Bank of America’s earns a 4.0-star rating from 4575 reviews, showing that the majority of banking clients are very satisfied with financial services.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

USB Security Key

Bank of America will phase out SafePass from 1 August 21

If you do not have a US cell phone (I am British and live in London UK) you have to purchase and register a USB Security Key in order to do wire transfers from 1 August

Apparently however the USB Security key will work once registered from 21 June

I purchased a security key but found it was impossible to register it via their website unless you have a US Cell Phone on which to receive a security code to register it

After several international calls and not before having to deal with numerous ignorant customer service agents I eventually managed to set up and register my USB security Key

Along the way however a really stupid agent told me that I had to delete my SafePass before the USB would register (completely wrong advice and incorrect)

Unfortunately now that my USB Security Key is registered and working I am restricted to $1kper day / $3.5k per week in transfers to outside banks and $10k per day / $25k per week transfers to other Bank of America accounts

In the good old days I could call up and do transfers over the telephone but BoA stopped those and made me get a SafePass.

SafePass allowed me to carry out my typical $50k to $100k transfers and as such I would never have problems with limits.

Anyway now the SafePass has been deleted I cannot reactivate it.

Hence I am stuck with these ridiculously low and totally inadequate limits because BoA say they haven't managed to transfer over all the software and that I will not be able to revert back to my normal transfer limits before 1 August and most likely not until late August 2021

In the mean time they have told me there is absolutely no facility that will enable me to do my normal weekly and monthly wires in a timely manner

Net result is that it will take me weeks if not months to pay someone to whom I owe money too using my Bank of America account

Basically they have introduced a flawed extra layer of security without having thought it through and without having prepared properly for it and offer no assistance in how I and other customers can be less inconvenienced by their stupidity and not offered any useable solution to enable me to pay people to whom I owe money to in an efficient and timely manner.

Desired outcome: Provide a means to transfer money efficiently and effectively and quickly

Service

I went to Bank America 3120 SW 34th Ave Ocala FL to open a new account and found customer service to be awful. There was an elderly lady beside me (sitting on these nasty fabric ottomans that look like dragged out of someone's house from the 80's, what happened to nice business chairs in a bank lobby) in lobby waiting . She was trying to get help with fraud on her debit card, but the girl would not let her go speak to representative and told her she never heard of needing a fraud report to file the police report. But the worst part was she did not bring her over to a desk to try and help her but talked about it in front of everyone sitting there waiting, as one of the account reps got up and left for lunch with a line of people there waiting. This was after she interrogated another guy sitting on an ottoman in front of everyone telling him that there wasn't anything they could do for him either as he was trying to close out an account. The way this girl handled the herself was not respectful of customers nor anywhere near the customer service I have received from other banks. I got up and walked out. May try a different branch but will not return to that branch.

Desired outcome: Hire professional branch managers that realize banking is a customer service line of work if you don't want to deal with people get into a different line of work.

Unauthorized charges

08/2021 I received a letter from boa prepaid card service stating on the amount of 12581.92 was credited to my account and the claim was closed and the credits was final.. two months later the account is frozen and the amounted listed above is taken out and left me in the new in that amount so I call boa they tell me due to all the fraud they froze accounts but once my identity has been verified it well go back normal so I did everything that boa asked fax in my ID, reports, and even went in the bank number of times to verify only for them to keep closing this claim (I wasn't under the impression was a claim ) I was told once my identity was verified the negative balance would even out to a positive the claim I did put in has been paid out and that claim closed but never received anything because all it did was take off the top of a neg balance that was never suppose to be there in the first place .I call almost every day to find out the claim. I request to be reconsidered is closed again the next day even after I was told by the claims dept.to fax in one again my ID police report and a letter stating that there is video of a female at a ATM which clearly I'm not a female and my claim will be fine but it's not as soon as I send it in it gets closed again

Credit Card

I had a 60k limit credit card. It took me over 10 years to build it up to this limit. My credit score is 800. I have never been late on payment. But, they decided to close my account out of the blue. They tell me that they contacted me to update my profile (social security #, which they should already have since I applied for the card using it), but I didn't respond back in time. I cannot believe this happened. I call customer service and all they tell me is "Go open another account. What's the problem?" Really? Unbelievable... I am seriously feeling very despondent and frustrated.

