Bank of America’s earns a 4.0-star rating from 4575 reviews, showing that the majority of banking clients are very satisfied with financial services.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

Claims

On 6/6/22 I file a slip and fall complaint with Snellville GA Bank of of America complain assign 7/14/22 c236801357-0001-01 sedgwich claims [protected] fax [protected] I am disputing decision made without knowing where I fell until after he made a decision and after asking for doctors who I contacted than a week later it's could be the reason for fall he didn't find a course of what thew me down in parking lot part of grass before decided my claim.

Desired outcome: be honesty of fake grass and find a new person to reinspect of fall and give results of complaint and pay for fall claim and medicaid back for doctor visit and physical therapy for fall related for pain .

still haven talk to no one been with bank of America scence 1993 no good customer service when needed.all the over drawn charges, not responding to my complaint not their for their customer i fell no concerns use my medical reason and i dont have falling prombles until crossing fake grass were down 6/6/23 2/27/23 i were at main st bank of america bank its brown straw down but not responding that were the cause of me falling not holding their resonsiabilitys with their customers i had to have phsical thearpy pain treatment from my fall no concerns just not respodning is un profesional of bank of america bank not for customers. u just told on yourself by covering up the fake grass cause my fall addmittied what make u professional.

My claim has been denied

This is about my Prepaid debit card from b of A now i got arrested in aug of 2021 and didn't get out until dec 2022. anyways when i got out i received my mail. Well anyways i got a card from bank of America so i went online cause i didn't have a phone seeing i just had gotten out. So i went and logged in my account and there were transactions from aug 21 too sep 21 in the amount of 3450 dollars. So i emailed bank of America and explained my situation. then i got a email back telling me i would have to call the claims department because they couldn't help me by emailing me. So, i went ahead and called em and they filed my claim. I didn't think of anything else i would have to do. so a week passes and i call to check the status and the lady told me to fa my id and a paper stating i was in jail. sent them the very next hour. soo after a day i call and they received my fax. still pending so i called a couple days later and a gentle men got on the phone and told me its looking good that my claim should be over on feb 13th and from what he can see I'm getting my money back but he just didn't know exactly when but soon he told me, SO then i called a week later just too see and a lady got on and said ohm mam Ur papers were hard too see imma write a note here stating this is your proof of incarceration ok but its still pending call back in a couple more days. On feb 13 the day my claim would of been up i call them, Some lady answers and tells me my money should be on my card by the night time and its closed and she was done with me,, well something jus didn't add up cause every agent asks me my personal information for security purposes and this one just didn't ask me anything besides my card info and my name that was it.. so the next lady gets on n tells me my claim was in fact closed and i got denied i am pissed cause i did everything they told me to do so i can get my money back. So i reopened it ion the 13th and the lady told me to file a police report within 5 days and once they receive it then i would get my money back. so i went and did that and faxed the papers too them and now i got told they received them but it would take another 43 days for them to reconsider my claim like wtf... i sent in papers proving i was in jail during the times of the charges my id and police report like really there Gunna say i let someone use my card and its like really all my [censored] got thrown away when i went in and when i came out my ebt card has been being used cause i went to go apply and they told me my case was active and i had to cancel the one that someone else had of mine and they tried tro ger a loan in my name from speedy cash but failed at that... but IM HOPING TOO GET SOME GOOD NEWS HERE SOON BUT EVER REP I TALKED TOO GAVE ME DIFFERENT answers from being told i was getting it too getting told denied,,,,, get it together people

Desired outcome: still waiting on themanother 43 days too reconsider my claim after they got all the evidence they need too see i was clearly in jail

Checking account

On 1/30/23, I had lost access to my mobile accounts. I kept getting "Account Locked", "No match found. Please create new User ID and Password. Thinking it was a bug with the system I went into BoA to make a deposit, and my debit card wouldn't work. The teller was able to locate my account with my SSN, and I was able to complete my transaction. I asked the teller what came up on their end when I tried to use my card, I was told that their system just couldn't find the account. Nothing else out of the ordinary, even after pulling up my account.

