your account with them(has to be a certain transaction process) and allows you to use those funds immediately upon arrival.

Has a lot more trading choices then Webull.

Cons

Their app has newborn functionality compared to Webull.

Real time quotes don’t keep up as fast as others.

App has way too many buttons to go to that can confuse the user.

Short interest or hard to borrow interest is not readily available when you want to make a short trade and you have to call in before making that trade if you want the information unlike Webull who provides that info in real-time on the stock you are wanting to trade.

I have had multiple issues since opening an account less than a week ago. 4-6 problems that should not have happen and never happened with Webull.

When in process of placing an order for a trade the real-time price of the stock will not update. You will not be able to see what it currently sits at when you are putting in the details to make that trade and to further this inconvenience you are not able to swipe down to refresh the page either...they have no option for that in that page.

View Order book option which allows you to see ask and bids only provides the last 10 for each, with Webull Nasdaq Total View you can get 30 clear up to date asks and bids in real time as they change without refreshing the page at all.

Margin interest is not clear and available on the app. You won’t know unless you ask.

Watchlists you create limit you to only 50 stocks you can have in a watchlist, Webull allows unlimited.

Trading hours for some stocks, even if they are open and trading premarital, only allow you to start trading at 7am. Even though they claim 4am. All stocks actively trading in premarket hours that Webull supports can have trades placed on them starting by 4am.

Trades cannot be canceled in the morning I realized today when I tried to cancel I sell order I have in for my GE stocks. I simply wanted to cancel and place a new order and still to this very moment my order is still not canceled. Unlike with Webull, you can cancel any placed order that is not filled at ANYTIME and it will come off your placed orders immediately.

Unfortunately there is more but I have grown tired of writing this review.

Bottom line: Fidelity Clearly cares more about their desktop version than they do their mobile version. They lack speed to make quick trades entering and exiting positions which is an EXTREME must for active daily traders and for a volatile market that you may want to buy or sell on. They stress the Desktop Pro Trader has all these features yet with all their money they refuse to spend it on giving you this power in the palm of your hand on the go. Good for longterm investors, maybe, absolutely dangerous for active daily investors.

Mr. Dalal

I have been account holder of Fidelity since early 1990's. My portfolio over considerable period is grown due to my effort.

I do not believed in day trading. Therefore, I do hold on an average my holding 3 to 6 months.

My family, has 9 accounts, and I managed , bring all new money. I generate reasonably good income for Fidelity Investments, way of commission and sometimes margin interest.

My turn over of all my accounts , depends upon situation.

Problem: when market crash, we understand "Mark to Market" bring value down of position therefore margin accounts value also depleted and as investment company you want to play safe. (1) All of sudden margin due following day, instead of normally 3 days, that put tremendous pressure on account, not only margin department representative became more rude, and do not show decency to discuss which position they will sell to recover.

Here is Fidelity management could do: Evaluate each account holders and their history, before another crash hit.

We do not believed in over extending in any of the accounts, and in normal time we do not pay margin interest on our accounts, but when price of the stock drops drastically, requires longer time to recover, the waiting time kick in margin interest , and managing our accounts we have first hand knowledge, therefore we should be given oral information and discussion with margin representative, so we can sell the position appropriate as per our information to keep our account in good order.

Just because market crash there is no need to be rude or misbehaved with account holder, we all here to generate profits, but not to put Fidelity in precarious position, so in the beginning you have to rate your customers based on accounts history.

In my, case started with very small amount and over such long period went up and down, at the end today I have reasonable large portfolio.

Loyalty, do not come without sacrificed.

I was in VIP Active Trader Team , all of sudden your management made decision to drop me from VIP. My portfolio value was sufficient, I was invited than my volume was lower than when they drop me.

Fidelity Investments, in a competition with other broker house, to attract more customers in general active trader pro team any new member could join at much lower Investments and lesser knowledge. Thus novice customers and many novice representable to serve this group.

This really, created bad situation for me because when you put my portfolio in general Active Trader , I do not get good service, wait time is much longer for me.

My total portfolio is over 12 M. All my accounts I generate reasonably good commission and margin interest, with such long relation I have to gulp this insult.

Some manager called for me to VIP group but they have grudge against me personally of no faults of mine, and someone acting to prove his or her authority.

I am very frustrated by Fidelity, as Fidelity do not understand we have 5 accounts of my children and grandchildren, once I moved out they will sever relationships with Fidelity rest of their life, that is very long period plus over 12 M dollars for an individuals you may have many like me, but others will realized , for a person's attitude Fidelity will loose future relationships.