Desired outcome: Nothing. They ain't gonna do anything about it.

BOA won’t refund fraudulent charges

I had $726 stolen off my EDD debit card from Bank of America and have filed over 5 different claims with them, they will not return the money that was stolen from me even though I provided a police report and other supporting documents to show it wasn't me that took the money out.

Desired outcome: Receive refund

Trying to cash my dads CD after he passed away

My dad passed away in Feb 2021. We went to the closes Bank of America and gave them my dads death certificate, living will, and will to take my dads name off of the account.

That was the easiest part except we had to send them the death certificate 3 times after that.

Then my dad had a CD and for some reason didn't put any one as the beneficiary, which is strange for my dad to do something like that. The other thing is my mom is on the same checking and savings account as my dad and the CD is under those accounts. Well we talk to the probate department and asked what we need to do. The sent us an affidavit of Heirship for Texas and said we needed to fill this out have it notarized and filled at the clerks office which we did.

So I faxed all the paperwork along with the death certificate again and my mom went to the local branch and handed all to be looked over and at the branch said everything looks good and was scanned and sent to the probate office. Now the where sent two copies of everything the same day.

I called a few weeks ago asked if they got it and they said they did and said everything is in order to call back next week. So I did, I called back today and was on hold for an hour waiting to be helped. Finally talked to someone and they said the Affidavit of Heirship wont work, we need to go to court and get paperwork from the judge.

The CD is worth 5000.00 dollars. Then I told them that we had a will and a living will saying my moms the beneficiary, so asked for me to send. I told him that we faxed it, emailed it, and when my mom went to the branch she handed it to them to scan and send. They tell me that they don't have it.

My mom is in her 80's and to do all this she has to drive into the city of Dallas which isn't a good ideal. So when we have stuff like this to do I have to fly down and help her. This is costing us a chunk of change.

So it looks like we might be out of 5000.00 dollars.

For me to fly there, get a lawyer, and go to court will be more than the CD.

I have been with some banks that have been so so, but Bank Of America is the worst and it not the first time we have had problem with them. That is why I am with another bank to do my banking with.

The bad think is that all she wanted to do is cash that in and put in her savings account which was the same account as the CD.

Then my dad didn't put anyone

Desired outcome: Let my mom cash it in

Bank of America block with $80000 but I got someone that help me out with it you can contact this number [protected]

Bank of America block with $80000 but I got someone that help me out with it you can contact this number [protected]

Closing my account no reason

On June 17, 2021 I woke up to my debit card being cancelled by Bank of America. I immediately called them to find out what was going on and the representative stated that they the Bank has decided to CLOSE my account. They also stated that it didn't matter that I had bills pending and transfer of $500 that was made the same day they closed my account. I wa...

Read full review of Bank of AmericaClosing of an account without my knowledge

I received a letter the other day Friday June 11th. It stated that Bank of America closed my credit card account and then lists various reasons why they did this. I have had that card for a while with a $2000 credit balance on it in case of an emergency. They send a letter telling me they closed it. I had no prior knowledge beforehand about this. I called Bank of America on Sunday Afternoon because I was simply outraged that they just closed it and not a word about it before doing so.

I spoke to someone on the phone and they simply said it was closed because I hadnt used it. Well that is my decision, I dont need a Bank to decide if I do or do not need that $2000 credit line available to me I explained I had received no prior notice telling me of their action before they did it. I also told the customer service rep I wanted to file a complaint, which I know will accomplish absolutely nothing. I have several accounts with Bank of America and have been their customer for a long time. I should not have been treated this way nor should anyone else.

They also stated that this would not damage my credit score which it better not. It is currently 718.

Desired outcome: I want my card reinstated and I dont want any blemish to my credit history.

