LoanCare’s earns a 2.0-star rating from 326 reviews, showing that the majority of borrowers are somewhat dissatisfied with loan servicing.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

Mortgage - loancare newrez returning payments made on time, then report late

LoanCare started returning my ontime payments made thru BillPay (WellsFargo) in September 2021, then reported me 180 days late. Do the math, it's < 90 days since they starting returning payments WHICH THEY SHOULD NOT RETURN. Infuriating. Calls to customer service yield "I don't know why your payments are being returned" ... not very useful.

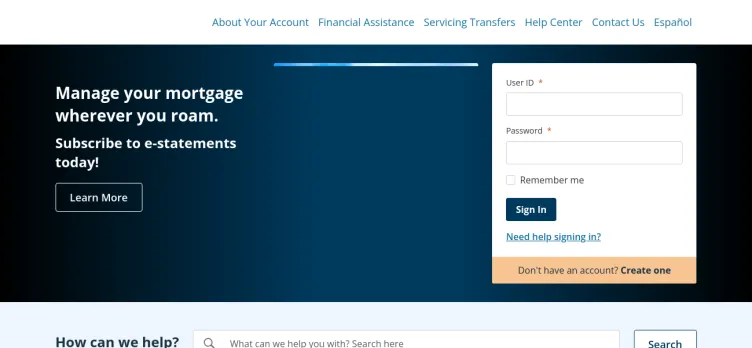

When you log in to their site, it shows last payment made 11/16/21 and next payment due 11/01/2020. Makes NO sense. See image below. In 43 years of having mortgages, this is by far the most screwed up company I ever dealt with. In fact EVERY OTHER mortgage company had ZERO problems accepting payments. They have marred a spotless credit report in error.

Desired outcome: Stop falsely reporting on my credit report, accept the damned payments !!!

Forbearance / loan modification denied

My husband and I applied for a loan modification in April 2021. We've been in forbearance since the pandemic of early 2020. To date, this issue has not been resolved by the loan mitigation dept. The current reason provided to us (dated 8 Nov, 2021) "denied due to failure to provide documentation". In here lies the problem; We began providing documentation repeatedly since April 2021, however there seems to always be missing documents or outdated documents each and every time. We in turn re-provide the said documents each and every time only to be told a week or so later additional documents are still missing. This has occurred at least 10 or more times.

We've been asked to reapply for the loan modification once again.

Desired outcome: Refinance our home at the current market rate

We’ve had the same problem since March of 2021. It’s beyond frustrating! A few times we were told certain documents were missing only to check copies we kept and realized that was impossible. Loan care is one of if not the worst company out there.

Forbearance/partial claim

In September of 2020 I requested, and received a covid related forbearance. I asked for a 60 day and received a 90 day instead, no big deal. In November we started making mortgage payments and when it expired in December we asked for a partial claim to add those payments to the end of the loan, pretty standard stuff I thought. We received our partial claim paperwork, had it notarized and sent back. Here's where it starts to get fun. My mother lives in another state and she co-signed on our mortgage. the paperwork that went to my mother didn't have her correct state on it, so the notary crossed out my state, wrote in my mothers state and sent it in, should be no big deal, right? Wrong, since December or January we have been going over this with LoanCare. If they don't want the partial claim paperwork corrected by the notary then they need to send paperwork reflecting the state in which my mother resides. They literally have me held hostage, I can't refinance because its an open forbearance, even though I've been making payments for a year now

Desired outcome: correct paperwork to my mother or accept the paperwork they have already recievied

Fraudulent loan modification?

We've been in the "process" (I say this with scorn) of trying to complete a loan modification with Loancare since 2020 due to my spouse's 10-month-long pandemic layoff. We called Loancare as soon as he was laid off and Loancare said - multiple - times at the beginning of the process that they would simply add the deferred payments onto the back end of our...

