Bank of America’s earns a 4.0-star rating from 4575 reviews, showing that the majority of banking clients are very satisfied with financial services.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

Making Homes Affordable Program

I have been in the Making Homes Affordable program with Bank of America for 12 months. I just learned yesterday that my request for a modification under this program had been denied by BAC Home Loans on December 8, 2010. I was never made aware of this decision. After learning that the reason was due to information not being received on time, I informed the person I spoke to that I had verification via fax reports that I faxed the information requested on two separate occasions on 11/03/2010 to two different fax numbers. This was because the agent handling my request (Fabiola Rousseau) said the first fax wasn't working and to send it to another number (which I did and have proof). The woman I spoke to yesterday (Melissa) said that unfortunately the correct department didn't receive that information on time and because it's been longer than 30 days, I am unable to file an appeal. This sounds like a total scam to me. I did everything I was asked to do and was never late on my original nor the modification payments. I am extremely concerned that Bank of American is attempting to fraud me out of my home. I was told by Melissa that my case was being assigned to someone named Dominique Jones to determine if BAC would accept some kind of modification. Otherwise, my home would go into foreclosure. I do not understand how this can happen to people who are doing everything - it's criminal in my opinion and I would appreciate it if someone could investigate this fraud that is occurring. PLEASE HELP! I have done since last March.

The complaint has been investigated and resolved to the customer’s satisfaction.

still waiting on a refi...

I started the refinancing process with bank of america the first of october to consolidate a first and second mortgage... It is now february and still no closing date. The appraisal was done at the end of october, and this should be a straightforward loan with no hiccups since my husband and I both have excellent credit scores and have been diligent in sending all the paperwork they have requested in a timely manner.In november we were assigned a new loan officer and every time I talk to her she tells me we have to resubmit a certain portion of the paper work (Such as pay stubs, bank account info) because the original paperwork is now out of date. She always apologizes and says she must have not recieved all our original paper work we sent originally (My fault? I don't think so... ) and says they have a large backload of loans they are working on, but she never calls me to tell me what she needs to move things forward - I always have to call her. To make matters worse I have to make a long distance phone call to reach her. I traced the phone number via reverse look-up on white pages and it is a landline in dallas tx. Does this mean she is working from her home? If so, who has access to my personal information? And how much more paperwork will have to be re-sent until something happens?

The complaint has been investigated and resolved to the customer’s satisfaction.

home retention

Bank of america discriminates against helping black people/african americans who wants to own a piece of the american dream. Maybe because of my neighborhood or the last name! It is funny how they do not return phone calls or refuse to speak with you. But there is a sale date on my home without any notices sent or given to us? Confusing the ### out of my family. Maybe I should apply for welfare and live off the whiteman's income? Slavery still exsists! Maybe they are upset because we finally have a black president!

My husband and I have divorced now, but he did all he could to have a home for us. We did a chapter 13, then

a chapter 7 still no real help. I am fighting to hold on to my home. I pray for those that are fighting, that GOD IN JESUS NAME would defend us from these oppressors.

Doesn't matter if your black, white, green, red, or purple - I am trying sine Aug 2009 to resolve a "missing check issue" and I have called them over 100 times, faxed them repeatedly, sent letters, and they just don't give a crap ! Received letter yesterday if I don't pay $1500. by 2-11 - I'm OUT!

I am on SS disability, my husband is out of work - they could care less ! I hope somebody out their can help all of us !

They have ruined my credit and my health . In my 63 years I have never experienced anything as absurd as this !

Whiteman's Income? Welfare? Who cares what color you are. Pay your bills and they won't foreclose. Not to mention your address is New York. It takes WELL OVER A YEAR OF MISSED PAYMENTS in New York to be foreclosed on. It is a judicial state as far as foreclosures go. Sound's like you have been living for well over a year without paying your mortage. Now they take action and it is there fault? Granted BOA is tough to deal with, BUT YOU HAD OVER A YEAR TO HANDLE THIS. You can't afford your house, or you chose not to pay on it. IT"S YOUR FAULT, GROW UP.

"Wants to own" ? cant help but chuckle there...

If they have imposed a sale date on your home, it sounds like your not making payments - going into foreclosure, therefore you had a chance at the "American Dream" and sounds like you failed. your only option left is to play the race card - easy way out - typical.

Speaking of welfare, i like the proposed law of making all welfare recipients pass drug tests each month in order to receive their check - the government would save millions!And this, from a black president - Im not upset with him...

Lisen, don't think that they don't return your call because you're black I am as white as a glass of milk and they don't return my calls either. Maybe what you need to do is hire an attorney and not blame it on the race issue!

foreclosure/retention

Bank of America offers loan modification for those who are in need of help.

However I believe they are discriminating against my neighborhood, since it is a low income black community they refuse to help us. My mortgage was originally with

Country Wide and since BAC took it over they have claimed we never paid our mortgage; confusing to my husband & I. We have documentation and it gets better

we were told that we do not have any income and do not forsee our financial situation getting better! My husband works 2 fulltime jobs our monthly gross income is 5000.

BAC refuses to return any call put a sale date on our home without any notices claims they tried to call us but the phone numbers given were not working. Ms Kathleen Nygaard whom I have called several times but goes directly in to voice mail does not return any of my calls, I have recieved a letter from her that states nothing but lies.

I am not sure what to do at this point, I am waiting to go to court but have not recieved any court dates as of yet, we can pay our mortgage and they are refusing to work with

us. What are we to do with a family of 6 where do we live? we are looking into a lawyer. Not only that the mortgage we were paying was used to pay for BAC legal fees.

