Tax1099’s earns a 3.4-star rating from 58 reviews, showing that the majority of users are somewhat satisfied with tax filing experience.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

User management system is very helpful!!

Utilizing Tax1099.com, the platform's advanced user management system has significantly elevated our tax filing processes. The ability to designate specific roles to users aligns seamlessly with the complexities of our enterprise-scale operations, providing a structured approach to managing tasks within the filing workflow.

Within our team, Member Users are entrusted with Data Entry tasks, leveraging their specialized skills to ensure accurate and meticulous input of foundational information. This strategic delegation allows us to capitalize on individual strengths, setting the groundwork for a reliable and error-free filing process.

At the helm of the process, Admin Users play a pivotal role in Form Approval and overseeing the e-filing procedures. Their comprehensive understanding of tax regulations ensures that all forms are not only accurate but also compliant before submission to the IRS. This level of oversight is crucial for our enterprise, where adherence to regulations is paramount.

Support has been a bliss and the product is easy to navigate and use!

Customer support plays a pivotal role in our user experience, and Tax1099.com has excelled in this aspect. The support team's responsiveness and clarity in providing solutions have been commendable. Knowing that assistance is readily available instills confidence in our continued use of the platform.

The consistent updates and adherence to the latest tax regulations have been noteworthy. Tax1099.com's commitment to staying current ensures that our filings are always in compliance. This aspect has relieved us of the burden of staying constantly vigilant about regulatory changes, allowing us to focus on our core business activities.

The detailed record-keeping capabilities, especially the storage of W-9 forms as PDFs, have greatly enhanced our document management processes. Having quick access to crucial documentation is not just a matter of convenience but a strategic advantage when it comes to audits or internal reviews.

In conclusion, our three-year journey with Tax1099.com has been characterized by efficiency, reliability, and continuous improvement. As a mid-size business, we appreciate not just the features offered but the overall commitment of Tax1099.com to enhance our tax filing experience. We look forward to leveraging this platform for years to come as a trusted partner in our financial success.

Support is really great and I can be stress-free

I have been using Tax1099.com for a long time, It is true initially the support was a little slow, but now it is the biggest reason for not moving on from Tax1099.com, being a CPA Firm it is crucial to have stability in the firm, and all the operations running smoothly the lightning-fast support, available seamlessly through both chat and email. As a user, I've experienced the invaluable benefit of instant help, eliminating any need to break a sweat over support issue

The support team's responsiveness, whether through chat or email, has consistently impressed me. Anytime I've had a query or needed assistance, the team has been quick to respond, providing clear and helpful solutions. This level of support not only saves time but also instills confidence in the reliability of Tax1099.com as a service.

The convenience of instant help is particularly noteworthy during critical times, such as tax season. Knowing that support is just a message away, whether through chat or email, brings peace of mind and ensures a smooth and stress-free experience with the platform.

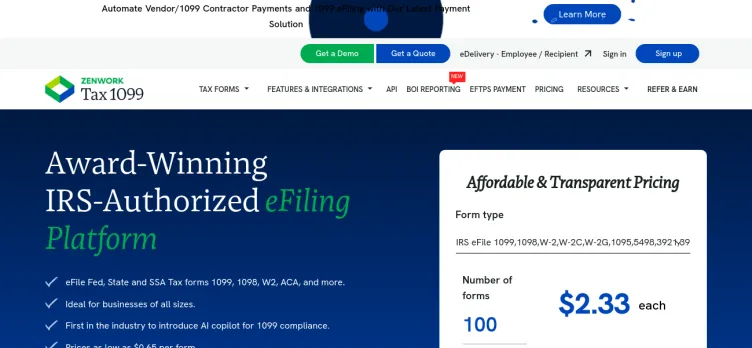

Transparent pricing is a bliss!

Tax1099.com has transparent pricing and also its user-friendly interface, making it a standout choice for those seeking both simplicity and clarity in their tax filing experience.