Read full review of LoanCare and 4 commentsNot picking up payments at the post office

Our loan payment was mailed on September 30, 2021 for the Month of October, 2021 via Certified Mail. It has been sitting in the post office in Philadelphia since October 4, 2021 at 3:33 PM ready for pickup. I have called twice about this matter. The first person I spoke to was a lady named "Felicia" (last name not known) who said she is in "escalations." I asked her if LoanCare employees process mortgage payments when received. She said they do. Then I explained that our October payment was at the post office, ready for pickup. Strangely, she said the problem is due to the post office being slow in delivery of mail. I clearly explained that our payment was ready for pickup at the post office and offered to give her the tracking number. She arrogantly responded that she did not need it!

Today the USPS sent an email advising that if the letter is not picked up by October 19, 2021 it will be returned to the sender. (I am the sender.)

This is not the first time this has happened. Last month (September 2021) we received a billing statement indicating that LoanCare, LLC had not received a payment for August, so we were billed for two months. We mailed a check for the two months and stopped payment on the check that LoanCare allegedly did not receive.

Later, after submitting a check to pay for the two months LoanCare attempted to process the check SUPPOSEDLY NOT RECEIVED. My wife and I received a statement for the Month of October showing a $30.00 "NSF" fee. That fee was waived as it should have been since the was NOT drawn on an account with "non sufficient funds." Due to LoanCare's practices reagarding NOT picking up mail and/or promptly processing mortgage payments a "stop payment" was issued on the check.

My wife and I have all of this documented.

Desired outcome: The desired outcome would simply be that LoanCare's representaives pick up the mail and process our current payment AND refrain from conducting business as described. Is that too much to ask?

Mortgage servicing - class action lawsuit

I have seen many people having issues with loan care. I have had a major one myself and I am in the middle of a legal battle for my home. They processed a loan modification that I didn't want extending the life of my loan EIGHT YEARS! Taking advantage of my financial hardship during Covid to make tons of money off of me. Anyone interested in a class action lawsuit, let's get in touch.

Hi there my email is demiansusan98@gmail.com feel free to email me as we are in the same situation

Taxes/escrow

They messed up my taxes and put me into the wrong tax bracket so i've been over paying for the last three months now and I have submitted documents proving they have done this. I have called three times regarding this issue and I have just now finally got a confirmation that it has been fixed and the representative I spoke with admitted to me that they dropped the ball on this. My family has been struggling enough and this sure didn't help. I am more than likely going to refinance with another company since I have only been with them a little over a year and I have already had so many issues.

Desired outcome: reimbursement.

Don't take monthly payments and charge late fees

I started having issues in August 2021. Loancare sent me a payoff statement with incorrect amount. After the first cashier check, I did three more attempts to do a payoff but every payment via cashier check or wire transfer had been declined. The amount wasn't applied to my balance and they started to charge me late fee. Customer service is disgusting. I can call 5 times per day and every time get the difference answer from a different person with a promise that everything will be fixed tomorrow.

Then, I started getting letter about foreclosure. Customer service told me they NEVER sent me any letters and have no idea what I'm talking about, and I have to disregard the 3 foreclosure letters.

So, after my several attempts to make a payment, money has never been withdrew from my account. They keep saying no errors found and they don't know what's going on.

I called to foreclosure councilor and I am trying all avenues to get this resolved but seems like it's running in the same circles.

Desired outcome: I just want to make a payment

Nothing has been solved after spending hours and hours on the phone and emails

Hello my husband and I are going through the same issues if you want to contact us email me @demiansusan98@gmail.com

Lies, no service when trying to exit forbearance

I went into Forbearance due to sudden unemployment related to the pandemic. I had gotten my hardship resolved around April of 2021 and called to start making my regular monthly payments at that time. I had been led to believe that I would be eligible for deferment, and I should have been. They asked a few questions over the phone then told me I was not eligible and would have to submit documents to try and get a loan mod. There is no reason I should not have been eligible for the deferment. It is now been 5 months, I call every day and get a different person saying a different story every time I call. This has been the worst customer service experience of my life. They told me yesterday that my file has not been in review when I have been being told for 2 months it was and we were waiting on the underwriter, now they say they put in in for review but it will be another 30-45 days since it was just put in. This is the most incompetent company and group of people I have ever dealt with. They say I can't talk to anyone higher up than the "customer service" people that don't have a clue what they are talking about. All I want is a resolution and the chance to talk to someone that actually knows what is going on so I can not worry every day what could happen and continue making my regular monthly payments as should have been the case back in April.

