Tax1099’s earns a 3.4-star rating from 58 reviews, showing that the majority of users are somewhat satisfied with tax filing experience.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

A Comprehensive Review of Zenwork LLC - Tax1099.com

As a seasoned professional in the tax industry, I have had the opportunity to explore various eFiling platforms, and Tax1099 by Zenwork LLC stands out as a reliable and efficient solution for businesses of all sizes. While some users have expressed concerns about customer service and pricing, my experience with Tax1099 has been overwhelmingly positive. The platform offers a user-friendly interface, secure eFiling options, and a range of features that simplify the tax reporting process. With Tax1099, I have found a trusted partner that streamlines 1099 compliance, saving both time and resources. I highly recommend Zenwork LLC's Tax1099.com for businesses looking for a seamless eFiling experience.

Worked as expected. Liked extended ad on features like TIN match, W-9 and State compliance

It's my bad that waited to file my 1099s until the last minute. My first batch of filing was during the Jan second week and it worked like a speed jet. Today, I felt that it was a little slow but I was still able to run my QuickBooks Desktop Plugin without any issues. What I like about this tool is, it offers all information reporting compliance in a single platform.

Better experience than the reviews

I was a little skeptical to use the site but eventually gave it a try and boy it's works way better than others I have used in the past. Site worked for QuickBooks import from Desktop and also from QBO. This is the only site that did my state filing for PA and OR. Rest of the sites including Intuit could not handle my state filing needs where states required a separate filing. Will come back again next tax year.

-

Pros

- IRS-Compliant E-Filing

- Robust Security Measures

- Multi-Platform Integration

- Real-Time TIN Matching

- Comprehensive Form Selection

-

Cons

- Limited International Features

- No Free Version Available

- Interface Can Be Complex

- Customer Support Variability

Love the QBD and QBO integration with Tax1099.com!

I was skeptical to use the service seeing some negative reviews but pleasantly surprised see how well it worked for my QBD 1099 vendor synching over to Tax1099. I also have some QBO customers and again their app turned out to the best compared to others listed out there.

Love USPS mailing and TIN match features that Intuit 1099 filing did not provide. It's definitely a feature-rich solution with affordable price.

SO EASY!

I had such an easy time of it! The website is very self explanatory once you navigate around for a couple minutes. I contacted the customer service team because one of the dates said it would be filed on 2/6/2017, I questioned it and they replied back saying that only box 7's had to be filed by 1/31. I was so pleased by the support I received! It's so affordable, i don't know why anyone would fuss with the paper versions!

Offers more form than just Tax1099

Liked using the site for my 941 and W-2 (both late filing). Will be back in January to file 1099s and other payroll tax forms. Found easy to navigate and very reasonably priced. I decided to give my first review on site so small businesses like me can benefit. A lot of 1s are scary but those reviews seems a little sketchy (hope it's not a competitor's job:-)

I will also explore the integrated TiN Match and W-9 features. Cheer!

Good platform, easy to use, great value for money

I had to file several 1099 MISC and 1099-INT corrections. It was easy to synch over data from QBO to do the corrections and copies were delivered to my recipients in 4 business days. Excel import and validations were decent for non-QBO clients. Overall a good service to have that saves a lot of time. Glad I am no longer using those clunky RED forms anymore. Will definitely be back to use several thousand 1099-MISC filing for my clients.

Works Great with Internet Explorer in Windows 10

I see a lot of people are having trouble with this software but it may be because you are using a browser that doesn't support it well. I first tried using Chrome and couldn't get the forms to come up. So I have learned that software has to be tweaked a little to work on different browsers so if one isn't working right I try another until I find the magic one.

The magic one for Tax1099 is the latest Internet Explorer. It worked great for me.

I decided to use this software for the first time this year after reading about it in Forbes magazine. Got my 1099s out in record time.

USPS Address Validation really sets me at ease

Address validation in Tax1099 it's a reliability booster. Whenever I input a state or zip code, Tax1099 goes the extra mile, checking it against their internal database for any discrepancies. And here's the kicker – when creating a new recipient, you have the option to select address validation. This takes the scrutiny up a notch, comparing the address against the USPS database for meticulous verification. It's like having a personal address guardian ensuring that every detail is on point.

The beauty of this process is evident in the precision it brings to the table. No more worrying about missing forms or communication breakdowns due to inaccuracies. This feature isn't just about meeting the standards; it's about exceeding them. It's a proactive approach that not only streamlines the process but also gives you the peace of mind that every piece of address information is not just correct but precisely so.