I wish there was someone out in this big world who can help us keep our home. As far as I see it BAC is full of ### and treat minorities like crap, I am sorry I am not white!

and trying to own a piece of the so called AMERICAN DREAM! MAYBE IF MY NAME WAS NYGARRD OR PITTSINGER I WOULD GET MORE RESPECT!

The complaint has been investigated and resolved to the customer’s satisfaction.

Same place with BAC that you are... started with Countrywide loan sold and I could never get any documontation of anything until I went to the attorney general... since then I have moved out of my home after 12 years and never a late payment because BAC kept telling me over the phone ( only) that they could have a sheriff at anytime lock me out of my home... All I asked for was something in writting anything in writting but I was not giving my credit card or bank info over a phone to someone who cant show me that they actually have my loan... I think the government should look into all this mess... but they wont... just more and more of us who try to have something on this earth lose it over the big boys (banks) getting away with what ever and how ever they choose to treat people... funny how so many people didnt have mortgage problems until the gov gave money to the banks instead of helping who needed it...But I would suggest complaining to your attorney general... the only way I finally got any paper work from BAC and also was prove that I was trying to get something in writting from them with no success... also I got the bad number run around from them as well... Like I said... wish gov would see how they treat people instead of backing them up with more money

Put your efforts into a lawyer. If your case details are as you described then your lawyer shouldn't have much trouble getting an injunction to prevent the foreclosure. Which means until your case is resolved BoA will be unable to sell your home or evict you.

loan modification program

my name is michelle and i live in los angeles. i have been appling for a loan modification with Bank of America since november 2009 with the help of NACA and Operation Hope. At this time was also the merger of bank of america and countrywide in which my original loan was with. unaware that Bank of America had sold my loan to a private investor/bank called The Bank of New York Mellon i continue to asked/apply for loan modification. ater 17 months of none payment which they told me to stop paying in order to get approval i finally found out in January 2011 that there was NO way that bank of america could have given me a loan modification under and Making Home Affordable program or any home affordable program because they sold my loan and they were no longer the lien holder and that bank of america was only a sevicer and The Bank of New York Mellon who has been holding my loan does not participate in any government loan modification program or any modification program. bank of america always knew and was very aware that no matter what i would do i would never be helped or qualified for any loan through bank of america. bank of america knew since 2009 that my loan had been sold to a private investor but continue to string me along with all the letters of "we can help you". if this is not one of those bank scams!...i am still fighting and will continue...if anyone knows any resolution or can help me or any pending lawsuits that i can join please contact me at the above email...any other bank of america clients PLEASE check and see who own your loan...

The complaint has been investigated and resolved to the customer’s satisfaction.

Wow... I just recently found this out about my loan as well. I am still paying mortgage... but not for long as funds are running dry and my ARM will be adjusting considerably on Dec. 1, '11

I felt like I was reading my own conversation with B of A about the Private Investor not participating IN ANY GOVERNMENT PROGRAMS... only option I have found (still researching) is that I qualify for a HAMP Program, however, it will cost my $900 to work with the attorney! Are you kidding me!

$1500 in nsf fees in a year!

I am a small business customer in Philadelphia, PA. I have been in business and banking with you for a year now. I opened my account in January 2010. I have taken advantage of a lot your services including 2 checking accounts and merchant services. Last year I have had a lot of problems with over-draft fees. At the time you did not offer overdraft protection between checking accounts. I could not afford a savings account at the time and I have paid about $1000 in fees to you last year. I’m not complaining about that because that was last year I just hope this year is better for me. But it gets very frustrating when you are a struggling business owner trying to make it in the economy.

i want 2 address a situation that I have incurred in your Philadelphia Branch on 10th & chestnut st on January 20, 2011. Around 11:30am I walked into the branch in hopes of finding a resolution to the $175 in over draft fees I was being charged for. I was helped by the branch manager, well at least I thought I would be helped. I went to him with my problems and he immediately shut me down with “I’m sorry but its nothing I can do”. I asked him about one fee of $35 that came out that day because it was funds available in my account, he could not explain why I was being charged again. The conversation went back & forth for a minute or two before I asked to speak with a manager. He then told me that he was the manager. Not once did he introduce himself to me- the whole time we spoke I thought he was just a customer service rep. I then asked to speak to another manager or maybe a supervisor, because I feel like its always something that can be done and I felt that I had a valid argument.

He then ended up giving me a number for a woman named Claudia Dulac. I called the number in his presence and the number was a automated machine. I then asked for a number or a email or address that I can contact her at. He then left and came back with a number and proceeded to call her in the room and place the call on speakerphone. He never closed the door and everyone seated in the waiting area heard my whole conversation! As I spoke to Claudia she was not really listening to me as if she really didn’t even care for the phone call. As I was trying to explain what my problem was she just kept saying that it was my fault, and she’s making the final decision to do nothing for me. I asked her who do I talk to if I wanted to put in a complaint or is it a district manager that I can talk to after her. She then said “No, I will not give you any information, someone will call you”. the Manager took the call off speaker said some things to her and they hung up. He told me that I had to leave because they were not going to help me or give me any information.

I know my business is small and I may not be one your million dollar customers but I’m still “A” customer! I asked him (manager) for Claudia’s information, he told me he would not give it to me, after some back & forth I called the Bank of America 1-800# in his presence because I figured they would assist me better with filing a complaint. As I’m on the phone, he started to call the POLICE! He called someone on his cell phone and then the Philadelphia police on me because I wanted a phone number and contact information of somebody that would be willing to help me. The woman from the 800# was on the phone with me and heard everything! It was the most embarrassing situation I’ve ever experienced in my life! Mind you the whole time the door is open and the whole lobby is watching me like a show! As I’m explaining the situation to the #800 rep. he tried to write down a name & number for me, as the police are there waiting. I told him I was going to close my account he showed No interest at all in keeping me as a customer. I asked him who was supposed to be calling me back and he said “ I don’t know, maybe someone from customer service or customer resolution”. well I said how are they going to contact me? Not once did he ask me for any of my contact information. Which leads me to believe that no one was ever going to call me back.