Ryan, I could have written this letter myself…this is EXACTLY what happened/is happening with us. Have you gotten any resolution? And I am so sorry. I know your anxiety and frustration well.

Documents being signed so payments can be applied

In light of Covid, the Human Services department has offered to make mortgage payments on my behalf. I have been trying since May 5th 2021 to get LoanCare Servicing to sign off of these payments. It is now September 8th 2021 and I still can't get a reliable source to handle this request. I have been calling, faxing, emailing regarding this request. I have spoken to countless people, I've been hung up on several times, transferred from department to department to no avail. I find it unrealistic that 4 months have gone by and I can't get help to have FUNDS applied to my account. The needed forms have had to be recreated 3 times now because the deadlines keeps passing.

Desired outcome: I'd like for the needed forms to be signed and returned asap before the deadline runs out again.

Assumption loan request forms

Good Afternoon,

Its been a whole 1 month, officially in which I asked for a rapid assumption loan form request. They told me I would get my package on the 25 Aug and it is passed 25Aug. I asked for the paperwork as soon as possible and they send the package through snail mail. We are in the 20th century and you decide to delay all the paperwork and give me a timeframe of 4 month for a assumption loan request to take place. This is unacceptable and very unprofessional. You are massive company taking advantage of home loaners across the country. I would like to be this issue to remediated as soon as possible. I have not receive any documentation regarding this paperwork and wondering where they send this paperwork because it has not yet come to me.

Desired outcome: Would like to get this situation quickly resolved.

Credit dispute

We started having issues in October 2019-April 2020. Loancare sent receipts for our payment being received, then a few weeks later we would get a letter stating NSF. The money wasn't being withdrawn from our account. I would call and their records showed it was paid. We finally sent a payment in December because we couldn't get them to auto draft the payments. Thinking this was resolved, it started again in January 2020. I made several attempts to call and resolve this because we kept getting receipts but the money wasn't being taken out of our account. Finally on May 11, 2020 I spoke with someone who realized they had the incorrect banking information for us. I have disputed this with the credit bureau and through Loancare's dispute center. They keep saying no errors found. This has had a very negative effect on my credit and I need this resolved in my favor. I have an excellent payment history on all accounts and if not for this would have excellent credit. I am trying all avenues to get this resolved and to have them delete the negative reporting on our credit

Desired outcome: Remove negative credit reporting

Fraud fraud fraud

I received a letter in the mail yesterday saying that my application for deferment was denied due to failure to supply documentation. I have attached PROOF of documentation sent to this email for over two months. There have been no emails or calls received from you stating otherwise.

I called today 8/17 and spoke with a laurie who told me I took my loan out of modification which is Not correct. She then left me on the phone for over 10 minutes not speaking said she was chatting online with colleagues. She then transfered me to a fake voice mail.

I called a 2nd time and Heidi answered and said I was missing documents but when I reviews the emails already sent with proof of documentation she told me she would put me on hold to see what was going on and then she never even came back. There as no hold music or anything, just silence.

I then called a 3rd time, and spoke to a Bill who said that my deferment application was approved and that I can start paying in september. However, I can access my online account so he was going to transfer me to online services. I was transfered to a tatiaja who said the loan was transfered to a gregory funding and I can no pay loan care anymore. However, I have not account information or anything regarding Gregory Funding.

Mortgage fraud!

I am once again on here writing about loan care. You can read in my previous posts that I have been trying to defer my loan and reinstate it after forbearance. I have been battling with loan care for months sending them endless amounts of all documents requested for the deferment application yet today I received a letter in the mail stating that it has been denied due to not submitting documents in time. Well that is funny loan care i have endless emails week after week emailing the same documents that you were requested. Called multiple times to check in and was reassured I would be able to pay in September. They sent no emails prior or called to update us on these missing documents.