Consider it your digital address concierge, saving you from potential delivery hiccups or returned mail nightmares. Address validation in Tax1099 is a meticulous ally in the tax filing journey, ensuring that your communications hit the mark with accuracy and reliability every single time. It's a small yet powerful detail that makes a significant difference in the overall efficiency and confidence of the tax filing process. So, here's to the unsung hero of precision in tax documentation – address validation in Tax1099!

Keep your data safe and sound, really don't have to worry from this aspect

Security is a game-changer with Tax1099. They've got our back by hosting all our data in SSAE-18 Type II compliant centers – it's like Fort Knox for our information. The 256-bit encryption they use is seriously robust; it's akin to having a high-tech bank vault protecting our data. Real-time backups are a lifesaver, ensuring that no matter what happens, our crucial information stays intact. And let's talk about that two-factor authentication – it's like having an extra padlock on the digital door, making sure only the right people can access our data. Knowing that Tax1099 takes these extensive measures to protect our info adds an extra layer of confidence when dealing with taxes online. It's like having a digital fortress, and it definitely eases the stress of navigating the online tax world. The security measures aren't just features; they're peace of mind.

Support team of Tax1099 really kicks in when you need any assistance without loosing any time.

Engaging with Tax1099's support has been nothing short of impressive. Their responsiveness in both the chat and email support channels is stellar, providing an instant Turnaround Time (TAT) that's a game-changer in the fast-paced world of tax filing. Whether I encountered a snag or needed clarification, the support team was right there, delivering solutions without delay. What sets them apart is their extensive repository of guides and snapshots. This treasure trove of resources became my go-to when tackling issues independently. The guides are clear, concise, and paired with snapshots, ensuring I could navigate through problems without losing precious time. Tax1099's commitment to prompt assistance and empowering users with a wealth of self-help resources has undeniably elevated my experience, making the support process not just efficient but genuinely user-friendly.

Transparent pricing really helps in planning ahead!

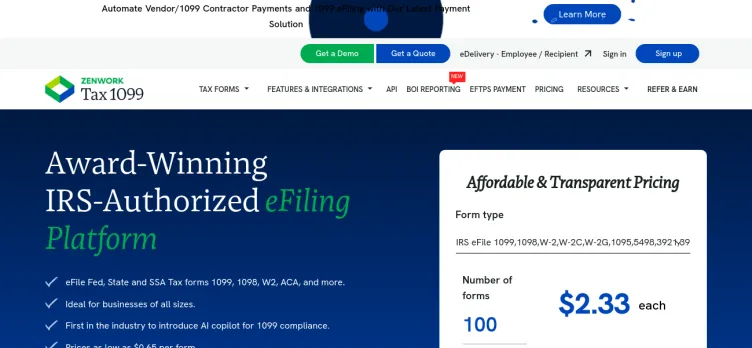

Tax1099 has been helpful in the often murky world of tax services, and their pricing structure is the unsung hero of this experience. In a landscape where hidden fees are the unfortunate norm, Tax1099.com brings refreshing transparency, laying out costs with a clarity that's hard to find elsewhere. There are no surprises, just a straightforward breakdown that even someone like me, not versed in tax jargon, can understand. What truly sets them apart is the flexibility in their plans – catering to businesses of all sizes without the burden of unnecessary features. It's a genuine value-for-money deal, offering a suite of features that go beyond just filing. The cherry on top is their cost estimator tool, a thoughtful touch that adds a layer of user-friendliness rarely seen in the tax game. Tax1099.com has not only simplified my tax season but also made me a loyal advocate for their transparent and comprehensive pricing. It's a breath of fresh air that every taxpayer deserves.

Had a wonderful expecirence filing my 1099-NEC with Tax1099! Highly recommend everyone

I filed my Form 1099-NEC with Tax1099.com, and I'm seriously impressed. Here's why this platform deserves a shoutout from a user's perspective:

1. User-Friendly Interface: Tax1099 made the whole process a breeze. The interface is super intuitive, guiding me step by step without any confusing jargon.

2. Bulk Upload: Tax1099 lets you bulk upload records using Excel templates, saving me a ton of time and headaches.

E-filing: The best part? Direct e-filing with the IRS. No more printing, mailing, or stressing over whether my forms made it to the right place. It's like a weight off my shoulders.

Error Checks Saved Me: The automated error checks caught things I might have missed, ensuring my filings were spot-on before hitting submit.

Speedy Electronic Delivery: Tax1099, my recipients got their forms electronically, meaning quicker delivery and happier recipients.

