TaxAct’s earns a 1.4-star rating from 62 reviews, showing that the majority of users are dissatisfied with tax filing experience.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

Mixed Experience with TaxACT

As someone deeply familiar with tax preparation, I understand the importance of choosing the right software. TaxACT has received mixed reviews from customers. While some appreciate its ease of use and affordability, others have faced challenges with customer service and unexpected charges. It seems that the software may work well for straightforward tax situations, but issues arise with more complex filings. If you have a simple tax return, TaxACT could be a suitable option. However, for those with more intricate tax scenarios, it might be wise to explore other alternatives.

Refer a Friend is a scam

Was supposed to get a$20 or $25 gift card for "referring" a friend to file with TaxAct. So, this was back in January with two people and nothing has ever showed up, nor has there ever been any contact from them. Also, when you are the "beneficiary" of receiving 20% off, when you follow the link provided it just so happens the price is about 20% higher so there is no net benefit. Also, the price is way jacked up from what it used to be and they "trick" you into purchasing a higher level of service than what you really need. You might only need the basic service, and all the sudden they throw the DELUXE price when you try to click the link. I have used them for years, but now I am done.

Woundering what went wrong

Never again will I use Taxact to do my taxes again nor any other taxes on the internet for that matter

-

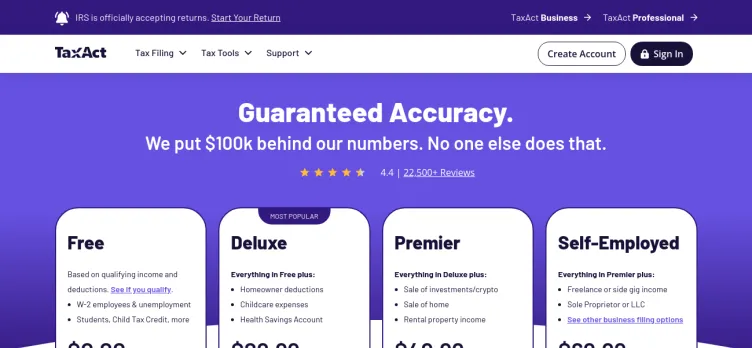

Pros

- Affordable pricing tiers for all users

- User-friendly interface and navigation

- Comprehensive tax resources and tools

- Maximum refund and accuracy guarantee

- Free IRS e-file for basic federal returns

-

Cons

- Limited customer support options

- Fewer features than top competitors

- Interface less intuitive than peers

- Upselling within the application

Very thorough and affordable way to file complex taxes!

I've been using TaxAct for years and it's not only affordable ($25) including federal and state tax filing, but I was able to use it for my complex tax situation! Highly recommend

$20 Amazon referral!

I didn't believe I would really get the $20 for the referral, but I did literally within 24 hours! I added it straight to my Amazon account :) ty Tax Act, great software, easy to understand, started doing my own taxes & all my kids & alot of friends through Tax Act in 2020. Free federal only $4.95 for my state :) very reasonable prices

Great tax help

I have been using Tax Act since 2015, with no problems whatsoever. I previously used another tax online program that ripped me off, but TAX ACT is legit. This morning I spoke with Jasmine and Julie re concerns I had, and Jasmine had the patience of a Saint, and Julie (tax expert that Jasmine asked if I didn't mind talking to) was outstanding. Don't fall for those other online tax frauds.I highly recommend TAX ACT.

Wonderful site and great price

Every year I use TaxAct to file my free federal taxes. This year I filed having bought a house. The price was really good, the site easily navigable, and I was pleased with the service. Another online tax service charges double and had a glitch in their system for 2014 that cost customers money in their returns. My neighbors used the other well known service and had to call their call center. Three different call center agents gave them three different answers. TaxAct is be far, the best service in self prepared taxes I have yet to encounter.

Tax Act Review: Good for Simple Returns, Price Jump, Limited Support, but Found a Solution

I've been using Tax Act for years to do my own taxes, and it's been a pretty good experience overall. If you know what you're doing and have a relatively simple return, it's a great option. However, I did notice a big price jump in last year's version, which was still cheaper than Turbo Tax, so I didn't mind too much.

Unfortunately, I've already run into some issues with the 2017 version. I found out that I needed the "Freelancer" version because I have to complete a Schedule C, which was a bit annoying. Luckily, they upgraded me for free since I've been a loyal customer for a while. But then I discovered a bug in my state's software, and the only way to get support was through a 40-minute phone call. There's no email support or any other way to report the bug, which is frustrating. I'm not sure if I'll be using Tax Act next year because of this.

Update 1/29/18: I actually found an email address for the marketing department on Sitejabber and sent an email asking them to forward my issue to the tech department. They did forward it, and I got a response a few days later. It turns out that there *isa way to handle my issue, but it's in the *statesection, which I had to enter via a tab that I've never used before. So, it wasn't actually a bug. Maybe if I had gone through the state interview, the software would have addressed the issue. I still think that this should be in the program's "help" file, but I'm increasing my rating from 3 stars to 4.

Effortlessly File Your Taxes with TaxAct - A Reliable and Affordable Online Service

I been using this site to file my tax returns for 6 years and it keeps getting easier and easier to use. Granted my taxes are pretty simple to begin with, but with TaxAct, I am able to reliably file both my federal and state taxes in under 30 minutes for just $18. There are no hidden charges and the interface is super easy to use.

Among the features I really like:

- automatic importing of information from your previous return, which basically fills out 90% of the return for you

- system of automated checks, flags, and alerts to catch any possible errors

- comparison of this year's returns with previous year's returns

- ability to print or save your forms via PDF

- ability to immediately file forms and pay taxes electronically

One thing to watch out for -- TaxAct partners with third parties to offer certain services, such as paying your taxes via credit card. If you choose to use those services, there are usually steep transaction costs which are not disclosed by either TaxAct or the partner. I find this borderline unethical, but believe it to be more the responsibility of the third party.