I thought it was strange that my mobile account and my debit cards weren't working, I figured maybe my account had been locked. So I called the customer service to resolve the issue, and was informed that my account was closed. And to quote the CS rep "As of 1/30, Bank of America determined that it no longer want to do business with you". I do understand banking regulations that Banks can drop customers the same way a customer can drop the bank, but it seems incredibly odd this even occurred. My account was in good standings, and it's active, so I don't understand why I was dropped as a customer. It puts me in a bind at the end of the month, because I have deposits to make and bills to pay.

I received no notifications my account had suspicious activity, no one contacted me, I didn't receive any letters that froze my account. As a matter of fact, my email was still getting bombarded with auto loans, mortgages, etc from BoA. The closure was so abrupt, and CS couldn't tell me anything.

I think it's outright shady business dealing by BoA. I've been a customer since 2008, I've had periods where I've maintained a balance on a checking account that was better suited in a savings. I've been a customer for 15 years, and I don't receive any contact on account closure at all. It's unprofessional. I had 0 time to prepare, and look for alternatives. I have payments due the next day and no bank account to make payments out of, I'm scrambling to ask my CC for a few extra days while I resolve my banking situation.

I'm not upset at the closure, it's whatever. I understand it can happen. It's the abruptness and randomness, the fact that it happened out of the blue doesn't sit right with me. Just a little bit of prodding around on Google, I discovered I wasn't the only one.

SSN#/SignatureTRUSTACCOUNT

I had a $200 overdraft some how Bank America let someone come in my account withdraw $1,400 no matter how much I disputed the charge. They paid it anyway, yet quarterly they owe EVERY member 250K minimum that the draw from their TRUST ACCOUNT which is your SS# and signature. They NEVER gave me probably you either your unearned interest. No bank can close account without our permission check into it…

Desired outcome: My account back open with a zero $0.00 balance and all my unearned interest they kept.

They more they ignore me.. the more people I will inform of their rights the banks and government don’t want citizens to know. Bank America you see what pride get you exposed.

Unfraudulent charges repayment denied

I was a Bank of America customer. I woke up one morning and checked my checking account on line, only to find that there was a 50.00 debit from my account. I contacted Bank of America and put in a claim with their Account Resolutions Department. The ARD checked the charge and told me that it was a debit that was done on my account using my debit card at an ATM machine. They provided the address of where the debit had taken place and when I looked the address up, it was the address of a Thorton's gas station not far from my home. I then remembered that I had went to that same gas station the day before and purchased some gas and chips for my children and when the cashier prompted me to put in my pin number to complete the purchase, I did. After I thought about it, I called the ARD back and explained to them that I was not the person that used my debit card at that ATM. I explained that I was at home in by bed the previous night and there was no way that I could have used my card to make a debit at that ATM. I did go to purchase chips and gas however I did not complete an ATM debit. The ARD went on to explain to me that they could process the claim and refund me the money until the investigation was complete. I was told that if the investigation turns out that it was not me that made the charge that the money that was credited to my account would remain, however if the claim was investigated and they find that there was no fraudulent activity that the money that was deposited by the bank would then be reversed and taken back out of the account. I was also advised to cancel my card in which I did, and I went to the local BOA branch and received a temp card until my replacement card came in the mail. I was okay with that, until two days later it happened again, only this time for 200.00. I immediately contacted the bank to advise them of what had transpired for the second time. I was told basically told that I would have to go through the same process as I did for previous claim, and so once again I followed their instruction. In fact, the ARD sent me a claim form to fill out and sign in which outlined the same thing that the phone rep in the ARD had already explained to me. Days passed and I received a letter in the mail about two weeks after both incidents and the letter stated that the credit in which they had placed in my account would be reversed as they had researched my claim and found that the person that debited my account must have used my pin number to do so. I begged the representative to understand that I had never shared my debit card pin with anyone and I begged them to look at surveillance camera's at the location and they would see that it was not me. I begged them to please understand someone stole my money and I do not know how they did it because I had my card in my possession the whole time. Another claim was entered but this time the money was reversed and nothing else was done about my claim. About a year later I was watching the "I Witness News Team" on channel 7 and they were covering a segment on scanners that placed are strategically placed over key pads and are used to memorize pin numbers and steal money from people's account through scanning their cards and pins. I learned that people had been using scanners underneath the key pads located at different places and apparently Thorton's gas station in Round Lake, Illinois happened to be one of those locations. In short, after all of that turmoil, the ending result was I closed my account due to the fact that the balance had went into negative status and Bank of America placed some sort of hold on my account that I am unable to open an account at any other banking institution. I feel upset due to the fact that I trusted this bank, I am not a rich woman, I live from paycheck to paycheck and my banking institution allowed someone to rob me and get away with it.

