Bank of America’s earns a 4.0-star rating from 4575 reviews, showing that the majority of banking clients are very satisfied with financial services.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

partial land release

I have been attempting to obtain a partial land release. We have 40 acres and want to sell 35 of the farm land. We have an equity loan with Bank of America and need them to authorize a release and tell us what requirements we must meet to do so. Our primary mortgage holder (Citicorp) has authorized the release as we have completed the paper work, obtained a survey and had property assessments. We are due to close on the land sale in two weeks (per Citicorp) and I STILL HAVE NOT HEARD A WORD from Bank of America. I was told we would receive documentation within 48 hours and that was two weeks ago. No response to email when referencing equity but if I do a general inquiry, they say they will look into it. When I call the department, I can only get a recording stating they will contact me within 48 hours (not a single call back yet). When I speak with customer service, they can do nothing except to send the department an email escalating the matter. The sale may fall through as we have NO idea what Bank of America may require. No one at Bank of America can get us in touch with a single soul in the PARTIAL RELEASE department. I also found out while working with a loan modification rep (who is very helpful) that our account information was a mess. Even though the statements have both our names on it and appears on both our credit reports, the account was listed under the husband but with the wife's social security. We had to send a copy of SS card, make MANY calls to corrrect THEIR ERROR which apparently occured when they took over the LaSalle Bank business with whom our accounts were with originally. It took nearly TWO MONTHS for them to correct this. Different departments had different information - what a mess. Funny...they sure have the information correct when payment is due. We will be cashing in some investments just to pay off our equity loan and be done with Bank of America. At that point we will close ALL our accounts with them, and there are five. They give misinformation IF you are fortunate enough to get in touch with a person in the correct department! NO ONE can help you ...so much for customer service. I will never again do business with Bank of America.

The complaint has been investigated and resolved to the customer’s satisfaction.

make home affordable program

We applied for the making home affordable program. What a night mare. We applied over 2 1/2 years ago, still at step one. We have sent the paperwork the same paperwork over and over again. Won't let us talk to a supervisor. We have some case worker that calls every 7 days to say it is in review. What a joke, I have screamed yelled etc nothing works. I am gonna yell to everyone who will listen BANK OF AMERICA WILL SCREW YOU. OUR HOUSE IS NOW TWO YEARS BEHIND IN PAYMENTS.

The complaint has been investigated and resolved to the customer’s satisfaction.

I got a loan modification approved through BOA. Dropped my payments by almost 300 dollars. What they didn't tell me, even though I was making my monthly payments, my house payment wasn't being paid. The money I sent went into some sort of fund for 12 months till the modification was approved. Then it payed my house payment. When I went to look for a car, BOA had listed an I9 on my credit. What this is states my house payment was greater than 90 days past due for reported 9 months. Took my credit score down from 708 to 564. I couldn't get a car approved because of what they did. I screamed at them too. it didn't so any good. I did pay my monthly payments in the amount the loan counselor told me my payments would be. And I still got screwed.

I went through BOA for the affordable home program also. It was a nightmare! I ended up refinancing with Quicken, it was fast easy and they saved me $100.00. I found out during the refinancing process with Quicken BOA put a lien against my house in the amount of $900 for administrative fees. I never signed anything approving this and when I ask them to send me a copy of this so called paperwork, they never did! I wish people like me who where just trying to do the right thing and NOT walk away from their house had some rights! I have had friends stop paying their mortgage, live in their homes for years, purchase a nicer home and never to this day have they had to be accountable for the foreclosed home! Some filed bankruptcy after it all too! Just goes to show it doesn't pay to be honest & pay your bills in this messed up world!

Just a thought... Maybe you could solve the problem by paying the mortgage.

unscrupulous business practices

We had a pipe burst the Sunday before Thanksgiving, 2013. AAA handled the

insurance end, and was so poor that we had to hire a public adjuster to force

them to pay for the damages. Of course, as holder of our mortgage (originally

through Countrywide), BofA was

listed as co-payees on the check. I called the property claims division to get

instructions on how to proceed and followed them to the letter. The first

disbursement check that was sent to us was for half of what it should have

been and took two weeks to arrive. Even though the check was drawn on BofA, they still wasted precious time in disbursing funds to us. This was the end of January, 2014.

I had our contractor lined up & ready to start, but didn't have enough money for the deposit, so we had to wait for the remainder of the original disbursement to be sent - another week went by. To get the rebuilding process started, I put several things on my personal credit cards, which shouldn't have been necessary. We were finally able to begin the real work in the end of February, 2014. The first visit from the inspector was another fiasco, where he was only available between 11am and 12n, so I had to take more time off of work to be able to meet him on his time line. He put our progress to that point at 68%. BofA called to tell me that they'd only release another fraction of the second disbursement. I was able to persuade a manager to send the whole amount after faxing all the bills I paid out of pocket to that point.