Before this, I also received a letter that the house was going to be in foreclosure even though we were in an approved forbearance for months! Once I called, the loan counselor, he told me that we were not in foreclosure but that this is something they just have to send. What!?

Not to mention, mysteriously my online account never seems to work everytime I try and access it. I constantly am locked out or kicked out or somehow I have not account or need to make a new password.

Some crazy things are going on with the mortgage company and they will not get away with it!

Desired outcome: Deferment of loan and I want to pay my mortgage!!!

Mortgage loan funny math, dishonest

The worst, yet I am forced to deal with them as my mortgage was shuffled and sold to third parties many times over. They claim to help, yet overcharged me three time for escrow and lied about mailing me back the overpayment (took 6mos to get that check to me)!

Then, they advise to make extra payments to principal, yet do not apply it in a timely manner. I had sent them $2000 on 3 occasions to go towards "principal only" over the last months and they only accepted one, while the others are "held in suspense"?!? When asked why it was not then resent to my bank... No answer — they lie and cheat.

They also do not follow up with requests (like a payout letter). And after reading others here who did indeed pay off but never had the lien remove?... You can be sure that i'll be lawyering up.

Avoid if you can.

My loan modification

I have been trying to complete the loan modification process with my loan care since october 2020. Each time I call and make a payment I am told it was cancelled for lack of payment. I have made all of my payments since april 2021. I called again today to make my payment and find out where my documents were to sign and I received the same message. I don't...

Read full review of LoanCare and 2 commentsMortgage

I have several dates that loan care is making errors on my account. I have made several phone calls, submitted notarized documents my attorney signed, payments returned to me etc. Every time I call to resolve the matter I get a different story.

I need help. This has been going on since march 2021

Lori priest

315 cook lane

Marlborough, ma 01752

[protected]

Desired outcome: Mortgage payment resolved

IRRRL mortgage discrimination against vets with seasoned loans

Gregory Thompson

Tracy Price-Thompson

[protected]

[protected]@gmail.com

August 7, 2021

Formal Complaint regarding IRRRL Refinance Denial/Discrimination Against Veterans with a Fully Seasoned VA Loan Prior to CARES Act Forbearance

Reference: Encompass Loan # [protected]

Lakewood LoanCare Loan# [protected]

Dear Sirs:

We are writing this letter and requesting that it be lodged as a formal complaint regarding the denial of a VA IRRRL streamlined refinance loan based on supposedly unmet "VA seasoning requirements."

The referenced VA loan has been in effect for eleven years, and has more than met the established six-month consecutive payments seasoning requirements. We assert that the refinance denial from Community Loan Servicing on a Lakeview LoanCare loan to be an illegal and discriminatory "punishment" by your organization directed against military veterans who hold fully seasoned VA loans, and who have gone on years after such seasoning to invoke a CARES Act forbearance.

We further assert that this "lack of seasoning" refinance denial is the result of your staff's lack of knowledge of VA seasoning requirements, and their deliberate misinterpretation of the VA's guidelines as they relate to the CARES Act, which are clearly spelled out in the Veterans Administration Circular 26-20-25, and in 38 CFR U.S. C. Para 3709.

The regulatory seasoning requirement states that six consecutive monthly payments must be made "BEFORE" a veteran invokes a CARES Act forbearance in order for a loan to be considered seasoned. It further states: If a loan being refinanced met seasoning requirements before a Veteran invoked a CARES Act forbearance, the seasoning requirement remains satisfied. We are completely astounded by the apparent inability of your entire mortgage team to grasp this and to differentiate between the words "BEFORE and"AFTER."This issue has arisen in part due to a lack of understanding of the VA's loan"Seasoning"requirements.

As you know,"seasoning"is the term used by the VA to ensure that VA loans are not refinanced within 6 months after their initial origination. In order for a loan to be considered seasoned, the veteran is required to have made at least 6 consecutive monthly payments after receiving their loan, which on a loan taken out more than a decade ago, we have more than accomplished.

Our VA loan was taken out eleven years ago, in September of 2010. We made our first mortgage payment in November 2010, and the loan was completely seasoned in May of 2011. A full decade ago.

