Bank of America’s earns a 4.0-star rating from 4575 reviews, showing that the majority of banking clients are very satisfied with financial services.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

transfer fee

A couple of weeks ago, my husband activated a new credit card. During that call, he was offered the option to transfer a credit card balance at which point he handed the phone to me. I decided based on the information presented to me by Cory Clark that it made sense for us to transfer $5000 to his credit card; however it was not disclosed to me that there was a $200 fee. We intend to pay off the balance before the end of year and had we kept the balance with American Express, we would have incurred lower fees in interest. I would have never agreed to this had I known there was a fee. I even asked if there were fees associated with an early pay off and was told there were no fees associated to the transfer.

I spoke to three different people at BofA tonight and no one is willing to reverse the fee. I have been a customer for 20 years - we have two mortgages with your institution, two savings accounts, two checking accounts one of which is a Prima account, and both of our children have savings accounts. We decided to stand by them during the debit card fee debacle, but I will take my business elsewhere if this fee is not reversed. I feel taken advantage of and deceived and am questioning their business ethics.

account closure with no notification

I have been banking with BOA for over 10 years and have the American Express card by BOA. I usually pay off our card each month because I use it for everything to accumulate points. With no advance warning my credit card was declined and when I called they stated it was closed due to but there was no reason why and i can call the account closure department. I have called and gone into local branches and no one can seem to help me other than directing me to call the account closures department. That department is simply a recording stating they are with other customers and stresses twice at the beginning and at the end that it is the BOA is not required to explain the reason for the closure. So basically they say leave your name and number and we will call you within 24 to 48 hours but it is their policy and they are not required to tell us anything. The worst thing is I have over 160, 000 points that I wAS saving and I cannot even access my points account because the card was closed and was told when I called that the points are usually forfieted when accounts are closed! REALY! I am moving the rest of my account to another bank and so will the rest of my family but I feel like something has to be done about this unfair business practice. Is this what i get for being a loyal customer

I can care less about giving them my business or banking with them. I am talking about them just closing my account so i loose my points which if i transferred would come out to $1500. Where is the consumer protection they can just do that with every customer who has over a certain amount of points and that would make it ok? of course not and I am not the first person this happens to just like the over draft fee which they got sued for and lost $410M looks like they might have another case on their hands soon

loan modification

Bank Of America has sent me reinstatement calculations (document attached) for my mortgage to prevent foreclosure. I also received a similar letter from B Of A attorneys. I in turn responded by remitting the exact amount requested well within the specified time limit of the letter. To which B Of A cashed the check I sent and applied payment to my...

Read full review of Bank of America and 126 commentsmisappropriation of mortgage payment

We paid the amount of two (2) mortgage payments at the end of December, 2009 to Bank of America who services our Veterans Administration loan. On Dec. 29, 2009, one-half the amount sent was posted as a regular payment with the appropriate amount applied to principle, interest, escrow, and the other half was dumped into our miscellaneous category along with additional funds which now total nearly twos full payment amount. Despite vigorous complaints via email, we cannot get a response regarding our mortgage account.

This misappropriation of our mortgage payments have deprived us of at least the amount of interest which should have been applied to our 1099 Mortgage Interest and included in our 2009 Income Taxes.

We have demanded a written response in the form of an explanation of the above actions but have been denied same.

We want to file complaints with officials of the Bank of America but cannot obtain the names of the officers, i.e., president, chief financial officer, chief auditing officer, mortgage loan manager, customer service manager, etc.

hoovers.com

annual enrollment wrong again

My annual enrollment packet for health insurance offered no options. My online acct was the same. I called last Tues and started a service request 2-[protected] phone for enrollment is [protected]. I have called 4 times since then and I have no faith that they even know the problem much less anything being done about it. I had other problems with them last year after Tom's death. I am the domestic partner of a deceased B of A retiree. Since Tom's death the Bank has been horrible to me. I realize they don't much care for things like domestic partnership in Charlotte. But it is law in California.

