LoanCare’s earns a 2.0-star rating from 326 reviews, showing that the majority of borrowers are somewhat dissatisfied with loan servicing.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

Forbearance scam

We entered into a hardship forbearance in 09/17. At the time, we were advised by the agent to not make that months payment in order to start the process. We were assured that our credit would not be affected, there was no danger of foreclosure, and the process would take 30 to 60 days. Almost 2 years later, the forbearance was completed, we were reported late for almost the entire time, were put in to foreclosure TWICE, and our mortgage payment increased. Luckily, we have proof of all of there deception. From losing our signed documents sent certified, screenshots from there system showing they witheld applying our payments, and emails where they continuously admit they were wrong. Unfortunately, Loancare will not correct ANY of their mistakes. I've tried numerous times to have them remove our late payments and they actually added late payments. They have reported No Information during months when we made our payments monthly and on time. Loancare also misplaced important documents with our financial and personal information subjecting us to possible identity theft. The last straw for me is when I disputed a legitimate mistake on my credit report and they changed it to a late payment. That lit then fire to start contacting attorneys. We went thru absolute hell with them for 2 years which resulted in having to go to counseling and stress related health issues that we deal with to this day. It's almost like PTSD when we have to deal with them. If anyone is in this or a similar situation, I would love to gather stories and present them to an attorney or someone in the media. A Google search will bring up numerous attorneys that have successfully sued Loancare and we started reaching out to them today.

Desired outcome: My credit fixed. An adjustment for all of our late fees. People to contact me if you wish to look into a possible lawsuit or contacting someone in the media. I'm ready for a battle because Loancare should NOT be allowed to be in business.

Major issues coming out of forbearance rewriting and rewriting documents

I have been trying to get my loan current for a yr now. Sign and notarized multiple documents, they take to long to process them. The back and forth going through divorce and removing my soon to be ex from title. Some how this is my fault. I have over 100k in equity in my home now. I want this resolved so I can refinance and take advantage of current rates.

Desired outcome: I want my loan current and refinanced. I have been making my payments per loancare for a yr now, get my loan current so I can get away from this horrible company.

We went thru this in 2017 to 2019. It took them almost 2 years for them to complete this. They repeatedly lost the documents we sent, never sent us follow up paper work, etc. even tho we sent everything certified or overnight. It was absolute hell. We would try to pay our payments, they refused to accept them. They advised us when we called about the hardship forbearance to stop making payments. They reassured us we would not be reported late or in danger of foreclosure. We have emails that prove this. They put us in foreclosure twice. The first time we paid the total past due amount. We were finally able to speak to someone that we thought would help us. That was a year in and it still took a year to finish. At one point they literally hid one of our payments in a dummy account. We have proof of this because the person we worked with sent us the screenshot. That put us in foreclosure AGAIN until they fixed it after repeated calls. The kicker is that after it was completed, they raised our payment due to an escrow shortage. I've contacted state and federal agencies to complain but it seems Loancare is free to do what they want. I resigned myself to the fact that they destroyed our credit. Recently I've been going over my credit report and found they are reporting No Information (that's what they will report as a "courtesy" on only some of your late payments) during the first year we had our mortgage when every payment was paid on time. When I disputed it, they literally added a late payment to my record. It was changed from a no info. Now, I'm pissed. We have been contacting attorneys, some of which have successfully sued them before. I'm not sure how to contact or be contacted thru this site but I'd love to gather more stories about them. It may beneficial to try and start a class action. I don't even want money for the 2 years of constant stress, I want my credit fixed.

Additional escrow payments made by separate check not being applied.

I have been making additional escrow payments for 2 years now. I have been sending separate checks from the actual monthly mortgage and was told to put in the memo field “additional escrow”. Per my Credit Union (Golden 1) they confirmed that all payments that went out for $50 to LOANCARE did indeed have in the memo field that it was for additional escrow. When I received my escrow statement stating it was short I immediately called. I spoke to Darryl who was very apologetic and said he would have those payments applied properly. He also said I should be getting a refund. He said he viewed the checks and verified the memo. When I called 2 days later, I was told by a rep, and then her, superior Joe (escalation agent) that they can only adjust the account for 6 months but they misapplied the payments for 12 months. I was also denied an audit on my account from Joe (escalations agent). I am refusing to pay the increase mortgage amount I June 2022 when I overpaid the escrow. Per my insurance company, my insurance increased $41 from the prior year and my taxes increased a total of $200 from the prior year. I need this resolved. When I continue to make the same mortgage payment due to their error I DO NOT want my credit report to reflect a past due. My current credit score is clean with a FICO score of over 750.