Almost impossible to make car payment

My wife financed a small balance for a new Land Rover Defender purchase. She was excited to hear from the dealership that Bank of America offered her a preferred rate on the loan because we had been great clients in the past. . The dealership said BOA would be in contact with information on the loan. The information never arrived. BOA finally contacted me (her husband) months later trying to collect a payment. She was at work and I paid the past due amount. In the process I discovered BOA was calling phone numbers and mailing information to phone number and address we had 5 years ago in another state. Their current contact information was from a previous joint account from another dealership and car. The account had been paid off 2 years early. None of the old information was communicated on the credit application she submitted for the loan. She bought the car as a surprise for me.

We tried to set-up an online account through BOA's website to schedule automated payments that would pay the account off in 18 months. We entered the required information and it directed us to call [protected]. We did and sat on hold for over an hour. We thought we would call back to set-up the account. I had paid several months in advance and thought we could set-up the account because they weren't open for customer service on Sunday when she isn't working at the hospital.

A week later she was diagnosed with COVID and within days on a ventilator. I have tried calling several times over the past 2 months to see if we can set-up the account while she has been sedated. Needless to say I have been transferred 10-15 times during each call and no one seems interested in a solution. I finally found someone to take the payment after explaining the situation. After hurting her credit and refusing to find a solution it makes you wonder why BOA talks about helping over 4 million nurses on their instagram page, yet that can't help me resolve an issue for a nurse that understood the risks with COVID and and volunteered to go back to work to help those in need.

I have attached a series of photos showing my hold time with BOA after an hour of convincing them to accept the payment from her spouse. The agent transferred my to a line that was supposed to help with this specific issue. I have remain on hold for over 5 hours. It is more of a challenge to see who will fold first. The screen shots are real and show the lack of concern shown by the department that should be helping me make schedule automated payment like we have done in the past. When I called originally today the first person I spoke with said she couldn't help and was sending me to a place that could. here I am hours later with holder music and the phrase, " Please continue to hold and the next available representative will be with you as soon as possible". We have never made a late payment for any account and now they report her as making late payments to the credit bureaus. Great way to run a business Mr. Dimon.

Desired outcome: Access to online account and correction to her Credit Reports

Estate service

I am filing a formal complaint as Bof A is holding funding unlawfully and I cannot get any resolution, , despite trying now since June 3rd (today is June 14.) Since June 3, I have

- visited your bank in person 2x

- called/been on hold at least 10 hours. When I finally got a person, I was told I needed to speak to a manager. I left my number and did not get a return call.

- written 2 emails with no response

- written /chatted via your online text feature. was told to call another manager and given number; left VM and no response.

Situation of case:

BofA policy states "accounts of deceased over 175k must go through probate". A recent error on the part of your bank warrants an exception be granted on behalf of the deceased policy holder and his family.

Justification is as follows:

- xxxx passed away January 10, 2021. He passed away with a living trust with his daughter, xxx, designated an executor. His saving account balance at the time was $0.00.

- In March 2021, xxx went to the BofA in Dublin, CA and provided a Death Certificate, copy of the trust and all relevant legal documentation and spent extensive time on site (with notary certifying documents) to have herself added to all accounts; they scanned and uploaded all documents including the death certificate.

- On June 1, net proceed from sale deceased and spouse's' home was deposited in checking account ending in 0688. On June 3, daughter and executor, who had online access to the checking and savings accounts, transferred the funds to the savings account.

- Post transfer, she was told that she no longer has access to the funds as the savings account was only in deceased's name and that funds must now go through probate.

Account owner was deceased when the transfer was made. Daughter/executor had no way of knowing that the account was in his name only. She had online access to the savings account, and obviously was the one who transferred the funds. If the account was in his name only, it should have been closed as the bank had a copy of the death certificate (since March) and she was told she was added to all accounts at that time. She would not have transferred the funds in June if she had known this would be the result.