I was embarrassed and humiliated. The woman at the call center heard the conversation and understood my reasons for being upset. She helped me so much she explained to me that I was eligible for overdraft protection set me up with a new account and refunded those fees. I was very grateful. At that point I didn’t even care about the fees anymore, I just wanted to file a complaint but honestly if it wasn’t for the woman Kristen from the Montana call center I would have closed my account.

Bottom line I have never been more embarrassed in my life. What did I do that I would make him feel that threatened that he needed to call the Police on me! I’m a young black female and I was alone. I have never been treated like that from ANYBODY! I am 30 years old and never have I ever had any legal issues. I never threatened anybody or had anything that could harm anybody. Did I get the police called on me because I was black? Or is this is how you treat your customers because they want to file a complaint? I thought as a customer if I wanted contact information on someone such as a manager I was able to get it? I’m hurt and confused. And I would never go into that branch again let alone downtown to do my banking, because of that humiliation. Before I left I was able to get the manager’s name that put me thru this drama, it is…

Raja Tazeem

Banking Center Manager I

10th & Chestnut Banking Center

I hope no one else would have to experience this kind of treatment…

The complaint has been investigated and resolved to the customer’s satisfaction.

account closed and charged

I opened an account at Bank of America 12/29/2008 hoping to transfer from Chase because I was looking to buy a home and decided I was going to use Bank of America. By 09/2009 I decided I was going to stick with Chase and went to close the Bank of America account on 9/21/2009. When I went to close it I was told that I owed $10.95 because I had already transferred the balance back to my Chase account. The $10.95 fee was for credit monitoring that I had on the account. I paid the fee so that the account was -0- and then told the teller I wanted the account closed. She went for another lady who proceeded to "close" the account, I should note that I've never closed a bank account before so when she told me that the account was closed and gave me my receipts for the payment I made I went on my merry way. On 03/02/2010 I received a letter from ERS solutions Inc. stating that I owed Bank of America $128.26, I called the bank to inquire what the charges were and was told that they were for credit monitoring. I informed them that the account had been closed since 09/21/2009 and asked how a closed account could be charged for credit monitoring. The representative told me that the account was not closed properly and that they were at fault and after giving all the details I was told that it would be taken cared of. I had not heard anything from Bank of America since after I closed the account to make me suspicious of the fact the account was still open. After speaking to the Representative in 03/2010 I had not heard or received anything further. Fast forward to 01/2011 I receive a letter from NCO Financial System about the same $128.26. I again explained the situation to the credit collector and contacted Bank of America only to get a run around, about how old the issue was and if I had resolved it sooner they would be able to give me a credit. They said they no longer have access to the information since it's with a collection agency. I first called customer service who gave me the number to recovery services who couldn't help and told me to call customer service, which connected me to customer solutions that sent me back to recovery. They told me that if I had closed the account I should have received a statement saying it was closed, which I never got and since I never closed an account and they never said that when I went to the Bank to close it, i guess I have no proof i actually closed it. Other than the fact that i am not dumb and I am cheap and hell and would never leave an account for charged to be billed for no reason. Clearly they are trying to make it seem as if I am at fault when I've spoken to reps who told me they were at fault and now they try to turn the table saying I should have known that I had to receive a statement saying the account was closed. I have $128.26 that is in collection and I refuse to pay it because I spend my time and money monitoring my accounts and money to ensure I am not being scammed by individuals and it's the institutions that you trust to be trustworthy end up cheating you. I don't pay lifelock and check my credit report trying to keep my name clear and myself debt free for Bank of America's billionaires to try to cheat me out of $128.26. They will get that money when I die. They can dig my body out of the ground and sell my body parts in order to get that money, but as long as I am alive they will not get that money. I've never owed a single person, or company for anything. I pay all my bills before they are due but I won't pay a bill I know I don't owe, I am not made of money Bank of America and if you heard otherwise then bully for you!

The complaint has been investigated and resolved to the customer’s satisfaction.

late charge pyramiding

If you ever get a little behind on your mortgage with B of A, they give you over to debt collectors immediately. Let's say your behind (1) payment, but make the next payment on time in full (regular amount.) Obviously, you need to somehow get the one payment in to them before you fall way behind. Well, they will tell you that even if you made that 2nd payment on time (and you specified the month you wanted it applied to) they will charge you a late fee because of the 1st payment you missed & they will keep charging you late fees until you catch up that 1 payment. GUESS WHAT, THAT IS ILLEGAL, it's called (LATE CHARGE PYRAMIDING) per the FCC.

If I had known this fact I would of called them on it, but if you think about it, they can always blame the people (comapny of debt collectors they pass you to.) How BRILLIANT, now they can claim they had no idea that it was going on. JUST A WARNING FOR B OF A CUSTOMERS. This company will not only kick you when your down, but will stomp on your head. By the way, for the negative nancy's that like to make snotty comments on how perfect you are - this kind of information sharing is what this site is about, so find another website. My mortgage when B of A took over my loan skyrocketed up $400 extra a month and my impounded account was only semi-impounded, because I was also getting extra $500-$700 tax supplement bills. This is after paying into the mortgage for 2 years, unresolved and no explanation! I give up...

dishonest refinance good faith estimate

Attempted to refinance my home 7 mortgages with Bank of America. They took money from my bank account without approval and are taking their time with refunding it. I'm sure this is just one more way they take advantage of customers taking funds and gathering interest on money that doesn't belong to them.