Desired outcome: All 12 months of additional payments applied properly, audit on case, updated escrow statement sent to me and refund of overage

Loancare loan

This company makes it a point to make it hard for you to pay and to contact anyone (hence as a loan shark now they can bill you for late fees)... All of their numbers require you to have both a loan number and a social security number of only two maximum people in any loan and that's it,.. if you are number 3 tough luck you can't do anything about it... I am unfortunate enough to have this company buy my mortgage loan from my original bank and this has been a hassle... there are three equal borrowers on my home, but because I was the last signature on that paper I'm not listed as a main borrower meaning I can not a make an online account or log in over the fone unless I produce the social security of the first person on the loan and that this issue is not fixable... they only put two people max regardless of anything, tough luck, they literally want you to be late or not pay! My ability to pay and acces my home information is severely limited and in some cases here stripped from me, the company stripped e of my reasonable ability to pay for my home unless I use social security of other people….

-as an equal party borrower this company has stripped me of all rights in regard to knowledge and payments on this property and made it unreasonably difficult to obtain such information

Desired outcome: I need my name on the acces menu or the loan so I can pay without using other people personal and private information…. and for this company to stop this unprofessional tactic to force others into late payments!

Mortgage rip-off and illegal actions

I applied for the COVID relief program since I lost my employment. The papers I received said my mortgage payments would be held for a period of time. That period ended in Dec 2021, and regular payments were to resume in January 2022. It was extremely difficult to get a date for the end of forbearance; they gave me different dates and even threatened me several times during the forbearance saying I was delinquent. It was the beginning of the criminal insanity! I started making my mortgage payments again in January 2022. I have made all payments on time every month. They kept sending packets saying I MUST choose a new repayment plan, even though they also sent me a letter stating that my forbearance had ended and one of my choices was to simply resume my mortgage payments, which I did! Now I received a letter stating my loan is in a delinquent state and they are threatening repossession. How can they do that when I have COMPLETELY COMPLIED? They cannot, they are fraudulent and I will meet them in court. I have kept detailed records and I have paid as agreed, they are simply crooked. I WARN everyone to STAY clear of this company!

Desired outcome: Be honest, don’t threaten. I have kept my end of the repayment plan, and now they need to acknowledge that in writing.

Payment not being processed causing my payment to go over 30 days.

I have had my payment not processed when i call my payment in several times causing my payment to go 30 days overdue inwhich they told me that i have to contact [protected]@myloancare to get that removed from my credit report.I typed in that website and its like that website don't exist.I made two payments on 3/14/22 for the month before and for what was the present monthly payment which payments are due on the 27th.

Desired outcome: CORRECT THE PROCESS OF PROCESSING PAYMENTS AND THAT THEY CORRECT THE CREDIT REPORT AND NOT THE PAYER.

Loan servicing

I have been working on my loan modification with LoanCare Since August 2021 and yet to receive a denial or approval for my loan modification.

While they are working on my loan modification they were secretly trying to foreclose on my property at the same time which against the law and is known as dual banking. Since I filed a complaint with NMLS and AG of Texas, They have yet to respond to any of the complaints filed. (Complaints filed 03/11/2022)

As of March 24, 2022, I received a letter from them stating I still have missing information. The missing information is:

Recent 60 Days consecutive bank statement.

Uniform Borrower Assistance Form.

How can you fill out a Uniform Borrower Assistance Form when you have a FHA loan. The Uniform Borrower Assistance Form 710 is for Fannie Mae or Freddie Mac loan modification. Another lie from LoanCare so they can steal my home from me.

Desired outcome: I am going after them for mortgage fraud if they do not complete the loan modification process for an FHA loan.

I am going through the same process. My foreberance ended in October 2021, I made the three payments and afterwards made it seem like I could just continue paying my mortgage in January 22, which I did. Now in March they informed me someone mishandles my case and I didn’t get the application until May 22, submitted and now waiting.

Their letter is dated May 25th, 2022, but I only received it on June 10th stating they will make a decision by June 23rd.