Desired outcome: I would like for Bank of America to remove the flag in which they have placed on my name and Social Security number, so that I am able to open accounts with other banking institutions as I desire to do so.

I should be protected as a customer

As per an article I read online concerning the amount of fraud and scam claims that have been occurring at the number 2 bank in the Nation, Bank of America, I searched for an answer on why BOA will not reimburse customers on a scam, only a fraud. BOA states the reason is, "when involved in a scam, the customer is the one that removes the money, not the criminal." While this is true, the criminal is able to steal all personal information about BOA customers via their website including Social Security numbers, bank account information including all of customers telephone numbers, address, marital status. The customer did not give this information to the criminal, they were able to infiltrate the banks site to obtain all of this. Why as a customer of BOA for 48 years should I not expect some security from the bank. I realize that these criminals are often not even in this country, but why should I lose all this money. I was involved in a scam with a alert on my PC from BOA stating that he was a Federal Employee, and he needed to let me know that my bank accounts have been compromised and that I needed to protect myself and it goes on. Why is it not BOA responsibility to reimburse me? Yes, I removed it and the only reason why is I fell for it, they are very good at what they do. I would not have done that if these criminals weren't able to get my information from my BOA account? I am 68 years old, recently lost my husband to leukemia and now I am trying to help my son and his family financially because their 5 year old little boy was just diagnosed with leukemia. I am not able to make this up! Who makes these decisions to throw out this case? Is it a team that goes over each scam and just says no because their customer removed the money? I was so frightened, they knew my every move, they knew when I stopped at a store to get a sandwich, they knew where I lived, they even knew that I was a widow and lived alone. I was so scared that I just did what they said, when my family spoke to me and convinced me that this was not BOA, but it was the scammers, we went to the Police station and filed a report, they even knew that I was talking to the police because they texted me while I was there saying, haha, you still lost! I don't know how BOA can make a blanket rule that they will not cover scams as this is a big part of them not being able to protect their customers

Desired outcome: to be reimbursed my $30,000 that was stolen from me

Credit card

After having this credit card for 17 years, I decided to transfer a $10,000 bill to this credit card. The minimum payment was $104 or so dollars, however, I started with a $500 payment in June of 2022. In July I paid $150, more than the minimum due. I paid the August bill early, instead of waiting for the 8th. I paid it on July 29th of $150. Showing I pay my bills on time. I continued with September payment on the 5th for $100.

I must mention, I get my bills the old-fashioned way, by mail on paper so I can keep track of payments.

I did not receive a paper bill for October.

In the beginning of November, I received a bill for over $350 stating that I was overdue the last three months. I was shocked and confused! I immediately paid that bill and set up for automatic bi-weekly payments, so I didn't have to wait for the mail, or no mail as was the case here.

I figured all was well until I received a letter dated November 11, 2022 stating that Bank of America decided to reduce my credit line due to past delinquent payments! This made my credit score tank from 798 to 578! I attempted to talk with multiple people from Bank of America only to meet with rude angry "customer service" people. One of the final ones said she could change my credit score anytime she wanted and if she wanted to lower it for now reason she could. She then accused me of not paying my bills when they were clearly online bill payments. I told her I had paper statements and she again said that was impossible. I had her on speaker so my husband could help me and hear this as well. I told her I had that statements in front of me and she said impossible and hung up with me. I called equifax a week or so later to dispute the claim and how it ruined my credit. On December 7th, the claim Bank of America made against me was removed and my credit went up. Four days later, Brenda with Bank of America calls me apologizing for the trouble and said she would put in an investigation to fix everything. She gave me a case number to follow being # 221209DRCT000048. I tried calling the other credit bureaus to fix it with them and I am in waiting.