Overall, I've been very happy with TaxAct and will continue to use them in the future. I've actually seen the interface and features get better every year, and I would recommend it to anyone looking for a convenient affordable online service to file their taxes.

TaxACT Review: Rollercoaster Ride of Efficiency and Declining Quality

I've been using TaxACT for more than a decade now, and I have to say that my experience with them has been a bit of a rollercoaster ride. When I first started using their services, I was blown away by their efficiency and customer service. However, over the years, I've noticed a significant decline in the quality of their services.

One of the biggest issues I've faced with TaxACT is their customer service. It used to be that you could easily get in touch with someone over the phone or email, but now it seems like you have to jump through hoops just to get a response. I've been on hold for hours, disconnected multiple times, and even had my emails go unanswered for days.

Another issue I've faced is glitches within their program. I've come across several glitches that I can clearly show exist, but TaxACT refuses to address them. Additionally, their assistance with individual state tax returns, particularly Utah, is not complete enough. I've had to do manual entries, and the information is not carried over for me.

One particular glitch that really frustrated me was with their social security benefit non-refundable credit. I spoke with someone on the phone who was curious why it seemed to work for another state, but TaxACT refused to acknowledge the issue. I also had an issue with a debit for my state tax, but then I received an email from TaxACT stating that I was going to mail in a check. I thought I had made a mistake, so I went ahead and mailed a check, but then I also had a debit taken out by the state. When I filed an email to TaxACT, it took them six days to respond, and all they did was tell me that their email was no longer valid instead of addressing the issue.

Despite these issues, I do appreciate that I'm comfortable with the program. However, I'm starting to wonder how long I can continue to use TaxACT if their customer service and program glitches continue to be a problem. Overall, I would rate TaxACT a two out of five stars.

TaxAct Review: Increasing Fees and Lack of Transparency Drove Me to a Free Tax Filing Service

I've been using TaxAct for a few years now and overall, it's been a decent experience. However, there have been a few hiccups along the way. One year, the IRS received payment but TaxAct failed to file my return. Luckily, I wasn't penalized since the IRS already had the money.

Another issue I've had with TaxAct is that my once-free Federal return is no longer free because I'm self-employed and filing a 1040 with Schedule C. In the beginning, the Federal return was free and I only paid for my state tax return. However, in 2015, I was charged for the Federal return as well. It seems that unless you have a simple tax return, it's no longer free. Unfortunately, I didn't find out until after I filled everything out and was charged. I paid it because it was easier to do so and still reasonably priced.

Last year, the price to file as self-employed had doubled, and it would have cost me almost $80 to file my taxes. That was the last straw for me. I decided to search for a free tax filing service and found FreeTaxUSA. It's actually free for Federal taxes and has a reasonable State tax filing fee (like TaxAct used to have!). So, I said goodbye to TaxAct.

Greed is bad, and I found that FreeTaxUSA has a better website and used the information from TaxAct from last year's return to make filing my return even easier. Why pay more when you don't have to? Overall, TaxAct was decent, but the increasing fees and lack of transparency made me switch to a free tax filing service.

TaxAct.com Review: Affordable, User-Friendly, and Secure Tax Preparation Software

I been using TaxAct products since 1999. A couple years ago, after my Windows PC died, I went to an Apple with Mac OS and had to do tax returns online. It was just as easy to navigate between windows and easy to understand along the way as the software products I had downloaded in previous years.

The help pages helped with passages from latest "J. K. Lasser" tax prep guide as well as well written passages from the IRS own tax prep guide. Importing previous tax returns was a simple process that quickly updated current forms.

Costs were just as reasonable as working on Desktop, about $20 for complete 1040+ state and e-file federal form(s) on a Windows Desktop and about $18 to complete federal 1040 + state AND e-file of 1040, all in a secure online account accessible by most updated browsers.

One feature I like is the program's testing of a completed tax return prior to printing/ e-file to ensure no "red flags" will cause the IRS to question accuracy of the forms submitted. Any "red" or "yellow" lights in the testing mode indicate the user needs to make the appropriate adjustments in easy reach back to the forms in doubt.

A subsidiary of Second Story Software, TaxAct.com is affiliated with the IRS "Free File" program which make e-filing federal 1040s a snap. All in all TaxAct.com has been a very good choice for our family and our small business tax returns. I recommend it to anyone who needs to file their taxes.

I hope you and your family are doing well. Stay safe and healthy.

L. Nowak

Boulder, Co.

Disappointed with TaxACT Online: Downgraded and Overcharged!

So, I gotta tell you about my experience with TaxACT Online. I've been using it for like 10 years now, and I always go for the Premium filing option 'cause I got some capital gains and stuff. But this year, they downgraded me to the simpler Plus filing without telling me! And then they charged me $40 instead of the $26.95 I was supposed to get as a repeat customer. I was so mad, I called them up right away and they only lowered it to $35. I mean, come on! So I found this other online filing service that's either free or super cheap with ads. And yeah, you can't transfer your tax data to next year, but who cares? It's not like TaxACT is doing me any favors. So until they get their act together, I'm staying away from TaxACT and you should too.

TaxAct Review: Cheaper Than TurboTax, But Not User-Friendly for Novices

I've always been a fan of doing my taxes by hand, but as technology advanced, I decided to give tax software a try. I started with Turbo Tax, but it didn't find me that elusive deduction I was hoping for. However, I enjoyed using it because it asked me an endless amount of questions and everything was well-organized. This year, I decided to try TaxAct, which is much cheaper than TurboTax. I found a site that reviewed tax software and ranked TaxAct a close second to Turbo Tax.