Mr Dalal

[protected]

Great brokerage; App could be improved

I first started investing with couple years ago using Acorns then Robinhood. I still use both, along with Coinbase for crypto currency, and Stockmaster that lets me add all of these to a single portfolio to keep watch on all of my investments.

A few months back I set up an account with Fidelity when they first offered fractional stock purchases. Overall I’ve been happy with the service and app.

COMPARISON VS ROBINHOOD

...for newcomers to trading

Robinhood is a great for new investors. The app is clean and easy to use. They now offer fractional trading. One can instantly deposit funds from a debit card and begin trading.

The performance charts are touch sensitive where placing your finger on the screen, moving left to right, will display the dollar and percent change over different time periods. When using two fingers will display the dollar and percent change between two different times/dates. Cryptocurrency can also be traded.

Fidelity, coming from Robinhood, will feel a bit cluttered. The app needs a serious overhaul to included the aforementioned features. Currently, the Fidelity app displays charts, but, unlike more modern trading apps (Fidelity) doesn’t have touch sensitive charts to view/compare changes. In addition, they lack the ability to deposit funds from a debit card or via cryptocurrency.

Before you begin trading you’ll have to provide documents for identification, add your bank account, and wait for your funds to transfer in from your bank. This means you’ll have to wait almost a week before trading. The app also doesn’t support trading cryprocurrency. One other issue is that the iphone widget is near impossible to read as it uses green text on a light grey background.

One advantage, of Fidelity, that I found over other Robinhood (and Acorns), is I was able to sell stocks and the money deposited into my bank in 48hrs. I recently had a family emergency and this was a life saver. Robinhood (and Acorns) can take 6+ days.

When you dig deeper, Fidelity has the benefit of stock trading, retirement accounts, and offers a lot of robust options to manage investments. They are a full featured firm with a long history. They offer a plethora of investment options along with connections to real advisors (not required) if you’re inclined ti move into serious trading/day trading/other investments.

There are many other differences between the two apps/services and I’m drawing comparisons for those just getting their feet wet in trading.

With that said, for newcomers, I recommend trying Robinhood first, especially if you need to add funds fast to scoop up a good price on a stock. The decluttered app, feature rich charts, iphone widgets, are a big plus. Just keep in mind it can take some time to settle your sales and some time to transfer funds back to your bank.

In conclusion, you may want to install Fidelity and get your account setup going while using Robinhood to start trading in both traditional stocks and cryptocurrency fast.

Due to the fast rate in which stock sales settle to the time the cash is deposited into into your bank account is why I’ll continue to use Fidelity as an emergency fund when I may need cash fast.

As a last note, both apps would benefit by allowing users to create a “3rd Party Portfolio”, as *Stockmaster does. For instance, I could record buys/sales of other stocks from any broker/app and record it. At a glance I could see my position/gains/losses for all trading accounts.

*For those using multiple brokers/apps, with experience, Stockmaster is worth checking out. It will allow you to create a portfolio of all your trades from different brokers, and tracked them all in one portfolio.