The last of the work was completed on March 10, 2014. I called to have the final inspection and disbursement released. We're in the process of refinancing with another bank. They have told me that BofA won't send them the payoff settlement figures, which is another game they're playing with us. The inspection is scheduled for today with the same inspector as the last time. Somehow, our insurance report is mysteriously now missing from their files, even though he had it the last time he came out.

Dealing with BofA property claims through this process has added insult to injury.

I totally agree, Bank of America is the worst, very corrupt

fraud / credit tampering

We gave back our house in Sept. 2008 rec'd our Deed of Lieu in 2012 when Bank of America sold the house to a Bank in New York in Feb. 2012 never telling us of the sale; we found out when we went to Kingman, AZ, treasury's office and paid for the copy showing the house was sold. We each filed an 1099C in 2012 with the IRS. We have made several attempts to have them remove the $179, 713.00 amount from our credit reports as they do not own the house, NOR do we owe them money. One time we were told to just get an attorney and sue, knowing their deep pockets and Government backing will allow them to commit these ILLEGAL acts and get away with it. We are convinced there are many if not millions out there Bank of America have done this too! By still being on our Credit Reports for money NOT owed to them they have ruined are Credit and Reputations, Characters as I can not find a job even with an University Degree because of my credit, and Kathy who is Disabled can not get a vehicle that can carry her chair/scooter so she can go to the Doctors, and other places. We also fell that they have done this as a HATE CRIME toward us as we have turned them in to you which turned into a Class-action Law Suit involving several states. Sincerely, GloryaJane Ryan & Kathy A. Blakeman.

The complaint has been investigated and resolved to the customer’s satisfaction.

credit card declined

I live in North Carolina. My card was declined in Tennessee (an adjacent state) because BOA decided I was "out of my area". I called and told BOA that I was going to be traveling cross-country and in Mexico. They agreed to let me out of my playpen. On the 6th day in Mexico my card was declined. When I called they said I had been "gone too long".

Their rationale seems t be that if my credit information was stolen online it might get used in another state or country. That's reasonable but I told them WHERE I was going and left a trail of gas and food purchases across the country into Mexico. In another country is the worst place to be stranded without credit.

My Complaint: If the computer can be programmed to cut off my travel because I am not in my home state or have been on the road too long, why not hire a high school programmer to have it send me an e-mail and allow me to verify my location a day or two before cutting off my credit and causing huge difficulties. Answer: because BOA COULD CARE LESS.

Bank of America elected to increase the intrest rate on my credit card after one late payment to 29.9% and after being on time for 14 Months they refuse to lower it.

I called and complained only the hear that my credit card is not set up for revioew and rate reduction it can only go up !

There must be a law against this, does any one know how to get help

international wire transfer

Bank of America steals money from every international wire transfer they process for their account holders. The way the scam works is that they do not conduct international wire transfers in dollars. They convert the dollars into the foreign currency at a very unfavorable rate for the account holder, far worse than the normal exchange rate for that day. When the money is received, about 5-7% of the transferred amount remains in Bank of America's pocket because of the below market exchange rate they use. They rely on their account holders to not compare the exchange rate they provide with published rates online, due to the account holders' assumption that this large American corporation would not engage in such bold fraud with impunity. Sadly, that trust is misplaced.

If an account holder coordinates with the wire transfer recipient to determine that a substantial portion of the transferred funds has been embezzled by Bank of America and calls the foreign currency transfer division, they have a scripted answer that the exchange rate you look up online is not the actual exchange rate available to people converting small amounts of currency. This, of course, is a flat out lie. If you look at the exchange rate offered by Western Union, for example, it will correspond exactly to the rate that you find online. If the account holder confronts Bank of America with this information then they change tactics and simply inform the account holder that he agreed to the exchange rate they used and there is nothing he can do about it. Online search reveals they have been engaging in this unethical practice for at least five years.

Obviously, no individual account holder is likely to lose enough money to justify legal action. The only way to confront them is to publicize the unethical practices of Bank of America as much as possible so that their current account holders will not use them to conduct international wire transfers, or will close their accounts entirely and move them to another institution (which is what we intend to do). We are young, successful professionals with three children and I can guarantee that neither we nor any of our children will ever be Bank of America customers again. While we won't ever see the $700 that Bank of America embezzled from our account again, we can at least take comfort in knowing that Bank of America will sustain far more than $700 in lost business profits as a result of their unethical business practices. Hopefully in the future, someone will pursue a class action suit against Bank of America and any other banks that defraud their own account holders in this way.