I am worried they are trying to foreclose my home and reading these reviews don’t make me feel any better. If anyone can help please e-mail brunos82@icloud.com

Hello I am going through the same process what can we do ! Same

Issues

Loss department insurance claim

Hello,

Loancare has been hanging onto a insurance claim check and every time we call we get different answers! We were told our home had to be at 90% to release the check, we had an inspection that came through at 98%. We have been coming out of pocket for everything! The online portal says one thing and the reps on the phone say another. This is absolutely ridiculous to put people through this when we've already gone through a disaster in our home! We have done our part, now Loancare needs to do theirs.

Forbearance / partial claim

I have begged and literally cried trying to get another partial claim packet fed ex'd to.me. Each time I get it notarized lately, it's "going thru the process" of Loss Mitigation and whoever else, of updating and approving this for my loan. Somehow its ending up sending me paperwork over and over again, prolonging me to refinance or ever get out of forbearance

Desired outcome: Fed ex the final partial claim packet and when it's sent PRIORITY MAIL and is received, process it and get me out of forbearancePLEASE

Loan servicing

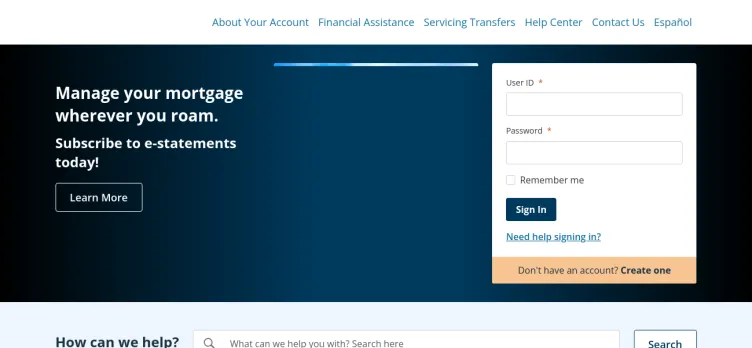

I have had nothing but issues with Loan Care from the moment my mortgage was sold to them. Initially it started by having a different due date than I was accustomed too. From there the online payment process continued to be an issue, as well as the login options.

In order to login into myloancare.com you have to verify with a text message code or email code.

On multiple occasions I was unable to receive a verification code to my phone. Following that issue, the website has been unable to process my verification codes.

Desired outcome: I would like the website fixed and/or removed fees from my mortgage payment.

Escrow misinformation

Loancare is BY FAR the worst company I have ever dealt with. If you were to call 10 times for ANY reason or question, you will get a different answer EVERY time. Today I asked them if they all go through the same training. Her response was yes. I asked then why do I get a different answer every single time? "I don't know". They took ALL year to correct my mortage payment. Almost $800 MORE a month for almost a year I paid. Now that they have corrected the problem, I've been waiting MONTHS for my refund... I get told "7-10 days" every time I call. EVERYTIME!. Now it's going to be another month they say... But I have a hard time believing anything that comes out of their mouth. I have ZERO trust in Loancare and their customer service reps. ZERO. So I guess we will see in a month from now if they give me MY money back or will it be another excuse... Because they have more than I've ever heard.

Desired outcome: I just want my money back....that's it. And maybe a little consistency with Customer service. If all their answers were the same, then it would be different

Agreed lets all work together and file a class action lawsuit.

Loancare mortgage.

My Mortgage was with Loan Care from July 2019 to Jan 2022 In December they were made aware that I was in the process of Refinancing, the mortgage, to lower my rate. In Jan they wrote the payoff . We were going to close on my new lower rate. When new mortgage company went to pay off mortgage they had sold the mortgage to another servicer, which held up the closing, and they gave us no idea of transferring, the customer service team will not tell me who to , they say I'll get letter in mail. Now my rate lock on my IRRL has expired and the rate that is now Available is one whole point higher. Payments are almost 350.00 a month higher then first rate. Why when they know I am Refinancing will they sell servicer

Desired outcome: I want loan with my orginal rate,

Unresolved mortgage issue

I started in a loan modification program for my mortgage in September of 2020. I paid three trail payments, September, October and November of 2020 and returned the signed and notarized paperwork (notarized by my lawyer) in November of 2020. That completed the modification process and I continued to pay the agreed upon mortgage amount every month since.

In August of 2021, I logged into my account online and noticed my account was showing past due. I called Loancare, was transferred to a superior who looked into the issue and saw there had been a miscalculation made in their underwriting department which was causing this issue. I was assured the issue was being escalated to be resolved. I have since been calling Loancare several times a month for the past 5 months - this issue has not been resolved, the calls I'm told will be returned are not and the issue persists. I continue to pay my mortgage, and each month it is showing I am behind - essentially my payments are not being applied properly.