Not Even Login Working on Fidelity App since March

Nothing Works on APPLE since March - Not even BASIC Login! Login doesn't work since March on FIDELITY App on APPLE iPad Pro, and now the Login does not work on the Google Chrome and Siri on APPLE iPad Pro iOS 15... Numerical Password with 10 Numerals and then Letters and Special Characters can't be typed as Fidelity App keeps Switching APPLE Native Keyboard from Numbers to Letters while Password is Typed. On FIDELITY Chrome Website Version, this issue is occuring since this Monday, 9/27. APPLE iOS was updated 2 weeks ago to latest iOS 15 and I was at least able to Log in on Chrome and Siri until 9/27, while having issues with Keyboard Randomly Switching on the App. Now all 3 Applications: the Apple Store App, Google Chrome based Application and Siri Application are Broken for Typing Numerical Alpha Password. On the Exact Same Device, Keyboard is not Switching on other Password Typing Entry Points such as Typing Logins and Passwords for Wi-Fi and Numerous sites like Morning Star, Bloomberg, etc. When I complained about not being able to place a fractional Trade about 1 year ago via Feedback as FIDELITY Software Code locked in the Phone Dialer Keyboard on the Field where you would type the number of shares and would not give an option to type the decimal point, that Issue surprisingly was addressed Quickly... within just less than a week. An issue with Broken Watch Lists on APPLE iPad Fidelity App was finally seemingly resolved after me complaining weekly via App Feedback for the Past 52 Weeks every other day or so... and monthly via their representatives who are Incredibly helpful when it comes to placing the trades etc, but they seem to be powerless as far as escalation of the Technology Issues and Bugs... and advocating on behalf of their Customer they are helping to trade as the Application does not work... But Login Issues Keyboard Switching Bug is still not addressed and ignored despite me giving Numerous examples of Specific Behavior of Keyboard Switching to Electronic Channel Support and Reps, the issue is now only worse as of Monday, 9/27 I can't login on Google Chrome and Siri without Typing 1 Number, Watching the Keyboard being Switched by FIDELITY Software Code BUG to Letters Only Keyboard (naturally only APPLE iPad Native Keyboard, no 3rd Party which worked for years just fine) If not for Fidelity Knowledgeable Traders and my Spare Android Phone where things work as expected for years, I would definitely have left Fidelity. Electronic Channel Support didn't even not care either of these or Major Login Issues on the App since March (it now allows me to type 3-4 Numerical Characters in the Password Field, but not a long String without Keyboard being Switched by FIDELITY Software Code)... It doesn't appear there is any Testing of the Application for Basic Features and Screens to Work on even old iPhone or iPad on Apple. How about this idea: Hiring s Single Apple Native Developer (out of college freshman in USA or even a College Intern in USA) who actually would fix all these flaws such as tiny unadjustable Font for for people to Actual read Great Content and who would be more than Happy to Test APPLE iPad and iPhone App on any second hand devices one can buy for $200- 300 on Amazon Prime. Instead of All Electronic Channel Support, Fidelity should invest in a single Apple Native Developer and a good QAT Team who would follow Traders Business Scripts and Test Manually clicking on things produce an expected Predictable and Correct Outcome in the Testing Scripts developed with Traders Business and Common Sense. If I were working at FIDELITY QAT I would Probably Start with Testing how Login Works on Apple iPad and iPhone when Password is 5 Numberic Digits and then 3-4 Letters and Special Characters. Make that Test a Good 15 min Exercise to Grasp that Not even Basics Work on Apple iPad and iPhone and see how CUSTOMERS Experience this App... That would be my suggestion... Today, there was only a second Electronic Support person who had APPLE iPad device to Test this issue and trying to give me workaround Suggestions, yet, since it's not a Native iOS Apple Developer, it's really Impossible to Hope this Issue would be even entered into their JIRA for Issues Tracking Purposes... Disappointingly, the Feedback I have submitted via the App and via the Website Feedback is Ignored as always for the past few years since March when Password Typing Keyboard Switching Bug was first Hard Coded into FIDELITY Seemingly new Application...

Fidelity is great!

I like Fidelity very much, so before I get to the app review, let me to compliment them as a whole - no/low fees, features, variety of accounts and trading options, their website, people on the phone, responsiveness, reliability. I hold everything with Fidelity - brokerage, 401k, HSA, and I would consider to move my banking there one day too.

The app basically does everything I want from it, and 99% of the stuff that you can do via website, plus one cool thing that you can't (as far as I know).

When I have fidelity website open on my desktop, I still frequently trade via phone app. Plus, the app can do what website can't (or haven't I found it) - fractional share purchases, and it is super convenient when you can provide the money amount you want to invest, instead of number of shares you want to buy.

The app can display tax lots/cost basis info, and it was very convenient, but after I merged two of my accounts into a third one, the app is not displaying cost basis/tax lots anymore, even though the website does. And it's not that there's a few days delay - I merged months ago.

Other thing, a few times the app didn't let me to trade extended hours, telling me I need to accept the conditions, which I did a long ago, but I could do extended hours trade the same morning via the website. It must've been some intermittent issue.

Ideally, the app would let me to manage account features; instead I currently can enable them only via web - the future is that people use tablets and phones more -"and more often. But I understand it is rather an one time operation, and developers are picking priorities.

I love and use the dark theme, but some tones of green are from different palettes - so "Fidelity green" is dill-pickle green tone, but "stocks up green" is plastic-toy green tone. And I think that super dark graphite is better than #000000 black.

I personally like to see markers map more often, but it is only easily accessible, and as a map only for a few hours before 1AM PST. Plus it is hard to get which up/down triangle is which index. You can click the triangle, it brings you to a table, but it is hard to find connection to map.

I wish the app/Fidelity had an option to display stock prices/"total net worth" during pre-market/early trade session, kind of like yahoo does.

Another thing I would like to see is for the mutual funds/non-brokeragelink 401k accounts to display the date of the price update on the main account list screen. I always wonder whether the amount I see is today's price, or still a yesterday's price.