The loan denial forwarded from Ms. Marie Salmon and Ms. Julie Watrous of Community Loan Servicing included the below misleading and erroneously interpreted snippet, which was extracted from VA Circular 26-20-25, which is the Circular that we as the veterans provided to Mr. Phillip Bonfiglio and requested be uploaded to our file in its entirety on July 29, 2021.

Instead of reading and comprehending the entire paragraph in the VA Circular, this snippet was deliberately taken out of context by your staff and used as a duplicitous basis to deny our VA refinance loan. Here is what the complete paragraph (d.1, 2) in context, actually states:

d. Loan Seasoning, Fee Recoupment, Discount Points and Net Tangible Benefit Standards. Lenders are reminded that all IRRRLs must meet loan seasoning, fee recoupment, discount points and net tangible benefit requirements, as prescribed by 38 U.S. C. § 3709 and VA policy guidance. Periods of forbearance cannot count toward seasoning; however, forbearance under the CARES Act does not, alone, cause the loan to fail to meet the seasoning standard. If a loan being refinanced met seasoning requirements before a Veteran invoked a CARES Act forbearance, the seasoning requirement remains satisfied.

A loan being refinanced is seasoned if both of the following conditions are met as of the date the borrower closes the refinance loan:

(1) The borrower has made at least six consecutive monthly payments on the loan being refinanced. For example, in a case where a borrower made five consecutive payments before invoking a CARES Act forbearance, such borrower would need to make six additional consecutive payments, post forbearance, in order to meet the seasoning requirement.

(2) The date of closing for the refinance loan is 210 or more days after the first payment due date of the loan being refinanced.

Again, our VA loan was closed on eleven years ago in September of 2010. Our VA loan has been seasoned for a full ten years. Thus, between 2010 and 2020, we have more than made our six consecutive payments BEFORE invoking a CARES Act forbearance in 2020. Our seasoning requirement remains satisfied, and we are fully eligible for a VA IRRRL loan.

As you see above, by cherry-picking sub-paragraph (1) out of context and failing to consider the paragraph in its entirety, your mortgage team is deceptively attempting to strip away VA protections by deliberately misinterpreting the sub-paragraph to state that a veteran who has a previously seasoned loan needs to make 6 consecutive monthly payments AFTER invoking a CARES ACT forbearance in order for the loan to meet VA seasoning requirements.

THIS IS INCORRECT.

Again, both the circular and US Code 3709 clearly state: If a loan being refinanced met seasoning requirements"before"a Veteran invoked a CARES Act forbearance, the seasoning requirement remains satisfied.

Yet, even under the snipped paragraph, we clearly meet the loan seasoning requirements.

(1) The borrower has made at least six consecutive monthly payments on the loan being refinanced. For example, in a case where a borrower made five consecutive payments before invoking a CARES Act forbearance, such borrower would need to make six additional consecutive payments, post forbearance, in order to meet the seasoning requirement.

Again, as evidenced by our eleven-year mortgage, we absolutely have made more than six consecutive monthly payments between 2010 and 2020 on the loan before invoking a CARES Act forbearance in 2020. In fact, we have made more than 100 consecutive monthly payments on the loan.

We assert that the Director of Underwriting, by painting this snippet as a stand-alone requirement and ignoring the rest of the passage is attempting to force regulatory requirements on disabled veterans that are well outside of the scope of the US Code and the VA's guidelines.

Part 2 of the snippet states:

(2) The date of closing for the refinance loan is 210 or more days after the first payment due date of the loan being refinanced.

Our first payment due date on this seasoned loan was in November 2010. Eleven years ago. Thus, the date of closing for the loan, when refinanced, will certainly be more than 210 days after the first payment due date. It will actually be more than 3650 days after the first payment due date. Thus, we've already met these requirements as well.