The complaint has been investigated and resolved to the customer’s satisfaction.

modiciation

Hi, just like to place a complaint as well, it being 3 years of wells fargo is really ennoying . Its abused for a customers who were with fargo for long time, . No help from wells [censored]o, what is the use to call in and ask for "hardship" my husband sufer a stroke, this is a big "hardship", I tried to modiy my house in 2009, 2010, 2011, 2012, 2013, Every year i was dragged for a year, all papers at my end was supplied to the bank for a modiciation. Noone never got back to me, when i was calling to the bank ask for a signed person, i come to know from other representaing not longer with the bank. What king of trick is that. Instead of help people with "hardship" Wells Fargo Bank puts you in more trouble. After which owners ends up in forclose status.

2013 i start again to do modiciation on the house thats what i was told. After faxed all my document to the wells fargo, after was asign with some one by the name Marine Villarieal who gathered all my info and doc, staited on 010314 " everything is fine, all papers in, will be forwarded to underwriter, " suddenly on 010514, called back to me by questioning me regarding my documents again, which was collecting document two month priour by him, before forwarded them to underwriter, also had no manners to speack with the client. . I think its a big abuse toward people who alrealdy suffering "hardship" someone really needs to look in to that matter. Irina Glelizer

closed my account

on 12/17/2012 deposited a ck for my sale of hottub. just to be sure i waited for it to clear to release my item.

when it did not clear i called the bank they told me the check was fake and closed my account.

They did not give me the funds so I asked if I could open a new one since I contacted local police and FBI and I would bring in a report.

They said I could never again open an account with them. It is not like they gave me any money. Even the FBI said that is wrong that i was scammed. He suggested I get another bank. If they bad mouth me can I sue them?

identity theft internal employee theft other employees covering up the fraud

I started conducting business with the Middletown, Ri branch in August. Since then I have had thousands on top of thousands of dollars stolen in fake ACH debits, deposits that have gone missing erroneous withdrawls and more. I have brought this to the attention of the executive offices and the claims department who at time has credited my account only to find some bogus reason to deny the claim I have been banking with B of A for 15 years and I never had a problem. The transaction history has always been the same for the most part but no one seems to think all of the things that have taken place on my account is uncharacteristic based on the fact that I have rarely filed claims in the 15 years my account has been opened, this did not begin until I made the mistake of utilizing the Middletown RI branch. I have more than a good idea who is responsible for this and they will eventually be brought to justice. I will stop at nothing to expose this inconsiderate thief. I attempted to close the account out twice and for some reason it was not done. The funny thing is after I finally did close the account and open another one, Risk Management decides they are closing the account due to fraud which I suppose they are trying to insinuate is me. I have offered to take a polygraph and that was ignored. Currently, I have filed complaints with local law enforcement, the state police, FBI, OCC FTC Department of Justice and a few others. I will be pursuing civil as well as criminal charges where they will be forced to stand jury trial. BOA does not care about their customers in the least. They are also responsible for trying to ruin my credit which I can fix easily due to the fact that I put a freeze and fraud alert on my report when the fraud began, . I was also threatened with being reported to Chexsystems. However, they told me my banks were the ones stealing the funds by way of ACH. I was later told I was not going to be reported to chex systems. You never know with these thieves though as all you get is lies and contradictions to the answer previously received. The president/CEO should be fired immediately for allowing all of the fraud and deception to continue as he turns the other cheek as and acts as if he knows nothing about it. I simply want what belong to me and that is my money! If this thief is in need of money to support whatever habit he is supporting, I suggest he get off of his overgrown A** and find a better paying job, but at least have enough self respect and integrity to leave a single disabled mother of five's funds alone as I have worked for years to build a decent life for my children and I. What a coward to go stealing and what classless, inhumane group of individuals we call people that work for this corporation. I just keep praying that karma will show his ugly head sooner rather than later and make this coward own up to what he is doing. In my heart and soul I know who it is and I will see to it that you suffer the highest criminal prosecution I can get. Then I will see to it that you sit on you oversized butt with a bracelet around your cankle! I am past furious, exhausted and beside myself that this fool feels no remorse and has not attempted to rectify the situation. The least you can do is figure a way to make claims stop denying the claims I filed after YOU stole my money and YOU know who you are as well as I do. It's a matter of exposing you. Hopefully the Secretary of States office will want me to tell my story on the news as they mention it to me. You are rotten to the core knowing my home burned down in early September, along with my best friend passing two days after that and me having to get into a home quickly. However, you stole the money for the rent. I was in the process of purchasing a home for my children to call their own and you have ruined that. No one has ever given me anything and I have NEVER stolen from anyone! Integrity is a word I am certain does not belong in your vocabulary.

The complaint has been investigated and resolved to the customer’s satisfaction.