Awesome Support: They've got you covered. Tax1099 offers support resources and a customer service team that's helpful. They made sure I wasn't left in the dark.

Tax1099's is really easy to use, and stores data up to 4 years

If you're like me, the thought of annual tax filing can be a headache, but Tax1099 has truly turned the game around with its seamless eFiling experience. I've experienced the convenience firsthand, and trust me, it's a stress-free solution that's a game-changer.

What sets Tax1099 apart is the simplicity of its eFiling process. You upload your information once, and that's it – no more repetitive data entry. It's a one-and-done deal that saves time and eliminates the hassle of navigating through complex forms each tax season.

They've taken it a step further by allowing users to access their information effortlessly year-round for up to four years. That means no more digging through old records or frantically searching for misplaced documents during busy tax seasons. It's like having your own virtual filing cabinet that's always within reach.

Whether you need to reference past filings for business planning or simply want to double-check information, Tax1099 ensures that your data is just a click away, providing peace of mind in an instant.

During hectic tax seasons, having a reliable and user-friendly platform like Tax1099 is a true blessing. It takes the stress out of the equation, allowing you to focus on what matters most – your business. The seamless eFiling experience is not just a feature; it's a lifeline for anyone looking to simplify their annual tax routine.

eDelivery make the recipient copy distribution so much easier specially when its IRS approved

I've been using Tax1099 for a while now, and their eDelivery feature has been simplifying the whole document distribution process. Let me tell you, it's a breath of fresh air for anyone tired of dealing with the traditional paper trail.

The eDelivery portal is my go-to option for hassle-free distribution of recipient copies. With just a few clicks, I can electronically send all the necessary documents to recipients, making the entire process quick and efficient. No more waiting for snail mail or worrying about lost papers – it's all done digitally.

What I really appreciate is how Tax1099's eDelivery isn't just about convenience; it's also rock-solid when it comes to IRS compliance. They've got all the bases covered, ensuring that the electronic delivery meets all the necessary regulations. It's a relief to know that I can streamline the process without compromising on compliance.

Speed matters and Tax1099's eDelivery gets that right. Recipients receive their documents in a flash, and that kind of efficiency is a game-changer during tax season. Plus, it's not just about saving time – it's also a more eco-friendly option, cutting down on paper usage and postage costs.

For businesses dealing with a pile of recipient copies, Tax1099's eDelivery is a no-brainer. It's cost-effective and time-saving, and it aligns with the shift towards a more sustainable approach to document distribution.

Features of the platform are top notch and always helps you in a crunch

As a small business owner, tax season used to be my annual stress marathon—until I discovered Tax1099's scheduled eFiling feature. Let me tell you, it's been a game-changer.

Planning has never been this painless. With Tax1099, I can schedule my eFiling dates well in advance, avoiding the last-minute panic that used to be the norm. It's like having a personal assistant for tax season, reminding me to stay on top of things without the stress.

What I love most is the flexibility the platform offers. Life happens, and business details change. With Tax1099, I can reschedule filing dates or update information whenever I need to, and the best part is—it doesn't cost me an extra dime. No more worrying about outdated data or scrambling to make last-minute corrections.

Tax1099's interface is a breath of fresh air. It's so user-friendly that even someone like me, who isn't a tax expert, can navigate it with ease. The simplicity of scheduling eFiling dates gives me a sense of control over the entire process, and that's priceless.

This scheduled eFiling feature has turned tax season from a chaotic rush into a well-organized plan. I'm saying goodbye to the anxiety of looming deadlines and embracing a more strategic approach to tax compliance.

Real Time TIN verification is a bliss and helps staying compliant

One standout feature that has significantly eased the burden of compliance is the real-time Taxpayer Identification Number (TIN) verification capability.

Ensuring the accuracy of TINs is not just a good practice; it's a compliance necessity. Tax1099.com has taken this requirement to the next level by integrating a real-time TIN verification feature directly into the platform. This feature has become my secret weapon for maintaining compliance effortlessly.

The real-time TIN verification feature operates seamlessly during the data entry process. As I input vendor information, the system automatically cross-references the provided TIN with IRS records in real-time. This not only reduces the risk of errors but also ensures that the TIN is valid and associated with the correct payee.

For businesses dealing with a multitude of vendors, this feature is a game-changer. It acts as a proactive measure, catching potential discrepancies before filings are submitted. This not only safeguards against costly penalties but also fosters a culture of precision in tax reporting.

What sets Tax1099.com apart is the speed at which the real-time TIN verification operates. In a matter of seconds, I receive confirmation of TIN validity, allowing me to address any discrepancies promptly. This instantaneous feedback is invaluable, especially in the fast-paced world of business where time is often a scarce resource.