These funds are needed for spouse's long term care, and there is a living trust (which was created specifically to avoid probate) for deceased's trust. The family trust attorney has attempted to contact your bank many times, as has daughter/executor, and the local branch.

NOTHING HAS BEEN DONE to DATE.

Desired outcome: -Transfer the funds currently held in the saving account back to the checking (this is preferred) or -Process affidavits allowing for transfer of the funds (more than one may be required) to provide widow access to these needed funds.

Account

I tried ordering a debit card and never received it. I tried logging in to the app and it stated I should go to the bank for ID verification. I went the bank in June 10 and was told my account was closed due to fraud alert. This was very inconvenient due to waiting for debit card that was never ordered. My account was closed so I was unable to withdraw any funds in the account and then I was told their was a check mailed for the remaining funds. The closure of the account also prevented my unemployment check to be received for this week resulting in my ability to further access any funds and this also causes the the check to be rerouted and now I'm not sure when I will receive my check for this week. I also spent time and money to travel to the bank. The day I opened the checking account I was also there for 3.5 hours with the bank representative Joanalet Rosato. She was very professional and apologized for the situation. I feel that I should be compensated for the situation the mistake was no fault of my own. It also caused me to be late on bill payments.

Desired outcome: Compensation

Fraud protection edd card. All lies.

Oh there was a cross charges on my EDD account and I follow the steps as soon as possible and it's been 4 months now and I haven't so much issues trying to get my money back lies after lies they tell me that they pursued my account but my account was closed so how they can investigate account that was closed and it was frozen and then they said that they couldn't do it because my account was frozen at the time. And money was taken out of the ATM at two different places minutes apart and it takes about 2 hours to get those distance. I'm going to have some video footage of ATM so why can't they process these people I'm on disability and it's been such a nightmare

Desired outcome: The clinic still open and I have Central police report and everything is just still a headache I have two claims with them they solved one claim in another claim is reopened

Blocked my account, even after edd verified identity 3x

I have been a customer of BofA for many years from personal banking, child support and as an employee of contra costa school district, but since I started receiving unemployment I have been disrespected, steriotyped, discriminated againsted, hung up on by BofA reps. In the beginning BofA refused to unblocked my account stating unusual activity. After three months with the assistances of Sen. Buffy and Sen. Skinner office contacting EDD numerous of times I believe it would have delayed the process even longer. After months of delay and completing the eligibility process my account was unblocked, I was able to put a roof over my kids head, after being released from the hospital from a three month stay fighting covid-19. While settling in our new home for the past two months, BofA blocked my account once again after a couple of months, referring me to my sponsor (EDD) for identity clearance once again. I contacted EDD/Assemblywoman Sen. Skinners office, my account was unblocked after a week. After catching up with my finances, excepting a jobs offer at the courthouse where a vehicle is required after placing my vehicle in the shop for major work, while in the mist of clearing my finances, BofA blocked my EDD account once again for the third time. Contacting BofA and after two identity verifications the rist department inform me that my card was reported stolen I was very upset, asking to speak with higher management with was even worse, while speaking to the supervisor l stated and l quote, "First you guy lie and stated EDD," QUOTE"place the block on my account, when the risk manager rep I spoke with previously that the block was placed by BofA for the following reasonings, going as far as denialing my unauthorized charges claim, locking my card on every money transfer attempts and online purschases I informed the supervisor that I would like to file a complaint. I started recording my phone calls after the risk department supervisor ask me this question,"What is ethicity?". I asked, 'What that have to do with you filing a complaint, I said since you do not know the difference between,"RACE AND ETHICITY" I will have a better chances filing the complaint online. It is going on sixty days and my account is still locked, EDD superior contacted me personally to inform me that BofA received the information they requested. The EDD rep stated that he remembered my situation and wanted to personally update me regarding my BofA debit card account; that was two weeks ago, after losing, my new home, my job offer with the counthouse, along with my vehicle being sold as lean sale because I could not afford to cover the repairs. The hardest thang was having to place my kids in my sisters care, not being financially able to provide for my family now the only thang left is the air that I breathe, and once that is gone then the pain cease, the struggle is over

Desired outcome: Turn back the hands of time.

