Bank of America’s earns a 4.0-star rating from 4575 reviews, showing that the majority of banking clients are very satisfied with financial services.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

closed a court ordered cd account without permission

My daughter had a CD account opened for her through attorneys due to a settlement in a personal injury claim in 2000, not to be accessed until she turned 18, which was yesterday. This account was set up so that only with a court order could it be accessed.

Yesterday on her birthday we went to our local B of A with our documents to access her funds and open a personal savings and checking account for her. We discovered that the account had been closed back in 2008. They couldn't find any documentation as to why. First of all, I don't care why. They shouldn't have been able to do ANYTHING with this account being that it needs a court order to touch it! After we returned home very frustrated, the bank called us and said they found the money after all. It had been turned over to the State of Oregon (state we lived in when the account was created) unclaimed property division because there had been no activity on the account and we couldn't be contacted. HELLO! NO ACCESS without a court order! I called and talked with the State of Oregon Unclaimed Property people today. By filing a claim form, my daughter is able to recover the funds that were transferred back in 2008. What about the last 5 years and the interest that would have been earned had the money stayed where it was? How can she get that back from B of A?

regon with a claim form, but what about the last 5 years of interest that my daughter is missing had the funds stayed in the CD account? How does she get that back?

The complaint has been investigated and resolved to the customer’s satisfaction.

falsey accused of check fraud

So I opened my first checkings and savings account. After a few short months I was informed that my account was being closed... Apparently someone had deposited a check endorsed to me into an atm under my account without a debit card was allowed to remove $300 of the $1, 000 the check was worth.. It was fake amd I was slapped with the blame. I fought it and even paid the account closing fee, I was eventually cleared in there system.. But now everytime I try amd open an account it gets closed! Even though I have a release letter from the ews! Its extremely frustrating.. I have done nothing wrong and iv even fixed the wrong done to me but im still paying the consequences!

The complaint has been investigated and resolved to the customer’s satisfaction.

Didn't this ATM have a camera? Have you filed a police report?

are you trying to open new accounts with BoA? Or is it with other banks?

Predatory lending practices

Bank of America is both predatory and an unethical institution. They have only one agenda, to target the exact people they are supposedly trying to help. There is not an incentive for them to preform modifications because if you have PMI and you have made payments on your home for several years it is in their best interest to foreclose on the home so they actually are making more money than if they were to reduce your interest rate. Plus they are pocketing what monies you put down to secure the loan. BOA has one agenda, to take your home but also mislead you by saying that they are running the home assistance program to help homeowners stay in their homes. It is gross negligence, a company this size that has been allowed to operate in this manner can only be described as criminal.

I have had a loan since 2007, the original home loan was with Countrywide. In 2009 both my husband I were laid off and we were forced to file chapter 7 Bankruptcy. Countrywide at that time would not preform any type of reinstatement procedures to secure the home loan after the bankruptcy. Texas is homestead state, which enables borrowers to keep their cars and homes out of bankruptcy proceedings. The loan was sold to BOA just a few months after our bankruptcy was discharged. We had applied for the modification just before we filed for bankruptcy because we were laid off and it was approved. But we were not able to make the first 7 payments because we were still not working. The loan was delinquent. The loan modification consisted of maintaining the loan term and reducing the interest rate by ¼ of a percent. It was 5.5% and went to 5.25%. What does that mean? It means that our original mortgage payment was $1700 and it went up to $2100. The just tacked on what we owed to the back of the loan and kept the loan term.

We eventually were able to bring the loan almost current, so that we only owed 2 payments. I wanted to bring the loan current so BOA suggested I apply for another loan modification for those two payments. I agreed and submitted all the documentation they requested. The loan officer Marina Henry based out of the Dallas, TX office told me to be considered for the modification you had to be at least 2 payments behind to be considered for the program and to not make any more payments because I would be ineligible for the program. I received a letter stating that I was not eligible for the program in May 2013 because I filed bankruptcy in 2009. This is the INCREDIBLE PART-I called Marcina and she told me to disregard this notice because it had been sent in error to literally hundreds of borrowers and it was not applicable to me personally because I had filed bankruptcy back in 2009 and this letter was sent out in error because that would only apply to me if I was currently in bankruptcy proceedings, which I wasn’t. Two days later I received a letter stating my house is in foreclosure. I called Marcina and never was able to get a hold of her and was assigned a new account manger Crystal Wright out of New York. I told her Marcina had informed me to disregard the notice and she said she was aware of this fact but it was NOT INTENTIONAL To mislead me but Marcina was misinformed and the policies changed as of March 2013. She also informed me the only way the house will not go in to foreclosure is bring the loan current to pay $10, 000 + penalties within 5-7 days! BE-AWARE of Bank Of America-They are Dishonest and have Sinister agenda

Th!sman- you comments reflect not only your level of education and lack thereof, but also your lack of understanding of both the financial and economic outlook at that time. I have worked my entire life and have paid more in taxes over my life time than most will earn in theirs. For you to insinuate I'm a deadbeat illustrates to me fully your level of ignorance and more importantly you moral character. So do all of us a favor and keep your negative, ignorant comments to yourself. I'm currently working with a forensic attorney because BOA at this point doesn't look like the title holder because they sold the loan and do not have the authority to proceed with foreclosure. When I mentioned this to BOA today one of their many mangers have asked what it will take to make this situation right. These comments have been made to help other homeowners in this situation not to be commented upon by an illiterate twit.

Sorry about the prior post, typed it from my iphone and some characters were corrupted when it posted.

You didn't. The littledaddy33 person, with the bad english, said something about deadbeats. I didn't really understand what this person was saying but it was weird. I suppose the S.M. Frisco TX person didn't read well enough to see that you were just giving advice, and that the littledaddy33 person was the one being strange. It was really funny though reading him go off on you when you didn't even say anything.

th!sman,

S.M. Frisco TX created their own problems and why I say that is they lost their jobs, but they to re-finance and they think a bank should help them when they to file a BK. S.M. Frisco TX an easy way out instead getting a job and doing what is right or they could be raised to be deadbeats.

failure to return funds

Bank of America deposited over $1000 of my money, in my name into another account. The account number between the third party depositing the money was some how incorrect and off by 2 digits. Bank of America does not confirm the name of the person receiving the money and the account number, be aware! This is a huge flaw, and it should be criminal for this to happen! I didn't even think that it was possible that my money could get deposited into the wrong account and no hope so far of it getting returned, so someone just gets a bonus of over 1k? CRIMINALS!

The complaint has been investigated and resolved to the customer’s satisfaction.