The real-time TIN verification feature on Tax1099.com not only contributes to compliance but also enhances the overall efficiency of the tax filing process. It exemplifies the platform's commitment to providing users with the tools needed not just for filing, but for filing accurately and with confidence.

In conclusion, for businesses committed to staying compliant in an ever-evolving tax landscape, the real-time TIN verification feature on Tax1099.com is a must-have. It's a proactive measure that empowers users to navigate the complexities of tax reporting with precision, ensuring that compliance is not just a checkbox but a seamless part of the overall tax filing experience.

Very easy and support makes it even more convenient

As someone who's navigated the complex terrain of tax filings for several years, I can confidently say that Tax1099.com stands head and shoulders above the rest. Having recently completed another tax season using this platform, I'm compelled to share the reasons why it has become my go-to choice.

First and foremost, the user interface is a masterpiece of simplicity. Having battled clunky platforms in the past, Tax1099.com's intuitive design is a breath of fresh air. The step-by-step approach streamlines the process without sacrificing depth, catering to both the seasoned professional and those less familiar with the intricacies of tax filings.

Where Tax1099.com truly shines is in its support system. It's not about hand-holding; it's about having a reliable partner in the journey. The support team demonstrates a deep understanding of the complexities inherent in tax filings, providing solutions with the kind of efficiency that only comes from experience. It's the type of support you appreciate when you've been down the road a few times and know how valuable it is.

The quick turnaround time from the support team is particularly noteworthy. As an experienced user, time is of the essence, and Tax1099.com has consistently delivered rapid responses, turning potential roadblocks into mere speed bumps. This responsiveness is a game-changer, especially during the hectic tax season when every minute counts.

Real-time updates and notifications have become a staple of my tax filing routine with Tax1099.com. The platform keeps me informed without overwhelming me, striking a balance that reflects an understanding of what seasoned users need – precision and clarity.

Very dependable & easy to use!

As a mid-size business, my two-year journey with Tax1099.com has been marked by efficiency, reliability, and a user-friendly experience. This platform has consistently proven to be an invaluable.

The ability to schedule e-transmits has been a key feature that aligns seamlessly with our operational workflow. It grants us the flexibility to validate information thoroughly before transmission, a crucial aspect for a mid-size business with diverse financial intricacies. This scheduling feature has undoubtedly contributed to a more organized and stress-free tax filing process.

Tax1099.com's dual delivery options—email and USPS—have been instrumental in catering to the diverse preferences of our vendors. This flexibility ensures that our vendor communications are not only efficient but also tailored to individual needs. Whether digital or physical, the platform accommodates our business requirements with ease.

Having utilized Tax1099.com's services for two years, I can attest to the platform's reliability. The seamless integration with our workflow, coupled with the consistent efficiency of the e-filing process, has significantly reduced the complexities associated with tax season. The peace of mind derived from knowing our filings are in capable hands is invaluable.

Tax1099 has really been a game-changer for me

Tax1099.com is a game-changer for my business tax filings. Its user-friendly setup makes managing Form 1099 filings smooth, even for those without extensive tax knowledge.

The platform's layout is clean and easy to navigate, providing a clear view of filing progress without unnecessary complications. It has exceptional customer support — prompt and reliable, they are always ready to assist with any questions or concerns.

What I liked the most was Tax1099.com's commitment to staying up-to-date with the latest tax laws. Their regular updates ensure that filings comply with the most recent regulations, giving users peace of mind about the accuracy of their submissions.

Tax1099.com simplifies the daunting task of tax filing. Its user-friendly interface, stellar support and commitment to compliance, makes it an invaluable tool for businesses seeking efficient Form 1099 filing solutions.

Tax1099 Complaints 13

Lack of security in creating account

An unknown person was able to create an account for our small business and issue W2's for persons unknown to us and never worked for our company. Tax1099 did not verify our company information before allowing persons to submit fraudulent W2's to the SSA. Multiple attempts to get Tax1099 to rescind the information or delete it were apparently ignored.

Claimed loss: Not yet known

Desired outcome: Person who committed this fraud to be apprehended and arrested

Confidential Information Hidden: This section contains confidential information visible to verified Tax1099 representatives only. If you are affiliated with Tax1099, please claim your business to access these details.

Worst program EVER. Horrible interface. Lag in the payment form. No support to be found

This is the worst program I have EVER used. It lags and requires you to repeat steps because the program has never worked the first time I import 1099s. I used this program last year and hated it. I used it this year thinking it surely had been upgraded.