I decided to call Bank of America and see if my credit line was fixed due to this error and if things were good. I mentioned that the balance was paid off in

December 2022 and wanted to hear the outcome. The number I was given to follow up was called and the representative had me on hold for at least ten minutes. She sent me to a recorded line that only spoke? Spanish? I have no idea! The customer rep's that I have tried to talk before today have either sent me to a recording that didn't give an option to speak with someone or they have hung up on me. I have not been given a chance to clear my credit when I was honest in my payments from the beginning. Now I am getting ignored and sent to dead end phone messages. I will never use Bank of America again! The customer service is appalling! If my credit score didn't need the credit card on my account I would cancel it. However, I need it to show I have more credit than used.

Desired outcome: Fix my credit line back to $27,500 so my credit score would be fixed. I did not deserve for it to go down in the first place.

Hold on multiple

Hold on multiple checks - I run a service business where the same 50 customers give me checks every month… On December 29, 2022 Bank of America put a 10 day hold on 30 checks… Ridiculous these are the same checks I get from customers every month-they all were stamped on the back there's no reason to place a hold on these scam shame on you Bank of America!

Horrible customer service, HOLDS YOUR CHECK DEPOSITS FOR A WEEK, due to the banking crisis I was told, how does BofA except any one to run a company that holds funds for a week? I was told it's new policy due to the banking failures recently. What a joke! They just want to make interest on your money and gamble it on investments, only looking out for themselves!

I opened a Bank of America credit card with a balance transfer that offered interest free for 21 months. I set up my automated payments, and for several months, paid an extra amount so the payment would ultimately be pulled the second half of the month. I suppose I was notified, that the customized automated payments would no longer be an option, but clearly missed the written notification, if sent. I went into my account online to figure out the issue, when realizing I was given only two options... either pay the full balance or the minimum amount! After 5 calls and discussion with multiple employees that were not made aware of this change, I was informed by a supervisor, that indeed Bank of America had made this change. What the heck?! I read about a lawsuit just settled against Bank of America for a drop down option for their automated payments that mislead card holders. I cannot wait to pay this card off and NEVER will I deal with Bank of America again! Warning to those considering this card!

Fixed amount payments on credit card

To whom it may concern:

I have a credit card with BOA and am not able to set up auto pay for this account. I want to set up a fixed amount per month to satisfy the balance.

I am being told, at 2 different times, that the only options are minimum payment or the balance on the account.

This balance was a transfer option with 0% for a limited time, which is why I returned to the BOA.

This is considered a serious problem for me as a customer. There is no other banking institution, that I have ever dealt with, that does not offer the option of a fixed amount.

It was explained to me that people would put fixed amounts in place that did not cover their minimum payments.

Why should all customers be inconvenienced due to some people not understanding/ignorant of what they did incorrectly.

Somewhere in the Bank of America Corporation, someone must be able to assist customers, like me, in this issue.

Thank you ahead of time for assistance and look forward to hearing from a representative in this matter.

Maureen F. Martin

3544 Stable Ridge Lane

Land O Lakes, Florida 34639

Email: [protected]@gmail.com

Cell: [protected]

Desired outcome: Auto pay for fixed payments on credit card

Fraud

I have had the absolute most horrible service from Bank of America in Wappinger falls ny 12590.

On Tuesday December 6th I was the victim of an online Zelle fraud via Bank of America. I have had to loose time from work and go into the Wappinger falls location to handle this matter in person. I have had to make multiple phone calls to their dispute department , been transferred multiple times, and no one has helped me resolve this issue.

I received a phone call from someone impersonating Bank of America and asking me for the codes being texted to me like Bank of America does. During this time they hacked into my online Mobil banking and sent a Zelle transfer to someone named Brianna for $3500.00.

I have again tried to handle this and to this day it is still unresolved. Bank of America refused to give me a temporary credit for the money taken. My account has gone into the negative because this was my bill money. Each and every single time I call I’m told how sorry they are and transferred all over into a circle. I’ve spent hours on phone calls trying to resolve this. When I ask for a manager no one will give me a manager. I have been in customer service for over 20 years and no that this has been handled completely wrong. I just need someone to help me with this matter. I will also be removing all money from all four accounts and dealing with a different bank.

Claims resolutions department

Claim number: [protected], 11/8/22/, account ending in 9591, amount $200.00.

Background; We had purchased a $200.00 credit to a friend's golf account as a "thank you" for taking care of our Florida house while we were away. According to a Bank of America RM, apparently there was a "double swipe" that caused our account to be charged twice for the same transaction. We were issued a credit to our account for $200.00 pending review by the claims department.