It is so difficult to reach someone with this company. You have to search online for a number because the number that was on my statement was disconnected. When I called to pay off my balance the automated system told me that "there may or may not be a fee charge, " but doesn't say what that fee may be. I never received bank statements for my payments. I sent a message on their website for someone to contact me via phone, but they just sent an e-mail. When I responded to the e-mail and asked again for someone to call me it took 8 days ((yet they said we'll contact you and your convenience)). I unfortunately got my loan transferred to this bank by M&I (now HMO) but I recommend that if you have a choice do not pick this bank!

hold payments out/don't apply to account

Ever since Bank of America took over Countrywide they have been holding our payments out and now say we are 26 payments behind. I have proof we are not that far behind. The statements they send show something called miscellaneous in which they refuse to explain. All my payments are showing In that category and not as a monthly payment. It's their fault that it shows us behind in payments, now they want to foreclose on our home unless we pay $25, 000.00. They keep denying our modification loan stating my husband makes too much. They can't add. They think 2000 + 2000 = 8400. Their full of crap. Their nothing but lowlife ### who rip people off. It makes them look like they are embezzling our money we pay.

The complaint has been investigated and resolved to the customer’s satisfaction.

foreclosure of mortgage

In Sept 2011, my father was diagnosed with lung cancer. He owned a 40 thousand dollar rental property in Conyers, Georgia since 2005. He was always current with his mortgage. Shortly after the purchase the taxes went way up and the property made no profit. He still paid the mortgage. In spring of 2012, his cancer had become so aggressive that he could no longer keep the home. He tried to do a short sale with a realtor. He tried working with BOA, and they put him in touch with a company called REDC. He found that he could not do a short sale or a deed in lieu of foreclosure due to a lien on the home from prior to his purchase of the home. There was already a lien on the home before he owned the property. It was a bad title search. He tried with all his effort to give the property to BOA. He jumped through ridiculous hoops that Bank of America set for him. He had his renter move out, knowing that he could not insure a vacant home. Bank of America required it. Shortly thereafter, he received notice of cancelation from his insurance company. Bank of America sent him letters stating it was his job to insure the property. At wits end, he gave up. He did not make anymore payments to BOA. BOA wanted the mortgage money, and REDC refused to work with Dad because of the lien prior to his purchase of the home. Bank of America started harassing Dad, DAILY! They would call and demand payment, they were not nice (which is somewhat expected when a bill collector calls.) The calls went from daily to hourly and then sometimes within 10 minutes he would receive another call from BOA collections. I tried to handle some of the calls because Dad could no-longer remember the answers to the exhausting list of questions that BOA used to confirm his identity. BOA refused to deal with me. Dad and I faxed written permission for me to handle the calls as the harassment was out of control. The collections agents for BOA said they worked a queue and they had no option on the collections calls nor did they know that we had just been on the phone with another collections agent just moments before. I finally sent a fax (with the help of a kinder collections agent- who was willing to listen). Dad was in hospice.. the fax was a cease and desist fax. We wanted absolutely no contact from BOA. We tried to work with them, they were and still to this date are unworkable. Currently BOA is now harassing me, the daughter of the mortgagee. They have NOT foreclosed upon the property. Dad passed away in Feb 2013. BOA harassed him so badly, in a way that was so wrong. It didn't matter to the collections agent that Dad could barely speak because he was so short of breath, nor did it matter that they had called his house and had to ask 15 identifying questions upon him before they would ask him for money or did the frequency matter. They didn't care about his well being, that he was on hospice and expected to live only a few weeks. Now they call me several times a week, they want me to know a huge list of identifier questions about Dad and a property I never owned. I am being harassed! I have had enough BOA, we have said and continue to say, we DO NOT have any interest in the property in question. Foreclose immediately! In July 2013 I received several letters from lawyers representing BOA that a foreclosure would happen July 2nd. After talking with Omatola from BOA, that never happened. I wish BOA would get their story straight. In the end had Dad lived, he may not have owned the property after all the payments were made, the title was never clear upon its purchase. Whose fault was that? We were grieving for Dad and with Dad but at the same time being harassed at all hours. I changed my address and phone number with BOA, and still they call and harass. I LOVE YOU DAD and MISS you everyday.

[protected]@charter.net

The complaint has been investigated and resolved to the customer’s satisfaction.

winnings from sweepstakes

I, have receive a phone call by Mr Mark Benit, who is saying that he works for Bank of America, and the bank receive funds from America pch sweepstakes & I, have won . And I, need to claim the money . It is here with our Bank, and why have you not claim it . This is the number he gave me to call [protected] him . This has happen to me 3-days ago . I, did not give him any personal information . Please help me, thank you . If, you wish, email me : [protected]@columbus.rr.com . I, think he said the Claim - blank- dept .

The complaint has been investigated and resolved to the customer’s satisfaction.