It did have an update that then proceeded to crash my quickbooks application and took me hours to get back.

The payment form is ridiculous. Taking a credit card payment is the most basic of coding and really has nothing to do with the tax portion of the process and yet, they can't even get that to run smoothly. The payment form reloads multiple times with blank information. Somehow, magically, multiple 1099forms were submitted to the IRS as a result.

Tried to call support and was asked to leave a voicemail. Imagine that.

Tried to chat support and was given a message that no one is available. Imagine that.

This is the default app used through Quickbooks desktop to efile 1099s and yet, it has the worst interface I have ever used in my LIFE and I work for a web development company.

Using this program has done nothing but cause grief, hours of troubleshooting and only to file 2 1099-misc forms it just isn't worth it.

I am disgusted knowing how large Quickbooks/Intuit is and they have invested so very little in this service which is a key element to doing business every year.

I would NEVER recommend Quickbooks or Tax1099 to ANYONE in the future. In fact, I will scream to the mountain tops how this company clearly doesn't care about quality and only wants to push you into paying for their online software with a monthly subscription.

Huge failure 3 years in a row - Seriously, DO NOT USE THEM!

REPLY TO YOUR COMMENT:

Following up to trouble ticket #6913. I have not heard back yet. I have more people today saying they cannot access their W9. I am trying to access it myself using the exact info we supplied you to generate the 1099s and it's not working. The guy on the phone yesterday admitted this was a problem that was happening and said you guys would get back to me with a resolution. I called again today but just went to a message saying you guys are busy and it hung up.

-----------------------------

1st year I used them, site was down half the time in January.

2nd year I used them, absolute failure. Site was crashing, nobody responding to chat, and their toll free number instantly goes to a message that says "Sorry, this mail box is full, Good bye". Maybe if you just need to submit a few 1099s, they are ok. If you need to manage records and use the system to handle W9s and mass import data, it's abissmal. Seriously poor execution from start to finish

Fast forward to 2018 and it's totally my fault for not choosing to find the time to switch away from Tax1099. So here we are again. A year later and full of new problems. This time, we issued out over 300 1099 forms this morning via email and none of our clients can open them because they messed up the passwords. I called this morning and was told I would hear back before the end of the day and its almost 5pm PST and they are closed for the day. I was told that a lot of people were calling because there was something wrong with the 1099 PDFs that they sent out. Isn't this exactly what they? The whole purpose for their existence? And they just can't get it right, or even some what "ok", and I've given them 3 years.

Next year I will hand-write my 1099s and let the USPS handle them before I let them touch anything. Absolutely pathetic at what they do.

Is Tax1099 Legit?

Tax1099 earns a trustworthiness rating of 91%

Highly recommended, but caution will not hurt.

Tax1099 has received 35 positive reviews on our site. This is a good sign and indicates a safe and reliable experience for customers who choose to work with the company.

Tax1099.com has a valid SSL certificate, which indicates that the website is secure and trustworthy. Look for the padlock icon in the browser and the "https" prefix in the URL to confirm that the website is using SSL.

Tax1099.com has been deemed safe to visit, as it is protected by a cloud-based cybersecurity solution that uses the Domain Name System (DNS) to help protect networks from online threats.

Several positive reviews for Tax1099 have been found on various review sites. While this may be a good sign, it is important to approach these reviews with caution and consider the possibility of fake or biased reviews.

The Tax1099 website has a cookie consent banner indicating the use of cookies for data collection. Reviewing the privacy policy and terms of use is crucial to understanding how the data is used and ensuring compliance with regulations.

We looked up Tax1099 and found that the website is receiving a high amount of traffic. This could be a sign of a popular and trustworthy website, but it is still important to exercise caution and verify the legitimacy of the site before sharing any personal or financial information

However ComplaintsBoard has detected that:

- While Tax1099 has a high level of trust, our investigation has revealed that the company's complaint resolution process is inadequate and ineffective. As a result, only 0% of 13 complaints are resolved. The support team may have poor customer service skills, lack of training, or not be well-equipped to handle customer complaints.

Tax1099 Review: System Fails to Deliver on Promise of Easy, Online Tax Filing

So, I tried out Tax1099 and I have to say - it's not quite living up to its potential. Okay, sure, it sounds good on paper - file your taxes online, make edits as you need to - but in practice it's just not working the way it should be. I entered a 941 and made some changes, but when I went to view or print it, it was still showing the old information. It's like the system just can't keep up with the edits I'm making, even though when I go back to edit it shows all the changes are there.