Using my Staples gift card that I won from QuiBids (too much information, I know), I bought TaxAct Deluxe Federal and State. The store had a more expensive version, but I thought it was "Premium." Looking at their website, I see they offer FREE, Deluxe, and Small Business. This was my first problem with the software. Should I spend the extra $10 or not? According to the box, I shouldn't. So, I didn't.

However, the darn thing kept asking me if I wanted to upgrade. Every time I clicked on more info or help, I got the cheesy nag screen demanding more money for the information that should be included. To do my taxes, I had to search the IRS website for the answers and enter the information into TaxAct. I needed to search for a form, but couldn't find it. It was a common form, so I had to go form by form through the included forms to find it. Apparently, TaxAct doesn't use the form number as a searchable key.

I also found it a little confusing to get back to where you were when you leave the interview session to jump to another location or when you exit the program and re-enter without selecting "Start Where You Left Off" (say if you wanted to make changes first).

Despite these issues, the interface was nice and filing was pretty straightforward. I recommend the software for someone who knows a lot about taxes. For novices like me (if there are any), I would pass.

Disappointed with TaxAct's Customer Service and Bait-n-Switch Refer-A-Friend Program

I've been using TaxAct for over 6 years now and I've always had good experiences until this year. Unfortunately, I've encountered two problems that have yet to be resolved. The first issue is more of an IRS problem where I had to file an amended return, but the IRS has yet to acknowledge it. As a result, what they think I owe is very different from what I actually owe. However, TaxAct's "expert" Audit Protection Service didn't even understand the IRS rules around one of the line items. I had to educate them on the topic by pointing them to an IRS publication! We crafted a letter to the IRS for follow-up, but I'm not sure when it will be acknowledged.

The second issue is a true bait-n-switch on their Refer-A-Friend program. The terms that are currently stated on their website are very clear: "A 'new' TaxAct customer refers to anyone who did not file with TaxAct in the previous tax year." With that being said, the PREVIOUS year refers to 2019. I referred my son this year to file his 2020 taxes. He did file with TaxAct in 2018 and previous years but filed them himself in 2019. After following up with TaxAct since they never sent the referral bonus, I received an email from Amanda in their Support Department. She said, "Unfortunately, the referral reward was declined as it was determined the referred friend has already been a TaxAct customer in 2018, 2017, and prior years. The purpose of the Refer-A-Friend program is to recruit new customers who have never heard of TaxAct or who have never used our services, that includes last year, but not limited to the year prior. I will put in a request to review the language used on our help pages to indicate a more accurate description of eligibility for the new customers recruited with the Refer-A-Friend program." Regardless of what they think is the Refer-A-Friend "purpose," the terms that are CURRENTLY stated on their website are very clear and should be honored. Amanda chose not to honor them and ignored further follow-up attempts; classic bait-switch.

Overall, I am disappointed with TaxAct's lack of customer service and their failure to honor their own terms and conditions. As a result, I am definitely done with TaxAct.

TaxACT Review: Frustrating Alerts and Inaccessible Tax Experts Make It a Less Than Ideal Option for Tax Preparation

TaxACT is a tax preparation website that has been around for a while now. It has its pros and cons, but one of the most frustrating things about it is the unnecessary alerts that it repeatedly gives. For example, if you enter "VARIOUS" in the date acquired field for funds acquired through several different purchases, TaxACT will give you an alert for 1099-B forms, even though this is stated on the IRS instructions. Another issue is that if your 1099-R form is blank for the (Illinois) State Distribution, the alert that TaxACT gives you is unhelpful and fails to notify you that you only need to enter your Gross Distribution amount to correct the input.

One of the most frustrating things about TaxACT is that it seems almost impossible to talk to any of their promised tax experts. When you call their contact support number, you get a recorded menu of numbers to press, but even when you select the option to talk to a human tax expert, you are told that their experts are currently assisting other callers and to try back later. This is extremely frustrating, especially when you have a pressing tax issue that needs to be resolved.

Their so-called Help Center is also not very helpful. It only gives several irrelevant links without any human expert help around. It is much worse than a Google search. It seems like TaxACT does not care about all the hours that their customers cannot reach any of their experts on their inaccessible Xpert Assist. It is not worth using TaxACT unless they make substantial improvements and start proving the assistance they promised with their all-inclusive $133.95 bundle.

Overall, TaxACT has its pros and cons, but the frustrating alerts and lack of access to their promised tax experts make it a less than ideal option for tax preparation. If you are looking for a reliable and accessible tax preparation website, it may be best to look elsewhere.

TaxACT's $100k Accuracy Guarantee Falls Short: My Experience with Filing Taxes

I recently used TaxACT to file my taxes and was disappointed with the outcome. While their website boasts a $100k Accuracy Guarantee, I found that they did not uphold this promise when I encountered an issue with my return.

Initially, the TaxACT software calculated that I was entitled to a refund of $3600. However, when the IRS processed my return, they determined that I was only eligible for a refund of $2400. Confused and frustrated, I contacted the IRS to find out why there was such a discrepancy. They informed me that it had to do with the stimulus checks, which I had not received in full. However, TaxACT's software had indicated that I was eligible for the full amount.

I reached out to TaxACT to request that they honor their $100k Accuracy Guarantee, but they refused to do so. Despite providing them with all the necessary information to prove that I had inputted the correct information, they denied my claim. Their response was that the program had calculated my return correctly based on my entries, and therefore the Accuracy Guarantee Claim was denied.

After several back-and-forth emails, I received a response from TaxACT that acknowledged that the IRS had adjusted my recovery rebate credit. However, they still refused to accept responsibility for the mistake and did not offer any compensation for the error.