As a user, the combination of transparent pricing and user-friendly design has significantly enhanced my overall experience with Tax1099.com. The clarity in pricing allows me to plan effectively, while the platform's ease of use ensures that I can navigate through the filing process without unnecessary complexities.

This combination of transparency and user-friendliness makes it a reliable and accessible choice for individuals and businesses looking for simplicity and clarity in their tax filing solutions.

eDelivery solves a lot of problem for my business!!!

As a user who has experienced the convenience firsthand, Tax1099.com's IRS-approved eDelivery service has significantly elevated my tax document transmission process. The peace of mind that comes with knowing that this service aligns with the stringent standards set by the IRS is invaluable.

The seamless integration of eDelivery not only ensures compliance but also streamlines the entire document transmission journey. Having used this feature, I appreciate the efficiency it brings to the tax filing process.

In conclusion, as a user who has utilized Tax1099.com's eDelivery service, I can attest to its effectiveness in providing a secure, efficient, and IRS-approved means of transmitting tax documents

Vendor compliance made easy with Tax1099.com

One standout feature of Tax1099.com is its ability to seamlessly save W-9 forms as PDFs on your vendor's record. This practical functionality ensures easy access to crucial documentation whenever it's needed, providing a centralized and organized repository for W-9 information.

As a user, I've found the convenience of having W-9 forms stored in PDF format invaluable. Whether it's for record-keeping purposes or quickly retrieving information during tax season, Tax1099.com simplifies the process, eliminating the need to sift through physical paperwork.

Moreover, after gathering W-9 information, Tax1099.com offers an additional layer of assurance through its TIN Matching Service. This service allows users to compare the information provided by vendors with the IRS database, ensuring accuracy and compliance with tax regulations.

The integration of W-9 PDF storage and the TIN Matching Service showcases Tax1099.com's commitment to providing a comprehensive and reliable solution for managing vendor information. This combination not only streamlines document accessibility but also enhances the accuracy of tax-related data.

Bulk W-9 makes my work very easy, reduces a lot of work

As a user of Tax1099.com, I've found their Bulk W-9 feature to be a game-changer when it comes to efficiently collecting W-9 forms from vendors. It simplifies the entire process, making it quick and hassle-free.

Using this feature, Tax1099.com takes care of sending secure e-signature-ready W-9 forms directly to my chosen vendors via email. This not only saves me time but also ensures a secure and legally compliant method for updating crucial vendor information.

The convenience of the Bulk W-9 feature is particularly noteworthy. It allows me to manage multiple W-9 requests effortlessly, streamlining the often tedious task of gathering necessary tax information from vendors. The user-friendly approach of Tax1099.com makes the entire process smooth, and the secure e-signature-ready forms make it easy for vendors to respond promptly.

Amazing support and easy to use

Tax1099 has an amazing support team that is really helpful when it matters. The team is quick to respond. The Knowledge base created by Tax1099 is one of the most useful in solving your queries as they have a massive repository of questions and answers with snapshots and SOP for any queries, even if the queries are not mentioned in the knowledge base the chat support provided is really quick to respond.

The platform is easy to use and doesn't overcomplicate the platform with complex navigation

Recommendation: Will definitely recommend people to try Tax1099.com as its simple to use and easy to navigate

Very happy with the performance and it keeps improving every year

I have been using Tax1099.com since 2017, the platform has improved exponentially over the years. My CPA firm has grown in business and the platform has not let me down in terms of my growth. At the same time, Tax1099 was able to hold its core intact to provide a platform for an easy and hassle-free filing experience. Adding new features has not complicated the software.

Features like instant integration with QBO and QBD are a blessing with real-time TIN verification to maintain compliance.

In summary, I would say Tax1099.com is a platform that can be depended on.