And don't even get me started on the tech support. In the beginning, it was pretty good - they seemed to know what they were talking about and were helpful with my questions. But for the last couple weeks, it's been a complete disaster. I try to use the chat and it just closes before anyone comes on, and when I try to call, nobody picks up. It's really frustrating when something you're using for something as important as taxes isn't functioning correctly and you can't get any help.

And I'm not just having issues with editing either. I've gotten kicked off the site multiple times when I'm trying to enter 1099s, which is just really annoying. I mean, I expect better from a product like this. It's supposed to be an Intuit product, so I thought it would be better than this. But honestly, they really blew it on at this one - they clearly weren't prepared for the demand. I think they're just in over their head right now.

Disappointing Experience with Tax1099: Double Mailings & Inaccuracies in Sensitive Information

I wasn't too pleased with the service provided by Tax1099. My clients were not pleased either, as they received double mailings. I was also frustrated to learn that the information I entered online did not match what appeared on the mailed copy! It's a bit concerning that there were inaccuracies on the documents that were mailed out, especially when it involves sensitive information such as payee social security numbers.

One of the issues that I found was that the Payor name was displayed as last name followed by first name with no space in-between. This made the name appear as one word only. This careless mistake can cause confusion for my clients and might cause them to discredit my work. Furthermore, another issue arose with a payee social security number that was incorrect. This is a serious issue as it has the potential to cause problems with the IRS.

When I looked at the information I entered for each form, there were no errors. This is why I find it puzzling that what was sent to the recipient or the IRS was not what I entered. It's difficult to know if there was an error in the system or a problem with the printing process. Regardless, it's not comforting to know that what I entered was not what was mailed out.

I was initially directed to Tax1099 through my Quickbooks software, so I'll be filing a complaint with Intuit as well. I'm disappointed with the level of service I received from Tax1099. Hopefully, they can improve their service so that mistakes like these can be avoided in the future.

Tax1099 Review: Buggy, Unreliable, and Overpriced for Filing 1099s

I got to file 1099s very often, so I got to use this eFile thing. My Quickbooks Enterprise is the top dog, but I been using Tax1099 for some years now. And man, every year it's something terrible happenin'. Like, I mean there's import errors coming out the ying-yang, sessions don't stay open for more than a few seconds, data gets imported wrong, and even the 1099s got bad "rental income" added on, like what? Like, you think that's bad? There's even fake 1099s gettin' made and it's a big ol' mess. Like, come on, man, where's the option for somethin' better than this "modern" software that's just like from 1995 or somethin'. It's like all kinda buggy and the people who pick up the phone when you got a problem, they're no help at all. I'm payin' just as much for Tax1099 as I do for Quickbooks. Ugh.

Tax1099 Review: Frustrating QB Import, Forms/Edits Not Working, Poor Customer Support

I must admit that Tax1099 is a total mess. The QB import feature just doesn't cut it, which is a total bummer. I had to waste so much time preparing an Excel spreadsheet just to import my information, and it's not like that was an easy task. Finally, I made it and imported what I needed. But wait, there's more! Today, when I tried to go back and make some important edits, I discovered that none of my forms had been saved! What happened? Believe me, I made sure to input all the necessary payer and recipient info before trying to complete the form.

To make things even worse, the Forms / Edit feature was not working. Whenever I clicked on it, it immediately shifted to People / manage payer or recipient, making me completely frustrated. I decided to seek help by using Tax1099's chat, but it took more than 20 minutes to get a response from someone. After finally getting someone to help me, we spent another 30 agonizing minutes trying to find out what went wrong, but with no success at all. I really wanted to know why my information wasn't saved or why I couldn't edit under forms, but my support person seemed to have no idea.

In conclusion, I must say that preparing 1099s on Tax1099 was the worst experience ever. I've already tried the Intuit 1099 and the difference was incredible. The latter was never this difficult! I'm definitely going to look for a different solution next time.

Tax1099 Review: Frustration, Poor Customer Service, and Inefficiency!

This service, Tax1099 (tax1099.com), is one that I truly have a hard time recommending. I found myself puzzling over why QuickBooks would choose to "partner" with this particular company. My frustration began when I couldn't download the plug-in that was supposedly needed for the site to function. Although I followed every instruction given, nothing seemed to work. Frustrated, I finally had to call their customer service team and found myself speaking to an agent who was struggling to communicate in English.