On Friday November 20, 2009, I went to the internet to pay my Bank of America mortgage payment for November, formerly Countrywide Mortgage. I entered all the correct information and hit the submit button (which you are supposed to hit only once). Well, I did hit “submit” but nothing happened – no confirmation – nothing. I waited and waited. Finally it was apparent to me that something was wrong. So I closed out, checked my account for the deduction – there was none – and then went back and tried over again. Same results. Frustrated, I called Bank of America and told the associate I shouldn’t be charged for over the phone payment since their website wasn’t working. She apologized and stated that with the transfer from Countrywide to Bank of America, they have been experiencing “technical problems” but would be happy to assist me in getting my payment in. This was only the beginning of my problems with B of A.

The next day, I checked my account and lo and behold there were TWO mortgage payments deducted from my account! I only wanted ONE. I never gave instructions to have two deducted from my account. Obviously some error occurred – most likely at the website. So Monday I called, spending 45 minutes before finally reaching the right party to assist me. I was sent to the Payment Research Dept, where I talked to Sharon. After a lengthy discussion, she told me it was approved for reversal and that it would be DEPOSITED BACK INTO MY ACCOUNT WITHIN 72 HOURS. That would make it Thursday, but being a holiday I shouldn’t see it until Friday. Ha, Ha, Ha…. And so begins the string of lies/deception/whatever I was given regarding my money.

On Tuesday November 24, I received another confirmation from Bank of America which I erroneously thought was another payment notification. (I was told on Monday that I should have 2 confirmations but I only had one so naturally when I saw B of A confirmation, I assumed it was for the second payment withdrawn on the 20th.) Now not knowing what is going on, my thinking was oh no, they deducted another payment! What is going on? So I contacted the bank again. I was assured that no further mortgage payments were deducted. I told the associate that this 72 hour business was totally unacceptable. Monies were withdrawn IMMEDIATELY but crediting my account back would be 72 hours? No no no. The associate then told me that the money goes to the “Federal Reserve” and it is difficult to get the money back and that is why the time frame. Again, I found this unacceptable, but had NO CHOICE. In other words, “tough luck lady”.

On Wednesday, November 25, there was still no money in my account. So I called again --- going through tons of hoops and holds, only to have the connection lost during one of the phone “transfers”. By now I was completely agitated so decided to stop in person at a BofA banking center and have a one-on-one assistance. I went to the Massaponex Banking Center in Fredricksburg VA and talked with Doris, who went hoops to assist me. After about 40 minutes, she assured me that I had been approved by the Payment Research Dept and I would see my money in my account either after midnight (Thursday) or first thing on Friday.

Neither Thursday nor Friday gave any results. So around 11:30 am I called Doris and asked her to please, please find out what is going on. She was reluctant and stated why didn’t I just do the calling. (See above). It was somewhere around 3:30 – 4 pm before I heard back from her. Basically she could do nothing and I’d either have to call myself or just wait.

Back to the Payment Research Dept where I finally connected with another associate (she was very nice considering I could hardly talk because I was in complete tears) but now I was told that the bank was short handed all week and my approval just sat there. It would be credited to my account asap as she was putting a “rush” on this. Well, Saturday no money. Monday no money. It is now 10 days from taking my money making it impossible for me to use and left with the feeling I was being given the run around. First thought, oh, it’s the end of the month --- hmmmm reports need to be done. Gee, if they did this to say, another 500, 000 or even 5, 000 people, imagine the amount of money B of A is getting to use!

Well, I created a list of contacts to file a complaint on Bank of America. However, I thought I’d give it one more chance. I called the B of A Center in Central Park, Fredericksburg, VA where I talked to a very nice and understanding manager – Keith. He apologized and agreed that I was treated unjustly. He stated since my Friday conversation was after 2 pm, and that the associate said she’d put a “rush” on it, I should definitely see my money back in my account by Tuesday, December 1 (today).

Guess what! Nothing! It is now 11 days later and I still don’t have my money back. Customer service is ABHORRANT!

Reviews and complaints from employees about working at Bank of America http://masterjobs.net/bank-of-america

In our situation we are now a month in. When checking on where the excess funds that were illegally withdrawn from my account were at, (which they can see was taken illegally since I verified on audio tape with their rep more then 3 times what the exact amount being authorized was) I have found out that the rep who entered it did so incorrectly & it was send back invalid. Instead of contactin anyone (they do not leave a message by phone or email & didn't contact the alternate numbers on the account) They just decided to hold onto the funds and play a waiting game to see if we didn't notice that we hadn't been refunded the hundreds of dollars they stole. Now that I have checked they say we have to re-submit all information a 2nd time. How the hell does a company doing business like this get an A+ rating with Better Business Bureau? It sickens me and I'm in the real estate business so I find it humorous when they start quoting RESPA regulation to me as though I don't know whats going on. It quiets them very quickly when I inform them of this fact. They like to give of the image that they are being helpful but I have yet to see any positive results from them.

I'm going through the same thing. I'm trying to refinace. They say I've been 30days late for a year. I make my payments on-line. The website says I'm paying the current month. My credit report says paying as agreed. I never got notice I was late...because I wasn't! Do I have any rights here? Why can BAC get away with all this bs? Is there anything an individual can do?

Yep. The same thing is happening to me right now. If I could afford the closing costs, I would refinance with another bank.

I am dealing with the same issue. Have a Home Equity Loan that was with Countrywide and now with Bank of America. I had been making payments on line to the Home Loan and two months ago I realized that even though the payment history shows my payments on their website, they have been applying them to some other account. I was doing paperless billing so was relying on the payment history on the website, then when I got a notice in the mail for all the month of no payment, that's when I called and found out the mess at the beginning of April. And here we are May 14, 2010 and they still can't figure it out. My Credit Union was even bridge on the phone with Bank of America to provide the Raw online payment files and they still can identify what account the funds are getting posted to. Meanwhile this is killing my credit and my second job (the Census Bureau) ask if I was delinquent on a federal loa, which happens to be a home loan. And it all adds up to a mess due to Bank of America's screwup. They still can only tell me they are researching and that their payment research department has found the payments being applied to a gold option visa/mastercard. But one problem with that, I don't have a credit card with them. It has been so frustrating calling them every day and speaking to many supervisors who insist the research is being done but cannot give me a letter explaining they have received payments and that credit report will get corrected once this research is complete. That would be enough to give my employer to show them I am not 9 months deliquent. I actually have a consultation and will be spending some money with an attordy starting today for I have had to take days off work and now my second job is on hold and Bank of America still can't get it together. I HATE: BANK OF AMERICA.