Tried to charge me application fees and lender fees on loans they already had in house. I can't understand how our tax dollars were used to bail out these people.

check processing

Agatha: hello! Thank you for being a valued bank of america customer! My name is agatha. May I have your full name and the last 4 digits of your account you are referring to?

You: _

Agatha: thank you for the information, _.

Agatha: how may I help you with your personal checking and savings accounts?

Agatha: are you still with me? Please respond so I can leave this chat window open to an answer any questions for you.

You: my checking account is overdrawn because the online banking system didn't give me a correct account of what was occuring. My gi benefits from the military was deposited into the account on the 6th around midnight...

Agatha: I understand your concern regarding the account balance.

You: and the online banking system told me I had around $720

You: this led me to believe that I could proceed with making purchases.

You: I made sure to keep money in my account because I knew that my cell bill would be processed the next day...

You: I mean before the 5th.

Agatha: thank you for your patience. I really appreciate it.

Agatha: I have reviewed your account.

You: I checked the account throughout the day on the 5th and the check I gave to my landlord earlier in the morning hadn't been processed...

Agatha: I see that the available balance in your account is overdrawn by $30.82.

You: today I was in the grocery store to buy food and it said I had insufficient funds, so I checked my online statement and the information had changed from what it was on the 5th and 6th...

Agatha: I see that the check number 139 for $447.00 was posted to the account.

You: I really don't know what happened because the check must not have processed on the 5th but on the 6th.

You: the funds to cover that check wasn't deposited into their account until the 6th, so I do not understand why I have an overdraft fee.

Agatha: yes, but whenever the payee presents the check we will pay the amount.

Agatha: this check for $447.00 overdrew your account and a overdraft fee was charged.

Agatha: the date on a check is for your reference.

Agatha: the payee of a check is not required to hold the item until after the date on the check. When you sign the check, you agree to pay the amount written on the check.

You: so why wasn't the money withdrawn from my account on the 5th and posted so I knew where I was financially?

You: it appears to me that the online banking system duped me into believing something false.

Agatha: I do understand your point.

Agatha: please note that if a check dated in the future, otherwise known as a post-dated check, is presented for payment, we may pay the check and charge it to your account even if it is presented for payment before its date.

Agatha: however, if you do write a post-dated check, it is only an agreement between you and the payee.

Agatha: by federal law, banks within the united states may process post-dated checks once they are presented for payment.

You: the money for the check remained in my account until the 6th and wasn't withdrawn from it until the 6th or midnight of the 7th right?

You: the $447 check was written on the 5th and given to my landlord that morning...

You: I really am in a bind here and would greatly appreciate a refund of that fee...

You: until I receive my financial aid I will not have money to eat.

Agatha: one moment please.

Agatha: I do understand your point.

Agatha: would you like me to explain how the fee was charged?

You: I guess...

Agatha: sure.

Agatha: one moment please.

You: electronically speaking, isn't the check manually typed into your system for removal from my account but it is not physically removed until processed... Which occurs the next day?

Agatha: the funds will be debited from the account when the check is presented for payment.

Agatha: we do accepts stale or post dated checks.

Agatha: *accept

You: but the online banking system didn't notify me of it.

Agatha: thank you for waiting. I'll be with you in just a moment.

You: isn't the check like a credit or debit transaction that posts to the the account to give an average of what is available, but it is not really taken out until the computers have updated the next day.

Agatha: we process all the transactions during the overnight processing, first the credits will post then, the debits will post to the account and all the updated transactions will post to the account on the next business day by 6 a. M.

Agatha:

Agatha: however, saturday and sunday being the non-business days, the overnight processing will not occur and the deposit will be considered as made on the next business day i. E., monday. Hence, the deposit will be processed during the monday's overnight processing and the funds will post to the account on the next business day by 6 a. M.

You: yes, but my gi benefits were posted to my account on midnight of the 6th.

Agatha: let me please explain this to you.

Agatha: our records show that the starting balance in your account on 1/5/11 was $38.88.

Agatha: there were 3 transaction that posted to your account which are $447.00 which is check 139, $5.00 and $1.00.

Agatha: the transaction for $447.00 overdrew your account and an overdraft fee fee was charged.

You: hypothetically speaking, if I made a credit or debit purchase for $40 then I would be in the negative, but if I put money in the atm to put me in the positive I wouldn't be charged a fee for being in the negative for a few hours?

Agatha: I see that the credit of $687.00 posted to your account on 1/6/11.

You: yes, I checked it that night on the 5th, I mean 12:30 a. M. Of the 6th, and it was in my account.

Agatha: we apply direct deposits as they are received throughout the day.

Agatha: the funds are made available on the effective date.

Agatha: this date is decided by the company that is sending your direct deposit and is reflected on the documentation that you received from the company.

Agatha: please note that making a deposit or transfer after items have overdrawn your account will not prevent the items from being returned as unpaid or fees being assessed.

Agatha: the funds must be in the account before items are presented in order to avoid overdraft fees.

You: whoa.

Agatha: hope, I am clear with you.

You: so what if my landlord's paperwork says the money was deposited into their account on the 6th?

Agatha: it depends on the financial institution of the land lord's account.

Agatha: I am unable to comment on it

You: so if I can prove that their institution received the money on the 6th will you guys please refund me the $35 feee?

Agatha: I see that the fee was charged correctly, so we are unable to refund any fee.

You: goodbye bank of america.

Agatha: is there anything else I may have pleasure to assist you today?

You: lol, no but thanks anyways.

Agatha: thank you for choosing bank of america's text chat service!

Agatha: bye. Have a great night.