Four days after submission a letter was sent to us from the Claims Department communicating: "The date of your dispute with CANE GARDEN GOLF for $200.00 fell outside the dispute timeframes we follow". The temporary $200.00 credit was reversed. Nothing was said about the actual transaction.

We have been a customer of Bank of America and Merrill lynch for over 50 years. We currently have 6 accounts with over 1/2 million dollars in balances. We have a VISA account that we payoff every month but run over $70,000 dollars through annually. I thought we had a relationship.

Based on this long "relationship", I am asking that a management level person review the entire situation and reconsider crediting our account for the $200,00.

I can be reached at [protected] mobile

Jim Schermerhorn

Desired outcome: Please refund the $200.00 that was taken out of our account twice.

BoA is illegally using my mortgage ESCROW

This has been going on for YEARS, and I have tried to CORRECT the problem WITHOUT cooperation from BoA... In 2007 we bought a piece of property with an old house on it (house #081).. Later, we found out it was actually TWO pieces of property with TWO separate tax bills (-11 and -11A)... When BoA found out one lot was empty, they SOLD the empty lot to another lender, but continued paying the taxes on the lot they sold.. I told them several times that I would pay the taxes on the lot, but they kept paying the taxes...

When the lot was paid off, I had to fight with BoA to get a lien release on the property that was PAID for, (-11A).. I went round and round AGAIN with them to STOP paying the taxes on the lot that they NO LONGER had any right to, but, I got nowhere... Customer service complaints got nowhere..

I went to the county treasurer about stopping them from billing BoA.. They stopped, but BoA STILL continues paying the taxes AFTER I pay them..

Recently, I spoke with the county treasurer again, and was told that the taxes were being paid by a company named core logic.. I called core logic.. I was told BoA had to end the tax pmt requests since THEY started it.. I have called admin several times and got nothing but deleted extensions and voice mails that have not been answered..

There is a NEW house on the lot (11A) (#057) AND a NEW mortgage company.. BoA just USED the escrow from the (#081) to PAY for the taxes on the property, that belongs to the OTHER mortgage company..

Desired outcome: I want BoA to STOP paying the taxes on BOTH properties.. "I" will pay the taxes.. They have ripped me off enough.

Fraud claim closed the judgment denied

January 6th 2020 received my b of a edd card. Activated card the balance was said 22 dollars and some change.. I stayed on the phone to then talk to the desired the fraud, claims department. They began to tell me that info on my card wasn't showing complete info. The same phone call transferred to me to another fraud person that it was showing that another card besides the one I have was showing other transactions. making the card I have would be the third card issued. Transactions were showing on his computer that withdrawals of up to a thousand dollars a day from a local bank here in Weaverville California. Coast central credit union. Lumber store also in the town I live in.. Weaverville California and Costco on redding California. and that nine thousand dollars was withdrawn and spent

and the other card twelve thousand. They filed two claims. ended up being actually one claim. August of 2020 went to redding b of a head branch they verified over the phone at the bank two claims were done and I would then wait 120 plus days to then have them close cause they didn't look at it. they opened it. two weeks later the reviewed it and they denied my claims.

Desired outcome: I would like my money refunded and interest if possible. this has been detrimental to my well being and I really appreciate this in every way. thank you

transfer of funds

I closed my BOA savings account ending in 1993 over four years ago. At that time I had scheduled an online transfer of 500$ from another bank checking account. But BOA continues to transfer out and transfer back the 500$ each month. I have called them MANY MANY times, including last week. Still, the transfer out of my other bank account into BOA continues including the recent one. This has caused me much emotional anxiety and stress as this 500$ transfer impacts my other payments.

Online Transfers from Bank of America

Tue, Nov 8, 4:03 PM (5 days ago)

to me

This message is a reminder that we will execute the following transfer request in 3 business days:

*********************************************

Item: [protected]

Amount: $500.00

Send on Date: 11/14/2022

To: Adv Plus Banking - 1993

Fee: 0.00

Service: Next Day

*********************************************

Please be sure to have enough funds in your account to cover this transaction.