Recommendation: Tax1099.com really is good for CPA firms and you will not have to look anywhere else for your filing needs

User friendly platform with amazing customer support

I have been using Tax1099 for the past two years, and I can confidently say that it's been the best e-filing platform. It's super easy and simple to handle.

Their dashboard clearly provides an overview of my filing status which makes it simple to track the progress of my submissions. Another plus point is their customer support team. They resolved our queries very promptly and helped the filing process.

Recommendation: Tax1099 has been my go-to tool for all my 1099 tax filing processes. It's quick, efficient and most reliable platform I have come across. I highly recommend it.

Tax1099 has really been game changer for me

Tax1099.com is a game-changer for my business tax filings. Its user-friendly setup makes managing Form 1099 filings smooth, even for those without extensive tax knowledge.

The platform's layout is clean and easy to navigate, providing a clear view of filing progress without unnecessary complications. It has exceptional customer support — prompt and reliable, they are always ready to assist with any questions or concerns.

What I liked the most was Tax1099.com's commitment to staying up-to-date with the latest tax laws. Their regular updates ensure that filings comply with the most recent regulations, giving users peace of mind about the accuracy of their submissions.

Tax1099.com simplifies the daunting task of tax filing. Its user-friendly interface, coupled with stellar support and commitment to compliance, makes it an invaluable tool for businesses seeking efficient Form 1099 filing solutions."

Tax filing made even better with Tax1099.com

I've been relying on Tax1099.com for my business's tax filings, and the experience has only gotten better. The seamless integration with QuickBooks Online (QBO) is a standout feature that has significantly streamlined my accounting processes. allowing for a seamless transfer of data between the two platforms. This has not only saved me valuable time but has also reduced the likelihood of errors that can occur during manual data entry.

The synchronization is quick and efficient, ensuring that my financial data is always up-to-date and accurate.

One of the standout features that sets Tax1099.com apart is its real-time Taxpayer Identification Number (TIN) verification. This feature has been a lifesaver, providing an extra layer of accuracy and compliance. The real-time TIN verification ensures that the information entered is 100% accurate, eliminating the risk of errors and potential penalties associated with incorrect TINs.

In summary, Tax1099.com has not only made tax filing easy and hassle-free but has also enhanced the experience with its seamless QuickBooks Online integration and real-time, 100% accurate TIN verification feature. For businesses seeking a reliable and comprehensive e-filing solution, Tax1099.com is undoubtedly a top choice.

Recommendation: Dont overthink go for Tax1099.com as you efiling provider and be at peace

Exceptional experience with tax1099 – a game-changer for e-filing!

I recently had the pleasure of using Tax1099 for my e-filing needs, and I must say it has been a game-changer for my business. The software is truly great, and my satisfaction level is through the roof.

One of the standout features for me was the ability to seamlessly bulk import data from my accounting software. This not only simplified the entire process but also allowed me to e-file in bulk, saving me a significant amount of time. As a business owner, time is money, and Tax1099 helped me reclaim both.

The user interface is incredibly user-friendly, making the entire e-filing process a breeze. I appreciated the intuitive design and the straightforward steps that guided me through the entire process. It's evident that the developers prioritized user experience.

Affordability was another key factor that impressed me. As a small business owner, every penny counts, and Tax1099 offers a cost-effective solution without compromising on quality. It's rare to find a tool that combines efficiency, ease of use, and affordability, but Tax1099 nailed it.

I can confidently say that I will be using Tax1099's services again and again for my future e-filing needs. The software exceeded my expectations, and I highly recommend it to fellow business owners looking for a reliable, efficient, and budget-friendly e-filing solution. Thank you, Tax1099, for making tax season a whole lot easier! 🚀✨

Recommendation: Go for it

Mid size cpa firm that handles all kinds of 1099

Tax1099 has been an absolute game-changer for me and my business when it comes to managing our 1099 tax reporting requirements. This platform offers a range of incredible features that have made tax season a breeze for my me and my staff accoutants.