*don't piss off the bank..."Why am I being assessed this fee?"

not paying bill as scheduled

I was automatically having my payments on my NEA Bank of America card made via the Bank of America website. Bill was scheduled for Jan. 2 which was a Sunday. When it was not listed as paid by Monday I checked the bank website & saw that I was still listed as having automatic payments for full credit card amount scheduled. On Wed. Jan 5 I got an e-mail stating I had a new bill with interest as the old payment was overdue. I spoke to several people in different departments who all claimed that not only was I not scheduled for automatic payments but I never had these done. When I checked the website I saw that suddenly there was no listing for me having automatic payments. I arranged on the phone to have the bill paid and almost convinced myself that I was losing my mind until I checked various consumer complaint sites and read of similar experiences. I can only hope that this small bill is straightened out so I can discontinue my card. I also wonder how long they can get away with this nonsense!

The complaint has been investigated and resolved to the customer’s satisfaction.

overdraft fees from a different account!

Recently, Bank of America went into my checking account and withdraw over $300 in overdraft fees. I did not sign any bad checks or make any purchases with my debit card that were over the amount I have in my bank checking account. When I called to find out what was going on, they informed me that I have overdraft protection from a family member's account. I have never signed up for overdraft protection on this person's account and this person has never signed me up for overdraft protection on their account. Bank of America's information is completely wrong. I went to the local branch where I signed up for the account. When I demanded my money back, I was told I am talking to the wrong people; I should be talking to my family member. I asked to speak to the manager, who also informed me there is nothing she can do. I then asked how I should go about making a formal complaint in writing. The manager told me they do not accept complaints in writing. To summarize, Bank of America can go into your account, take your money for no reason and make up stories that you signed up for overdraft protection for another person's account when you have never even been to a bank with that person.

The complaint has been investigated and resolved to the customer’s satisfaction.

I doesn't make sense for anyone to be a joint owner of any account without signing something and knowing about it.And the tellers or manager should be providing answers better than there's nothing they can do. Can they show you what papers you signed? I'd ask what branch has the right papers and go there looking if it's forgery or what. Then you should be entitled to claim a theft, if that's the case. If they don't have signed papers I'd ask how they can authorize anything without your signature. You at least deserve some answers.

Boy that sounds nasty. I haven't dealt with a BofA account since 1996, since I moved to Utah and stopped using the credit card about 1998. But I always had good service. If they went that down hill, I guess i'm better off that there are none in Utah. I wonder if my friends in California still bank with them.

disparate treatment of deaf

I am a deaf customer. I opened an account at local branch of B of A in September 2010. At same time, I asked for contact via email (written language is my primary language) with the local mortgage/loan officer for this very small bank. I was ignored. I then sent 2 emails asking for "preapproval" of a home loan. I was ignored. I then sent the branch manager a long fax explaining what the Americans With Disabilities law is and why he needs to respond to me in writing, because I do not use a telephone and bank refuses to use live relay. I was then ignored for another month. Sometime in December 2010, manger and loan officers both began emailing. As of this date (December 31, 2010) they have STILL NOT been able to either approve or deny a home loan, despite my immediate responses to all of their requests for my personal and financial information. Excuses are: we have the name of your old landlord, but not the phone number. We did not get the fax you sent 11 days ago. We misunderstood what you were asking, etc. Nobody responds to me unless i first email the bank manager. Does it normally take more than FOUR months to make a decision about a home loan applicant who has a steady income? Or just for deaf? Seems to me like DISPARATE treatment. proof is dozens of private emails with dates on them.

boa not helping with home modifications

My house was foreclosed on in September. Six months before the foreclosure of our home was to occur, we secured full time jobs and immediately contacted Bank of America (BOA) to start the home modification process, as we were more than qualified to pick up and start our house payments again. BOA told us we qualified, and would send us a packet of information to fill out by FedEx. We never got those papers. After calling time and time again, BOA would not return our phone calls, send us the requested forms to be filled out, nor assist us in any way after that first conversation. We hired an attorney to assist us and even BOA's attorney here in Denver tried to help us, but nothing happened. I kept a list of everyone I talked to at BOA for those months and what they said.

BOA called me today to tell me that Fannie Mae now wanted to help us get back our home. Fannie Mae would pay any costs associated in doing this. After thinking about this, I am wondering if Fannie Mae is just now getting clues of how BOA has been screwing over people who are qualified, yet not being assisted, in receiving the home modification program. Clearly, BOA has denied (or not assisted) people that could have stayed in their homes by using the President's modification program. Having said this, has Fannie Mae been foreclosing on a lot more houses than it seems like it should? I bet you it is because BOA is not doing their job. Look at the thousands of websites on complaints against BOA. The consumers are complaining about the exact same thing I am talking about. No wonder BOA is having states filing class action lawsuits against them.

I just wanted Fannie Mae to know that there has to be a lot of people like me that could have kept their home and not have had them foreclosed on and dumped back on to you at a loss. (I was willing to continue paying my loan if they would have just tacked my missing payments to the end of the loan.) My house is still on the market and they currently have it listed for $60, 000 less than I was willing to pay to get the modification.

I have written our State Attorney General regarding this as well. If you are aware of this problem or need help in pursuing BOA's inaction to assist its valued customers, please let me know. I would be happy to help. After the grief of losing our home, I would be more than willing to assist.

Anyway, I wish you much luck. With BOA denying qualified people their home modification loans, I believe you are going to continue to be saddled with a lot more homes to come; homes that should not have been foreclosed on.

The complaint has been investigated and resolved to the customer’s satisfaction.