As someone who has used TaxACT for years, I was extremely disappointed with their lack of accountability and unwillingness to honor their guarantee. While I appreciate the convenience of their software, I will not be using them again in the future.

TaxAct Complaints 45

TaxAct for 2022 is the MOST FRUSTRATING AND UNHELPFUL version that I've used for over 15 years

It repeatedly gives many unnecessary Alerts, such as for 1099-B forms when you correctly enter VARIOUS in the date acquired field for funds acquired through several different purchases as is stated on the IRS INSTRUCTIONS. If your 1099-R form is blank for the (Illinois) State Distribution, the unhelpful Alert FAILS to notify you that you only need to enter your Gross Distribution amount to correct the input. Most frustrating is that now it seems to be almost IMPOSSIBLE TO TALK TO ANY OF THEIR PROMISED TAX EXPERTS: telephoning their Contact Support at ***600 gives a recorded Menu of number to press (I pressed 2 for assistance with filing the 2022 taxes, and then another 2 for their next selection, never getting a number for talking with a human tax expert), invariably, even with any other number selections, each time ending with the repeated statement that I should talk to someone on their Xpert Assist. BUT SELECTING IT ON THE TaxAct computer display screen repeatedly gives a popup that states: Our experts are currently assisting other callers (in bold fonts)... Please try back later, or on our next business day. You can visit the Help Center in the top-right corner for further assistance,...

And below this displaying their regular hours, a Try Again Latter button, and a Go to Help Center button.

Pushing the Try Again button puts you into a ridiculous infinite loop that I wasted several hours in without any possibility that that TaxAct would care enough about their paying customers to even ask me if they could at least put me on a call back list and CALL ME BACK LATER, INSTEAD OF FORCING ME TO STAY IN A REPEATED LOOP FOR MANY HOURS, DAYS, AND WEEKS! Their so-called Help Center is much WOST than a Google search, only giving a several irrelevant links without any human experts help around. Does TaxAct even care about all the hours that their customers cannot reach ANY OF THEIR EXPERTS ON THEIR INACCESSIBLE XPERT ASSIST? DO NOT USE TAXACT UNLESS THEY MAKE SUBSTANTIAL IMPROVEMENTS AND START PROVING THE ASSISTANCE THEY PROMISED WITH THIER ALL-INCLUSIVE $133.95 bundle.

Did not uphold their guarantee

From TAXACT "$100k Accuracy Guarantee: If you pay an IRS or state penalty or interest because of a TaxAct calculation error, we'll pay you the difference in the refund or liability up to $100,000. This guarantee applies only to errors contained in our consumer prepared tax return software; it doesn't apply to errors the customer makes. Find out more about our $100k Accuracy Guarantee."

When I filed my taxes they ran it through all the checks and information, it said I was getting back $3600 and all the information I put in was accurate. The IRS said that I was not entitled to that amount that I was only getting back $2400. I contacted the IRS to find out why and they said it had something to do with the stimulus checks, I argued that I had not received all of them, they stated that I wasn't eligible, however TaxAct's software said I was. When I contacted TaxAct they would not uphold their guarantee, I provided all the information that was proof that I inputted the correct information and the proof that the IRS was saying I was ineligible for that amount. After a lot of back and forth this is the response I got, "Because the TaxAct program calculated your return correctly based on your entries, the Accuracy Guarantee Claim is denied."

"Dear TaxAct? Customer,

We have reviewed the notice you received from the IRS in conjunction with the information we can see in your electronically filed 2020 return. According to the notice, the IRS is adjusting your recovery rebate credit. They provided a list of reasons the credit was reduced.

Some of the items we can verify are correct based on your entries, such as your adjusted gross income being within the income threshold, the ages of your dependents and the actual calculation of the credit itself. We do find that when you originally filed your return, you reported that you received the 1st stimulus payment in the amount of $1,200 and the 2nd, anticipated, in the amount of $1,200. Our records indicate that you are qualify for the recovery rebate credit in the amount of $3,600."

So you can see some of the emails that I sent back and forth with them, I included the notice from the IRS but they still would not accept that it was their software that made the mistake. I've used TaxAct for years but this is the last time. I won't use them again!

Disappointed with Tax ACT. COM's Paid Service - Lack of Support and Service Promised

Tax ACT. COM - I have been using taxact.com to start my tax returns for a few years now. I first used their free service back in 2006 and then decided to pay extra in 2007 to have the ability to recall and import my 2007 tax information. However, this year, for my 2008 taxes, I have been having trouble accessing my account. I have been filing assistance requests and following the information provided while on the phone with tech support, but I still cannot access the information or availability that I paid for back in January 2008.

I have been trying to get a response from the owners of the site, Tax act. Com, for the past two weeks, but have not received any response. I am very disappointed with the lack of support and service promised after they received my money. I would advise others to use the free service, but not the paid service, as it seems that the company is not providing the support and service promised. It is very frustrating to pay for a service and not receive the promised benefits.

Overall, I believe that the company is good with their free service, but they seem to be setting consumers up for fraudulent guarantees in order to receive a higher payment. As a consumer, I feel cheated and disappointed with the lack of support and service provided by Tax ACT. COM. I hope that they will improve their services in the future and provide better support for their paying customers.

Is TaxAct Legit?

TaxAct earns a trustworthiness rating of 91%

Highly recommended, but caution will not hurt.

We found clear and detailed contact information for TaxAct. The company provides a physical address, 4 phone numbers, and 2 emails, as well as 5 social media accounts. This demonstrates a commitment to customer service and transparency, which is a positive sign for building trust with customers.

TaxAct has received 9 positive reviews on our site. This is a good sign and indicates a safe and reliable experience for customers who choose to work with the company.