loan modification nightmare

After 2 Years of my wife & I applying for a Loan Modification through Bank Of America ( BAC Home Loans Serviceing ) the Bank Actually confirm they received all the paper work! We were Instructed by Bank Of America Not to pay for the Month of March 2010 our 3 payments start in April, May, June 2010. After 3 timely payments we were told that we would be permently enrolled in the Modification. It even states that on their own websit. However thats not what happened. You see even though it took us 2 years to apply & finally get a temporary loan modification untill 3 timely payments during the waiting game that the Bank does ( Intentally) I believe the Bank is waiting for a reason to say hay you guys dont qualify thats what append to us she lost her job so insteas of the Bank helping us they urt us by telling us Lies reason # 1 why we did not qualify ( we paid our Trial loan modification late. Lie # 1 from the Bank I proved them wrong by our BANK OF AMERICA CHECKING ACCOUNT SHOW TIMELY PAYMENTS. Lie # 2 we simply did not qualify ( WE MET EVERY CRITERIA SET FORTH IN HAMP DEPARTMENT. ) This is the 3rd Lie & the one they ( BAC HOME LOANS has been saying to my wife & I ) EXCESSIVE FOREBEARENCE... Its no isolated incident that this is a schem to make more money for the Banks ( WHERE IS OUR GOVERMENT STANDING BY ALL THIS ) IT WOULD TAKE THE US GOVERMENT 99 YEARS TO FIGURE OUT OR DO ANYTHING WE WILL BE DEAD BY THEN... Loan modification..we applied in late 2008 & we are still applying even now with 2 different lawyers..

The complaint has been investigated and resolved to the customer’s satisfaction.

pod account problems acquiring funds

Organic apex will make you pay for "marketing fee" for nothing... Our company's name has never been at the top of the search results pages on any search engine! Organicapex.com sales person is terrible on the phone. They said they could get our website in the first page and push back the untrue complaint one of our exemployee made but I can't see any work done. When we tried to cancel our services with organicapex and get our money back but it seems that is impossible as we can't reach anyone from that firm!

very very poor customer service

Three weeks ago I deposited my husband's paycheck and Bank of America put a hold on 673.00 until January 29th. Since automatic payments have come out and they are charging me 35.00 per fee, until this date they will have used up most of the money that is on hold in fees. Mark is the branch manager and I explained my situation, he told me to come back next week after more fees had been charged and he will credit them, I did and he acted like he knew nothing of the situation. Very Very poor customer service.

Bank of America Corporate Contacts

Contacts in the corporate offices of Bank of America

The following are contact numbers and emails for the corporate office of employees whose job is to specifically address all complaints on behalf of the company.

If complaints are not answered or provided adequate attention, I would suggest going online and filing a complaint with the OCC, Office of the Comptroller of the Currency, the agency that regulates national banks www.occ.treas.gov/.

The corporate office MUST respond to both the consumer and the OCC. So if you are unable to get your issue resolved or feel there is questionable behavior or handling of accounts, I would go directly to the OCC or call/email a BOA manager. Better yet cc everyone on the list; calling is always a good option as well, as sometimes the issues can be resolved immediately.

Evelyn Upstill, manager

[protected]

evelyn.upstill@bankofamerica.com

Susan Smith, manager

[protected]

susan.a.smith@bankofamerica.com

Renee Holmes, manager

[protected]

renee.e.holmes@bankofamerica.com

Kasey Dressler, manager

[protected]

kasey.e.dressler@bankofamerica.com

Christina Yuschak, manager

[protected]

christina.yuschak@bankofamerica.com

Scott McGhghy, manager

[protected]

scott.mcghghy@bankofamerica.com

Cassandra Dejurnett, asst manager

[protected]

cassandra.g.dejurnett@bankofamerica.com

Norma Adams

714-579.8510

norma.j.adams@bankofamerica.com

Karin Herndon

[protected]