My Credit Union even emailed me the raw data files on the online payments since Bank of America does not know what to do with. so after many calls Payment Research is just telling me they need to research and will correct it as soon as research is done. So when I ask how long that will be for it's been over a month of me working with them and they cannot say for this takes time. I finally paid an attorney to help me. Didn't know what else to do. Crying didn't help but it made me feel better. email me if you have any idea's (betty.bustillos@gmail.com)

Same thing happening to me. I accidentally made two payments, two separate months. I asked to get reversed two payments, and this was two weeks ago. 11 calls later, stil nothing. I received the same response, call regular BAC mortgage number, then get transferred to payment research department. I submitted, THREE TIMES, my checking account bank transactions to show my payment cleared. THEY DON"T NEED THIS! It's cleared on their end, and they have my money, and that's the end of the story. They made up an additional step to keep your money, per "policy." Bunch of ###. I work in accounting, and they don't need this. It's like going into a store to return and item, to get a refund, and they state, I need to see your credit card statment to see that your payment to us has cleared. ###! WTF? IT"S CLEARED AND BEEN CLEARED FOR OVER THREE WEEKS! Thats why I'm ###ing calling, you stupid ###. If it didn't clear I'd have my ###ing money. But I don't. Therefore the call. You can clearly see I made a ###ing payment, 4 times in two months. I'm asking for two of those back so I can pay my ###ing bills.

The same mess just happened to my wife and I. We just bought our first home in Sept 09 shortly after getting married. She just graduated and started a career and I work night shift at the nissan plant and attend middle tennessee state full time during the day. They are slowly, but surely, taking it all away from me.

We attempted to make a payment over the phone but the voice recording could never get the date or anything we said, correct! In turn, I decided to pay it online. The first attempt, however, did not do anything except take me to the previous page. So I went on and did it again after checking under the link that says something like cancel payment or whatever. Well a few days later a transaction went through... "house payment went through babe!" The next morning after work I had my suntrust debit card declined. So I once again checked my account and what do ya know... another $1100 payment went through!

So I did the whole faxing the statement thing in hopes of getting my payment paid back as well as the $700 worth of overdrafts and two checks that bounced. they called two days later and left a voicemail saying they had info on my reversal payment. I called back with hopes that i would be getting my money. Once again i was wrong. They just wanted to tell me that everything was ready to go, but they just needed me to send them my bank statements showing it actually went through. I said that it had been done already...TWICE! not by me but by the branch manager at my bank. anyways it's too much to write, but to let ya know, we are still waiting after a week! Our balance= $-1600. I have no idea what to do. bills are popping up everywhere, rest of tuition is due next week, supposed to go to doctor for mri on rotator cuff, called out of work because I didn't have gas to get there, and so on.

If I ever see a customer rep in person, especially CHRISTINA, I will grab the nearest food item and have it make physical contact with his or her skull! Screw BofA and every last one of the representatives, but most of all... that stupid recorded voice woman that seems to only be compatible with an early version of oregon trail!

Yes, the same thing is happening to me. Very similar situation, Countrywide customer now at B of A, but in my case, they claim that I had an automatic payment set up. Not true, and even if there had been some glitch and it had accidentally been set up, there was no indication anywhere on my records that an auto debit was in place. So I paid once online, and then a second debit came out of my account the next day. I am now on day 14 and still no money. The first three days I called they said the computers were down in the repayment department, then I finally got a supervisor, who promised to have it back to me in 24 hours . . . that was a week ago. I call every day, always the same: 24 hours. Finally today I've talked to someone in Payment Research (the first I'd ever heard of such a department, but apparently I should have been talking to them all along. Thanks, customer service), and guess what . . . thats right. . . 24 hours.

I take down names, first and last, extension numbers, and locations, and I can never get the same person twice. They have a perfect firewall system in place so that no one can claim responsibility or be held accountable for their actions. I, too, tried to go to my bank for help, but they could do nothing--the fellow I talked with actually laughed at me!

All this nine days before Christmas . . . Christmas!

I realize it's futile to say this, but something really should be done to prevent B of A from treating its customers like this.

Eric in St. Louis MO

corruption & racism

Dogged by lawsuits for the past four years, now has another one on its plate – and this one may gain the most exposure in racist Augusta Georgia: Racism, corporate corruption, securities fraud lawsuit accusing Corp Chief Executive, the Augusta Branch Staff- discriminating against & mistreating customers who are African-American, and stealing money from customers!

It does not matter what the buyer "did" or "did not do", "what they said" or "did not say" if a buyer wants her/his deposit back a cat breeder will infact give it back or have a police/sheriff report filed its that simple, case closed!

False advertisement/fraud

Date: 4/17/2013

Dear Sir/Madam:

Re: False Advertisement/Fraud

Please be advised that I am submitting additional information and proof that the attorney hired by Bank of America placed an ad in the Times Picayune newspaper on March 27, 2013. This ad was actually placed in the newspaper after I filed a complaint with your office for investigation.

Most importantly, after speaking with Attorney William M. Doyle on March 6, 2013 by phone regarding the issue, he informed me that he would return my call on the following day to discuss the matter in regards to me not being properly served the foreclosure documents. But, instead of Attorney William Doyle returning my call he decides to place an ad in paper about my whereabouts without my knowledge.

Furthermore, when Mr. William Doyle answered the phone he announced that he had found me. I also want to state for the record, Mr. William Doyle filed this ad on March 27, 2013, in The Times Picayune newspaper knowing that he was to return my call the following day.

Service request number: #1-[protected]

BOA Acct. ending: #2126

fraudulant forclosure

My house was forclosed on back in 2010 i recieved letters stateing that a auction date had been set and that if i wasnt out by sept of 2010 that sheriffs would be there to kick me and my family out i had been told by boa that i had no options as i did not qualify for home mod and it was to late for a short sale i then asked if i could continue makeing my regular payments plus an additional 300 a month to pay back the then 5000.00 dollars i was behind i was told no. then i spoke with the help numbers they provided and was informed that once the auction date passed the forclosure was done and that since it was a non judicial forclosure the bank could not sue me for the remaining balance so i picked up my family and moved into my moms basement in montana. Two months ago i was checking my credit report and found an active mortgage with boa showing that i was 41, 000.00 behind in payments with no mention of a forclosure i then did some research and found that in sept of 2011 a full year after the forclosure that boa did a discontinuation of the forclosure and furthermore a month later in oct 2011 changed the locks without at any time makeing me aware of the situation fast forward to today and ive been fighting with them for two months trying to get the situation resolved and they keep passing me off from one person to the next ive been calling every number ive gotton from every manager i can get and now it seems theyre just refusing to call me back