A long registered date for taxact.com can be seen as a positive aspect for TaxAct as it indicates a commitment to maintaining the website and its domain name for a long period of time. It also suggests that the company is organized and has taken steps to secure its online presence.

The age of TaxAct's domain suggests that they have had sufficient time to establish a reputation as a reliable source of information and services. This can provide reassurance to potential customers seeking quality products or services.

Taxact.com has a valid SSL certificate, which indicates that the website is secure and trustworthy. Look for the padlock icon in the browser and the "https" prefix in the URL to confirm that the website is using SSL.

Taxact.com has been deemed safe to visit, as it is protected by a cloud-based cybersecurity solution that uses the Domain Name System (DNS) to help protect networks from online threats.

TaxAct as a website that uses an external review system. While this can provide valuable feedback and insights, it's important to carefully evaluate the source of the reviews and take them with a grain of salt.

We looked up TaxAct and found that the website is receiving a high amount of traffic. This could be a sign of a popular and trustworthy website, but it is still important to exercise caution and verify the legitimacy of the site before sharing any personal or financial information

However ComplaintsBoard has detected that:

- While TaxAct has a high level of trust, our investigation has revealed that the company's complaint resolution process is inadequate and ineffective. As a result, only 0% of 45 complaints are resolved. The support team may have poor customer service skills, lack of training, or not be well-equipped to handle customer complaints.

- We conducted a search on social media and found several negative reviews related to TaxAct. These reviews may indicate issues with the company's products, services, or customer support. It is important to thoroughly research the company and its offerings before making any purchases to avoid any potential risks.

TaxAct Review: Terrible Customer Service and Inconvenient Account Recovery

TaxAct is a tax preparation website that has been around for quite some time now. However, their customer service is something that needs to be improved. I had a terrible experience with them recently. I was told that I would receive a call back from a representative because the wait time was over an hour. I waited for two hours and twenty minutes and never received a call back. This is unacceptable and I will not be using TaxAct for my next year's tax returns.

Furthermore, I had trouble recovering my account from last year because I changed my phone number. Instead of sending a reset or verification code to my email, they sent it to my old number. This is a major inconvenience and it's ridiculous that they don't give you the option to choose which number to send it to. It's such a hassle to deal with and it's frustrating.

I'm sure that the long hold and wait times are because many people are calling about similar issues. It seems like they don't know how to handle the situation, so they refer you to the IRS website. I ended up going to the IRS website myself to save time instead of waiting for an hour or two for a phone call that never came.

Overall, I would not recommend TaxAct to anyone. Their customer service is terrible and they need to improve it if they want to keep their customers. It's a shame because their website is easy to use and navigate, but the customer service ruins the experience.

TaxAct Review: Buggy Software, Useless Customer Support, and Overpriced Forms - Stay Away!

Been using TaxAct for a long time now, and I gotta say, the desktop software used to be pretty good and affordable. But this year, things have gone downhill fast. The company's got new leadership, and it's been a total disaster. I tried to use the software on two different computers, both of which met the requirements (including Internet Explorer 11, which is required for the desktop app), but it just wouldn't work. And don't even get me started on the customer support - it's useless and frustrating.

To make matters worse, the pricing has gone up a lot. They're even charging extra for each form you need ($21 for Sch C, can you believe it?). And when I asked for a receipt or invoice for the eFiling fees I paid, they couldn't even deliver on that simple request. Complete incompetence.

Honestly, unless you want to deal with buggy software that's constantly throwing script errors, I'd avoid TaxAct. I've been a customer for years, but I'm done with them now. And the person responsible for all this mess is Sanjay Baskaran. Blucora Inc needs to fire him ASAP.

Trust me, it doesn't get any worse than this. Stay away from TaxAct if you know what's good for you.

Warning: Beware of TaxACT's Dishonest Practices and Exorbitant Fees

I recently had a negative experience with TaxACT and I strongly advise against using their services. I was charged $54.95 to pay for my $24.95 fee for TaxACT software, which was completely outrageous and dishonest. I have been a loyal user of TaxACT for years and have never experienced anything like this before. If I had known that they were going to charge me such an exorbitant fee, I would have paid the $24.95 out of my own pocket with a credit card.

I contacted TaxACT twice on January 30th, 2022 at approximately 7 p.m. Eastern Standard Time, but neither representative was able to help me. This was within 2 hours of me doing my return, and I was extremely disappointed with the lack of assistance I received. If I had understood the situation clearly, I would have never agreed to pay $54.95 for a $24.95 fee, especially since it was supposed to be taken out of my return.

Overall, my experience with TaxACT was extremely frustrating and disappointing. I work hard for my money, and I do not appreciate being ripped off by companies like TaxACT. I would strongly advise against using their services, and I will no longer be using them myself. Beware of their dishonest practices and do not make the same mistake I did.

TaxAct Review: False Promises and Incomplete Returns - Use TurboTax Instead!

TaxAct is not a good choice for preparing your financial returns. They make false promises to self-employed customers, leading them to believe that they have the necessary tools to handle their financial reporting. However, once you finish your tax return, they inform you that you can't e-file because they don't have the necessary forms to complete the job if you have taken any distributions from a retirement account, and so on.

Imagine spending your valuable time preparing your return, paying the bill, and then realizing that there is nothing you can do with it if you print the return because the necessary tax forms never come in according to their timeline. TaxAct keeps saying they will get the forms any day, but that day never comes!

Weeks later, you are left with an incomplete return that you cannot file because even the printed version requires you to have the appropriate retirement form prepared properly by a tax expert. TaxAct denies you a refund, and you are left in a lurch to pay another tax preparation company to prepare the return.

I would suggest using TurboTax instead. I have had no problems with them. I have learned my lesson, and I am done with TaxAct!