First and foremost, the ease of form preparation is a standout feature. Creating and preparing various types of Form 1099, from 1099-NEC to 1099-MISC has never been this simple. It's user-friendly and efficient, which has saved me valuable time and energy.

The ability to e-file with Tax1099 is nothing short of amazing. E-filing is not only faster but also more secure than other tools out there. It's a relief to know that my tax forms are being submitted accurately and on time, including the scheduling feature that they offer. Plus, the real-time status updates allow me to stay in the loop and ensure everything is going smoothly.

For our diverse set of businesses that we serve today, dealing with a high volume of 1099 forms, the bulk filing feature is a godsend., especially for non QBO or QBD users. It streamlines the entire process, making it incredibly convenient and time-saving. No more tedious, manual submissions one by one!

Importing data into Tax1099 from various sources is a breeze, thanks to its data import feature and direct integration with QuickBooks Desktop and QuickBooks Online.. This has greatly reduced the risk of data entry errors and made the whole process more efficient.

The TIN matching service is another fantastic feature. It helps me identify and rectify discrepancies or errors in recipient information before filing, ensuring compliance and reducing the risk of costly penalties.

The platform's support for state reporting is invaluable. It simplifies the often complex process of state-specific 1099 filing requirements, making it easy to stay compliant at both federal and state levels. The state efile rule engine automatically detects the state filing requiremnts based on data that we provide is super helpful.

Lastly, the print and mail services offered by Tax1099 are a lifesaver for those who still prefer paper filing. They handle the printing and mailing of forms to recipients on your behalf, saving me even more time and effort.

In summary, Tax1099 is a comprehensive and user-friendly platform that has revolutionized my tax reporting process. Its diverse range of features caters to various needs, and I couldn't be happier with the results. Tax season is no longer a stressful period, thanks to Tax1099. I highly recommend it to anyone looking to simplify and streamline their 1099 tax reporting process.

Tax1099 is nothing but great for me.

While the website says complaints board, I thought I should share my positive experince on contorary to the name.

Found this app to be great for -

- Used for collecting W-9 electronically, TIN Match, State efiling for OR that most website did not support.

- Pricing was low

- Was able to file forms for the current and prior year.

- Customer support was fantastic on chat.

Disappointing Experience with 1099-MISC Filing System: No Confirmation & Long Wait Time

So, I submitted a 1099-MISC on the 25th day of January in the year 2016. The site let me know that it would be transmitted on 31st January in 2017. I tried my best to change the date on transmission, but it didn't seem to work, which is quite unfair. But at least, I thought that the deadline for filing would be met. But then, the process took way too long for my liking.

I had expected to receive at least an email notification that confirms that the agency had received and taken in the transmission. As of the second day of February in 2017, I hadn't received any confirmation at all, and I couldn't find any kind of confirmation on the site. You know, I usually e-file payroll returns through QuickBooks all the time, and I get to see agency acceptance confirmations right away on the same day. It's quite frustrating that there isn't any record of filing 1099's in QB with this system either.

Honestly, I don't plan to use any system that cannot guarantee me that I am compliant with filing requirements, more so since I file on behalf of my clients. Besides, the fact that it doesn't record a history of filings in my accounting software just doesn't make it look good at all, you know what I'm saying?

Negative Review of Tax1099: Unreliable Import Tool and Poor Customer Service

So, I gotta say, I had some high hopes for Tax1099 this year. I figured with Intuit partnering up with them, the process of integrating my tax information would be a breeze. But, oh boy, was I wrong.

The import tool they offered seemed great at first, but quickly turned into a complete nightmare. I tried to import my new data, but it was a no-go. The tool wouldn't let me import what I needed, and instead just kept importing the wrong file. I tried deleting the file and starting over, but it just wouldn't work. No matter what I did, Tax1099 just wouldn't cooperate.