You have my condolences and understanding. I also knocked myself out working almost 20 hours per week or more at times to try to modify Countrywide loans only to have them fold and all went to B of A. From my reading it seems Countrywide sold most loans as securities in bundles which means that groups own the loans and they are not held individually as they used to be. Even though they sold the notes B of A has servicing rights which is why they always emphasize they are a debt collector. They are out to collect the debt and I don't even know if they have authority to rewrite loans that have been sold as securities. It is a big mess and I can say I was asked over and over and over for documents I already sent and it seemed just a stall. I got a big run around and now feel certain they never were sincere in their communications but only were stalling me until they could do foreclosures. I had six of them and now they are coming back again to re-foreclose on one they must have made mistakes on because they have the title in my name still though they did take it back.

Hi I need help to make a very long story short we purchased our first home in 2004, in late 2005 I lost my high paying job.I called Countrywide dozens of times to let them know of my situation they denies us any help at all. We found another company who got us a refinance and were promised the world, However we were lied to and given a bad loan once again through Countrywide who sold our risky mortgage to Bank of America who gave it back to us. For over 2 years now we have been working on getting a loan modification with no results every month paperwork re-submitted our rep keeps changing and the same story over and over again. I have contacted the office of the President they cant help I called my local state and A/G no one can help we are going crazy trying to get help some one please help

making home affordable

I am trying to make sure that anyone who is trying to get a loan modification through the Making Home Affordable program and their mortgage is with Bank of America knows that all of us must band together and file a class action suit. Bank of America is not going to help you with your loan.

Bank of America wants to put you in foreclosure. That is the simple fact. It is not going to suffer losses to shareholders. It is my prayer that an exceptional class action law firm comes across this and notifies me their is pending class action or they will be willing to hear what Bank of America is doing to destroy the lives of Americans. Unless their abuse of the Making Home Affordable program is publicized, no one can expect that Bank of America mortgages will be modified.

My story is long but, I needed to write this today. It is Christmas and my contact with Bank of America on Chrismas Eve resulted in this being the most joylessness Christmas I have ever had.

The complaint has been investigated and resolved to the customer’s satisfaction.

As a former Countrywide customer and now a Bank of America customer I have been told several times that my paperwork is not complete. Since July of 2010, I have resent the supposedly missing documents an additional three times to their fax number, with the appropriate loan number, attn: HOPE TEAM, and still they claim the hold-up is the paperwork not forth coming.

UNDERSTANDING that this is the problem, Since day one with a fed-EX tracing number they are claiming lost paper work included in the envelope. I asked what happens to the envelope with my documents, personal information, and bank account numbers, and every other kind of document asked for lost? HOW.

The representative could not answer what happens to the envelope upon opening, if it is checked before tossing or if they shred the envelope. She did not have a clue; neither did the other three individuals I spoke too. I worked for Bank of America and the procedure use to be to retain all envelopes for 30 days then shred all the paperwork, but if a customer calls about missing documentation they would have someone go through the dated materials if it wasn’t shredded. I know what I sent them is accurate and I have done my due diligence.

Bank of America does not even contact me or e-mail, or send a letter to inform me that there was a problem, I am the one that has to do all the calling, waiting 45minutes or more to get a quick answer of wait 30 days, then 90 days and I will get a response. I am not the problem. I am beaten and about ready to go through a third party, “Mortgage Attorney”.

I had my hopes up when I had a message from Bank of America, but sadly it was one of their “Advisors” inquiring why I hadn’t sent my payment in. I explained about the problems I have been having and I get the rehearsed I’m sorry. I lost it!

If there is true representation in our government for all of us who are struggling in a declining job market, they need to have strong regulation for the mortgage and banking industry; accountability and fairness. This is our shelter, saved for, cared for and contributes beyond the banking industry’s profits. It houses human beings, pets, establishes community and its community is in need of real help, When anyone of us call’s Bank of America it should be I am happy to help you and mean it! Not the same old rehearsed lines (lies) that it is my fault and I don’t send the paperwork, when it has been sent.

Thanks for the opportunity to sound off!

I found out that even though a lot of banks got money from government (i.e. taxpayers!) they are not required to give loan mods of any sort, even obama's little "making homes affordable" The fine print is what most Americans weren't made aware of and several people have tried to take B of A to court and lost. The courts stated these banks are not obligated in anyway to help consumers. And, yes I know there website makes them sound innovative, helpful, with loan modifications, principal reductions, etc. They do only a few token mods, just so they can say, "see, we are helping the American people stay in their homes." They took over my loan, they are a rotten fee f*%ker bank, run by teenagers. I would still be able to afford my loan if they never took over my loan, I'm having a forensic audit on the points, impounded tax/supplement discrepancies that changed mysteriously when they took over. That is the only way to get them for being corrupt, and it takes patience to get even in court. I know they did something with my Country Wide loan, an attorney is going over everything, the only way to catch them. Good luck to you, hope you don't lose your place..

I'm am so with you on that one. Personally, I would love to see across-the-nation class action suits against all the big corporations. B of A isn't the only bank that benefitted from the bailout and they aren't the only bank profiting from the billions we all paid from our tax dollars to, not only make money, but make sure they destroy the credit of the borrowers while making sure they put as many borrowers as they can in foreclosure. My guess: within another year or so, all the banks will be demanding yet another bailout...so bring on the lawyers to represent the people!