Disappointing Experience with TaxACT's Trust and Estate Product

I really wish I had come across TaxACT before I made my purchase. I needed to file an Initial/Final return for a Grantor Trust and had heard that TaxACT was recommended on some other sites because they have a product specifically titled "Trust and Estate." So, I decided to buy the Download version. However, I must say that the interview process was not very intuitive, and whenever I clicked for Help, I got a very basic sentence or two and a link to the IRS Instructions.

I also had to input a 1099INT that was mostly IRD, and I feel like there should be a related Statement to explain where the "missing" interest is being reported, but I could never find one in the Forms, and the Interview did not ask. To make matters worse, the program shuts down at random, and sometimes it comes back and offers to continue where you left off, but sometimes it doesn't.

And, to top it all off, I woke up this morning and opened the program to find that all the work I had done to that point was gone. I tried a Restore from Backup option, but it said the backup was unreadable. So, I'll be doing the return all over again, but not with this POS.

I have decided to order TurboTax Business today instead. I hope it will be a better experience than what I had with TaxACT.

TaxACT Review: Unreliable Filing Options and Lack of Support

I recently used TaxACT to prepare my federal and state tax returns. However, I was disappointed to find out that my returns were not eligible for e-filing. This was a first for me, and I was unsure of what to do next. I decided to print and mail my federal tax return before the April filing deadline, which was a bit of a hassle. Unfortunately, when I went to print my state tax return, I was met with a notice that the forms for filing were not yet available to print. This was frustrating, as I had prepared my return with plenty of time to file and had already paid for my state taxes to be prepared.

To make matters worse, it is now May 19th, which is four days after the tax filing deadline for my state. I have been checking my online account regularly, but the forms are still not available. This means that I cannot file my state tax return yet, which could result in negative tax consequences for me. I have tried to get in touch with TaxACT to fix this issue, but to no avail. There is no email or chat support available after 5 pm local time, which is not very helpful.

As a tax lawyer, I am well aware of the importance of timely and accurate tax filings. I have been using TaxACT for close to ten years, but I think this will be the last time. I hate it when tax preparers pull this kind of crap, and I have seen it happen before. However, this is the first time that this particular service has done this to me. I paid for a service that I have not received, and this is unacceptable.

Overall, I would not recommend TaxACT to anyone who wants a reliable and efficient tax preparation service. The lack of support and the issues with filing deadlines are major red flags. If you want to avoid any potential tax consequences, I suggest looking for a different service that can provide better support and more reliable filing options.

TaxAct Online Review: Misleading and Inadequate Services, Costly Mistakes, and Poor Customer Support

On March 15, 2020, I finally finished filling out my small business return on TaxAct Online for Federal and North Carolina Returns. They charged me a whopping $159.90 for their services. I followed their step-by-step directions and answered their questions, but unfortunately, they totally misled me to fill out the wrong forms. I thought everything was complete and correct because I paid them to do this, but Federal rejected my return, and state rejected my return because Federal did.

TaxAct does not have the proper forms, and they did not provide me with the correct help. Now, I have to manually fill out the correct forms to mail in to amend my return. The proper form I was supposed to use was 1120S, which TaxAct never provided or could be found when I tried to amend my return using TaxAct.

I sent an email to customer support on March 15, 2020, but they never replied back. I also called on March 16, 2020, at 7:30 pm, and the customer service rep could not help me. She had to transfer me to technical support, but I was then put on hold for another 15 minutes!

Finally, they called me back and said that they are providing me with a full refund. I won't know for sure until another 10 days when it is processed. It was a frustrating experience, and I hope they improve their services in the future.

TaxACT Review: Great Software, Terrible Bank - Republic Bank & Trust

I have been using TaxACT for several years now and I have never had any issues with the software. The fees are minimal and I have never had any problems paying them. However, this year was a different story. It wasn't TaxACT that caused the problem, it was Republic Bank & Trust, the company that handles TaxACT's direct deposits.

To start with, they messed up my direct deposit and then they mailed my check to the wrong address. I had to wait for 6 business days while I had to stop payment on the check. After that, they tried to direct deposit my check again into a different account which was wrong. Now, my check is lost in the mail and it has been 22 days and I still haven't received my refund.

When I called Republic Bank and Trust, their phone system gave me the run-around for so long that I got fed up and wanted to hang up. However, I had to hang in there and wait for someone to answer. When I finally got someone on the phone, they were rude and unwilling to help. They even tried to blame all of the problems with the bad deposits and lost check on me when it was clearly their fault. They mailed it to an address that I haven't had in 20 years.

I have decided not to use TaxACT again simply because they use Republic Bank and Trust. Instead, I will be using TurboTax next year. While TaxACT's software did a good job, Republic Bank & Trust is the one that really screwed me over. I still haven't received my refund and it's been 23 days now. It's frustrating to deal with a company that doesn't take responsibility for their mistakes and treats their customers poorly.

TaxAct Review: Issues with State Filing and Printed Forms

I've been using TaxAct for a few years now and it's been pretty smooth sailing, until I tried to file my 2016 income tax return. I needed to claim a deduction that wasn't very common, so I had to write something on the top of Schedule C. This wasn't a big deal, but it did mean that I had to print off the forms instead of e-filing them. Unfortunately, this caused some issues when it came to filing my NY State tax return.

TaxAct kept telling me that I had to e-file my NY return, but I couldn't do that because I was manually filing my Federal return. It was a bit frustrating, but I figured I could just print off the NY return and mail it in. So, I paid an extra $25 to print the forms, but when I got them, they had "DO NOT FILE" written all over them. Apparently, the printed forms hadn't been approved by the NY Taxation Department, so I couldn't use them. This also meant that I couldn't e-file my NJ tax return.