Are you frickin crazy scam scam scam

eric myers

Mr. Myers should not be part of American Spirit Federal Credit Union as he does not represent what a credit stands for. Mr. Myers was rude, unprofessional, and confrontational when I called to let him know when I could pay on my loan. Mr. Myers stated that it was not acceptable. I returned his call as he has been leaving

threatening messages about filing a judgment against me. My Myers made it clear that he didn't care about my business and previous history with the credit union. I mentioned how I paid previous loans off and was never late on them and he said that you cannot rest on your laurels which offended me. Mr. Myers played games on the phone by hanging up stating that I wasn't listening to him and I chose to talk over him. I called back to ask for a Bank Manager and he stated that he is the manager and no one else would speak with me regarding my loans except him. Mr. Myers advised me that he could freely express his opinion as we live in America. I can't understand how Mr. Myers can continue to work at the credit union and talk down to customer's. I can't wait until I have no more business with the credit union. I would rather pay higher bank fees than to be treated badly. I hope no one else has to deal with Mr. Myer's ignorance and stupidity. When I got home today

I received a letter in the mail today stating to call to make payment arrangements. I can't believe the credit union allows this to happen.

dual power of attorney

I was told at Bank of America that the dual power of attorney that I have for my mother would not be honored next time I tried to use it for my mothers banking purposes. They want me to have their own paper work notarized which is called " CA-Signature Card Addendum Power of Attorney". Isn't this breaking probate laws? Aren't they obligated to except the power of attorney by law?

untruthful information

Ben Christopher (mortgage loan officer, NMLS I.D.# 179356) was approached by my brother in June 2013. My brother had just finished paying off his chapter 13 bankruptcy and was waiting to receive the official document showing that he had successfully paid it all off. (Note: the death of his spouse and the ensuing bills and problems related to that death had plunged him into bankruptcy). He was inquiring of Ben whether or not my brother could qualify for any loan program through bank of America now that the bankruptcy was behind him.. My brother was up front about all aspects of the bankruptcy, he let Ben know that he had just paid it off and he answered all of Ben's questions about it and Ben then said the bankruptcy wouldn't prevent him from getting an FHA loan.

Ben then pulled my brother's credit report from all 3 credit reporting agencies, looked it over and pre-approved him for over $200K. My brother went looking for a house, found one for $89K and paid for the house inspection and septic. House failed septic, so my brother moved on to find another home to buy. He found a nice one which he could get for $117K and again paid for all of the inspections which bank of America required.

Less than a week before Bank of America was due to sign off on the mortgage loan and two weeks before the new house's paperwork was to be signed, Ben called my brother to tell him that Bank of America had declined him because of two small marks on his credit report. Those "marks" had been paid off, however, and my brother had proof that they had been recently paid off. It is my understanding that Ben told him that the fact that both small marks had gone into collections was what had disqualified my brother from obtaining a mortgage with Bank of America. HOWEVER Ben had already known about those two items from day 1 when he had pulled my brother's 3 credit reports, yet he never addressed them. Instead, he pre-qualified my brother and gave him a high dollar range to buy within.

My brother spent a few thousand dollars on home inspections, fees, deposit, etc. only to learn yesterday through another mortgage lender at a different bank that FHA rules prohibit anyone who pays off a bankruptcy from being qualified for a loan until 2 years have passed since the date of the bankruptcy's payoff. It would have stopped him even if his credit reports had showed perfect credit.

For some unknown reason, Ben Christopher appears to have strung my brother along and caused him to spend a few thousand dollars in the mistaken belief that he would qualify for an immediate FHA loan. My brother had kept in close contact with Ben Christopher throughout the entire house-buying process (weekly/bi-wkly) and Ben had been very reassuring through the rough patches. Ben never hinted that there could be a glitch in obtaining an FHA mortgage loan. He kept encouraging my brother to continue on..

It wasn't until the loan deal was about to go through when Ben told my brother he had a 50/50 chance of getting this loan. That shocked both my brother and myself, because wasn't pre-approval suppose to guarantee that a prospective buyer could get the funds to buy the chosen home, barring any new information suddenly appearing on the credit report? Pre-Approval is suppose to assure the seller that a solid, bona fide buyer is standing before him with the ways and means to buy that house.

Ben Christopher is a mortgage loan officer. He had to have known from the beginning that my brother's bankruptcy would disqualify him from obtaining an FHA loan for the next two years. Another mortgage lender said that this is common knowledge throughout the mortgage industry. Ben also had to have known whether or not those two small paid off marks on my brother's credit history would cause any problems, too.

We have no idea what Ben Christopher got out of this, but I hope this Karma returns to him. PLEASE DON'T DO BUSINESS WITH BANK OF AMERICA IN WAKEFIELD, MA.