I wish the charts were more powerful - super responsive to finger gestures, infinitely adjustable to any scale, plus if could click on the account history chart in any point, and it would display a date and the exact amount. Currently, web version has it a bit better. Yep, ideally that chart functionality would also go to the "research" section, which I would emphasize more, and ideally it is able to do everything that yahoo app does, including the baseline/side-by-side comparison.

And I know the app is super fast and responsive, but I would like it to be even more so - so right after it verifies face id, I still can click around for that one second it tells me it is refreshing.

And also a minor thing, I think the app doesn't allow me to place a regular hours order before the market is open? Because I think, the website does, but I'm not sure because I don't need this very often.

And for both the site and the app, I would love if stock exchange dates/holidays and session hours were more easily available, so you see it as a calendar for holidays, and a progress bar + how many hours till open/close for the day session.

And for the tax long/short positions, I would love if it told me when is the date it becomes long position, in addition to purchase date.

And for the brokerage account, I would love if I could click a button to quickly filter/sort by long/short position. The question I want to answer is that if I need money, how much do I have in long position right now. And ideally, it would also be clear that in a week from now, I am going to have X much more, because it would be a year since I purchased.

Other thing I do is I rebalance between stocks. So it would be fantastic if in the account I could select several stocks, and it would display a precentage/amount pie chart between them, and give me a slider so I can realign as single transaction. I know it is not that easy, because prices change, but guess what, when I rebalance, I am doing this anyways, only that I have my excel sheet, it tells me how much to sell and how much to buy, and I switch back and forth updating the price, making the purchase, and there's already some price delay, and the whole thing takes me up to half an hour for 3 accounts. But if I did it in the app, yes I understand prices are subject to change, but you still can do faster than me, and we would be done in 3 minutes. Especially with fractional purchases. Let me to slide the ratio between two stocks to 50/50, and boom I would love to see it done with maybe not ideal precision, but the app is still more responsive and accurate than when I do the same thing manually anyways.

Fidelity Investments Complaints 127

Fidelity accounts

I had 5 accounts with fidelity, cash management, brokerage, 401k, fidelity spend-save, etc. they randomly restricted/closed my accounts over a month ago and won’t let me login or give me a reason why or even tell me how I can get my money out from the said closed accounts. I’ve talked to 2 reps now that both said they don’t know why my accounts were closed but that they are staying closed and won’t be doing business with me moving forward. I just want my money from the accounts sent to me..

Desired outcome: My money sent to me

Retirement plan for my deceased mother

Fidelity Investments had mailed a letter stating my late mother has retirement benefits and we should reach out to start the process. It's been 2 months! I have submitted everything they have requested. I've spoken to maybe about 20 different people and each one has a different story about this account. One says documents are missing (which wasn't because I faxed everything over as well as uploaded it). One says it's being processed. They won't let me speak with the back end staff to see what exactly is going on. I keep telling them they have everything so what is the hold up! They can't provide me no information. I told them their process sucks and it's not right that they are withholding information esp since they have received everything. I feel like they are knick picking- shouldn't take this long to process!

She has pension plan with this company and was with the same employer and didn't take this long! ALL the information is the same. My mom doesn't have any property or estate! Gave everything to them!

Desired outcome: process her benefits asap! my mom has passed about 2 yrs ago.

This app conveniently always fails right when the morning bell rings & the market is opening

Not only has it happened numerous times there’s always a delay when you want to purchase stock as soon as the bell rings. A lot of other times you buy stock and you literally typing a specific amount for a limit purchase yet without your permission you end up paying more! I don’t understand what the point is of putting in a limited purchase amount per share if it’s just gonna be disregarded!?!?!? Not everyone is an expert in trading so perhaps they should explain why they are allowed to do this instead of just doing it and expecting us to ask accept it with no explanation. There’s a lot of other times when it just fails and I simply can’t get log back in for 5 to 10 minutes most of the time but other times its inaccessible for 30 mins to an hour. One instance this year it was down for 3 days. Again it would’ve been nice had they sent an email out to their customers to let us know that their operating system was completely in operable instead no one sent any notification and we just had to wait and wait and wait. So I hope that never happens again because I know I received 3 good faith violations during that 3 day period resulting in a suspension of certain privileges...all because I couldn’t see any of my normal reminders or warnings!

Is Fidelity Investments Legit?

Fidelity Investments earns a trustworthiness rating of 91%

Highly recommended, but caution will not hurt.

Fidelity Investments has received 12 positive reviews on our site. This is a good sign and indicates a safe and reliable experience for customers who choose to work with the company.