securities fraud, mortgage fraud

. Research the courts documents for Satisfaction of Mortgages and refinances lines of credit as well as reverse Mortgages. If they are willing to walk away from millions it is because they are scared to be discovered for the billions they have hidden all this time. 3 billion is nothing., The four entities I have disclosed since October 2012 have laundered trillions out of the Federal Reserve, Bank Of America, HSBC, Citi Bank, Naval Credit Union, and the New York Mellon Bank and transferred to Deutch Bank, Israel Bank, Iran, and World Bank. I have never miss lead your administration despite all the games they have played with me. I expect to be rewarded for all the work I have done and the information I have provided. I do not need an Attorney. I am capable obviously more so than what I have witnessed by your administration, the FBI and the IRS since I am the one who has provided the documents needed to bring the Banking, and Securities fraud criminals down. I am asking you to please re-open my case under the Whistle Blowing program and to honor my claim. Remember I have 4 claims with the IRS, 1 claim with Medicare/Medicaid and 1 claim with the pass port division. It is not right I am being treated like I am the criminal and not given the respect I deserve. I have never lied nor miss lead anyone but yet I continue to be treated badly. Please Mr. President Obama I deserve justice and I deserve my rewards for what I have disclosed. Everything I sent I sent immediately after I found it. Ironically the activity was taking place during the same time I discovered it. Everyday I would photograph what was posted on the registry that day and I forwarded it on to [protected]@barackobama.com and the fraud division of the FBI(FFETF)There is no possible way anyone sent what I sent especially in the time I sent it in. Now I have had my video and my petition removed so I can even request to have it investigated. It is not right. I am a US citizen and a Veteran as well as a law biding citizen but yet Lawyers, Government officials and politicians are continuing to steal from me as well as others that come forward. I am asking you with all do respect, do your job. The more you remain quiet the more it appears you are involved in this and that is what they want. Guilt by association. By being a witness to a crime and not pursuing the criminal is obstruction of justice. They have every intention of pulling you into their crimes so they can hold it over your head and force you to conspire with them. I have never misled you Mr. President. I urge you to act. I will not give up. I am not breaking the law. Everything I have I received on public domains. Nothing I have was classified and I am in my rights to expose them with the material I have. Freedom of Speech. I do not want to discredit our Banking system and expose the corruption on my own but I will If I need to. It is within my legal rights to do so. I need some kind of feedback from you. Direct contact. I called the White House and spoke to operator 14 Dan on 03/19/13 and left a message. It is not right that I continue to be kept in the dark when I have been the White Light shining on your administration. I deserve better in my Journey. My video is on you tube under darline spencer whistle blowing

account closure

Received letters from b of a advising our business had 21 days to close all of accounts. This included 2 business checking accounts. 1 personal account and the companies profit sharing and trust account. There was no explanation given by the local management and a recorded message when we contacted them via the phone number provided by them on the letters . A rep returned our call just to tell us she was not permitted to give us a reason. Our company generated approx. 2 million in deposits each year, including merchants services and two mortgages. We never had a late payment, bounced a check, or overdrawn. Current credit rating is in excess of 800. This situated is not only humiliating, but also creates a great deal of anxiety for our customers and employees. It makes no sense to us why a company can accept federal bail out capital from our tax money then turn away business that generates positive cash flow from the public sector.

The complaint has been investigated and resolved to the customer’s satisfaction.

Hi,

I have closed my Checking and saving account 04th Aug 2010 since i have left the country. I was told that the account will be closed and the amout will be sent as pay order to my International address i.e. in India. but i haven't received any confirmation regarding account closing. Also, i ahven't received the pay order as of now.

Please look into the issue ASAP.

Thanks

Manish Goel

My complaint may be small by comparison yet, cumulatively, it has substance, I have been with the B of A since 1973, recently requested a new ATM card (mine was warped) they charged me $5.00 to replace, this is not the only nonsensical charge I have gotten, to numerous to mention.

freddie e. boatfield deceased

Home equity loan [protected]. Estate of freddie e. Boatfield. Letter of testimentary 1/31/13 from executor james johnson. Results-sucess. Donna boatfield bishop 4101 reynolds rd pays the loan of over 5 years now. Called [protected] as told by douglas branch still told cant discuss the loan not in my name. Phone number 770/852/1684 donna (Boatfield) bishop. Need help with this ongoing problem.

The complaint has been investigated and resolved to the customer’s satisfaction.

Legally they can ONLY discuss the loan with the executor of the estate.

short sales

I purchased my home at 55, 000 in 2008. At that time I struggled for several months to make my mortgage payment, and was also hit with some medical payments that I did not expect (The cobra payment was more than twice what I was paying when employed). I knew I would have to sell my home to protect my credit rating and possibly have enough cash left over for moving expenses and some savings. I put my home up for sale in oct 2012, but there were several problems that I did not have enough money to fix, such as the broken fence in the back yard and some pretty severe leaks in the roof which indicated a new one was needed. Over the next three months I lowered the price three times and received 3 offers. Boa didn’t except the offer for 23, 500 and it was appraised for 21, 000. I am now working with a real estate agent and I believe she will be able to help me sell quickly. I really love my house, but I know that I cannot afford it. I am a single parent, working as a temporary employee with few benefits and no savings. My financial situation cannot sustain a home mortgage of nearly $500 per month. I want to sell the home, avoid foreclosure and salvage my credit. I know that a foreclosure on my record will affect me for years to come. I would ask that you please assist me in avoiding this. Please accept this offer as payment in full. My attorney has advised me to file bankruptcy, but I prefer to avoid further destruction of my credit. I just want to move on and start over. I deeply appreciate your help and understanding in this matter. If you have any questions, or need anything further from me, please contact my agent or me personally please find out why boa didn't to except the offer and how I can short sale the house. 4811 time street memphis tn 38127 acct [protected] brian mitchell [protected] ext 58115. All paperwork is scanned into equitor system and there is nothing me or my real estate agent has to do. Sherritt mccray at [protected] can validate that we have completed

The complaint has been investigated and resolved to the customer’s satisfaction.

gold option credit line

I took out the Gold Option Credit Line to pay off some hospital bills in 2006. The loan was supposed to be paid off in 2014. About a year ago I noticed that the principle amount on the account was not getting smaller. I called and was told that "something" happened in 2007 to change the terms of the loan, but she would NOT tell me what the something was. I requested a history report of my payments and all I was sent was a copy of the current terms. I borrowed roughly $30, 000 and have paid them over $50, 000 to date and still owe an additional $21, 000 through 2018. When I call they give me a run around. I asked to speak with a supervisor today and they sent me to collections. I haven't missed a payment since 2006!

customer service

i have been going to this same branch since 06. this branch is where they train so there is always new faces. the biggest problems with this branch is the slowness and the tellers calling you up to the counter but there ready for you yet so they keep you standing there waiting. one older lady Ann does this to us all the time and this past Thursday i had said to her that you called us up here and your not ready for us. the lady next to you could of helped us in the time you left us standing here. Ann was adding up checks and stamping them from another account and then she went into the back. don't call a customer up if your not ready for them. the slowness is crazy slow. if i go to the branch down on gulf boulevard i am in and out.