BoA shape up your act as a Giant money hunger grubbing entity that swallows others up whole. Stop doing all these devious banking practices not only to the little guy. But, for God sakes to everyone. How much money is enough for you bankers. It's true what I read, American workers bailed many banks out with our wages and taxes and then you treat the public and customers like s_ _ t. You will never have my forgiveness for putting me through all these things and I can only hope God does see all these bad things you're doing and brings you all to justice for all Americans to have satisfaction for the day you fail and meet the Lawyers to bring you down! You greedy butts.

charged for bank mistake

Bank of America provided to us the wrong closing amount for the refinancing of our mortagage (we owed less than the amount which was provided to us), and realized their mistake after the closing of the same, so Bank of America scrapped (?) our signed and notarized paper and required us to close again; then Bank of America attempted to charge us $934.49 for closing costs! Bank of America is not to be trusted!

Bank of America provided to us the wrong closing amount for the refinanncing of our mortgage (we owed less than the closing amount they provided), and realized their mistake after the closing, so Bank of America scrapped (?) our signed and notarized papers, and required us to close again; then Bank of America attempted to charge us an additional $934.49 to close again! Bank of America is not to be trusted.

The complaint has been investigated and resolved to the customer’s satisfaction.

phishing attempt

received call from [protected]. Woman indicated that she was from Bank of America and wanted me to share information with her about my account in order to verify who I was sp that she could then tell about an issue with my accounts. I asked her how I could tell who SHE was and she said that I could call the number on the top of my statement (or [protected]) and they would be able to tell me what the isue was. I called the number on my statement. They told me that this DID NOT come from them, that it was a Phishing scam. They suggested that I place an alert on my accounts and at the credit bureau for 90 days: [protected]

The complaint has been investigated and resolved to the customer’s satisfaction.

Report them to newyork@fbi.gov

I got the same call today, however it was from [protected] and a lady from Bank of America (Aveln) asked to for my last 4 of SS#. I asked her for my account number to verify that she was with of BofA. She said I cant give you such info but you can call me back at [protected] X 14408. I gooled the number and fund no link to BofA. I called my bank and reported them.

file complaint with the Consumer financial protection bureau, CFPB. I have mortgage bank of america, bought me from countrywide, so much drama, i hate to even explain it all right now. i went to NACA, and they helped me try to get modified, and i still got denied and NACA filed complaint with CFPB, now bank of america kissing my butt and sending letters and i am in foreclosure, 3 court dates so far, no action yet, CFPB has taken over for the independant foreclosure review, IFR, I thought all my chances were over, i still no job extremely depressed filed disability, im 48 and unwanted by employers, no husband, never married, 2 grown kids 25 and 22. so many troubles no car, living on 74.00 a week from unemployment, I m praying i get approved. try to modify or move, hope bank pay me at end, im so tired, but im greatful i fought for 5 yrs, and im still in my home. foreclosure started in feb, 2013.

bank teller jessica cheater

Me and my boyfriend have a business for 5 years together we have been going to this bank branch for 2 years now everyone new us there as together we have 2 accounts there mine and his for business. Well about a month ago I found out that a bank teller has been cheating with my boyfriend stating she didn't know he had a girlfriend at all. So I spoke to her manager and she said she was so sorry and shocked well the girl Jessica said she would stop that she is sorry as well but it seems she was not because I found my boyfriend with her again. Now at this point I'm upset because she knows our info and I don't know what she's capable of doing to our account and I think she just wants him for him money. So I call corporate and I didn't here nothing back from them. So I'm am upset at this bank for allowing this teller to still work there know what she has done.

The complaint has been investigated and resolved to the customer’s satisfaction.

This has nothing to do with Bank of America or "Jessica". I hope corporate was laughing at you when you were attempting to get this girl fired because YOUR boyfriend can't keep his d- in his pants. You thinking she wants him just for his money is just making up another excuse for your sorry excuse for a boyfriend.

All the talk about her knowing "your information" and you don't know what she's capable of yet you are the one that is attempting to mess with her livelihood, her reputation at work and go as far as to say she's going to steal your personal information and do what with it exactly?

Honestly if you are going to try and get this girl FIRED for this and then actual go online and complain because the business won't do it -- I don't want to imagine the high school drama you create in your own business for the last 5 years.

Yeah, Jessica's a great gal - always offering to help any man complete a deposit.

That's not the way Jessica tells the story...

modification violations

I have been trying to get a modication for over a year now. I have submitted the same documents several times to Bank of America. Every time I am told all of my documents are in I get a new account manager and the new manager is missing documents. Can someone please help me I am afraid I am going to lose my home. I am on my 4th accont manager now who is asking me to submit the same documents that I have submitted several times already and I don't know what to do anymore. If anyone can assist me I can be reached at [protected]

The complaint has been investigated and resolved to the customer’s satisfaction.