Netbenefits.com has a valid SSL certificate, which indicates that the website is secure and trustworthy. Look for the padlock icon in the browser and the "https" prefix in the URL to confirm that the website is using SSL.

Netbenefits.com you are considering visiting, which is associated with Fidelity Investments, is very old. Longevity often suggests that a website has consistently provided valuable content, products, or services over the years and has maintained a stable user base and a sustained online presence. This could be an indication of a very positive reputation.

The domain associated with Fidelity Investments is registered with a high-end registrar, which can be an indicator of the company's commitment to maintaining a secure and reputable online presence.

Fidelity Investments website is deemed to be popular and indicating that it receives a high volume of traffic. It is important to be cautious when using a highly trafficked website, as it may be a target for cybercriminals looking to exploit vulnerabilities or steal personal information.

Adult content may be available on netbenefits.com. It is important to be aware of potential risks and to use caution when accessing or engaging with such content.

However ComplaintsBoard has detected that:

- While Fidelity Investments has a high level of trust, our investigation has revealed that the company's complaint resolution process is inadequate and ineffective. As a result, only 11% of 127 complaints are resolved. The support team may have poor customer service skills, lack of training, or not be well-equipped to handle customer complaints.

Too Obfuscated

Initial account setup and bank linking was a nightmare. I ended up with two locked accounts that could not be deleted or have banks linked to them. Chat support was excellent and resolved my issue by manually deleting one of the accounts and guiding me to a page where I needed to submit additional documents. Not only was this not immediately clear to find on the desktop site, I believe it is not even an option on the app. And even on the desktop site, that singular page is the only indication that my account is locked. Nowhere else is this information apparent. The process needs to be way simpler or at least clear about account restrictions and why they are in place. Rather than saying “account is ineligible to link a bank account. Please create an eligible account,” the app should have given me a prompt saying my account is locked and cannot be linked with a bank account until additional documents are received and approved. To which then I should have been able to submit those documents within the app and have the status of that be at the top of the main page considering I literally cannot do anything with my account until that is resolved. The fact that this isn’t even in the app whatsoever and insanely hidden on the desktop site is unacceptable.

Fidelity Chart issue

Fidelity chart issue :

I do like the fidelity IOS app, the Information is comprehensive and effective to an extent. However, when it comes to the deciphering chart on iOS fidelity app, it is frustrating and outright exasperating. Problem with the chart is , data, it is not spread out at a glance, it is slow, and needs to be colorful. For example when the stock is down amber color is preferred amongst stock traders, green when stock price is rising. Recommendation is Please update the chart section. In addition, FaceTime login also seems to be lagging comparable to the other platform (Robinhood). As a new young investors, iPhone apps is highly preferred and is always with us. Thus, making the fidelity app faster and easy to read chart highly recommended. Lastly, when transferring money to fidelity brokerage account, there is no way knowing when exactly the money will be available. Only expects indication is (2-4 days). Which often takes more days. Exact available date for transfer would be exceptional . It is annoying and having to check account weather the money has arrived or not . In the transfer section adding a status of transfer and exact available date update would be highly appreciated. Please fix aforementioned issues next update . Thanks .

Several issues

1.I can’t link my husband’s Fidelity account to mine in this app so that I can see everything in one place,l. But in his Fidelity Net Benefits app (which I don’t like as much) I’m able to link my accounts to his and see everything... Why can’t I do that here?

2. I’ve used other companies for stock trading but making transactions through Fidelity is new to me. The “good faith” warning which kept popping up prevented me from making a stock purchase because it isn’t explained well. (I’ve never received a warning like this from any other company.)

After several days of wanting to make a stock purchase and receiving the same warning, I finally had time to call Fidelity about it. Unfortunately, I found out that I could have made the trade DAYS AGO and didn’t need to wait for my funds to “settle! (Since I’ll hold the stock for a long time, it would not have been a good faith violation.)

The stock price increased by over $125 a share yesterday, so it would have been really nice to make the purchase before that happened!

They should change this scary warning and add an explanation so laypeople are comfortable proceeding if it’s appropriate.

The representative that I spoke with said they field a lot of calls about this, so it’s clearly an issue which should be addressed.

Crashing is unacceptable, and so is not understanding that I just want to check my dang stocks

I use this app constantly, and it crashes just as much as I use it. It has major issues with Face ID and resuming login. Often times I will be met with an empty state message that it "cannot connect". I'll have to close the app quit it and then restart.