Karin.l.herndon@bankofamerica.com

Claudia Amaya

[protected]

claudia.j.amaya@bankofamerica.com

Bridgett Loya

[protected]

bridgette.m.loya@baml.com

Derek Kaltenbach

[protected]

derek.kaltenbach@bankofamerica.com

Celestina Burresch

[protected]

celestina.burresch@bankofamerica.com

Andrea Lowry

[protected]

andrea.m.lowry@bankofamerica.com

Yvonne Gonzales

[protected]

yvonne.gonzales@bankofamerica.com

Janelle Worthen

[protected]

janelle.worthen@bankofamerica.com

Adriana Valdez

[protected]

adriana.m.valdez@bankofamerica.com

Kerrie Roberts

[protected]

kerrie.a.roberts@bankofamerica.com

Carlos Pena

[protected]

carlos.j.pena@bankofamerica.com

Asuncion Ngaosi

[protected]

asuncion.c.ngaosi@bankofamerica.com

Additional #’s

[protected]

[protected]

[protected]

[protected]

[protected]

[protected]

[protected]

suspected fraud

tue, oct 4th i, wolfgang esch went to this westchester, LA branch location to withdraw $300. at the ATM located inside the bank. Approximately 15 schoolage teenagers followed me inside the ATM lobby and started to make an alarming amount of incoherent earshattering noises. both ATMs were occupied by individuals that appeared to have problem finishing their transactions perhaps also starteled by said earsplittingly loud teenagers. therefore i went to the teller to get my money there. At this point the noise had ceased. The teenagers had left by the time i made it to the teller, ( Brenda Zavala ). Curiously though Brenda Zavala now developed a problem with her Bank computer to the effect of asking me repeatedly (total of eight {8} times) to enter my pincode. I complied but later became worried since Im overdue to recieve an insurance check in a significant amount. can you check this out, please. Was there a large check ( >$ 100000), made out to me, Wolfgang Esch, cleared at your Westchester branch and put into someone else's account. NO JOKING !

The complaint has been investigated and resolved to the customer’s satisfaction.

promised to shred paperwork, then funded loan anyway

At the end of April 2011, I applied for a mortgage refinance through Bank of America to drop my interest rate from 6.75% to 4.75%. My closing took place on June 30. Prior to my closing, I was not given a copy of my HUD to look over the final numbers. Also, no one explained the numbers on the HUD to me; not Melvin Crawley (my loan processor), nor Christine Mason (the lady who put the HUD together), nor the attorney who was present at the closing.

The night of the closing, I noticed that two mistakes were made on the HUD: 1) I was charged $3503.40 for transfer taxes when I was promised a CEMA loan with no transfer taxes. 2) I was charged $1963.20 for the 4.75% interest rate, when I was only supposed to be charged $1210.93. (I was supposed to be charged for .625 points, but I was mistakenly charged for 1 point.)

Despite the mistakes, the attorney at closing persuaded me to sign the papers for two reasons: 1) He told me to call Bank of America the next morning. He confided that Bank of America waives transfer taxes all the time. They would not want to risk losing my loan. He also told me that just that morning, the attorney attended a closing in which Bank of America waived all of the closing costs. 2) I would have three business days to file a right of rescission, so there would be no risk.

Against my better judgment, I signed the papers as the attorney advised. I called Bank of America the next morning and spoke to Yoshi Hoover (the loan officer I have been working with since April). Mr. Hoover understood the mistakes that were made and that I should have received a CEMA loan. He was going to try and contact a manager to get my loan taken “one step back”. (It was the Friday of the July 4th weekend, and I guess managers were few + far between.) He also told me that if I did not hear back from him by Tuesday July 5, to definitely file the rescission papers.

But I did hear back from Mr. Hoover a couple of hours later. He said that Melvin Crawley’s manager Missy Ryan was on vacation, but he was able to get in touch with covering manager Jason Walters, and he was successful in getting my loan taken “one step back“. According to Mr. Walters, the closing papers would be “shredded” and it would be “as if the closing never happened”. Mr. Hoover has proof of this conversation.