It was very clear that this agent was struggling with understanding my concerns, while I impatiently waited to get the issue resolved. After waiting for almost half an hour, the agent suggested that I allow her remote access to the computer, which made me uncomfortable. With the amount of data and sensitive information involved, there was no way I was about to agree to such a request. Eventually, I had no choice but to hang up in frustration and manually enter all my data into the on-line forms.

All of this inefficiency required me to waste my valuable time and made me feel as if I was doing more work than necessary. Honestly, I would probably be more comfortable gouging my eyes out with a dull stick than trying to use Tax1099 again. If you find yourself in a similar situation, I implore you to consider expressing your dissatisfaction to QuickBooks. I want to spread the word to as many QuickBooks users as possible, so they too are aware of this taxing ordeal.

Disappointing Experience with Tax1099: Filing Date Issues & Poor Support

So, I recently used Tax1099 to file my 1099's. However, I encountered a problem when I received my receipt with an e-file date of 02/06/17, which is well past the deadline. This means that I will face penalty fees due to failing to file on time. Despite reaching out to their support team, I did not receive adequate help. The response I got was simply to go to their website, which was not helpful at all. I even waited for 25 minutes to chat with their support team online only to be told that I should expect a response within a "few hours", which was totally unacceptable.

After trying to find out when their deadline was for filing on time, all I got was the IRS deadline, which I was already aware of. I tried to avoid this issue by seeking clarification earlier on. However, Tax1099's support team failed to provide any satisfactory answer. As a result, I have no other choice but to print out and mail my forms.

I must say I'm extremely disappointed with the level of service I received from Tax1099. I regard them as scammers, hence I regret having used their services. Furthermore, I would like to express my disappointment with Quickbooks for directing me to their link in the first place. Overall, it was a disappointing and frustrating experience.

Disappointing Tax Filing Experience with Major Issues and Confusing Charges

This program seems to have some issues. It did not upload the data correctly and once it was uploaded, it kept trying to change the filing date to next week, which was a bit confusing. Additionally, it would not let me file the taxes without selecting a method of delivery to the recipients. When I selected USPS, it charged me to have them mailed by THEM. I did not realize this until I paid for it and it was mentioned at the end. I was quite disappointed to learn that it would take 3 - 5 business days to be mailed because they were due to be mailed today. Although we are mailing ours, as recommended by Tax1099, we have not been able to get in touch with anyone to confirm that they have been sent. This has left me uncertain about the process. When I tried to print them, I was required to print each individual 1099 which was quite time-consuming. I don’t think I will be using this product anytime soon and would not recommend anyone else do so either.

Poor Customer Service Experience with Tax1099.com

I left a message fer someone to call me back cuz I needed hep wif me taxez. He called me back and while he seemd to undastand what me problem was, it was kinda hard to understand him. He had dis accent dat sounded like he be from da Philipeens. There was also a kid who was talkin loud in da background, like he was playing or somethin. When I asked da guy bout it, he just said "Nothin." I don know why a big company like Intuit would hire people like dis. I'm tellin you, dis be da second year in a row I used Tax1099.com and I had nothin but trouble. It's not right to hire peeps dat don't speak proper English. Next year I'm doin me homework and goin wit anotha 1099 processing company. I suggest you guys do da same cuz tax season be comin up again soon.

Tax1099.com Review: Complicated Navigation, Nightmare Data Import, but Solid Customer Service & Pricing

Tax1099.com ain't that obvious, man! Seriously, navigating through it makes me feel like I'm back in my math class trying to make sense of the equations on a board. I wish they could redesign it or something. And don't get me started on the data import - a nightmare. The only quick way out was to set things up on an Excel spreadsheet which took lots of time. And don't even try downloading multiple PDF files at once - they just don't do it here, mate! We were forced to download one at a time which took ages.

But you know what? The customer service desk was cool - polite and with quick responses. They answer the call, and they are there to help you. Thumbs up on their part. The pricing made sense to me, although it was slightly confusing. I mean, sure the cost reduces if you try to create 11 to 100 forms, but that's ONLY if you're creating 11 to 100 forms - not for any other numbers outside of that range. A bit complicated, but I still can hang with it.

Tax1099 Review: False Advertising and Poor Customer Service - Disappointed and Wouldn't Recommend

Hey, I gotta give my honest opinion on Tax1099 (tax1099.com). Let me tell ya, I ain't too happy with 'em. They claimed they could get my clients' W2's and 1099's to 'em in 3-5 days, but it's been 3 weeks now and still nothin'. I was hopin' to save some time and just pay the extra fee to have Tax1099 handle it, but now I'm realizin' I coulda done it myself for way cheaper.