This app also suffers from too many features. Clearly, my goal is to check my positions regularly. What is with this dashboard login screen, and what is with me having to click on accounts and then go into my positions. I want all of my positions right away, every time I open the app.

when I look at my positions, why am I not able to check the volume of one of my positions when I am trading? Instead of touching one of the shares I own and getting the volume, I have to do a search for this year and then scroll down to find the volume. Not into it.

Clearly, the Fidelity team could actually go out in the field and do some user research to understand the needs of the people who use their app as opposed to reading app reviews and or following some kind of backlog that has no bearing on the needs of the people who are using the app.

Do better! There are plenty of modern day brokerage apps that exceed the user experience of this app. Why are you still driving a Cadillac, there are plenty of Teslas out there to look at and figure out how they work.

Terrible customer support

I had a terrible experience with fidelity and their customer service. Long story short.. the New York State Child Support Department accidentally levied my account and sent notice to fidelity. I called fidelity and they notified that nothing was going to happen with my money after me asking multiple times for reassurance. 3 weeks later I get a notification that my positions were closed on my BEST stocks. I called again, dealt with people who tried to rush me of the phone to just be directed to their law and operations office, which I had to wait for a returned phone call. I received my return call and I spoke with an absurd and extremely rude representative by the name of Krissa. She told me “it was a courtesy that she was even calling me back and wasn’t obligated to do so.” She even told me that they didn’t even need to notify me that New York State was placing a levy! What?! A courtesy? After investing thousands with them it’s a courtesy that they call me about someone trying to take money out of my account when it’s their fiduciary responsibility to protect my assets and they failed to do so and now I’m waiting 3 weeks later for money still from New York State! I was just about to transfer $25,000 from Robinhood to them, but now I’m looking to cancel my account with fidelity and also report them to the ComplaintsBoard.com.

Be careful!

I signed up for Fidelity a few months ago. Everything seemed to be working well at first. Then, I realized that over $500 had been taken out of my account as I was trading, claiming that it was taxes that were being withheld. I have never had this happen on any of the other apps I use (Webull, Robinhood, Ameritrade, etc.). So I called Fidelity. The person whom I first spoke with said that I just needed to fill out a tax form and then the money would be placed back in my account. He then sent me the tax form. I filled it out and uploaded it to my account. After about 10 days of not seeing the money placed back in my account, I called again. This time, the representative said that the first person whom I spoke with was not correct. The money cannot be placed back in my account. And in order to get the money back, I would need to go through the work of retrieving it from the government when I do my taxes next time. So just to warn people, if you are going to use Fidelity, realize that if you download the mobile app and link it to your bank account, this may very well happen to you. And there is no warning or notification that you even need to fill out this tax form. So I would personally use one of the other well known apps, which all seem to be immune to this problem. Or, if you do create a Fidelity account, make sure to figure out how to get their tax form and upload it to avoid this mess.

Not a good experience

I went with their app thinking their years of experience would be a good one to go with. I have an account with Robinhood and due to recent events I thought I might should look for a different app. I signed up and had it going so I sent a transfer from my bank on a Sunday to have an account ready to trade and buy on within the next 3 business days. That was on Feb. 28 and I checked it on Wednesday and the moneys not there. I checked on Thursday and it’s not there yet on March 4th. I thought I better check out what was going on. My bank shows transfer on Feb. 28th. So I call and they tell me since I didn’t send it till Wed. It would be in my account on the following Monday the 10 th. I told him my bank initiated the transfer on Feb. 28th and it would be there on March 3rd. He insisted that I initiated the transfer on March 3. I told him again it was the 28th and it should already be in the account. He didn’t know what to tell me, he didn’t know where my money was? I told him when you find my funds transfer just wire it back to me because I intend to close the account and he was going to pay the fee to wire it. He talked with his supervisor and then told me He would wire it at no cost. I just didn’t trust them to be responsible with my account after that. I guess I’ll be at Robinhood again. I’ve had no problem with them. Oh and I was placed on hold for 30 minutes waiting for someone to help me!

Needs a Lot of Improvement

Fidelity’s app is lagging in UX design, feature selection, uniform metrics, and desirable metrics that other asset management apps currently have as standard features.

One account will display YTD return, another type of account will display daily returns and aggregate account balance. Why? Give me my returns across time horizons(D, W, Q, YTD). This is a basic thing and not difficult to deploy.

Benchmark returns are always 1-yr returns. Meaningless since everything else is either daily, again depending on account type. Make this uniform so you know how you are performing vs beta.

Mutual funds in an IRA will show performance by purchased tranche whereas mutual funds purchased in an individual account will display a dollar-cost average return with no journaling of tranche purchase price. What is this? Again make it uniform.