I deposited a check to my account 2/2/09; it cleared 2/3/09. Then bank of america said the check had a stop payment placed on it 2/5/09 and withdrew the money from my account. 2/9/09 the issuer verified the check cleared with a bank of america representative over the phone; but bank of america would not restore the funds to my account without a copy of the check; needless to say this will probably take 7 to 10 business days. in the meantime my checking account is overdrawn; and bank of america has still not admitted to their error.

Have been trying to call for two weeks and the two times the phone has been answered, I have been transferred to lines with no voicemail on them. They are not much better in-person either. I worked with a personal banker to open a small business account and the manager who assisted her was rude to her and didn't even acknwledge our presence.

I have been a Bank of America customer for many years. Then, when I was relocated overseas, I suddenly had no more access to many of the online banking services. Apparently, if you do not list a US address, then you are no longer a valued customer. Nothing has changed about me except my mailing address. They had no qualms about accepting my deposits but now I cannot transfer the fundsto my son's college or to him.

Customer service is run by ###s who give cut & paste responses that are ridiculous. Let's see: "please visit your nearest BoA service center" like where? in China? "Please call our CS number"...sure, at my own expense while I sit on hold for 30 minutes "waiting for a representative to become available." The best line was that since I have a foreign address, I am now an "alien non-resident" in my native country! I am not only insulted but absolutely disgusted that in a global economy, which encourages people to work in many locations, the largest bank in the world cannot be more accomodating with their "online" banking services.

If you are an expat or planning to move overseas - do not rely on Bank of America for your financial services. You will be left without being able to access your own money.

Bank of America sucks! I've been trying to get a hold of someone to answer a question about my home mortgage loan and why they made changes to it without my authorization and I am yet to get to the right person to answer me. Every time I call, I am kept on hold for 20-30 minutes only to be told that it's not the right dept. and they need to transfer me, and then I hold for another 20-30 minutes. After a coule of hours of being on hold and getting transferred, they just hang up, so I never get to the "right departmment". This is the worse system I have ever had to deal with.

I am yet to get a hold of the "right department" and someone who could give me an answer.

I had agreed with Bank of America to make payments on my credit card.

I wrote BOA a letter informing them I would only be able to pay 50% of the payment.

I lost my employment and religiously made my payments.

I continued to make my payments religiously.

After about 5 months they called me and said I should stop sending in payments.

I was flabberghasted !

I subsequently stopped the payments since they told me to.

Subsequently, collection agencies started contacting me.

I have adapted a letter that I now send them registered mail.

It stops the telephone calls and they quit contacting me.

I am not encouraging anyone to stop paying their credit card debt, but if you are ill-treated like me I encourage to act accordingly.

Very Poor Customer Service

We did not have our mortgage transferred to Bank of America by choice, it was sold. And I have hated it ever since. I tried to set up online banking, we were having some trouble keeping up on our payments (they were paid, just sometimes late). I tried to go online to make the payment and it said there was an error message, I had to call customer service. After being on hold at least 15 minutes, they said they had to transfer me to someone who handled website problems. I was on hold another 10 minutes, only to find someone who figured out that the website would not let me make late payments and I again had to be transferred to customer service to make the payment over the phone (god forbid they explain any of this on their website when they give you the message to begin with). I was on hold for over half an hour only to be charged a fee for making the payment over the phone.

On more than one occasion I have had to do this (not the issue that I'm focusing on) to be told by the customer service rep that there is a late fee I need to include in the payment. i have done that every time, only to consult my payments history a few months later and discover that none of those payments have been applied as a late fee, they've either been submitted to the principal or put down as a credit towards the next months payment. It took another 30-40 minutes on hold as well as talking to several different people (there was a $15.00 discrepancy and it took being transferred to a manager to find out that it was a fee for determining house occupancy). No one had an answer as to why I was told there were late payments when there weren't.

This last time I tried to make payments online only to discover an error message, yet again. I was on hold over 10 minutes to be told I needed to talk to someone in the website issues department. Transferred and on hold yet again to be told to clear out cookies/history and restart the browser. I did that, no effect and called (on hold yet again) to finally find out that if we are filing a ch13 bankruptcy, the customer service rep doesn't think we can make payments online, it has to be over the phone. (Fine, why couldn't it have said that on the website or had some sort of message the first rep could have seen when I called?)

Every time I call I have to speak to at least 3 different people to get a correct answer (and then it's always, "well, maybe it's this issue...") and I am on hold for over 30 minutes just trying to do something as simple as make a payment. Apparently because of our attempts to file ch13 bankruptcy we now can't even make payments online or even view the account history. I am especially peeved about being told there were late payments when in fact there weren't (because they were trying to get us caught up on payments). That in itself is only a few hundred dollars, but that's a few hundred dollars that I could have put towards another bill.

Frankly there's a part of me that's rather glad that we're trying to get the mortgage written down. I would never willingly do business with this company again. Oddly enough, having a credit card with them was much easier.

WOW.. This is a comment for ALL OF BANK OF AMERICA.. Beware all banking customers who want to invest their money in a bank that takes care of their customers. After noticing my credit card account was not showing up on my online account, I called Bank of America to help troubleshoot... where I sat on hold for THIRTY MINUTES... at which point a woman came on the line and told me that I would have to call back "in two hours or tomorrow morning" to speak with someone because the systems were updating. Excuse me?! Why was I sitting on hold for thirty minutes to find this out? And when I asked if I would be able to speak with someone in the morning, or would this happen again, she told me that I would just have to call back in. WOW. I have been a Bank of America customer for SIX YEARS and frankly have never been more upset with a company. In tough financial times, I need a company that will staff their customer service lines so that I can speak with someone promptly and not "SOON." Keep away from Bank of America!

After BOA's on line banking site did not accept my log in information it locked up. I went to on line chat to reset. They asked for information that I was seeking on line which of course I couldn't get. I had my account number, my debit card number with the three digit number on the back and other information such as the details of the two accounts I closed with them on the third because bank errors that cost me around $52. When the account locked it provided a number to call which was unavailable until the next day. After half an hour with one person I was given the same number. I asked for a supervisor and after another half hour answering the same questions I previously answered I was given the same number. Three times I was asked for the branch and provided it. It doesn't match their records? They stall, go over the same info time and again trying to wear you down then pass you on to the same unavailable phone number I got when I was locked out and which began the process. Rather than call the number I will go to the branch that doesn't match their records and cut my last ties with BOA. It will be a good morning.

WORST CUSTOMER SERVICE BANK IN THE COUNTRY. Everybody knows it. When are those rednecks in Charlotte going to do something about it. Hiring people with IQ's over 40 might help.

mortgage fraud

To all consumers debating getting involved in a hamp program. Don’t do it!