I asked Mr. Hoover if I should still file the rescission papers anyway, but he told me no. If I file the rescission papers, he said, it would void the entire loan, including all the work that was done over the past two months leading to the closing, and we would have to start over again at square one.

Throughout the month of July, Mr. Hoover and Mr. Crawley continued to work on getting me the CEMA loan. I received a refund for the check that I had written out on the night of the closing. Bank of America was having trouble locating my original note, so on July 27, Mr. Crawley called me and offered to waive $1000 of my transfer taxes if I were willing to move forward with my loan without proceeding as a CEMA. I politely declined because I wanted the CEMA loan that I was promised.

Two days later, on July 29, my loan was funded. I don’t know how that happened as I was assured by Mr. Walters that my closing papers were to be “shredded” and it was to be “as if my closing never happened”.

To this day, I have been unable to obtain any kind of recompense from Bank of America. Missy Ryan (Melvin Crawley’s manager) has been less than helpful, stating that a mistake was made, I should not have been told what I was told, and they cannot ignore signed documents. Jason Walters has not returned my e-mails. I have also left a couple of voicemails for Norman Brooks (Missy Ryan’s supervisor), but he has not returned my phone calls either.

I feel as if I have been defrauded by Bank of America.

systemic corruption

As someone who has the misfortune of working closely with bank of america on mortgage modifications and repurchases, I can attest to the fact that bank of america, via the countrywide division, perpetually demonstrates the highest degree of incompetence, gross mismanagement, and institutional corruption. Their modos operandum is to bully, intimidate and muscle others to comply with their improper and unethical demands. The same pond ### that perpetuated mortgage fraud on a massive scale with countrywide home loans are still infesting the organization. Unfortunately, they are now focused on whitewashing their past sins and off-loading the consequence to others. The public will continue to be victimized by the deceitful and dark behavior of this company unless the regulators and/or lawsuits dismantle this company.

The complaint has been investigated and resolved to the customer’s satisfaction.

mortgage mishandling of payment

I mailed my payment to BOA through my bank's online bill pay system. I mailed a payment of $347.10, but my payment due was $374.10. BOA held my check for two weeks, without contacting me to notify me that the payment was wrong (by $27). Two and half weeks later I received a check in the mail from BOA, for the payment I had mailed, with no explanation. I called BOA and was told they had a new policy of accepting NOTHING but the full amount. When I asked why I had not be notified of this policy, nor the fact that the payment was incorrect, the customer service representative was unable to provide an answer. Today, 10/08/2011 I received a notice of intent to forclose on my home!

How complaint can be satisfactorily addressed

I want the late fee refunded, and I want extra time to make the payment from September, so that I can pay this month and last month in two payments rather than one lump sum. BOA says they will ONLY accept payment in full on the account or they will forclose. Payment due is $766.91. I would like to pay $374.10 10/14/11 and the remaining $374.10 10/21/2011.

The complaint has been investigated and resolved to the customer’s satisfaction.

rip off

To whom have mortgage loan with bank of america, I borrow money on my home with cash out back 7/2004 amount of $120, 000 and the interest rate is 6.4% my payment is $890.16 each month I pay home owner ins. And the property tax my self. You was think out of the $890.16 some should go to interest and some would go to principal, since I have this loan for 7...

Read full review of Bank of America and 17 commentswhat a ###

My 16 year ancient son got his first JOB and was paid via a check written on a Bank of America account. He went into branch and was charged $6 to MONEY a check written on BofA's own bank!Talk about gouging! The bank took no risk on CASHing the check because they knew the account had funds in it. It was written on their own account holder! Then to charge what amounted to a 12% interest to MONEY their own check!Explanation given was that this was "their policy". Secondly, they didn't look at his age. I pointed out they sure looked at his ID and fingerprint! What ###!How do they sleep at night?