What's extremely disturbing to us is the customer service experience we've endured during this process with Community Loan Servicing. After a series of non-responses to our emails, and 6-7 weeks of diligently attending to every request for documents in this supposed"streamlined" process, and after providing both Ms. Salmon and Ms. Watrous with written documentation from VA Circular 26-20-25 and 38 CFR U.S. C. Para 3709, it seems the frontline people that you entrust to process loans and provide accurate information to your veterans have absolutely no knowledge of VA regulations, and are apparently unable to comprehend and correctly interpret the regulatory information even when it is provided to them in black and white.

This lack of comprehension creates great frustration and is a great disservice to your veteran customers because it's clearly impossible for both Ms. Salmon and Ms. Watrous, and apparently for your director of underwriting as well, to comprehend the below passage while denying a veteran with a fully seasoned loan a refinance based on lack of seasoning, even when the information is clearly articulated in the VA Circular and the US Code:

If a loan being refinanced met seasoning requirements before a Veteran invoked a CARES Act forbearance, the seasoning requirement remains satisfied.

We are uploading this complaint to Lakeview LoanCare (who can attest to the period of loan seasoning) and we also request that someone competent at Community Loan Servicing review this matter and correct and reverse the loan decision so that our loan can be approved and finalized. Otherwise, we will forward this complaint to the VA Regional Loan Center and the Consumer Financial Protection Bureau, and request that they investigate your VA mortgage and refinance denial practices to fully eligible veterans.

We have attached this letter in PDF format to this email, and have also attached VA Circular 26-20-15 for your review, and we're providing this link to 38 CFR United States Code Para 3709 here for your review as well.

https://uscode.house.gov/view.xhtml?req=granuleid:USC-prelim-title38-section3709&num=0&edition=prelim#:~:text=%C2%A73709., Refinancing%20of%20housing%20loans&text= (ii)%20for%20discount%20point%20amounts, of%2090%20percent%20or%20less.

We look forward to hearing from you and resolving this issue most expeditiously.

Thank you,

Gregory Thompson

Tracy Price-Thompson

[protected]

Desired outcome: Correct interpretation of VA regulations and Loan Approval

Mortgage

We submitted documentation to come out of forbearance in late February 2021 and were given the run around and told different excuses every time we followed up and were told to wait on a team lead to call back which never happened and the first associate did not process our forbearance correctly and then we had to start over. It happened a second time with a supervisor after we were approved for a loan modification and she restarted the forbearance and we had to wait again for underwriting which took until August 1st to actually be out of forbearance. Terrible communication and no one know what's happening.

Desired outcome: I want to have my date of coming out of Forebearce corrected to Febuary like we originally agreed on and intended so I can move to a new Mortgage servicer because they are terrible and abusive.

This exact situation happened to me.

Class action lawsuit - legal action needed

I have noticed that I am not alone in my struggles with LoanCare's unethical mortgage servicing practices. The company is incredibly deceitful and specifically targets customers who are struggling to make payments during a hardship or have a lower to middle socioeconomic status due to that customer's inability to financially support the legal battle that would be required to hold them legally responsible for their abhorrent actions. I have made the decision to invest in legal help to fight them, but there is strength in numbers when you have a David and Goliath style battle such as this.

Please feel free to reach out to me via email. Due to encryption and protections that are placed o these comments I will be giving my email address without the @ and without the ending. It is KateLeeScanlon and it is a google email address (gmail).

Please contact me if you have been experiencing issues with your escrow account, an inability to contact anyone to explain the funds and balances. In my experience, the company specifically went into my account after 1 year of paying my mortgage on time and according to my monthly billing statements. They decided to perform an internal "audit" of sorts and someone in their company "reversed" all of my payments and reapplied them the way they saw fit which led to a retraction of the last 5 payments and made it looks like i was suddenly more than 120 days late on my mortgage after having on time payments each month until then.

The battle that continued with constant disconnected calls, being placed on hold for hours at a time, and promised escalations and calls from managers that never came to fruition. I also spoke with an Amber who gave me her "direct email" address with emails that never went through.

We need to come together as consumers and hold this deplorable company accountable. I am a hard-working, single mother of two girls and I go to school full time. I am not afraid of grit and fighting to make this right. The pain and anguish they have caused me and my family to no fault of my own simply because they had the power to is exactly what is wrong with corporate America.