The below letter was sent to the maryland attorney general’s office detailing bank of america’s (Boa) fraudulent activities involving my hamp mortgage modification. The attorney general’s office stated they would not handle this case and would forward my documentation to the us federal trade commission, bureau of consumer protection. Several weeks later, I was contacted by bank of america who advised that they had received my documentation from the ftc and would follow up on my complaint. So basically, the company boa that i’m complaining about has all my supporting documentation. They have insisted everything is in order but cannot explain the escrow irregularity and refuse to provide a matrix of how they arrived at my payment and fee amounts. No state or federal government entity cares about these issues. Put me in with any class action lawsuit filed against bank of america. My request for hamp was based on a brief period of unemployment.

Attorney general’s office maryland

Consumer protection division

200 st. Paul place, 16th floor

Baltimore, maryland 21202

September 13, 2012

To whom it may concern,

This four page cover letter is seeking your assistance in reference to our submission # 218675. I am convinced that bank of america (Boa) is committing fraud against me and hud fha. The listed time line is provided for your reference. Please see attached, boa fha hamp trial period documentation, dated 9/25/10. Boa completion of trial period plan, dated 4/20/11 and boa pending approval for permanent modification dated 8/21/12. Also attached are mortgage statement and escrow balance sheets. Thank you in advance for help in this matter.

Original monthly loan amount $2091.78

Based on boa’s own hamp calculator, using my income and debts, my payments should have been $1, 691.00

On 7/20/2010. Made initial call for modification

On 8/5/2010. Submitted required info via fed ex. With letter notice of new job with no pay stubs yet. Attached notice of pay rate pending stubs.

On 8/27/2010. Called to get fax number to send two pay stubs. Sent two pay stubs via fax.

On 9/3/2010. Called boa in underwriting, send another current bank statement. Needed current bank statement sent via fax. Three statements sent total. Assigned to francis thompson.

On 9/15/2010. Todd said in underwriting.

On 9/22/2010. Jessica stated nothing changed call back in a week.

On 9/23/2010. Boa letter stated denied because of date. Received on 9/24/2010

On 9/25/2010. Terri spoke with marneesa, stated we were approved for mha will receive 3 month trial period info in 2 to 3 weeks.

Approx. 10/6/10. Received fedex letter from boa stating we were eligible for the fha home affordable modification. Returned requested documents to boa prior to due date of 10/25/2010. Letter stated to begin making three month trial period payments of $2, 095.84 on 11/1/10, 12/1/10 and 1/1/11. All payments were made on the due dates.

Call boa regularly after the trial period and was told our case was in underwriting.

On 4/20/11, received fedex packet from boa stating you have successfully completed the trial period plan. We completed the packet which required us to agree to having $15, 147.44 as a second loan for the modification. We had paperwork notarized and returned to boa prior to may 20, 2011 deadline. Also included first modified payment of $2, 056.46 with the documentation.

Continued making monthly payments as required since 11/1/10 and called regularly about the status of the modification. Advised paperwork has not been finalized.

Currently payments are being made monthly for $2, 056.46

On 8/10/11, we received a letter by usps from boa advising us to contact a boa customer assistance center to schedule an appointment with a counselor. The enclosed documentation requested by boa is the same documentation they requested and received a year ago. No appointment was made with boa.

From august 11, 2011 to present, I continued making routine calls to boa concerning finalized modification and have spoken to the following people.

Francis thompson

Allen lorne

Kenneth brown

Jaqueline edelen

Deon rashad

Linda linsey

Ronnie raja

Received letter dated august 31, 2012, from bank of america advising that our mortgage modification is near finalization and requested we sign, notarize and date the attached agreement. After reviewing the documents I noticed several errors. I immediately call bank of america and spoke with kenneth brown and advised him of the errors and made him aware I would not sign them due to these errors. Mr. Brown advised me after I sign the papers the statements would straighten themselves out. I advised him I was not comfortable signing with these errors. I explained to mr. Brown the errors that I found and they are as follows:

1. I explained to him that our payment is 2056.00 and for the last 23 months our statements are saying 2477.75. Why and when did our payment increase to 2477.75? After speaking with kenneth he stated that in october 2010 our payment was changed to 2, 477.75.. I asked him why was our payment changed our taxes and homeowners insurance did not change so how could my payment go up by $421.75 a month. He did not have an explanation and explained to me that after we sign the papers our statements would reflect correctly. I explained to him I was not satisfied with this explanation and who else could I talk to.. He advised me he had a meeting at 9 am and he would run it by his boss. I did not hear back from kenneth that afternoon so I called him back and asked if he found out anything. He advised me he spoke with his manager and they sent it up to underwriting to check for errors. I advised kenneth that this matter would have to be rectified in 3 days because the modification due date is september 15, 2012. He advised me he would call probably the end of the week.

2. The modification paperwork has the following errors:

In the partial claim amount section it claims that we will owe fha 18, 293.26.. It list 4 months of arrearages at 9, 911.00, this divided by 4 equals 2, 477.75, if you will note this is not the modified amount or any prior mortgage amount…this amount was created at the time the fha hamp trial period started…all the other fees are based off of the incorrect monthly mortgage amount! It reflects past due interest at 4, 748.26. It shows and past due escrow 6, 472.09. And other deferred amounts totaling 4, 662.70. This is all stemming from boa changing our payment when we applied for modification.

Prior to the modification as you will see in the attached statements our escrow payments prior to modification were 453.49 a month. Once we agreed to the trial plan the escrow monthly payment increased to 839.46. There is no reason for this increase. There has routinely been a positive escrow balance. Why would they all of a sudden double this.. Even the most recent mortgage statement reflects an escrow balance of 4, 313.34. Also this same statement reflects unapplied funds which is money we have paid 5, 748.09.. Obviously the unapplied funds balance is large because boa expected us to pay 2, 477.75. So with them changing this payment for no reason and not continuing with the modification amount they considered each modification payment as insufficient…boa can not answer why my payment went from 2, 056.00 to 2, 477.75 after filing for a modification. I think I know why the mortgage amount changed. Boa gets reimbursed quickly by hud fha in the full amount of the partial claim amount. The higher boa got the partial claim amount the more money they make. So by making up a bogus payment amount they get more immediate government funds. Of course, they don’t care if the math is not correct, i’m the one having to agree to pay hud fha back on a subordinate note. It was a pretty clever idea boa had. They knew we would pay the agreed modification amount of 2095.84 while they claimed our mortgage payment was 2, 477.75. This would always show us as being behind and not paying the full mortgage amount. On their end it looked like they were paying overage costs and escrow deficiencies and absorbing late fees. This was clearly done to defraud me and hud fha.