The same thing happen to us we tried to do loan modification we did the reinstatement they messed everything up ... Nobody had record of anything no knowledge of agents that they work with . a total disaster.. they totally suck and heartless

The first time calling customer service, you are hopeful because BOA customer service tell you that you will hear from BOA in a couple of weeks...the call never comes & so you call to find out that they are missing papers & go through all the information again & again...we have been going through the same for 3 years & it is hopeless...the worst feeling ever not knowing what direction this BOA will go...I have a list of case managers plus others I spoke with over 3 years - I believe that any countrywide mortgage BOA took over is with intention to foreclose so as to profit from BOA "loss".

short sale

had a mortgage with Bank of America. In Mid-August 2011 I was let go from my job. From September - December 2011, I had conversations with Bank of America for loan modification due to my unemployed status. In January 2012, when I did not receive the paperwork for the loan modification application, I contacted BOA again. They had no record of my previous conversations.

Started process all over again. Long story short, my modification application was turned down twice.

I talked to BOA about a short sale. Took several months, but finally heard from short sale department. Filled out all the paperwork, sent it in (some of it multiple times). The short sale representative in November 2012. She even talked to my Authorized Representative/Real Estate Agent and we listed the house for short sale, even had an appraisal.

Excerpt from email communications from Bank of America Short Sale Department:

Homeowner(s) Name: KATHLEEN CHAPPETTA SPIESS

Loan Number: [protected]

Property Address: 70076 9TH STREET, COVINGTON LA 70433

The Phase 1 review of your file has been completed. Based upon HUD Guidelines, it is confirmed that the Seller qualifies to participate in the FHA Pre-Foreclosure Sale Program. A request has been submitted for the file to proceed to the next phase in the process.

I did not receive a formal letter of approval nor of declination of approval. Then the rep was moved to another department.

Found out on 7/2/2013 that the short sale was not approved. That the house was foreclosed on mid-June.

I received no documentation and the BOA short sale representative led both me and my agent to believe that the short sale was a go. I tried to work with BOA from the very beginning. Looking back in my notes (I documented every encounter), it was nothing but a series of phone calls, unkept promises, paperwork (which was an added expense to copy/fax/mail to BOA, four to five representative changes (at least). In addition, paperwork I received was contradicted in talking to representatives and/or follow up documentation. Now it is all out of my hands. I appealed to BAC for assistance from the very beginning, in an effort to find a way to work through my financial hardship. I was unemployed for 15 months. My efforts to mitigate the effects of my hardship on mortgage and credit rating were for naught.

I don't know what, if anything, can be done now. I feel that I was treated unfairly. In good faith I did everything that BOA asked, sent them what ever they needed, never avoided their phone calls, returned calls if they left a message.

This whole experience made a hard time much worse.

Was this the way it was supposed to happen? Was it Bank of America's intention to lead a client on, then kick her when she was down?

Was this what mortgage crisis recovery programs supposed to accomplish? Is this what Obama intended when he put into place recovery programs?

File a complaint against the servicer and Bank of America at consumer

finance protection bureau. It is the only way, short of a lawsuit, that

you can get them to move. They are, under law, supposed to reply to your

complaint in a minimum period of time as to a resolution. I don't like

having to go to the government for anything. Especially when I consider

them the reason for this problem with mortgages; but this works because

there are legal statues the servicer can't avoid. I have done it and it

has worked. Also let the servicer know that every time you have a

problem with them you will do this. You'll get better treatment because

they now know you have some help.

Consumer Finance Protection Bureau www.consumerfinance.gov

Agreed. BoA is a terrible institution and the Federal Reserves should liquidate their organization. They certainly act less like a bank and more like a money-laundering outfit run by the Mafia. Their short sale record is abysmal.

Bank of America Reviews 0

If you represent Bank of America, take charge of your business profile by claiming it and stay informed about any new reviews or complaints submitted.

About Bank of America

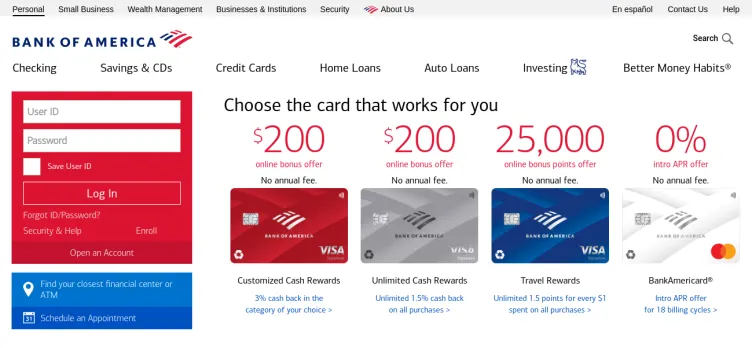

One of the key strengths of Bank of America is its commitment to innovation and technology. The bank has invested heavily in digital platforms and mobile banking, making it easier than ever for customers to manage their finances on the go. With features like mobile check deposit, online bill pay, and real-time account alerts, Bank of America is at the forefront of the digital banking revolution.