pre paid card - new card never received

I have a bank of america pre paid visa were I receive my child support money. My old card expired last month and I did not receive my new card. Called bank of america because I moved a few month ago and had them change my address. Was told that they send out my new card to the old address but that they would issue me a new card to my new address. Few days later - no card. So I called again and was told that my account was in the negative and they would not issue me a new card until my account is in the positve. How can a pre paid card be in the negative. Asked the support person and she said that my suscription to the sportsmagazine was being paid and that this was the money that brought my account in the negative. So I waited a few days until I received another child support payment. Again no new card. Called again and was told that the card was on its way. Waited a few more days... Nothing. Today I called for the fourth time. Was told again that they can issue me a new card... Asked for the supervisor. Cecile answered the phone after a long waiting time. He informed me that they will issue me a new card (For the fourth time) and that if I want to expedite the delivery that I have to pay 24 $ or they could western union the money. Again I have to pay for the service. I have now 1.600 $ for two weeks somewhere and cannot access it because bank of america cannot issue me a new card. Where is my card... ? Where is my money?

The complaint has been investigated and resolved to the customer’s satisfaction.

rude branch managers

Bank of America is the Worst bank! I am not complaining because I was charged with fees or a check did not clear...I am talking about the rudeness and uprofessionalism of management and back offices. I went to one of the branches to be informed about their procedures and services...I was not complaining and before I knew what was going on the manager started to respond very rude and said that is the way it is and I have other customers to attend to. Where did this come from I have no idea... I closed all my accounts.

The complaint has been investigated and resolved to the customer’s satisfaction.

annual fees even with account closed

Since I lost my job in 2008 and moved from Calif. to Indiana I have no need of a Alaska Airlines Card. This bank, in spite of my closing the account as a no longer needed credit card, continues to charge $75.00 per year every August even though I can no longer use the card. Just having a balance that I'm trying to pay off each month is enough for them to charge it. I am now disabled and on Social Security and there are 14.8 million of us unemployed workers out there who cannot afford these rip off fees.

It's bad enough that this bank got into the fix it was in and borrowed money from us taxpayers and they constantly complain they don't make enough money. I say that is a load of BS and just not right and is highway robbery. I am going to write a letter to the home office but I doubt it will do any good.

I am being ripped off every year by this bank - I might as well give a homeless person the $75 rather than this bank - at least it would do some good.

The complaint has been investigated and resolved to the customer’s satisfaction.

small business account

Had a small business account with bank of america which I now closed. started getting 14.95 service fee every month for online banking, when called their cust. service dept they said I signed up for something called business suite account management I never did I was told it was free for three months and then if I became an advantage customer it would only cost 0.05 more a month, now I’m recieving 29.95 monthly maintenace fee even though I used their business debit card when asked to cancel it they did but no refunds or apologies the customer service rep was very ignorant and proceeded to tell me to pay attention to my accounts with online banking.

Bank of America should give courtesy lessons to their service reps in Florida and have consideration for those customers who don’t have a computer or want to do online banking. All Bank of America wants to do IMO is nickle and dime their customers I’ve had an account with them for close to 10 years, now I will stick with my local bank at least their customer service and practices spend time explaing not just adding products without the customers knowledge. SHAME ON YOU BoA for “ripping off” customers that had trust in your bank.

I just paid $23.57 for an iPad2-64GB and my girlfriend loves her Panasonic Lumix GF 1 Camera that we got for $38.76 there arriving tomorrow by UPS. I will never pay such expensive retail prices in stores again. Especially when I also sold a 40 inch LED TV to my boss for $675 which only cost me $62.81 to buy.

Here is the website we use to get it all from : BidsBit.com

business open line of credit called due

I have banked with boa for 25+ years. Dec 2010 I received notice our $100, 000 open line of credit is due and payable 12/2011. Used/paid back many times; never late.