In closing, I was looking for mortgage assistance and desire to keep my home. Boa is trying to force this modification down my throat and sign the paperwork with any fraudulent numbers they provide or face foreclosure.In the end, my initial mortgage payment was 2, 091.00 at george mason mortgage (See attachment) and then sold to boa at the same rate and payment schedule. The new modified mortgage amount is 2095.84 (See attachment). But according to today’s phone call with boa the new payment will be 2, 105.00 this is a scam without a doubt.

I appreciate the assistance of the attorney general office. I and most other consumers cannot deal with this corporation alone. I can speak with you at any time.

Name and address removed.

[protected]@aol.com e-mail

said i was credited 10.3 million dollars

mr.brenake officer of bank of america{aid send 185.00 to Peter Nweke, nigeria, city Abuja bak of america. And they would credit my account for 10.3 million dollars.

Read full review of Bank of Americaharassing phone calls

The company started calling me today twice, I am disabled and have an attorney and I am waiting for me court date and I cannot pay right now, The Bank of America has had a letter filled in court about this. They do not have to call me and harass me at Christmas. They know the story. I cannot do anything with a broken back.

Please stop this harassing phone number [protected]. They need to put things in writing.

reverse mortgage scam

Do Not Acquire a Reverse Mortgage with this Bank. They will try every trick in the book to shove you into foreclosure. I was $39.00 short on my property tax payment; I took my payment amount from the County website, not knowing it is not kept current. Bank of America had my payment of $342.00 kicked out, submitted the payment all over again, plus the shortfall, then accused me of having been delinquent in the full amount and started charging me interest and finance charges. They also lied by stating they paid my property taxes way before I did. Even when they demanded the entire amount under threat of foreclosure, and I mailed it to them, they held it for over one month, then sent it back stating they did not want it. Of course not. They wanted those charges to keep accruing. They are now over $1, 000 for a $39.00 shortfall that I paid one day after Bank of America interfered. Then they transferred my account to Champion Mortgage, that lied stating they paid my property taxes. They are licking their chops to foreclose.

My reverse mortgage had a zero line of credit balance, therefore there was no interest accruing. As a senior, we are supposed to stay in our homes until we die if we pay all taxes. But there is a lot of harassment. I was accused of not living in my own home, then taking a long journey which is forbidden, it was one thing after another, all very, very false. During the period of having a reverse mortgage with Bank of America, $1, 600 was removed from my account without any explanation as to why. It took the efforts of HUD over one year before Bank of America returned that money to my account, all the while being extremely nasty to me, stating I had no right to complain as an auditor would have picked the error up sooner or later, and telling me I was foolish and acting "in an unpredictable manner." In short, gender insults. And so, sir, if you want to take out a reverse mortgage with Bank of America, you may have better luck, especially being a male and perhaps younger. I gave up my line of credit because they were making so many errors it wasn't worth the headaches of trying to straighten them all out.

This is actually happening to my in-laws. Same issue as you have stated. Champion Mortgage is despicable.

delay of processing refinance loan

I have had a refinance loan in process with bank of america since august 1, 2012. The loan still isn't ready to close and there something wrong. I think that it is quite possible that the slow process has nothing to do with incompetence or complacency at the bank but something else entirely. Does anyone know how this bank prioritizes the loans that reach the desks of the home service specialists and the underwriters? If prioritizing isn't done by date and by first come first serve basis, how is it decided? What is the determining factors for getting prompt attention? I think it has something to do with money and i'm wondering if some others and myself are in a particular refinance situation that does not afford us the quickest attention. For instance I already have a 6% mortgage loan with the bank and a equity line of credit on which I pay interest only. Truth is, the bank will begin to lose money when it is converted to a 4%. So, are there others out there in my situation?

The complaint has been investigated and resolved to the customer’s satisfaction.

For any one trying to get a loan through the Bank of America, RUN. The are the shadiest banking around. We were stuck with them when our home loan with Countrywide was taken over by them. We had no problems ever with Countrywide and no notice of Bank of America taking over. Since then we have had nothing but problems. First of all we had insurance through Countrywide if we became disabled but that was not included with the take over loan and when my husband became disabled was when we found out we no longer had it.

We have never had a late payment, but we make payment months ahead, which is allowed. We make a full payment write the month it is for and then get a late charge because they continually are putting it in misc. post. Then say we have a late charge because of their inappropriate placement. I have made constant calls to customer service and they would fix the error have them send payment history, talked with an their advisor and used his recommendations, wrote no misc. posts on payments and still have the same thing happening. I have had 16 misc. posts, 4 late charges (waved after I called) and this has been in the last 8 months. We have been dealing with them since 2012.

Wells Fargo has been our mortgage company for 51/2 years. Paid on time every month and we have very good credit. Since September we have been in the process of trying to get a refinance that will lower our payment over 1, 000.00 per month. They seldom answer or return calls and when they do they have a billion excuses as to why the process is taking so long. I finally filed a complaint with the Consumer Financial Protection Bureau and am in the process of going to other banks for the refinance. I do not want them to get one more cent of our money in interest.

Thanks Diane

illegal fraudulant lien

Bank of America filed an illegal fraudulent lien on my property. I bought a waterfront home site in October 2007 with clear title and title insurance. In 2010 I paid off the property and built a house paying cash . In October 2012 I sold the home and scheduled a closing for October 30, 2012. On October 15 the title company discovered an illegal fraudulent lien-of my property and contacted BOA. They admitted that it should not be their and submitted it to the "Corrective Actions Department". BOA admits the lien should have been on my neighbors property across the street BUT they are still stalling on removing the lien from my property. If they do not remove the lien by October 30 I will be in violation of contract and may lose my sale of my property. This is a $250, 000 property. They have committed a criminal activity and are restraining my ability to sell my proprty

The complaint has been investigated and resolved to the customer’s satisfaction.

This seems to be a pattern with Bank of America on releasing liens. I have a paid off mortgage and asked five weeks ago for a lien release letter. They say it belongs to another bank (it was a bank they acquired), even though I have proved to them through the FDIC and Federal Reserve that they are the successor bank.

You have a case. Do what the first guy told ya to do. Dawdling is intent. Easily proveable too.

Get a lawyer now and file suit (injunction) so you can tie up the transaction and include your legal fees in the suit so BOA has to pick up the fees.

bank of america home loan modification program

I have been trying to get a loan modification for almost 2 years now. It started when the film and

TV writers went out on strike and I was out of work for almost 8 months. This was about the same time when the economy crashed and the housing market also crashed. I got some work at the Art Institute of CA. I was forced into retirement last October 2011, because the union had raised the number of hours needed for medical benefits and I couldn't find work since companies were hiring kids out of school for 25% of what I made. I filed for a loan mod with B of A and it was turned down because I hadn't missed any payments. I didn't matter that I had lost just about all my savings trying to pay the mortgage. I tried again, no dice. I went to the Mortgage Law Center, they just had me file out the same paper work over and over again, what a scam and a waste of money, they made it seem like they have teeth, what a joke, they didn't even have dentures. To this day I'm still trying to get a modification through NACA, we'll see how that goes. Trying to get though to anyone at B of A without getting hung up on is also a joke. These guys are the worst. This will be the first month I won't be able to make my payment, maybe things will change after that. B of A, you took a lot of our money in the government bail out, now it's time for you to step up to the plate and help us out after you've taken away all of our equity, helped to reduce what the middle class gets paid and took us to the bank, so to speak!