I have been approved by another lender to refinance so I can get away from Loancare as they won't resolve the issue, but because the issue is unresolved, and my payoff being given by Loancare to the new lender is showing I'm behind, I can't refinance . I have given my new lender authorization to communicate with Loancare and they have spent over 6 hours on the phone with them over the past three weeks - still being promised that the issue is being escalated and someone will call them back with resolution, but no call backs have been received.

It feels that Loancare is being unethical holding my business hostage with them as they refuse to resolve an issue that I have been trying to resolve for several months. This is negatively impacting my as I have the opportunity to get a lower interest rate and with each week that passes, I loose the chance to do so.

Desired outcome: For the issue to be resolved and my account shown as current so I can refiance.

Claim check James Sasse

They have made it difficult every step of the way including questions about roofing contractors signature to requiring numerous documents and claiming not receiving them. I have over 27k in receipts and just had a inspector come on Friday 1/12/22. He was impressed but they failed it and won't release my money. I doubt anyone at this company who answers the phone has 27k at their disposal. From rap music in the background to people eating while talking, this company is the most unprofessional I have ever met. Know this if I must take you to Federal Court I will sell everything I own to do so. I am done with you and the bs you stand for!

Desired outcome: For! Money

Overpaid insurance

We decided to change insurance companies in 2018 we sent documentation Of our homeowners insurance To Loan Care They paid them both The year of 2020 and 2021 At this point my escrow Was short I didn't know I sent my original payment Which made my payment late In July 2021 Because it was not enough December I made a payment Through my bank Thought that they would receive it on the 16th But they did not receive it until the 24th which made my payment late Called to see if I could get that late fee Back They tell me because I was late in July I could not I feel because they messed my mortgage payment up by Paying 2 different insurances Not only that I have 2 late fees on my report And I've only been late once

Refund of escrow

re:[protected]

Spoke with Loancare twice about property tax exemption. I asked why was I paying property tax when I was taxed exempt. Loan care stated I needed to contact the county. The county office stated that the tax refunded will be sent back to Loancare and it should be refunded. I called Loancare today and they advised that it will not be refunded.

Desired outcome: Escrow Overpayment Refunded

Loan modification

We were approved for a loan modification in March of 2021. Since then each set of documents received has been incorrect. At one point they told us our modification was rejected due to not receiving paperwork. In some cases they instructed us to do certain things as a work around which they promptly rejected upon receipt. Once they said a key document was missing however we have copies of everything sent each time and said document was in our set. We've called pretty much every week sometimes more since this began, hold time before getting an agent on line is upwards of an hour. This doesn't take into consideration when the agent places you on hold to transfer you to someone else. We've documented each call with date, time, name of agent and proposed solution and/or gist of call. If our next set is rejected for any reason we'll be contacting an attorney and giving them our documented detail.

Desired outcome: Correct documents received and accepted

Holding insurance claim check

My brother had a kitchen fire and Loan care has been stalling the draw so he can complete his work. He's been coming out of his pocket to finish the work. Increased building material and labor cots along with supply chain constraints has increased the cost to rebuild and delayed the process. Now Loancare is delaying it further by holding his funds. I spoke...

Read full review of LoanCare and 5 commentsInsurance fraud

I purchased hazard insurance and sent it to loancare several times. They still have no record of the insurance and purchased much more expensive insurance on my behalf. I spoke with them in September 2021 regarding this insurance issue. They apologized profusely and told me that their online insurance upload system only loads 3 pages. My insurance was a 79 page document. They requested I email the policy to [protected]@mycoverageinfo.com. I sent them the documentation on September 28, 2021. It is now December 10, 2021 and they have not rectified the situation. They have substantially increased my monthly mortgage payment based on the shortage they created by not tracking my insurance info. I called to find out what was going on and they still do not have record of my insurance policy. I am being told they have no record of my email, because they do not track by loan number but by ticket number for that request. So based on the timing of this, I can only assume that the company is fraudulently ignoring my insurance in hopes that I will just attempt to pay the extra shortage, or the company is negligent in handling their insurance coverage information. I have tried to work with the company 3 times on this and have gotten nowhere. I have asked how I will get a receipt that they received my policy and there was supposed to be a ticket number, which I never received. I can provide screenshots of the email I sent on September 28, 2021. I want this situation rectified asap.