I've been tryin' to reach 'em for a week now, callin', emailin', even tryin' to chat with 'em. But they ain't responded yet. Yet they can find the time to respond to these reviews and try to make themselves look better. It's just fake to me.

And don't even get me started on their false and misleading advertising. I feel like I got scammed now. They promised me somethin' they couldn't deliver, and now my clients are sufferin' because of it. Ain't right.

I mean, I get it's a busy time of year with taxes and all, but if they can't handle it then they shouldn't be makin' promises they can't keep. And if they can't respond to their clients' concerns and questions, then that's just plain bad customer service.

Overall, I'm disappointed in Tax1099. I ain't gonna be usin' 'em again, and I wouldn't recommend 'em to anyone else neither.

This is just fab and integration is easy to use.

Tax1099 is very simple to use and has great chat & email support. The interface of the platform is very easy to navigate through which makes the filing process that much simpler. The Dashboard is very intuitive and clear to understand and get status of the the filing.

Great tool to pullover allmy 1099 Data form QuickBooks Dekstop and QuickBooks Online.

Easy to use and few clicks that gets all qualified data pulled over and then submitted in a ziffy.

PRice is right and TIN match.w9 feature was even better.

About Tax1099

Tax1099 is built upon a commitment to providing clients with the fastest and most efficient way to file tax forms 1099, W-2, and ACA, among others. The platform is very user-friendly and intuitive, enabling even those without prior knowledge or experience to generate, file, and deliver tax forms with unprecedented ease.

One of the key features of Tax1099 is that it allows businesses to utilize direct data imports, saving them valuable time and effort. This means that businesses no longer have to worry about manually entering data into tax forms or copies. Tax1099 automates the entire process, ensuring accurate and reliable results. Furthermore, the platform helps businesses to stay up-to-date with the latest IRS regulations, ensuring compliance at all times.

Tax1099 provides a safe and secure platform for filing tax forms electronically. The platform is SSL encrypted, and all data transfers are done securely. This ensures that businesses' sensitive information remains confidential and safe from unauthorized access. Additionally, Tax1099 provides audit trail and transmission logs, providing businesses with clear visibility of their tax form activities.

Using Tax1099 means businesses will no longer have to spend countless hours filling out tax forms. Tax1099 streamlines the entire process, saving time and resources that can be otherwise spent growing and expanding the business. With its intuitive and user-friendly interface, direct data imports, and secure document exchange mechanism, Tax1099 guarantees fast, reliable and hassle-free tax form filing and delivery.

Here is a guide on how to file a complaint against Tax1099 on ComplaintsBoard.com:

1. Log in or create an account:

- Start by logging into your ComplaintsBoard.com account. If you don't have an account, create one.

2. Navigating to the complaint form:

- Locate and click on the 'File a Complaint' button on the ComplaintsBoard.com website. You can find this button at the top right corner of the website.

3. Writing the title:

- Summarize the main issue with Tax1099 in the 'Complaint Title' section.

4. Detailing the experience:

- Provide detailed information about your experience with Tax1099. Include key areas of concern, relevant transactions, steps taken to resolve the issue, personal impact, and the company's response.

5. Attaching supporting documents:

- Attach any additional supporting documents that can help validate your complaint. Avoid including sensitive personal data.

6. Filling optional fields:

- Use the 'Claimed Loss' field to state any financial losses and the 'Desired Outcome' field to specify the resolution you are seeking.

7. Review before submission:

- Review your complaint for clarity, accuracy, and completeness before submitting it.

8. Submission process:

- Submit your complaint by clicking the 'Submit' button.

9. Post-Submission Actions:

- Regularly check for responses or updates related to your complaint on ComplaintsBoard.com.

Ensure to follow these steps to effectively file a complaint against Tax1099 on ComplaintsBoard.com.

Overview of Tax1099 complaint handling

-

Tax1099 Contacts

-

Tax1099 emailssales@tax1099.com94%Confidence score: 94%Salessupport@tax1099.com93%Confidence score: 93%Supportfeedback@tax1099.com75%Confidence score: 75%Support

-

Tax1099 address1600 Solana Blvd., Suite 8130, Westlake, Texas, 76262, United States

-

Tax1099 social media

-

Checked and verified by Stan This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreJun 05, 2024

Checked and verified by Stan This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreJun 05, 2024 - View all Tax1099 contacts

Most discussed Tax1099 complaints

Tax1099 Review: False Advertising and Poor Customer Service - Disappointed and Wouldn't RecommendRecent comments about Tax1099 company

Tax1099 Review: False Advertising and Poor Customer Service - Disappointed and Wouldn't RecommendOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.