Savings

Hello, My Name Is Randy Nelson Jolly . I've Been A BOA Checking Acc. 22 yrs. And Last Month I Decided To Open A Savings Acc. With BOA . I Deposited A $ 1000.00 To Start... And Today 6/3/2021 I Was Going To Deposit $500.00 more but when I went online to do so... My BOA online acc. informed me that there was a Hold On My BOA Saving Acc. for the amount of over $877, 000, 000. So I telephoned A BOA Rep. This was today 6/3/2021 . The BOA Bank Rep. said to me Mr. Jolly BOA placed A Hold on your Savings Acc. without explaining Why . So after all the verifications were in order... The BOA Rep. said OK you Are Unlocked From "Your Savings" Acc. which was an irresponsible move On The BOA's Part ! I Informed the BOA Rep. To Close My BOA Savings Acc. which I Was Very Proud of Opening... And, Then I Opened A New Savings Acc. Online Today With "Bank Of Hawaii" ! Since BOA Is Not Proud To Have Me As Your Customer... I Have A New Bank That Is ! Because your Savings Dept. Treatment I'm going to be transfering as much as possible... Over to my New "Bank Of Hawaii" Savings Acc. -4954 ! Cordially: Randy N. Jolly [protected]@outlook.com

Old Credit Card Gone to Law Firm Debt Collectors

Wages are being garnished on Credit Card that has been paid. Now I am being garnished again. Need proof this has been paid already.This was a Bank Of America Card in 2008.

Desired outcome: Speak to someone

claim dispute

I submitted a claim for fraudulent charges on my account only to be sent a letter back stating they were unable to pay for the charges when I in fact did not make them! I never even had my phone in my possession hence why I had to purchase a new one which I also have proof of. I called customer service which stated I could submit this documentation online but I am unable to do so. I would appreciate any assistance asap seeing as how I was just informed I only have a few days! the claim number is [protected].

Desired outcome: refund my money!

Customer service - overall negative, horrific experience.

I bank at Bank of America.

And then there's this HOT MESS - EDD Bank of America.

A dereliction of duty that INTENTIONALLY BLOCKS/PREVENTS our access to accounts. EDD BoA has a reckless indifference when you "callback to demand UNDO BS BLOCKS to our accounts. "They say" occasionally, its a security issue and things go from bad to worse.

Now think about it - if you're blocked on your account by EDD BoA -- they will make you go to hell-and-back, deliberately, intentionally, to provoke, rile, and ridicule you BY ASKING 100 M'F QUESTIONS. To no end.

Think about it -- you cannot access your money or online account

access. You call in to have them REMOVE BLOCKS from your account -- they block you/CREATE A BARRIER FOR YOU because you first must answer "security questions". After 10-12 questions, I flatly state, "you know this is my account so let's move on''. THEY REFUSE. There's more. You ask how many required in totality in order to move on to get to them TO REMOVE ALL BLOCKS & RESTRICTIONS? They will reply, "as many as I choose to ask" he/she satisfactory verification of account.

The next 2 additional questions are: What kind of car is registered under your name? What was your address 5 years ago?

I'm done. MY QUESTION NOW BECOMES MAY I SPEAK TO SUPERVISOR? ... Endless questions and I cannot access money, " transfer" feature removed, and your online access blocked. And, after holding forever, agent comes back because supervisor is a mind/reader and retort, "I still have to verify account'. *** ( Representative retaliates below)

Angrily, we hang up and call back and they next supervisor (if you get one after 30 minute wait), to say we want to file a complaint ==and after he/she is detached, fail to properly address or assist, "so you dislike the bank"? It is a flat out, NEGLIGENT AND RECKLESS failure to provide a recourse of action to resolve problems/issues permanently. REFUSES to provide their names or employee ID s or call center location to you once you say you're filing a report.