Fidelity products are missing key information. Certain Vanguard products that directly compete with Fidelity products also have missing information. Why bother having institutional class shares listed or other mutual funds if you lack data and can’t purchase them.

I expect far more from a company with the amount of resources and talent that Fidelity possesses. Get focus groups together. Have your customers help you with UX design. This app was made in a bubble because it would be better and cleaner if you had asked for user input.

Step it up. You’re Fidelity...act like it.

Lip Service

No follow through and or feedback from Fidelity per my suggestion and numerous requests spanning several years.

To wit……..

1. To make a mobile deposit, one must omit a number from the account number imprinted on my Fidelity Check and substitute it with a numeric number.

2. To pay a bill online, one must lop off the First four (4) numbers from the account number imprinted on the bottom of the check and substitute with pre-determined eight (8) digits.

Where are the written instructions? My phone conversations today with a Fidelity Customer Service personnel in Florida said there are none.. I don’t pay or deposit often and it is difficult for the lay person to remember let alone memorize the process and this is where Fidelity fails to service the needs of all clients. By this lack of procedure, Fidelity ASSUMES their clientele have full knowledge of its online tools and learning process. Please simply and have your brilliant programmers design written procedures like……”STEPS TO TAKE FOR A MOBILE DEPOSIT; STEPS TO TAKE FOR PAYING A BILL THROUGH DIRECT DEBIT FROM YOUR ACCOUNT.

If time is money, I have wasted valuable time of Fidelity’s personnel who had to orally explain the two procedures listed above.

Let’s reform and use some formative evaluation skills to right the above, but I have personal feelings that the status quo prevails and nothing gets done.. Take this as an angry constructive critics.

Donald Mar

Great App- Updates Need

So far this all has been terrific. I’m in my 5th year of consistent investing and Fidelity appears to have the best interface thus far. I do believe with update to IOS 14 there should be widgets, and an Apple Watch feature, but hopefully those updates are in the pipeline.

On area of feedback is the early warning system:

1. It takes well over 30 minutes to sign up, but THEN after the initial setup you link your back account only to find out you have to go on a goose chase to link your bank accounts.

2. Called customer service rep who wasn’t able to explain why my account couldn’t immediately link. This person took 15 minutes of hold time to speak with, only to be transferred to an early warning call center... who couldn’t tell me why I could not immediately link my Chase acct.

3. So now I’m REQUIRED to get a medallion signature from my banking institution, then mail the form to Fidelity... this will take 5-7 business days of which I could be trading... but no the early warning system is to protect me... hot it thanks.

Needless to say my first day of business with Fidelity is bitter sweet. Please empower your employees to inform the customer of the EXACT issue in the future. It doesn’t appear the service has the customers best interest in mind, but has scripts they read off of. So the customer is required to find the solution when the rep doesn’t have the answer.

I’ll provide a 90 day review, day 1..,,,, not a good look Fidelity.

Poor User Experience in every way

This is a review of the fidelity app, not the company (which is a 6 out of 5 stars). The app is CLUNKY!

The user experience of the app is poor in nearly every way: it takes multiple clicks to get anywhere and basic things are inexplicably not available. If the designers just implemented a cost per click metric they could see how awful the user experience is.

1.When I open the app, I want to see my positions but I have to click through three screens to find them. The first two are pretty splash screens but are unnecessary.

2. Historical charts are not available for stocks in the position tab. I have to add that stock to a watchlist to get a chart. There’s a one-day activity chart in positions and clicking on that should lead to historical chart but it doesn’t. Some stocks like RDSA don’t even have a historical chart available. Not sure why.

3. Watch tab doesn’t have a one day chart - you have to click on the ticker to see a basic chart then double-click on that to see the advanced chart. I would like to see a buy/sell line.

4. You can’t add a stock to a watch list from the search screen. You have to select it, click add to watch list, then select which list to add it to. A default favorite list would be nice.

5. Options chain and watch list aren’t available when you click on a stock from the position view.

There are so many more examples.

Also, I don’t like logging in every time I open the app. It’s on my phone and my phone is already secure.