It would be really helpful if TaxAct had a feature that allowed you to add words to the top of Schedule C, and if they allowed you to e-file State returns even if you're manually filing your Federal return. It was a huge hassle to have to find printed forms online, fill them out, and then mail them in. I definitely won't be using TaxAct again in the future. I had already pre-paid for the 2016 year, so it was a waste of money to pay an extra $25 for something that was useless.

Tax prep

just noticed tax act didn't add my eligible child tax credit of $2,000.00 to my return. After noticing this I went over my past tax statements and realized it hadn't been applied to last years taxes ether. This is $4,000.00 would really be useful to a single parent barely making ends meet as I am. I tried to contact Tax Act but found that there is no customer service. Despite all this they still seemed justify in charging me $160.00 for their incompatance.

Desired outcome: I would like my $4,000.00 now and I'll never use this program again!!!

Sign in difficulty now in affect.

I tried to get into my taxact acct from 2021 and it sent me a verification email, but when I tried to use the number it wouldn't let me. I spoke with the chat person and was told that is I didn't have a cell phone I couldn't use taxact. It upset me since ive been using taxact for a few years now, and I wondered what happened to my acct previouse info, which I no longer can access. I have a cell phone only for emergencies, not a smart phone. It seems sad that I now have to find another tax company and start all over again when tax act has my info on hand. I'm not sure why you are no longer able to email me the verification number, but I don't want anyone else to be able to get at my old info as I am very paranoid about it. It's your loss but it makes no sense to me..!

Desired outcome: I would have liked to use tax act again this year, but now I just want to know my infomation is safe from prying eyes, and hackers. I will use another tax filing apt with the hope it won't assume everyon is living by cell phone.

Take the money charges off my credit card, $114.95. Refund my credit card.

02/21/2023 I tried to file taxes with the tax act for my grandson and his wife. It showed a payment due of $114.95. I paid it with my credit card and a few minutes later I cancelled the order for the taxes because they weren't happy with the service from the tax act. I cancelled the e-file and cancelled the order. On 02/22/2023 tax act charged my credit card after the fact that I cancelled the e-file of the taxes and cancelled the order for their services. I tried to call their phone numbers they have several times to talk to someone but all I receive are voicemail recordings and can't talk to anyone. The voicemail recording doesn't have anything to do with why you are calling regarding the fragility of charging my credit card after I had cancelled everything the day before. I will be contacting the federal fraud bureau and the attorney general's office to report this. They are running a scam, stealing people's money after cancellations of their services. My bank has been notified of this fraud transaction and a claim has also been filed with them. They can't seem to get a response either.

Desired outcome: I WOULD APPRECIATE IT VERY MUCH IF THEY WOULD RESPOND TO ME, BUT CAN'T TALK WITH ANYONE FOR A RESPONSE.

No customer service assistance

Attempted to log in again since did taxes last year and previous, but couldn't had open again and said that SSI and email already registered but wouldn't let me access my previous account now cant get to finish because don't have ip pin and don't have copy of last yrs forms due to fire now cant do anything because of these [censored] that won't answer phone or assist anyone

Desired outcome: Want my ip pin

Tax return error

On April 11, 2022 I filed my taxes with TaxAct and I’m going to say I was at first impressed with your software and was pleased with my refund amount until I got not even 25% of my return from the IRS, and I wasn’t sure what happened and have looked back at my tax return today and just found that my son was not added as a dependent, when I put all of his information in there and expected it to be done. This financially set me back to even care for my family. The amount I was supposed to receive from my taxes $8,928. My actual refund was

$1,638.05. MAJOR DIFFERENCE. I have added screen shots of my tax return as well as the direct deposit from the treasury.

Whoever made this mistake had put my son where it wasn’t supposed to even be stating he wasn’t my dependent when HE WAS.

Desired outcome: I would like this resolved, and I want it done immediately, which means I want my money!And I want a refund I paid to use your service at the amount of $133.95

Paid my taxes online with a credit card

Received a letter from the IRS that my taxes were unpaid and unfiled. TaxAct is fraudulent I've paid taxes twice now. I don't make very much money. This is a horrible rip-off. I paid once with a credit card and then with PayPal and there is no one to contact at this rip-off, fraudulent organization that has now put me in hot water with the IRS. I'm getting letters from the IRS that I did not pay my taxes.

Deluxe 1040 for tax year 2021

The tax "experts" don't seem to really know the software or the tax code very well. The software just seems to be buggy, and I don't trust it for my taxes, which are a little complicated.

First, I spoke to one tax expert for about 45 minutes about why my total childcare expenses did not qualify for the credit, and he was able to finally help me qualify all of my expenses by applying all of my expenses to the right child (I only have one). However, even though my total tax credit increased by about $70, the federal tax I owe stayed the same. He wasn't able to explain why.

Next, I talked to a second expert Eulee for about 25 minutes about this question, and she gave me non-sensical answers like "you haven't paid any taxes yet, that's why the tax you owe remains the same." When I asked her how my taxes was calculated with the Qualified Dividends and Capital Gain Tax Worksheet, she says that I can only see that once I file, so there is no way to check the forms to understand their calculations before filing.

Lastly, I started using the Free File product and then upgraded to the Deluxe 1040. When I did so, I also found a coupon for it. The coupon was applied to a completely new and empty tax return instead of the one I've worked hours on for the last two weeks. When I called to ask for the coupon to be applied to my original tax return, the support person said it will be applied in 30 minutes to my original tax return. The coupon was not applied as she said it would be.

I tried out TaxAct for the first time this year, but I don't trust their software to help me do my taxes correctly. I also don't find their tax experts very helpful or knowledgable. As much as I don't want to, I am going back to Turbotax.