In addition to its digital offerings, Bank of America also has a strong network of physical branches and ATMs. With thousands of locations across the country, customers can easily access their accounts and get help from knowledgeable staff members whenever they need it.

Another key advantage of Bank of America is its wide range of financial products and services. From checking and savings accounts to credit cards, loans, and investment products, the bank offers something for everyone. Whether you're looking to save for the future, buy a home, or invest in the stock market, Bank of America has the tools and resources you need to achieve your financial goals.

Overall, Bank of America is a trusted and reliable financial institution that has been serving customers for over a century. With its commitment to innovation, technology, and customer service, the bank is well-positioned to continue to meet the evolving needs of its customers for many years to come.

1. Log in or create an account: Ensure you are logged in to your ComplaintsBoard.com account to proceed. If you do not have an account, please register by providing the necessary information and verifying your email address.

2. Navigating to the complaint form: Once logged in, locate the 'File a Complaint' button situated at the top right corner of the website and click on it to access the complaint form.

3. Writing the title: In the 'Complaint Title' field, concisely summarize the main issue you have encountered with Bank of America. Make it specific and clear, such as "Unauthorized Overdraft Fees" or "Difficulty with Mortgage Loan Modification".

4. Detailing the experience: In the complaint description, provide a detailed account of your experience. Include key areas such as customer service interactions, problems with account management, loan servicing, fees or charges that were unexpected, issues with online banking, or any other specific incidents related to Bank of America. Clearly describe the nature of the issue, including dates, locations, and any relevant transaction details. If you attempted to resolve the issue, outline the steps you took and the responses received from Bank of America. Explain how this issue has personally affected you, such as financial loss or stress.

5. Attaching supporting documents: Attach any relevant documents that support your complaint, such as correspondence, statements, or receipts. Be cautious not to include sensitive personal information like your social security number or full account numbers.

6. Filling optional fields: Use the 'Claimed Loss' field to quantify any financial losses you have incurred due to the issue. In the 'Desired Outcome' field, describe what resolution you are seeking from Bank of America, whether it be a refund, apology, or corrective action.

7. Review before submission: Carefully review your complaint for clarity, accuracy, and completeness. Ensure that all the information provided is true to your knowledge and that your desired outcome is reasonable and clearly stated.

8. Submission process: After reviewing your complaint, click on the 'Submit' button to officially file your complaint on ComplaintsBoard.com.

9. Post-Submission Actions: Keep an eye on your ComplaintsBoard.com account for any responses or updates regarding your complaint. Be prepared to engage in further communication if necessary to resolve your issue with Bank of America.

Overview of Bank of America complaint handling

-

Bank of America Contacts

-

Bank of America phone numbers+1 (800) 432-1000+1 (800) 432-1000Click up if you have successfully reached Bank of America by calling +1 (800) 432-1000 phone number 8 8 users reported that they have successfully reached Bank of America by calling +1 (800) 432-1000 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number 3 3 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number45%Confidence scoreEnglish+1 (800) 688-6086+1 (800) 688-6086Click up if you have successfully reached Bank of America by calling +1 (800) 688-6086 phone number 16 16 users reported that they have successfully reached Bank of America by calling +1 (800) 688-6086 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number 1 1 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number88%Confidence scoreSpanish+1 (315) 724-4022+1 (315) 724-4022Click up if you have successfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (315) 724-4022 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone numberInternational+1 (757) 677-4701+1 (757) 677-4701Click up if you have successfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (757) 677-4701 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone numberCredit Card Issues+1 (800) 214-6084+1 (800) 214-6084Click up if you have successfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (800) 214-6084 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone numberVice President Bank+1 (312) 992-6618+1 (312) 992-6618Click up if you have successfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (312) 992-6618 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number

-

Bank of America emailssupport@bankofamerica.com100%Confidence score: 100%Support

-

Bank of America address100 N Tryon St., Charlotte, New York, 28255, United States

-

Bank of America social media

-

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreNov 09, 2024

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreNov 09, 2024

Most discussed Bank of America complaints

pmi remove problemRecent comments about Bank of America company

ATM security firm illegal in nycOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.

I have been having the same experience for over a year now with my partial release. It is unbelievable the complete lack of contact, despite multiple messages and various phone numbers. The sooner I can be done with this company the better.