Only minutes before I called, I accessed my online account to transfer funds into my regular BOA account. The "TRANSFER FUNDS" feature removed. I thought due to updates in system when told this feature was actually "blocked or removed". Representative "restored" feature--ability to transfer funds --then transferred me to security (outlined above) to obtain responses (why was "transfer" feature blocked and when/how did they notify me?).

And again, one of countless, awful, distasteful, aggravation experiences . I re Supervisors lazy, won't assist or support.

This Representative MALICIOUSLY TAMPERED WITH MY ACCOUNT in retaliation. A gross violation of stewardship and care, deliberate, intentional "effort" to block me out/prevent me from accessing my online account and to disrupt/interfere any transactions I wanted to make.

I returned to login --there is no access whatsoever -- only a message "call the number on back of your card".

Recall, the 1st representative RESTORED the feature to "TRANSFER FUNDS", and verifying all fully functioning again.

One important function I was prevented from doing tonight is "self-blocking' my debit card after leaving it at gas station. I returned to find it gone. Someone had taken it. I am documenting it now, if that person uses/spends/steals anything it is the fault of the Representative who tampered with--interfered and preventing my ability to "self block'.

Seek disciplinary action against employee for tampering.

Seek an oversight panel to review all complaints (including countless thefts and fraud), set or approve a drastic plan of improvement of operation and protecting customer interest. Set a deadline. Impose HEAVY PENALTIES AND FINES for noncompliance.

Desired outcome: Seek an oversight panel to review all complaints . Impose HEAVY PENALTIES AND FINES for noncompliance.

Credit card - boa disgusting manager

A overpayment was automatically took from my checking account. I used credit card which has my own overpaid $600 sitting in the account.

BOA charged me a fee on my own money, when called and spoke to a rude manager Abby-ID DCN8C of Phoenix Arizona, she blatantly refuse to refund the fee that was charged using my money, not borrowed from BOA.

She said; she can close my account if I am not happy, so who the hell are these employees offering to close account but not to resolve their issues.

I will not do further banking with Bank of "America", they do not represent "America" at all.

Desired outcome: Refund

Need to build My credit up

Money withdrawal.

On May 25th I tried to make an ATM withdrawal from my account; but was unable to because of insufficient funds. When I called customer service; they told me someone withdrew $803.00 from my account on May 22nd 2021. My last transaction that I made was on May 18th 2021. My EDD card has never left my side; so I don't know how someone could access my account. Thank You Sincerely Ralph E. June

Desired outcome: Hope my money can be replaced so I can pay my mortgage. Thank you Sincerely Ralph E. June

Bank of America Reviews 0

If you represent Bank of America, take charge of your business profile by claiming it and stay informed about any new reviews or complaints submitted.

About Bank of America

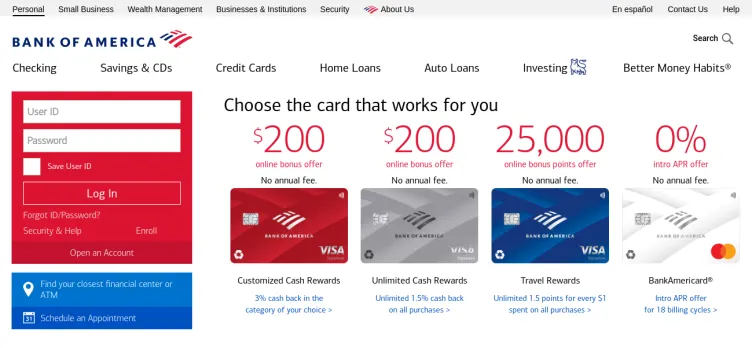

One of the key strengths of Bank of America is its commitment to innovation and technology. The bank has invested heavily in digital platforms and mobile banking, making it easier than ever for customers to manage their finances on the go. With features like mobile check deposit, online bill pay, and real-time account alerts, Bank of America is at the forefront of the digital banking revolution.

In addition to its digital offerings, Bank of America also has a strong network of physical branches and ATMs. With thousands of locations across the country, customers can easily access their accounts and get help from knowledgeable staff members whenever they need it.