Desired outcome: I wish TaxAct could give me back the countless hours I've spent already filing my taxes.

tax filing

I am on social security with some interest paid on a couple CD's so I figured i would use the free version to file, but when I got to the end they made me pay for the deluxe version. I did not have any tax due or returned on either my federal or state, so why couldn't it be done for free? They always advertise for free filing, but you always end up paying.

Desired outcome: Please refund

About TaxAct

One of the key benefits of TaxACT is its user-friendly interface, which makes it easy for even novice users to navigate and complete their tax returns. The software guides users through each step of the tax preparation process, providing helpful tips and explanations along the way. Additionally, TaxACT offers a variety of tax calculators and planning tools to help users optimize their tax savings and minimize their tax liability.

Another advantage of TaxACT is its affordability. The software offers a range of pricing options, including a free version for simple tax returns, as well as paid versions for more complex tax situations. This makes TaxACT an ideal choice for individuals and businesses of all sizes and budgets.

In addition to its tax preparation software, TaxACT also offers a variety of other tax-related services, including tax planning and consulting, audit support, and tax resolution services. These services can be particularly helpful for individuals and businesses facing complex tax issues or dealing with IRS audits or collections.

Overall, TaxACT is a reliable and comprehensive tax preparation solution that offers a range of tools and features to help users file their taxes quickly and accurately. With its user-friendly interface, affordable pricing, and helpful tax planning resources, TaxACT is a great choice for anyone looking to simplify their tax preparation process.

Here is a comprehensive guide on how to file a complaint against TaxAct on ComplaintsBoard.com:

1. Log in or create an account:

- Start by logging into your ComplaintsBoard.com account. If you don't have an account, create one.

2. Navigating to the complaint form:

- Locate and click on the 'File a Complaint' button on the ComplaintsBoard.com website. You can find this button at the top right corner of the website.

3. Writing the title:

- Summarize the main issue with TaxAct in the 'Complaint Title'.

4. Detailing the experience:

- Provide detailed information about your experience with TaxAct.

- Mention key areas of concern.

- Include any relevant information about transactions with the company.

- Explain the nature of the issue.

- Describe steps taken to resolve the problem and the company's response.

- Share the personal impact of the issue.

5. Attaching supporting documents:

- Attach any additional supporting documents that can strengthen your complaint. Avoid including sensitive personal data.

6. Filling optional fields:

- Use the 'Claimed Loss' field to state any financial losses.

- Utilize the 'Desired Outcome' field to specify the resolution you are seeking.

7. Review before submission:

- Review your complaint for clarity, accuracy, and completeness before submitting.

8. Submission process:

- Submit your complaint by clicking the 'Submit' button.

9. Post-Submission Actions:

- Regularly check for responses or updates related to your complaint on ComplaintsBoard.com.

Ensure each step is clearly defined to guide you effectively through the process of filing a complaint against TaxAct on ComplaintsBoard.com. Remember to focus on issues related to TaxAct's business category.

Overview of TaxAct complaint handling

-

TaxAct Contacts

-

TaxAct phone numbers+1 (319) 373-3600+1 (319) 373-3600Click up if you have successfully reached TaxAct by calling +1 (319) 373-3600 phone number 0 0 users reported that they have successfully reached TaxAct by calling +1 (319) 373-3600 phone number Click down if you have unsuccessfully reached TaxAct by calling +1 (319) 373-3600 phone number 0 0 users reported that they have UNsuccessfully reached TaxAct by calling +1 (319) 373-3600 phone numberCustomer Service+1 (319) 731-2682+1 (319) 731-2682Click up if you have successfully reached TaxAct by calling +1 (319) 731-2682 phone number 0 0 users reported that they have successfully reached TaxAct by calling +1 (319) 731-2682 phone number Click down if you have unsuccessfully reached TaxAct by calling +1 (319) 731-2682 phone number 0 0 users reported that they have UNsuccessfully reached TaxAct by calling +1 (319) 731-2682 phone numberProfessional Customer Service+1 (319) 731-2680+1 (319) 731-2680Click up if you have successfully reached TaxAct by calling +1 (319) 731-2680 phone number 0 0 users reported that they have successfully reached TaxAct by calling +1 (319) 731-2680 phone number Click down if you have unsuccessfully reached TaxAct by calling +1 (319) 731-2680 phone number 0 0 users reported that they have UNsuccessfully reached TaxAct by calling +1 (319) 731-2680 phone numberProfessional Tax Help+1 (319) 536-3571+1 (319) 536-3571Click up if you have successfully reached TaxAct by calling +1 (319) 536-3571 phone number 0 0 users reported that they have successfully reached TaxAct by calling +1 (319) 536-3571 phone number Click down if you have unsuccessfully reached TaxAct by calling +1 (319) 536-3571 phone number 0 0 users reported that they have UNsuccessfully reached TaxAct by calling +1 (319) 536-3571 phone numberSales

-

TaxAct emailsassistance@taxact.com100%Confidence score: 100%Supportmelanie.milton@taxact.com94%Confidence score: 94%Operationselvis.bernauer@taxact.com94%Confidence score: 94%Operationssarah.crouch@taxact.com93%Confidence score: 93%Operationsgreg.detweiler@taxact.com93%Confidence score: 93%Operationsstephanie.blood@taxact.com92%Confidence score: 92%eric.ballew@taxact.com92%Confidence score: 92%Operationsprosales@taxact.com91%Confidence score: 91%Communicationpr@taxact.com91%Confidence score: 91%Communicationsupport@taxact.com85%Confidence score: 85%support

-

TaxAct address1425 60th St NE, Cedar Rapids, Iowa, 52402-1284, United States

-

TaxAct social media

-

Checked and verified by Nick This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreMay 24, 2024

Checked and verified by Nick This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreMay 24, 2024

Recent comments about TaxAct company

Free Tax Act onlineOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.

We have received your comment. Thank you!