Sincerely,

Member Service

Desired outcome: First STOP TAKING MY MONEY. And would appreciate some compensation for the time and energy I spent in ensuring that there are funds available to pay my mortgage and credit card payments.

Credit card issue

Back in April of this year I was paying my bill starting at $100.00 every 8th monthly. Each time I paid my credit card bill I was also charged interest so that although my crdit balance would go down it would quickly go back up so that my balance woud NOT go down. I am now paying $106 for "purchases" which I have not made in quite some time and what I don'quite understand is why I'm being charged enormous interests each month for "finance services" or so-called purchases which I do not make. Example, last month I paid my minimum bill of $104 which brought my balance to $40.90.99 but interest was charged of $65.27 which brings e back to $4156.26. Excuse me for being quite upset and totally disgusted with this friggin thief of this bank. Greedy bank yes. Im 78 y.o. And you obviusly think I can continue to pay your friggin iterests on a credit card I no longer use or will ever use again? I live on social security and trust me I will probably die soon and you won't get a friggin penny from me. HOw's that thieves? I started paying double interests in April 8th of this year and every month on the 8th I paid over $100 min. payment. And as soon as I've made this payment, you add another $60+ interest and I'm back to the $100s. So [censored] you B of A. I'll be the one with the last laugh! I absolutely despise greed and that's what B of A is!

Customer service

I've been trying to close my deceased father's checking account now for 4 months with no success and horrible customer service. Customer representative (Graeham) is incompetent and whole branch (Ladue) has no interest in resolving the issue. Over 12 times I've been by to check on status and never get anywhere. No one in the branch has the authority or knowledge as to how to close an account. Office hours are horrible and now need an appointment every time you want to try to resolve the issue. Would not recommend this company to the average consumer. They have no interest in helping nor know how to accommodate them.

Desired outcome: Close the account and transfer the money.

Credit card dispute over atm's malfunction

This incident happened on May 22, 2021, around 4:30 pm. One of the Bank of America ATMs has just taken my money and the dispute is still ongoing. But, it is almost to the end because I ran out of options but to take it to the small claims court.

On the afternoon of May 22, 2021, I went out to make my credit card payment of $620.00 at the BofA ATM located at the cross streets of Foothill Blvd. and Alameda Ave in Azusa, CA. I deposited a total of seven bills together. Six 100 dollar bills and one 20 dollar bill. Shortly after the deposit, the ATM said it couldn’t take my bills, and it would return the bills without any explanation. So I waited, and it returned four 100 dollar bills and the ATM accepted and credited 220 dollars and printed out the receipt for $220.00. So, I thought to myself that the ATM couldn’t handle multiple bills at the same time because I had just noticed that the ATM was very old. So, I decided to deposit one bill at a time. Hence, I deposited one of four 100 dollar bills that was returned to me. Again, the machine said it couldn’t take my 100 dollar bill so it would return the bill to me. So, I waited, waited, and waited but the ATM never returned the money. The ATM didn’t say anything, didn’t print out the receipt or anything, but complete silence. It has just taken my money. When I complained to BofA, I thought it would be an easy fix but it wasn’t. I filed complaints multiple times, talked over the phone around 20 times, I filed the complaint with the Enterprise Resolution Department at BofA, I filed a complaint through the state. But, none of them worked because I didn't have the receipt. How can I provide a receipt that was not printed out in the first place? As a result, the dispute is still ongoing and, as my last step, I have to take it to the small claim court and let the judge decide.

Is there anyone who has a similar case, especially not printing out the receipt? If you do, please help me out by replying with a brief explanation so that I can take it to the small claim court as evidence that the ATM machine can and does make mistakes in not printing the receipt? Because I have nothing to back up my story. Thank you.

Desired outcome: I want the Bank of America to pay me $100.00 that the ATM took on May 22, 2021. And another $100.00 as punitive compensation for the lost time and efforts to try to solve the case.

theft of money

I deposit a check in the bank on 08/31/2022 i knowed that money started coming out of account i nwent the branch the lady in the told me to open a new account i did that and she filled a fraud claim for me witch i later found out that she could not file claim only the fraud department then i put money in the new account that was gone . The lady at branch even put a new jersey address on my account without me know and taking money and bank of america dont want to give me my money and they can clearly see that this is fraud the fraud departmwent called me and told me it was fraud . The following week the new jersey branch contacted me and told me i need to contact the fraud department that some one was pretending to be me and i live in stone mountain. Ga. I been with this bank for years and im treated like this im in shock

Desired outcome: I WOULD LIKE TO GET MY MONEY BACK AND LEAVE THIS BANK ALL TOGETHER

Worst service at bank of america branch

I went to the Bank of Americas branch located at 16370 Pines Blvd, ,Pembroke Pines, FL 33027 today Saturday 10/29/2022 at 9.45 am and there was only one Teller serving lots of people.