The complaint has been investigated and resolved to the customer’s satisfaction.

Receiving a modification is contingent upon investor approval. For instance some investors require that you prove imminent default meaning you must be 61 days past due. Hardships can very, death, disability, disaster, divorce are all factors that are considered permanent changes. Please send your information to lmassey@naca.com

Bank of America Reviews 0

If you represent Bank of America, take charge of your business profile by claiming it and stay informed about any new reviews or complaints submitted.

About Bank of America

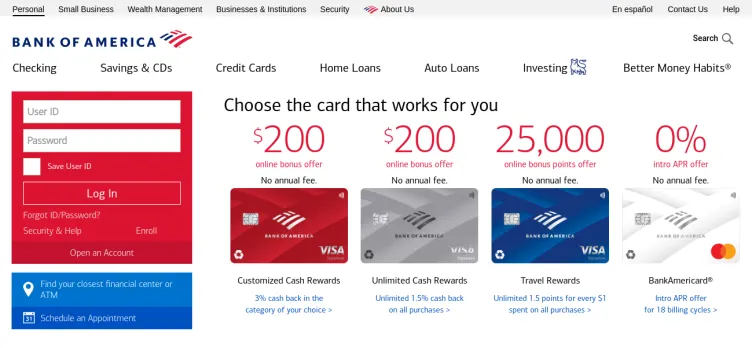

One of the key strengths of Bank of America is its commitment to innovation and technology. The bank has invested heavily in digital platforms and mobile banking, making it easier than ever for customers to manage their finances on the go. With features like mobile check deposit, online bill pay, and real-time account alerts, Bank of America is at the forefront of the digital banking revolution.

In addition to its digital offerings, Bank of America also has a strong network of physical branches and ATMs. With thousands of locations across the country, customers can easily access their accounts and get help from knowledgeable staff members whenever they need it.

Another key advantage of Bank of America is its wide range of financial products and services. From checking and savings accounts to credit cards, loans, and investment products, the bank offers something for everyone. Whether you're looking to save for the future, buy a home, or invest in the stock market, Bank of America has the tools and resources you need to achieve your financial goals.

Overall, Bank of America is a trusted and reliable financial institution that has been serving customers for over a century. With its commitment to innovation, technology, and customer service, the bank is well-positioned to continue to meet the evolving needs of its customers for many years to come.

1. Log in or create an account: Ensure you are logged in to your ComplaintsBoard.com account to proceed. If you do not have an account, please register by providing the necessary information and verifying your email address.

2. Navigating to the complaint form: Once logged in, locate the 'File a Complaint' button situated at the top right corner of the website and click on it to access the complaint form.

3. Writing the title: In the 'Complaint Title' field, concisely summarize the main issue you have encountered with Bank of America. Make it specific and clear, such as "Unauthorized Overdraft Fees" or "Difficulty with Mortgage Loan Modification".

4. Detailing the experience: In the complaint description, provide a detailed account of your experience. Include key areas such as customer service interactions, problems with account management, loan servicing, fees or charges that were unexpected, issues with online banking, or any other specific incidents related to Bank of America. Clearly describe the nature of the issue, including dates, locations, and any relevant transaction details. If you attempted to resolve the issue, outline the steps you took and the responses received from Bank of America. Explain how this issue has personally affected you, such as financial loss or stress.

5. Attaching supporting documents: Attach any relevant documents that support your complaint, such as correspondence, statements, or receipts. Be cautious not to include sensitive personal information like your social security number or full account numbers.

6. Filling optional fields: Use the 'Claimed Loss' field to quantify any financial losses you have incurred due to the issue. In the 'Desired Outcome' field, describe what resolution you are seeking from Bank of America, whether it be a refund, apology, or corrective action.

7. Review before submission: Carefully review your complaint for clarity, accuracy, and completeness. Ensure that all the information provided is true to your knowledge and that your desired outcome is reasonable and clearly stated.

8. Submission process: After reviewing your complaint, click on the 'Submit' button to officially file your complaint on ComplaintsBoard.com.

9. Post-Submission Actions: Keep an eye on your ComplaintsBoard.com account for any responses or updates regarding your complaint. Be prepared to engage in further communication if necessary to resolve your issue with Bank of America.

Overview of Bank of America complaint handling

-

Bank of America Contacts

-

Bank of America phone numbers+1 (800) 432-1000+1 (800) 432-1000Click up if you have successfully reached Bank of America by calling +1 (800) 432-1000 phone number 8 8 users reported that they have successfully reached Bank of America by calling +1 (800) 432-1000 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number 3 3 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number45%Confidence scoreEnglish+1 (800) 688-6086+1 (800) 688-6086Click up if you have successfully reached Bank of America by calling +1 (800) 688-6086 phone number 16 16 users reported that they have successfully reached Bank of America by calling +1 (800) 688-6086 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number 1 1 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number88%Confidence scoreSpanish+1 (315) 724-4022+1 (315) 724-4022Click up if you have successfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (315) 724-4022 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone numberInternational+1 (757) 677-4701+1 (757) 677-4701Click up if you have successfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (757) 677-4701 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone numberCredit Card Issues+1 (800) 214-6084+1 (800) 214-6084Click up if you have successfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (800) 214-6084 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone numberVice President Bank+1 (312) 992-6618+1 (312) 992-6618Click up if you have successfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (312) 992-6618 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number

-

Bank of America emailssupport@bankofamerica.com100%Confidence score: 100%Support

-

Bank of America address100 N Tryon St., Charlotte, New York, 28255, United States

-

Bank of America social media

-

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreNov 09, 2024

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreNov 09, 2024

Most discussed complaints

pmi remove problemRecent comments about Bank of America company

ATM security firm illegal in nycOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.

You would spend every cent of that money fighting B of A in the courts. Take the available funds and close out any existing accounts with this horrifically corrupt entity. Note: When the FED finally collapses the dollar - once and for good - these banks WILL take every penny you have in their accounts. We've already witnessed B of A arresting (through NYPD) patrons when there was a run on their banks last year in NY. No one was able to access or close their accounts, and a large amount of disgruntled patron were actually arrested for trying to do so! Move your funds to a credit union and/or purchase some hard metals to off-set your portfolio - you'll thank me when the final crash hits our markets (in the very near future).