Please reach out to me to work together to fight this.

There needs to be direct phone lines and representatives that can be reached to directly via emails and more transparent and ethical practices regarding escrow accounts and notification to the consumer along with their consent prior to any audits or adjustments to their mortgage. I would also like my credit report fixed to remove all "late payments" and negative marks that have been made by LoanCare. They are responsible for the loss of investments as I had the ability to utilize the equity in my home for financial investments and gains that I would have had if they had not altered my credit score with their unethical practices. The company is responsible for hours lost while I combed through paperwork, records and made countless phone calls to them that went unanswered. This company has had a detrimental effect on my financial situation as a result of their business practices. I had paid everything else off and was ready to invest and become financially independent after my divorce 4 years ago. The reparations that are due to the consumers they have continued to hold down by stepping on their necks needs to be adjudicated.

Desired outcome: A public apology by LoanCare and a change to their customer service procedures and company structure. Reparations to the consumers that they've negatively impacted.

I am contacting you. Please be on the lookout for my communication by email.

LoanCare Reviews 0

About LoanCare

Here is a guide on how to file a complaint against LoanCare on www.myloancare.com on ComplaintsBoard.com:

1. Log in or create an account:

- Start by logging into your ComplaintsBoard.com account or create a new one if you don't have an account yet.

2. Navigating to the complaint form:

- Locate and click on the 'File a Complaint' button on the ComplaintsBoard.com website, found at the top right corner.

3. Writing the title:

- Summarize the main issue with LoanCare in the 'Complaint Title' section.

4. Detailing the experience:

- Provide detailed information about key areas of concern.

- Mention relevant transaction details with the company.

- Explain the nature of the issue.

- Describe steps taken to resolve the problem and the company's response.

- Share the personal impact of the issue.

5. Attaching supporting documents:

- Attach any relevant supporting documents but avoid including sensitive personal data.

6. Filing optional fields:

- Use the 'Claimed Loss' field to state any financial losses.

- Specify the desired outcome in the 'Desired Outcome' field.

7. Review before submission:

- Ensure your complaint is clear, accurate, and complete before submitting.

8. Submission process:

- Click the 'Submit' button to submit your complaint.

9. Post-Submission Actions:

- Regularly check for responses or updates related to your complaint on ComplaintsBoard.com.

Make sure to follow these steps to effectively file a complaint against LoanCare on www.myloancare.com.

Overview of LoanCare complaint handling

-

LoanCare Contacts

-

LoanCare phone numbers+1 (800) 274-9900+1 (800) 274-9900Click up if you have successfully reached LoanCare by calling +1 (800) 274-9900 phone number 0 0 users reported that they have successfully reached LoanCare by calling +1 (800) 274-9900 phone number Click down if you have unsuccessfully reached LoanCare by calling +1 (800) 274-9900 phone number 0 0 users reported that they have UNsuccessfully reached LoanCare by calling +1 (800) 274-9900 phone numberHead Office+1 (800) 274-6600+1 (800) 274-6600Click up if you have successfully reached LoanCare by calling +1 (800) 274-6600 phone number 0 0 users reported that they have successfully reached LoanCare by calling +1 (800) 274-6600 phone number Click down if you have unsuccessfully reached LoanCare by calling +1 (800) 274-6600 phone number 0 0 users reported that they have UNsuccessfully reached LoanCare by calling +1 (800) 274-6600 phone number

-

LoanCare emailscustomersupport@myloancare.com100%Confidence score: 100%SupportCustomer.Advocate@myloancare.com100%Confidence score: 100%Supportsocialsupport@loancare.net100%Confidence score: 100%Support

-

LoanCare address3637 Sentara Way, Virginia Beach, Virginia, 23452, United States

-

LoanCare social media

-

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreOct 28, 2024

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreOct 28, 2024 - View all LoanCare contacts

Most discussed complaints

Loancare website/portal to pay your mortgage.Recent comments about LoanCare company

Loancare website/portal to pay your mortgage.Our Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.