It is inhuman to pressure on one Teller only when Bank of America could have had another teller to reduce the pressure from the existing teller .

This is utterly wrong unfair and inconvenient to the customer. There were three Branches nearby before Pandemic and now one has been closed and other branch opens on Monday to Friday from 10.00am to 4.00pm just part time and thus giving lousy services to customer.

Therefore, Bank of America should give best services to its customer. at all times Thanks

Malkit S. Sappal

Bank Customer for 40 years.

Desired outcome: Improve your Service .

Elderly fraud protection of accounts

My 83 year old mother put every penny she had in a checkin g and savings account with Bank of America. Her account was taken over by fraud and they stole thousands of dollars. Bank of America opened a new checking account for her but left the old one open so the criminals just had funds transferred. They actually had their personal info and phone number out in the account so they were called if there were any questions my mother has banked with boa for over twenty years her banking habits are very predictable over the past year and a half they stole close to $90,000 from my mom who has had to spend everything from her retirement account to survive this last year and no matter how many fraud claims I file they just keep denying them saying g my mom authorized it it is ridiculous. My mother is going to transfer money to an account that was supposed to be closed. No one at boa helped her when her checking account was changed to also change all her automatic monthly payments she forgot about that and her credit has been demolished. The thieves stole her stimulus checks when they came in on one of the closed checking accounts and one of her social security checks. They purchased thousands of dollars of stuff from shrub and champs I mean my mom doesn’t even know what those places are . But Bank of America will not return her money and my moms remaining years on this earth have been devastated. It seems like this world has changed to just a greed fest where decency and kindness is no longer valued but looked at as though it were proof of weakness. I think a lot of human beings are going to feel quite differently when their spirits are judged to evaluate where they end up, they find out the universe doesn’t care what right job you had, or right school you went to, or car you drove, or how wealthy snd envied you were but how much of a decent compassionate human being you left in your wake . I will fight Bank of America to the last to see my mother gets justice and retribution I have made numerous calls to the claim fraud dept and am transferred three or more times and then finally my call gets disconnected it has happened too many times for it not to be a strategy the bank usss to get rid of consumers looking for stolen funds to be returned. It is as though they are saying “me speaka no English”. I am going to fight for the “George Bailey’s” in out world . The main character in the great movie “It’s a Wonderful Life”

Desired outcome: Bank of America goes through the insurance company they must have for consumer accounts and returns the entire sum that she deposited initially in 2019 when she relocated to florida.

Bank of America Reviews 0

If you represent Bank of America, take charge of your business profile by claiming it and stay informed about any new reviews or complaints submitted.

About Bank of America

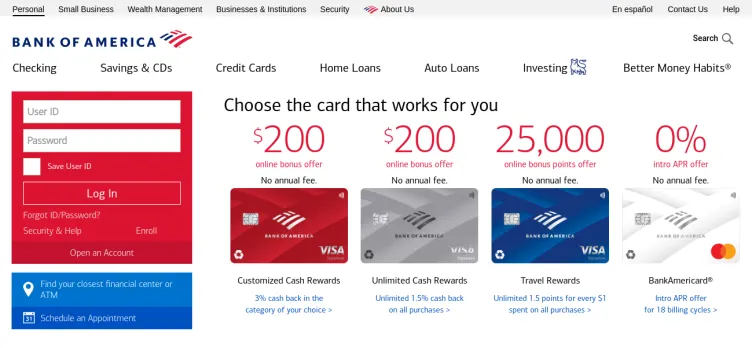

One of the key strengths of Bank of America is its commitment to innovation and technology. The bank has invested heavily in digital platforms and mobile banking, making it easier than ever for customers to manage their finances on the go. With features like mobile check deposit, online bill pay, and real-time account alerts, Bank of America is at the forefront of the digital banking revolution.