At my wit's end, I finally gave up and called customer service. Now, don't get me wrong, I'm sure they're doing their best, but it was like they couldn't understand what I was saying. Trying to communicate the nuances of a technical problem over the phone was like pulling teeth. And, unfortunately, it turned out that my problems were far from over.

When I finally managed to block the submissions, Tax1099 neglected to tell me that there was no way to stop the incorrect 1099 copies from going out to the recipients. I didn't realize what had happened until one of my recipients got two 1099s for the same amount - one from Tax1099 and one that I'd canceled. I tried emailing their customer service, but the response I got was basically a big ol' "if you don't know how to use our tool, that's your problem, not ours."

Needless to say, I'm none too pleased with Tax1099. Even though they're partnered up with Intuit, I've come to realize that they're just not reliable. Save yourself the headache and skip out on this service - it's just not worth the hassle.

Tax1099.com Review: Slow System & Poor Customer Service, Caused Filing Errors

I gotta say, I didn't have a great experience with tax1099.com. Like seriously, it was a total mess. My company needed to mail out some 1099's and they were supposed to arrive within 3 to 5 days. But get this, they didn't show up until 12 days later. I mean, what gives? And then, I processed some W2's over two weeks ago and my employees still haven't gotten them. It's like, come on already!

What really got me heated though was the fact that their system was crazy slow. Like molasses slow. And their customer service was nowhere to be found. Like seriously, I tried calling and emailing and chatting but nobody answered. And because of all this, I ended up sending wrong information to the IRS. I was so frustrated that I emailed their customer support today, but they still haven't given me a solution.

This website was supposed to be easy to use, especially with how QuickBooks Desktop importing was a breeze. But I found it hard to navigate for simple tasks like checking the status of submitted forms. In the end, I had to use another service for the rest of my W2's and it was a much smoother experience.

I really feel like I let my clients down by using this website. It's just not worth the time or trouble. If you're thinking of using tax1099.com, my advice is to steer clear and look for something else.

Terrible Website for Accounting: Slow, Unreliable, and No Customer Support

This website is just terrible. For like, the last four years or something, we've been using this thing and it's gotten worse and worse every time. We do accounting stuff or whatever, and like, we gotta file like 1000 of these 1099 things every year. And like, listen, this site is so slow, I feel like I could run around the whole building three times before the page loads. And get this, like, right before the deadline to file these one thingies, the site just straight up stopped working. I couldn't import nothing from my Excel sheets and stuff. I tried calling these tech people for help and they weren't doing nothing. Finally, someone picked up and they said they'd help us out and they'd call back before 7pm on January 31st. Well, you can betcha balloons they never did call back. These jokers said they'd email them 1099-Misc forms for us, but they didn't do that either. When I called them back, they wouldn't answer. This site is so whack, if you're serious about filing those forms on time, don't mess around here. Try using something based in the US that is actually made for the tax people, even if it's more expensive. They'll least have people to help you out when things go sideways.

Tax1099 Review: Nightmare Customer Service and Cumbersome Processes

Last year, I was excited to try out the electronic filing system offered by Tax1099 after reading positive reviews about its smooth process. And yes, filing 1099s for 2017 was relatively painless. However, this year, I had a completely different experience. It was nothing short of a nightmare! The customer service was almost nonexistent, and it was frustrating trying to get help via chat. After filling out the chat request box repeatedly, I was told that there was nobody available to assist me. There were instances where I had to wait for long periods, but eventually, I had to leave just to come back and find out that they had come online, and then left! It was frustrating!

Seriously, Tax1099, these are taxes we are talking about, not something to be treated lightly. I had a feeling that it was run by people in a third world country who don't understand anything about the IRS. It made me doubt whether all my information was safe.

Apart from the poor customer service, some of the processes put in place were more cumbersome than they needed to be. For example, I had to enter a new recipient before adding the form. Why couldn't they integrate everything into one screen? It would have made everything less exhausting.