Escrow refund check

loancare phone [protected]

I refinanced my house beginning of Sept, 2021. Unfortunately for me, loancare had already paid my real estate taxes of $1, 138.75 from my escrow acct. At closing, I was told that we have to pay the real estate taxes again because the city had not received them and it was necessary in order for us to close. So we paid the taxes again. Two weeks later I called City of Norfolk to see if they had sent a refund check out and they said they it was being processed. I waited another two weeks, I called Loancare and they said they had not received the refund yet. I called the city again and talked to the treasurer Jenny Brandelen, direct number [protected], they said that they had mailed the check on Oct 28 and that it was cashed by Corelogic on Nov 5, 2021. I called loancare back on 11-16-21 and talked to Keisha agent 93559, she said she would escalate this to another team and it would take at least 3 business days. I waited until 11-23-21 and called loancare and talked to Angie agent 8780. She said that they do not have the check or money to refund me. I told her to call the treasurer so she can verify that the check was cashed on Nov 5. She continually said that they do not have my money. I asked to speak to her manager and she said that I couldnt. I explained to her that I have no choice but to seek legal action, which brings me here first I attempted to contact Corelogic at [protected] and they will not talk to consumers, you have to go through your mortgage. This is maddening that I cannot get my real estate tax refund, which is my money, refunded to me. I, Jesse, can be reached at [protected] if you need more info

Desired outcome: refund to me my escrow refund of $1,138.75

LoanCare Reviews 0

About LoanCare

Here is a guide on how to file a complaint against LoanCare on www.myloancare.com on ComplaintsBoard.com:

1. Log in or create an account:

- Start by logging into your ComplaintsBoard.com account or create a new one if you don't have an account yet.

2. Navigating to the complaint form:

- Locate and click on the 'File a Complaint' button on the ComplaintsBoard.com website, found at the top right corner.

3. Writing the title:

- Summarize the main issue with LoanCare in the 'Complaint Title' section.

4. Detailing the experience:

- Provide detailed information about key areas of concern.

- Mention relevant transaction details with the company.

- Explain the nature of the issue.

- Describe steps taken to resolve the problem and the company's response.

- Share the personal impact of the issue.

5. Attaching supporting documents:

- Attach any relevant supporting documents but avoid including sensitive personal data.

6. Filing optional fields:

- Use the 'Claimed Loss' field to state any financial losses.

- Specify the desired outcome in the 'Desired Outcome' field.

7. Review before submission:

- Ensure your complaint is clear, accurate, and complete before submitting.

8. Submission process:

- Click the 'Submit' button to submit your complaint.

9. Post-Submission Actions:

- Regularly check for responses or updates related to your complaint on ComplaintsBoard.com.

Make sure to follow these steps to effectively file a complaint against LoanCare on www.myloancare.com.

Overview of LoanCare complaint handling

-

LoanCare Contacts

-

LoanCare phone numbers+1 (800) 274-9900+1 (800) 274-9900Click up if you have successfully reached LoanCare by calling +1 (800) 274-9900 phone number 0 0 users reported that they have successfully reached LoanCare by calling +1 (800) 274-9900 phone number Click down if you have unsuccessfully reached LoanCare by calling +1 (800) 274-9900 phone number 0 0 users reported that they have UNsuccessfully reached LoanCare by calling +1 (800) 274-9900 phone numberHead Office+1 (800) 274-6600+1 (800) 274-6600Click up if you have successfully reached LoanCare by calling +1 (800) 274-6600 phone number 0 0 users reported that they have successfully reached LoanCare by calling +1 (800) 274-6600 phone number Click down if you have unsuccessfully reached LoanCare by calling +1 (800) 274-6600 phone number 0 0 users reported that they have UNsuccessfully reached LoanCare by calling +1 (800) 274-6600 phone number

-

LoanCare emailscustomersupport@myloancare.com100%Confidence score: 100%SupportCustomer.Advocate@myloancare.com100%Confidence score: 100%Supportsocialsupport@loancare.net100%Confidence score: 100%Support

-

LoanCare address3637 Sentara Way, Virginia Beach, Virginia, 23452, United States

-

LoanCare social media

-

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreOct 28, 2024

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreOct 28, 2024 - View all LoanCare contacts

Most discussed complaints

Loancare website/portal to pay your mortgage.Recent comments about LoanCare company

Loancare website/portal to pay your mortgage.Our Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.

Let us know how this transpires! So tired of these Scammers. I’m happy to know we are not the only ones getting played but feel terrible that this is even happening to anyone.