loan modification rip-off

I am on a fixed income, until recently supplement with a part-time job. I sustained a rotator cuff injury and no longer am able to supplement my Social Security Income. I contacted Bank of America and requested a loan modification. I not only never have missed a mortgage payment with them, I pay in advance and also make an extra payment annually to decrease the repayment term of my loan. Here's what B of A doesn't disclose, but which I discovered in conversation with the modification negotiator: if B of A grants a loan modification, they take the difference between the original loan repayment amount and the lowered modification amount and add that to the principle balance on the loan...each month. In effect, their loan modification is a negative-amortization loan. Additionally, if the modification is granted, Bank of America reports the borrower delinquent each month to the credit reporting agencies...their rationale being, as it was explained by the negotiator, that the borrower has failed to comply with the original, pre-modification terms of the loan. Therefore, after receiving billions in bailout funds, Bank of America has found a loophole in the bailout terms that allows them to grant modifications, but penalize the borrower by destroying the borrower's credit rating AND recouping the full payment should the borrower ever manage to sell his or her home by increasing the principle balance owed each month - thereby devouring what equity the borrower may have in the home. Bank of America is not the only lender bailed out with our tax dollars engaging in this practice...and the Senate is well aware of this practice by the banks bailed out; I called some Senators and was told this is not illegal and there is no regulation in place to prohibit this practice. I'm refinance my home through a local credit union - same payment, but at least none of the thiefs we bailed out will benefit from my monthly mortgage payment.

home affordable modification program

Today is Dec. 14, 2010 and it has been almost 2 years since I initially applied for the Home Affordable Modification Program with Bank of America in July 2009. I sent them a clean file and kept following up and escalating to numerous supervisors only to be told to that it takes 60 - 90 to hear back from the bank in regards to my request. In December 2009, I was able to get the direct contact number of the negotiator handling my file (after being told that information was proprietary). The negotiator was understandable and sent me my trial payment package which would begin on April 1, 2010. I completed all 3 trial payments on time only to be told that it would be another 90 days before a final decision is made. In July 2010, I received numerous FedEx packages asking for several things that did not apply to me...so I called and the rep said just disregard it. Well another month passed with no word on my modification. In August 2010, I continuously called BAC weekly to check the status and make sure my paperwork was up to date and was told it was fine. Well after hearing nothing yet again as to when I would be receiving my final package...I filed a complaint with the NC Commissioner of Banks. My file was immediately escalated to the Office of the President only to be called with broken promises just to keep the heat off the company. I'm fed up and if I could pay this mortgage off in full, I would just so I would never have to deal with Bank of America again. All of their reps are incompetent and probably have NO mortgage experience or proper training. That should be against the law. I spoke with the 2nd negotiator (office of the President) on Dec. 3, 2010 and she assured me that my file was escalated to underwriting and I should hear something back in a week...well On December 13, 2010, I received another FedEx package thinking it was my final modification...only to find out it was a package asking me to apply for the HAMP...HELLOOOOO! I applied for the HAMP in July 2009 and have been waiting for the idiots to give final approval. I'm about to contact my Congressman next because this is beyond ridiculous.

Hello Tracy,

Yes they are the worst company! They took over my mortgage that was initially with Countrywide. As far as the credit issues, they tried to ruin my credit but I went directly to the credit bureaus and disputed every false report they made. Luckily I kept every proof of payment (online) and I also logged every call and who I spoke with. It was a nightmare dealing with them and I kept calling demanding answers on file. I literally called daily from work. It was total chaos. I received my final modification at the end of December but I'm still dealing with them trying to ruin my credit and piling on unfair late fees (when I was never late). It is not the fault of the consumer that BOA takes the trial payments and apply them to an expense account versus applying it to the loan. Once my mortgage is paid in full, I will never do business with BOA again. I stopped banking with them along time ago because they are CROOKS! I advise you to keep calling and request a supervisor because once you make the trial payments, that's the final stage of a modification. If you didn't qualify for the HAMP then they would have never put you on trial payments. After speaking with a supervisor, I found that the main issue with my file was that someone coded it incorrectly which caused it to be held up in the system for so long. If at all possible, contact the Commissioner of Banks in your state of residence.

hello to comment on the issues with Bank of America, this story sounds as though I'm reading the exact same problem as everyone else.My husband and I have been trying to go through with the home affortable modificationfor almost 2 years as well. we were sent our trial package as you did and made all of the trial payments. WE must of spoken with atleast 100 different represenitives since we started this process. We were not behind what so ever when we started the modification, and now we are very far behind, due to being misslead the entire time. Noone had a clue as to what they were talking about and we never recieved any calls back.We checked the statues numerous times and were told it was in review.well now 2 years later we are told they donot have a program for us and were told we should just short sale our home. There is absolutly no compassion from these people at all.This has got to be the worse Mortgage company in the world.We donot want to sell our home, we want to save our home and we thought BOA was going to help us with that. Every single complaint I have read about BOA is all exactly the same as mine. I just want some answeres. our files were lost many times which then we had to keep sending the same papers back to them. I am extremely discusted with this entire situation.

name change without my permission

BOFA is kind of backwards in some ways as a rsult of being very southern in origin. I submitted a check reorder with my full name on it only to receive new checkd with park of my last name being changed to an initial. BOFA has personnel that make changes without authorization which really pissed me off when I provided the correct way m y name should be on the checks. BOFA dos not get it when a customer has two last names such as mine. To make pat of the last name an initial is just plain stupid. I do intend to go into one of it poor customer service centers on the South Side where you are treated and greeted with an attitude like "what do you want?" My exerience with North Side service center is much more pleasant. I wonder why, but blieve BOFA know the answer very well. Lack of respect for South Side Customers in general!

The complaint has been investigated and resolved to the customer’s satisfaction.

South side of Chicago? Or the South?