In conclusion, Tax1099 has to improve its customer service if it hopes to retain and increase its customer base. Taxpayers deserve the respect and support that they need when it comes to filing taxes, and a comprehensive system that integrates all the processes into one would be ideal.

Tax1099 Complaints 0

However, if you have something to share with the others, you can write a complaint

If you represent Tax1099, take charge of your business profile by claiming it and stay informed about any new reviews or complaints submitted.

About Tax1099

Tax1099 is built upon a commitment to providing clients with the fastest and most efficient way to file tax forms 1099, W-2, and ACA, among others. The platform is very user-friendly and intuitive, enabling even those without prior knowledge or experience to generate, file, and deliver tax forms with unprecedented ease.

One of the key features of Tax1099 is that it allows businesses to utilize direct data imports, saving them valuable time and effort. This means that businesses no longer have to worry about manually entering data into tax forms or copies. Tax1099 automates the entire process, ensuring accurate and reliable results. Furthermore, the platform helps businesses to stay up-to-date with the latest IRS regulations, ensuring compliance at all times.

Tax1099 provides a safe and secure platform for filing tax forms electronically. The platform is SSL encrypted, and all data transfers are done securely. This ensures that businesses' sensitive information remains confidential and safe from unauthorized access. Additionally, Tax1099 provides audit trail and transmission logs, providing businesses with clear visibility of their tax form activities.

Using Tax1099 means businesses will no longer have to spend countless hours filling out tax forms. Tax1099 streamlines the entire process, saving time and resources that can be otherwise spent growing and expanding the business. With its intuitive and user-friendly interface, direct data imports, and secure document exchange mechanism, Tax1099 guarantees fast, reliable and hassle-free tax form filing and delivery.

Here is a guide on how to file a complaint against Tax1099 on ComplaintsBoard.com:

1. Log in or create an account:

- Start by logging into your ComplaintsBoard.com account. If you don't have an account, create one.

2. Navigating to the complaint form:

- Locate and click on the 'File a Complaint' button on the ComplaintsBoard.com website. You can find this button at the top right corner of the website.

3. Writing the title:

- Summarize the main issue with Tax1099 in the 'Complaint Title' section.

4. Detailing the experience:

- Provide detailed information about your experience with Tax1099. Include key areas of concern, relevant transactions, steps taken to resolve the issue, personal impact, and the company's response.

5. Attaching supporting documents:

- Attach any additional supporting documents that can help validate your complaint. Avoid including sensitive personal data.

6. Filling optional fields:

- Use the 'Claimed Loss' field to state any financial losses and the 'Desired Outcome' field to specify the resolution you are seeking.

7. Review before submission:

- Review your complaint for clarity, accuracy, and completeness before submitting it.

8. Submission process:

- Submit your complaint by clicking the 'Submit' button.

9. Post-Submission Actions:

- Regularly check for responses or updates related to your complaint on ComplaintsBoard.com.

Ensure to follow these steps to effectively file a complaint against Tax1099 on ComplaintsBoard.com.

Overview of Tax1099 complaint handling

-

Tax1099 Contacts

-

Tax1099 emailssales@tax1099.com94%Confidence score: 94%Salessupport@tax1099.com93%Confidence score: 93%Supportfeedback@tax1099.com75%Confidence score: 75%Support

-

Tax1099 address1600 Solana Blvd., Suite 8130, Westlake, Texas, 76262, United States

-

Tax1099 social media

-

Checked and verified by Stan This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreJun 05, 2024

Checked and verified by Stan This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreJun 05, 2024 - View all Tax1099 contacts

Most discussed Tax1099 complaints

Tax1099 Review: False Advertising and Poor Customer Service - Disappointed and Wouldn't RecommendRecent comments about Tax1099 company

Tax1099 Review: False Advertising and Poor Customer Service - Disappointed and Wouldn't RecommendOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.

We have received your comment. Thank you!