Tax1099’s earns a 3.4-star rating from 58 reviews, showing that the majority of users are somewhat satisfied with tax filing experience.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

Disappointing Customer Service and Website Navigation from Tax1099

I gotta say, I'm pretty darn disappointed with Tax1099. I mean, come on guys, you've been around for a bit now, can't you get your [censored] together and provide some half decent customer service? I only ended up using them this year because Quickbooks stopped offering their other service, but boy do I regret it.

First, let's talk about their website. It's a hot mess. Trying to navigate it gave me a headache. And don't even get me started on their customer support. What a joke! When I tried to call them, I got a message saying they were super busy and that my call would be directed to some unmonitored voicemail. At least put in some effort to help your customers, guys!

And don't even bother with the chat feature. They say you'll get a response in a few hours. Give me a break. By the time someone finally read my message, I had already lost all patience. And their excuse for the delay? "Oh sorry we're super backed up right now." Boo hoo. Get your act together and hire more staff if that's the issue.

Oh, and let's not forget about their forms. It takes ages for them to generate once you've paid. What's the deal with that? If I've already paid, why should I have to wait hours to print and save my documents? That's just plain ridiculous.

Overall, Tax1099 seems to take their sweet time answering questions and definitely lack adequate support to help their clients with any sort of issue or concern. But hey, at least they'll accept your payment right away. Yay, I guess?

Tax1099.com Review: Poor Technical Support and Software Design for Efficient Tax Filing

I'm a CPA and I've been in practice for over 30 years. Recently, I stumbled upon Tax1099.com because it was recommended by QuickBooks, but what a waste of time it turned out to be! As a QuickBooks Advisor, I'll definitely let them know not to recommend this service. I was hoping to be more efficient this year, but instead, I had nothing but trouble.

Let's start with their tech support - it was abysmal. I wanted to contact them for assistance, but the only option was through chat. It was a time-consuming process just waiting for the text bubbles to appear and then trying to describe my issue, only to receive answers that either didn't address the problem or posed more questions.

The software itself was nothing to write home about either. I had to double-check every recipient, especially if the information would upload to the State, because the software had a poor excuse for designing, which uploads to the State of the contractor's address. Unfortunately, that doesn't comply with State regulations, which require the Payor to report the 1099 for all contractors who worked in the State. I had to fix the recipient errors by wasting more time, so I could move on to the next screen. However, when I got to the next screen, I found out I had missed the Payor information! Even though I had made all of the necessary edits, I couldn't update the Payor information because there was no way to save it all at once.

Furthermore, the upload program instructions were terrible, and the customer support was even worse. Suffice it to say, I will never use Tax1099.com ever again.

In conclusion, I don't recommend using Tax1099.com for your tax needs. It's simply not worth the time or the headache.

Disappointing Experience with Tax1099.com for 1099 Forms Issuance & Filing

I've been using Tax1099.com for my 1099 forms for a while now, but I have to admit that I'm not too happy with their service. It used to be that I could issue my 1099's through the quickbooks application, but that's no longer an option since QB started using Tax1099.com. At first, I didn't think it was too big of a deal since I only had 5 vendors to add manually but I was wrong.

For some reason, I couldn't get my info to automatically transfer, which was frustrating. I had to manually add all the information myself. The lack of email confirmation was the most disappointing as there was no way of knowing whether the forms had been sent out to the vendors or not.

Moreover, the status forms took ages to load and locating the option to view the status of whether or not the forms had been mailed to vendors or not was impossible. I eventually had to use the online chat to get some assistance, which wasn't too bad. The guy walked me through how to run the report, and I discovered that they were still showing "scheduled" to be mailed.

I didn't mind that too much as the deadline was still a little far off. But that was until I checked again today and discovered that Tax1099.com shows my federal submission as "processing." According to the key, they've been submitted, but they're just waiting on the IRS to approve the submission.

This isn't what I was expecting. The quickbooks app I used to use had a 24-48 hour turnaround from filing to acceptance. It's now Feb 3, and I did a new exported excel report, but the status of the forms to be mailed to vendors still shows "scheduled." This isn't acceptable for me, and I'll not be using their service again. I hope quickbooks rethinks their decision to switch to Tax1099.com as well.

Tax1099 Review: a frustrating mess that wasted my time and crashed Quickbooks

This program is bad, let me tell ya. It's a mess and makes you repeat steps cuz it ain't never gonna work the first time you try to import 1099s. I used this thing last year and it sucked just as bad. Thought they might've made it better this year but nah, it just made my Quickbooks crash and wasted hours of my time fixing it.

The payment form is a joke. Ain't nothing more basic than coding a credit card payment, but somehow they can't do it right. That form reloads so many dang times with no info, it's insane. I ended up submitting a ton of 1099forms just by magic.

I tried calling for support but got told to leave a voicemail. What good is that? Thought maybe the chat would work but that didn't help either.

This is supposed to be the main program to efile 1099s on Quickbooks desktop but it's the worst app I've ever used and I work for a web dev company. Ain't worth the hours and hours of grief just to file 2 1099-misc forms.

It's shameful how little Quickbooks/Intuit invested in this service that's so important for business every year. I would never recommend Quickbooks or Tax1099 to anyone EVER. They clearly don't care about quality and just wanna make ya pay for their online software with a stupid subscription.

Disappointing Experience with Tax1099: Website Crashes and Poor Customer Service

I have to say, my experience with Tax1099 has been less than satisfactory. Last year, when I first used their service, their website was down half the time in January. But I figured it could just be growing pains, so I decided to give them another chance this year. Unfortunately, my second experience was even worse than the first. Their website kept crashing, their chat wasn't responsive, and their toll-free number went straight to voicemail that was so full that I couldn't even leave a message.