I immediately contacted them and told the product simply is not offered anymore; nothing to do with relationship or credit. I was told boa would contact me at the end of the year to discuss. Because of these tough economic times, I did not want to wait and demanded to know what other options would be substituted as I was concerned with qualifying for a new loan under the present loan changes etc. And of boa recent business practices. I stopped making payment to assist me in getting proper contact and answers. With non payment, I finally was able to get in contact with pamela san culbreath who is my client manager to assist me my small business accounts. She kindly closed my checking account without notice. She next refers me to a different person to speak to regarding this loan and new application. I spoke to new contact briefly and set up contact date. He did not call. When I called him, he was now unavailable until 9/9/2011. Now I have another contact. She made the decision to close the checking but yet will not tell me why she made that decision. When I got out of the hospital, I contacted her;she sent their standard bank statements saying if at 0 balance they can open or close. I am not sure pam took the time to know us and our businesses. She said she did not want our deposit account (60 days no activity except their withdrawals for banking fees). I had a personal account without activity which was not closed. I have other business accounts she did not close; but I am not sure she even knew us or spent enough time to know of other business accounts. Needless to say I am in the process of closing all accounts. I further would like to know of any others treated in this manner. I have asked for a copy of the document that allows them to call the open line of credit note due in full at anytime which I have not received. Pam ignores my request.

Bank of america now seems to be in trouble; perhaps they need to look at their client managers and their effectiveness!

The complaint has been investigated and resolved to the customer’s satisfaction.

private mortgage insurance cancellation

I have a mortgage with Countrywide / Bank of America that I have had since October of 2005. Since this time, I have been paying PMI and constantly requesting Bank of America to cancel the PMI. I had an appraisal completed on April 17, 2009, and both the appraiser and myself forwarded the appraisal to Bank of America on April 20, 2009. Since this day, over $3, 120 in PMI payments have been collected from me. I have been in email discussion with Bank of America on this issue and received a voice mail from Bruce Wood, at [protected] extension 1511661 on July 28, 2011 at 11:25AM. Mr. Wood advised that he was looking into the issue and will either resolve the issue or give me a status update within 48 hours. On Tuesday August 2, 2011 at approximately 11am, I called and left him a message requesting a status update. On Wednesday August 3, 2011, I left another message. I have yet to hear back from anyone at Bank of America and it has been well over the 48 hours promised. To pay PMI for over six years is a complete mockery of any fairness to Bank of America's customers. The constant refusal to remove PMI although I have paid $400 for an appraisal is a blatant disregard of any policy.

The complaint has been investigated and resolved to the customer’s satisfaction.

Bank of America Reviews 0

If you represent Bank of America, take charge of your business profile by claiming it and stay informed about any new reviews or complaints submitted.

About Bank of America

One of the key strengths of Bank of America is its commitment to innovation and technology. The bank has invested heavily in digital platforms and mobile banking, making it easier than ever for customers to manage their finances on the go. With features like mobile check deposit, online bill pay, and real-time account alerts, Bank of America is at the forefront of the digital banking revolution.

In addition to its digital offerings, Bank of America also has a strong network of physical branches and ATMs. With thousands of locations across the country, customers can easily access their accounts and get help from knowledgeable staff members whenever they need it.

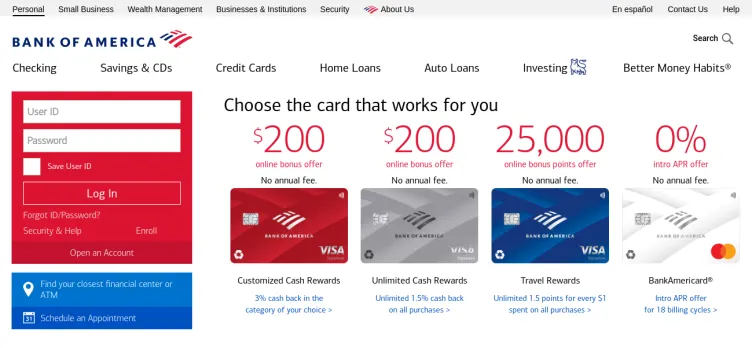

Another key advantage of Bank of America is its wide range of financial products and services. From checking and savings accounts to credit cards, loans, and investment products, the bank offers something for everyone. Whether you're looking to save for the future, buy a home, or invest in the stock market, Bank of America has the tools and resources you need to achieve your financial goals.