They Don’t Care

0 stars for this company... they mislead their clients with their policies and don’t care how much money you lose while you wait for them to take their sweet time with everything... When you need help you call in and get a load of smug attitude from the fidelity reps, who lied multiple times to me, veiled the answers to my questions in a strange secrecy (won’t tell you anything about the requirements) and kept me waiting for over a month for a basic options application! Repeatedly telling me to correct this part or that part to reflect the same information but differently... only to tell me a month and 1/2 later that it’s probably not helping to resubmit multiple times and they will just continue to be denied.

online (reddit and elsewhere) everyone says to lie and pump up your numbers in order to be accepted for these applications... I refuse to do this and so was denied despite having over 20k in my fidelity portfolio, a business degree, and around 13 yrs trading experience... I guess they only want liars trading options at their firm.

It takes forever to even get someone on the phone because they have a zillion customers... if anything is happening in the market forget about it... and even if you do get someone, they don’t need your business and make that apparent.

This was the last straw for me, especially during this volatile COVID period, when having higher levels of control over trading strategies was crucial... already Transferring my portfolios elsewhere... somewhere with customer service.

Cluttered interface

The app provided easy access to screens containing the same generic information you find on Yahoo or Morningstar: e.g. easy to find tabs directing you to screens summarizing market conditions and news stories. That said, finding tabs directing you to a screen that provides the status of a specific trade you have made, or tab directing you to a screen listing the funds you have, or even funds available from Fidelity, are virtually impossible to find. The saving grace here is the “virtual assistant” can often provide you with links to these site, but you have to ask the assistant every time. The links provided by the assistant will often “null” values for different fields but tend to work anyway (buggy).

The app will also not allow you to link outside accounts in what Fidelity is calling “full view”. Trying to so produces an error message indicating you need to use chrome when you set up the link. This message comes up despite the fact that I’m using Chrome. For me, setting up the links on the website works when I use a laptop, but going back to the app produces still more error messages.

The website is much easier use as there are obvious tabs linking you to screens providing information on order status, account holdings, etc.

The new Beta version does not seem to be different in any substantive way (the feed tab is replaced with a home tab but the content and navigation seems to be similar). I’m deleting the app.

Note that while other users are giving the “app” 4 or 5 stars, many of reviews are really praising the “company”. These are separate.

Slow, slow, slow

Here is some of my experience for what it is worth.

This upgrade is so slow, it is a complete joke.

Entering watch lists manually requires long wait times while each keystroke catches up. And no, it is not this particular iPad.

This update also LOST my entire watchlist which I now must recreate.

While I do this task manually, I also notice that my efforts make no difference on the Fidelity website. So, the app does not talk (at least in that way to the Fidelity website.) Quite strange in that buying and selling of securities are certainly communicated!

There is no list of changes from the old iPad app to the new iPad update to facilitate user understanding of the new app.

WHY doesn't the developer want to talk to the user base as if we are important?

Other app developers will state quite precisely xyz feature was here, but we have placed it over here for this and this reason. Truly folks, how hard is that?

It is obvious that the software development team is in a silo.

If I were in charge of customer relations, I would be blowing a frigging gasket given how important the user experience is to overall satisfaction with the Fidelity brand.

Here is the bottom line- Customer relations is nowhere on the radar of the development team. As such, the upper management cannot possibly be integrating crucial concerns of both the app and the brand. Problems like this one are just floating out there waiting for each small problem to be flagged and attended to after the fact rather than, by design, having the radar follow both customer relations and app development at the same time.

Clunky, slow and incomplete app for active traders

For checking your portfolio daily and making an occasional trade it’s adequate. If you’re trying to trade beginning or late day it typically bogs down (presumably congestion on Fidelity’s end) and is slow refreshing. The app includes pointless “updating” messages that temporarily and unpredictability displace menu items vertically which promotes errors when making rapid fire selections. Specifically, the list of accounts moves vertically as do individual positions within accounts with “updating” shown when first displayed or refreshing. I repeatedly have to back out of a selection, wait a moment for the display to “settle” then reclick the position I’m interested in. Intraday charts are inaccurate, movement color indicators in text normally red or green are intermittently black. Company research within app nearly useless with major omissions in basic information under quotes, ex market cap, book value etc are found nowhere, and useless information like bid/ask exchange names is shown. Account feature management (ex transfer lockdown, beneficiaries) which are inherently safer to set within an iPhone app vs a website are unavailable. I have attempted to trade riskier positions (ex VXX and shorting) only to find the trade rejected at last step with a referral to website, when this should have been displayed first step. I write having been a happy Fidelity customer for nearly 30 years (entire adult life) and believe the company and their funds are great, their app just needs a complete review and rewrite by professionals. I consider transferring everything to etrade for their better app interface.

Active trading is painful with Fidelity app

Login security is solid, but it requires a third-party application and manually copying one-time code into Fidelity app. Integrating 2FA into the app would make sense.