In addition to its digital offerings, Bank of America also has a strong network of physical branches and ATMs. With thousands of locations across the country, customers can easily access their accounts and get help from knowledgeable staff members whenever they need it.

Another key advantage of Bank of America is its wide range of financial products and services. From checking and savings accounts to credit cards, loans, and investment products, the bank offers something for everyone. Whether you're looking to save for the future, buy a home, or invest in the stock market, Bank of America has the tools and resources you need to achieve your financial goals.

Overall, Bank of America is a trusted and reliable financial institution that has been serving customers for over a century. With its commitment to innovation, technology, and customer service, the bank is well-positioned to continue to meet the evolving needs of its customers for many years to come.

1. Log in or create an account: Ensure you are logged in to your ComplaintsBoard.com account to proceed. If you do not have an account, please register by providing the necessary information and verifying your email address.

2. Navigating to the complaint form: Once logged in, locate the 'File a Complaint' button situated at the top right corner of the website and click on it to access the complaint form.

3. Writing the title: In the 'Complaint Title' field, concisely summarize the main issue you have encountered with Bank of America. Make it specific and clear, such as "Unauthorized Overdraft Fees" or "Difficulty with Mortgage Loan Modification".

4. Detailing the experience: In the complaint description, provide a detailed account of your experience. Include key areas such as customer service interactions, problems with account management, loan servicing, fees or charges that were unexpected, issues with online banking, or any other specific incidents related to Bank of America. Clearly describe the nature of the issue, including dates, locations, and any relevant transaction details. If you attempted to resolve the issue, outline the steps you took and the responses received from Bank of America. Explain how this issue has personally affected you, such as financial loss or stress.

5. Attaching supporting documents: Attach any relevant documents that support your complaint, such as correspondence, statements, or receipts. Be cautious not to include sensitive personal information like your social security number or full account numbers.

6. Filling optional fields: Use the 'Claimed Loss' field to quantify any financial losses you have incurred due to the issue. In the 'Desired Outcome' field, describe what resolution you are seeking from Bank of America, whether it be a refund, apology, or corrective action.

7. Review before submission: Carefully review your complaint for clarity, accuracy, and completeness. Ensure that all the information provided is true to your knowledge and that your desired outcome is reasonable and clearly stated.

8. Submission process: After reviewing your complaint, click on the 'Submit' button to officially file your complaint on ComplaintsBoard.com.

9. Post-Submission Actions: Keep an eye on your ComplaintsBoard.com account for any responses or updates regarding your complaint. Be prepared to engage in further communication if necessary to resolve your issue with Bank of America.

Overview of Bank of America complaint handling

-

Bank of America Contacts

-

Bank of America phone numbers+1 (800) 432-1000+1 (800) 432-1000Click up if you have successfully reached Bank of America by calling +1 (800) 432-1000 phone number 8 8 users reported that they have successfully reached Bank of America by calling +1 (800) 432-1000 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number 3 3 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number45%Confidence scoreEnglish+1 (800) 688-6086+1 (800) 688-6086Click up if you have successfully reached Bank of America by calling +1 (800) 688-6086 phone number 16 16 users reported that they have successfully reached Bank of America by calling +1 (800) 688-6086 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number 1 1 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number88%Confidence scoreSpanish+1 (315) 724-4022+1 (315) 724-4022Click up if you have successfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (315) 724-4022 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone numberInternational+1 (757) 677-4701+1 (757) 677-4701Click up if you have successfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (757) 677-4701 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone numberCredit Card Issues+1 (800) 214-6084+1 (800) 214-6084Click up if you have successfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (800) 214-6084 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone numberVice President Bank+1 (312) 992-6618+1 (312) 992-6618Click up if you have successfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (312) 992-6618 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number

-

Bank of America emailssupport@bankofamerica.com100%Confidence score: 100%Support

-

Bank of America address100 N Tryon St., Charlotte, New York, 28255, United States

-

Bank of America social media

-

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreNov 22, 2024

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreNov 22, 2024 - View all Bank of America contacts

Most discussed complaints

pmi remove problemRecent comments about Bank of America company

ATM security firm illegal in nycOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.