Maybe Tax1099 is okay if you only have to submit a few forms, but if you're managing records, using their system to handle W9s, and mass-importing data, it's a complete disaster. And not only that, when I tried to issue out over 300 1099 forms to my clients via email, nobody was able to open them because Tax1099 had messed up their passwords.

When I called Tax1099 to try to get this resolved, I was told that I would hear back before the end of the day. However, it's almost 5 pm PST and they are closed for the day without responding to me. Apparently, a lot of other people were calling them to complain about problems with the 1099 PDFs that they had sent out. This is exactly what Tax1099 is supposed to do, and they can't even get that right, even after using their service for three years.

Honestly, their performance has been so poor and disappointing that I would rather hand-write my 1099s and send them via USPS than deal with them again. In short, Tax1099 is absolutely pathetic and I cannot recommend them.

Tax1099 Complaints 0

However, if you have something to share with the others, you can write a complaint

If you represent Tax1099, take charge of your business profile by claiming it and stay informed about any new reviews or complaints submitted.

About Tax1099

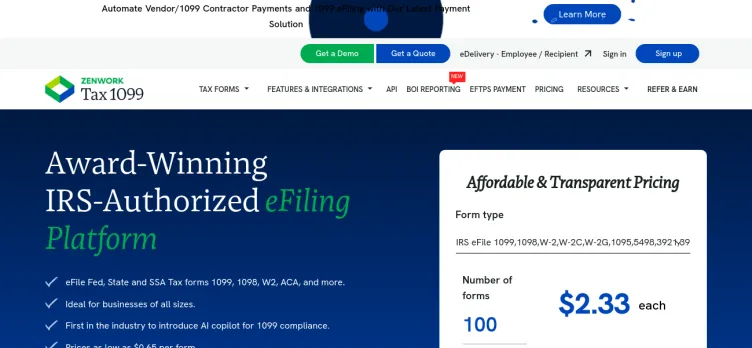

Tax1099 is built upon a commitment to providing clients with the fastest and most efficient way to file tax forms 1099, W-2, and ACA, among others. The platform is very user-friendly and intuitive, enabling even those without prior knowledge or experience to generate, file, and deliver tax forms with unprecedented ease.

One of the key features of Tax1099 is that it allows businesses to utilize direct data imports, saving them valuable time and effort. This means that businesses no longer have to worry about manually entering data into tax forms or copies. Tax1099 automates the entire process, ensuring accurate and reliable results. Furthermore, the platform helps businesses to stay up-to-date with the latest IRS regulations, ensuring compliance at all times.

Tax1099 provides a safe and secure platform for filing tax forms electronically. The platform is SSL encrypted, and all data transfers are done securely. This ensures that businesses' sensitive information remains confidential and safe from unauthorized access. Additionally, Tax1099 provides audit trail and transmission logs, providing businesses with clear visibility of their tax form activities.

Using Tax1099 means businesses will no longer have to spend countless hours filling out tax forms. Tax1099 streamlines the entire process, saving time and resources that can be otherwise spent growing and expanding the business. With its intuitive and user-friendly interface, direct data imports, and secure document exchange mechanism, Tax1099 guarantees fast, reliable and hassle-free tax form filing and delivery.

Here is a guide on how to file a complaint against Tax1099 on ComplaintsBoard.com:

1. Log in or create an account:

- Start by logging into your ComplaintsBoard.com account. If you don't have an account, create one.

2. Navigating to the complaint form:

- Locate and click on the 'File a Complaint' button on the ComplaintsBoard.com website. You can find this button at the top right corner of the website.

3. Writing the title:

- Summarize the main issue with Tax1099 in the 'Complaint Title' section.

4. Detailing the experience:

- Provide detailed information about your experience with Tax1099. Include key areas of concern, relevant transactions, steps taken to resolve the issue, personal impact, and the company's response.

5. Attaching supporting documents:

- Attach any additional supporting documents that can help validate your complaint. Avoid including sensitive personal data.

6. Filling optional fields:

- Use the 'Claimed Loss' field to state any financial losses and the 'Desired Outcome' field to specify the resolution you are seeking.

7. Review before submission:

- Review your complaint for clarity, accuracy, and completeness before submitting it.

8. Submission process:

- Submit your complaint by clicking the 'Submit' button.

9. Post-Submission Actions:

- Regularly check for responses or updates related to your complaint on ComplaintsBoard.com.

Ensure to follow these steps to effectively file a complaint against Tax1099 on ComplaintsBoard.com.

Overview of Tax1099 complaint handling

-

Tax1099 Contacts

-

Tax1099 emailssales@tax1099.com94%Confidence score: 94%Salessupport@tax1099.com93%Confidence score: 93%Supportfeedback@tax1099.com75%Confidence score: 75%Support

-

Tax1099 address1600 Solana Blvd., Suite 8130, Westlake, Texas, 76262, United States

-

Tax1099 social media

-

Checked and verified by Stan This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreJun 05, 2024

Checked and verified by Stan This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreJun 05, 2024 - View all Tax1099 contacts

Most discussed Tax1099 complaints

Tax1099 Review: False Advertising and Poor Customer Service - Disappointed and Wouldn't RecommendRecent comments about Tax1099 company

Tax1099 Review: False Advertising and Poor Customer Service - Disappointed and Wouldn't RecommendOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.

We have received your comment. Thank you!