Overall, Bank of America is a trusted and reliable financial institution that has been serving customers for over a century. With its commitment to innovation, technology, and customer service, the bank is well-positioned to continue to meet the evolving needs of its customers for many years to come.

1. Log in or create an account: Ensure you are logged in to your ComplaintsBoard.com account to proceed. If you do not have an account, please register by providing the necessary information and verifying your email address.

2. Navigating to the complaint form: Once logged in, locate the 'File a Complaint' button situated at the top right corner of the website and click on it to access the complaint form.

3. Writing the title: In the 'Complaint Title' field, concisely summarize the main issue you have encountered with Bank of America. Make it specific and clear, such as "Unauthorized Overdraft Fees" or "Difficulty with Mortgage Loan Modification".

4. Detailing the experience: In the complaint description, provide a detailed account of your experience. Include key areas such as customer service interactions, problems with account management, loan servicing, fees or charges that were unexpected, issues with online banking, or any other specific incidents related to Bank of America. Clearly describe the nature of the issue, including dates, locations, and any relevant transaction details. If you attempted to resolve the issue, outline the steps you took and the responses received from Bank of America. Explain how this issue has personally affected you, such as financial loss or stress.

5. Attaching supporting documents: Attach any relevant documents that support your complaint, such as correspondence, statements, or receipts. Be cautious not to include sensitive personal information like your social security number or full account numbers.

6. Filling optional fields: Use the 'Claimed Loss' field to quantify any financial losses you have incurred due to the issue. In the 'Desired Outcome' field, describe what resolution you are seeking from Bank of America, whether it be a refund, apology, or corrective action.

7. Review before submission: Carefully review your complaint for clarity, accuracy, and completeness. Ensure that all the information provided is true to your knowledge and that your desired outcome is reasonable and clearly stated.

8. Submission process: After reviewing your complaint, click on the 'Submit' button to officially file your complaint on ComplaintsBoard.com.

9. Post-Submission Actions: Keep an eye on your ComplaintsBoard.com account for any responses or updates regarding your complaint. Be prepared to engage in further communication if necessary to resolve your issue with Bank of America.

Overview of Bank of America complaint handling

-

Bank of America Contacts

-

Bank of America phone numbers+1 (800) 432-1000+1 (800) 432-1000Click up if you have successfully reached Bank of America by calling +1 (800) 432-1000 phone number 8 8 users reported that they have successfully reached Bank of America by calling +1 (800) 432-1000 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number 3 3 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number45%Confidence scoreEnglish+1 (800) 688-6086+1 (800) 688-6086Click up if you have successfully reached Bank of America by calling +1 (800) 688-6086 phone number 16 16 users reported that they have successfully reached Bank of America by calling +1 (800) 688-6086 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number 1 1 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number88%Confidence scoreSpanish+1 (315) 724-4022+1 (315) 724-4022Click up if you have successfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (315) 724-4022 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone numberInternational+1 (757) 677-4701+1 (757) 677-4701Click up if you have successfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (757) 677-4701 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone numberCredit Card Issues+1 (800) 214-6084+1 (800) 214-6084Click up if you have successfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (800) 214-6084 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone numberVice President Bank+1 (312) 992-6618+1 (312) 992-6618Click up if you have successfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (312) 992-6618 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number

-

Bank of America emailssupport@bankofamerica.com100%Confidence score: 100%Support

-

Bank of America address100 N Tryon St., Charlotte, New York, 28255, United States

-

Bank of America social media

-

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreNov 09, 2024

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreNov 09, 2024 - View all Bank of America contacts

Most discussed complaints

pmi remove problemRecent comments about Bank of America company

ATM security firm illegal in nycOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.