Another key advantage of Bank of America is its wide range of financial products and services. From checking and savings accounts to credit cards, loans, and investment products, the bank offers something for everyone. Whether you're looking to save for the future, buy a home, or invest in the stock market, Bank of America has the tools and resources you need to achieve your financial goals.

Overall, Bank of America is a trusted and reliable financial institution that has been serving customers for over a century. With its commitment to innovation, technology, and customer service, the bank is well-positioned to continue to meet the evolving needs of its customers for many years to come.

1. Log in or create an account: Ensure you are logged in to your ComplaintsBoard.com account to proceed. If you do not have an account, please register by providing the necessary information and verifying your email address.

2. Navigating to the complaint form: Once logged in, locate the 'File a Complaint' button situated at the top right corner of the website and click on it to access the complaint form.

3. Writing the title: In the 'Complaint Title' field, concisely summarize the main issue you have encountered with Bank of America. Make it specific and clear, such as "Unauthorized Overdraft Fees" or "Difficulty with Mortgage Loan Modification".

4. Detailing the experience: In the complaint description, provide a detailed account of your experience. Include key areas such as customer service interactions, problems with account management, loan servicing, fees or charges that were unexpected, issues with online banking, or any other specific incidents related to Bank of America. Clearly describe the nature of the issue, including dates, locations, and any relevant transaction details. If you attempted to resolve the issue, outline the steps you took and the responses received from Bank of America. Explain how this issue has personally affected you, such as financial loss or stress.

5. Attaching supporting documents: Attach any relevant documents that support your complaint, such as correspondence, statements, or receipts. Be cautious not to include sensitive personal information like your social security number or full account numbers.

6. Filling optional fields: Use the 'Claimed Loss' field to quantify any financial losses you have incurred due to the issue. In the 'Desired Outcome' field, describe what resolution you are seeking from Bank of America, whether it be a refund, apology, or corrective action.

7. Review before submission: Carefully review your complaint for clarity, accuracy, and completeness. Ensure that all the information provided is true to your knowledge and that your desired outcome is reasonable and clearly stated.

8. Submission process: After reviewing your complaint, click on the 'Submit' button to officially file your complaint on ComplaintsBoard.com.

9. Post-Submission Actions: Keep an eye on your ComplaintsBoard.com account for any responses or updates regarding your complaint. Be prepared to engage in further communication if necessary to resolve your issue with Bank of America.

Overview of Bank of America complaint handling

-

Bank of America Contacts

-

Bank of America phone numbers+1 (800) 432-1000+1 (800) 432-1000Click up if you have successfully reached Bank of America by calling +1 (800) 432-1000 phone number 8 8 users reported that they have successfully reached Bank of America by calling +1 (800) 432-1000 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number 3 3 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number45%Confidence scoreEnglish+1 (800) 688-6086+1 (800) 688-6086Click up if you have successfully reached Bank of America by calling +1 (800) 688-6086 phone number 16 16 users reported that they have successfully reached Bank of America by calling +1 (800) 688-6086 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number 1 1 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number88%Confidence scoreSpanish+1 (315) 724-4022+1 (315) 724-4022Click up if you have successfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (315) 724-4022 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone numberInternational+1 (757) 677-4701+1 (757) 677-4701Click up if you have successfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (757) 677-4701 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone numberCredit Card Issues+1 (800) 214-6084+1 (800) 214-6084Click up if you have successfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (800) 214-6084 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone numberVice President Bank+1 (312) 992-6618+1 (312) 992-6618Click up if you have successfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (312) 992-6618 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number

-

Bank of America emailssupport@bankofamerica.com100%Confidence score: 100%Support

-

Bank of America address100 N Tryon St., Charlotte, New York, 28255, United States

-

Bank of America social media

-

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreNov 09, 2024

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreNov 09, 2024

Most discussed complaints

pmi remove problemRecent comments about Bank of America company

ATM security firm illegal in nycOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.