I find it so funny that uneducated northerners have such a bias against the south. As if these branches of BOA in Chicago are sleeper cells of The Confederacy. When nobody is looking, everybody in BOA north of the Mason Dixon hits Dixie on cassette deck and bakes a possum and sweet potatoes. C'mon, you can't be serious. The reason BOA got your name wrong is because you don't know how to express yourself linguistically; I could barely slog through your cryptic mess of writing. By the way, the South is not really backward, or "backwards" as you say. It's probably too tough for you down here, you would be advised to stay up north, where they suffer fools lightly.

complete disregard of escrow close date

If you are trying to make a decision between Bank of America and another bank, or if your loan will be processed at the BAC Home Loan Processing Center in Brea, CA, please read this review. We are currently in escrow with Bank of America Home Loans, and it has been a complete nightmare. Actually, everything was going smoothly up until the week ago. Our loan processor told us that after he received the last two pending items, our latest bank statement and the termite clearance, that we would go to underwriting and that we should close on time. As soon as both items were ready, they were sent to our processor two days later. And then he disappeared. We didn't get confirmation that he received the documents, we weren't told that we were in underwriting, he didn't return phone calls FOR THREE DAYS. In the meantime, emails were flying all over the place between buyers, sellers, escrow company. Three days later, which was two days before we were supposed to close escrow, he sends this message. "Whew. I've been out for three days and am trying to catch up on my paperwork. BTW, we're not going to be able to close on time". My jaw just dropped because I had realized that our file sat frozen on his desk while he was gone.

We contacted his manager by phone and email, we were not contacted. We contacted another manager in the same department and were not contacted. It is now the day after we were supposed to close and we just got a message from the manager. It was a general message that explained that our processor had an emergency and had to leave unexpectedly and that we were now in underwriting. No apology, no explanation of how they were going to makeup for lost time, and why/how our file was abandoned. We are now closing late, on a date that has not yet been determined. My husband and I both have a steady income, high FICO scores, turned everything in on time. This delay in funding is clearly due to our processor's absence.

Do not choose Bank of America. They have horrible customer service skills, will treat you like a number, and have no regard to sticking to a timeline.

is ruining my credit

Bank of America is ruining my credit! I've been lucky enough to keep my job through out this recession. I make six figures and have always been financially responsible. I've been unlucky enough that Bank of America has aquired two of my credit card accounts. I already had two lines of Credit with BOA. I've NEVER been late with a payment and actually pay more each month than what is due. They have continued to drop my credit so that it appears that I am right at my limits. For example: I had an MBNA credit card with an $18, 000 limit. I made a $5, 000 payment and they lowered my limit to 13, 000. I just made a $2500 payment and they lowered my limit the additional $2500. I just needed to buy a car and because it looks like I'm at my limit on all of my BOA accounts- I had to get a higher interest rate! I just paid off one of my BOA lines of credit ($9, 950) and the closed the account. They are taking good people thatt are working very hard to make their obligations and screwing them. My credit has dropped from good to fair thanks to BOA! There has got to be someone we can talk to about this. Does anyone have any suggestions?

The complaint has been investigated and resolved to the customer’s satisfaction.

Try to switch the balance on these credit cards to another bank. We got out two years ago when they were "yo-yoing" the interest rate with every statement! No explanation, no excuses and with a great deal of complaint, they would turn it back a couple of points only to put it up on the next statement. No ethics here!

Bank of America has come newest Bank and in this little bit time, it has become very popular in everywhere. Because most of the big companies is merge with this Bank. And there's also very beneficial scheme available to customer in this Bank .

http://www.myspace.com/557774587/blog

Bank of America Reviews 0

If you represent Bank of America, take charge of your business profile by claiming it and stay informed about any new reviews or complaints submitted.

About Bank of America

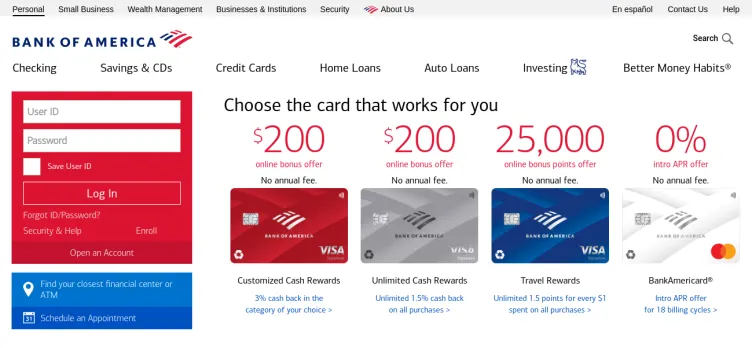

One of the key strengths of Bank of America is its commitment to innovation and technology. The bank has invested heavily in digital platforms and mobile banking, making it easier than ever for customers to manage their finances on the go. With features like mobile check deposit, online bill pay, and real-time account alerts, Bank of America is at the forefront of the digital banking revolution.

In addition to its digital offerings, Bank of America also has a strong network of physical branches and ATMs. With thousands of locations across the country, customers can easily access their accounts and get help from knowledgeable staff members whenever they need it.

Another key advantage of Bank of America is its wide range of financial products and services. From checking and savings accounts to credit cards, loans, and investment products, the bank offers something for everyone. Whether you're looking to save for the future, buy a home, or invest in the stock market, Bank of America has the tools and resources you need to achieve your financial goals.

Overall, Bank of America is a trusted and reliable financial institution that has been serving customers for over a century. With its commitment to innovation, technology, and customer service, the bank is well-positioned to continue to meet the evolving needs of its customers for many years to come.

1. Log in or create an account: Ensure you are logged in to your ComplaintsBoard.com account to proceed. If you do not have an account, please register by providing the necessary information and verifying your email address.

2. Navigating to the complaint form: Once logged in, locate the 'File a Complaint' button situated at the top right corner of the website and click on it to access the complaint form.

3. Writing the title: In the 'Complaint Title' field, concisely summarize the main issue you have encountered with Bank of America. Make it specific and clear, such as "Unauthorized Overdraft Fees" or "Difficulty with Mortgage Loan Modification".

4. Detailing the experience: In the complaint description, provide a detailed account of your experience. Include key areas such as customer service interactions, problems with account management, loan servicing, fees or charges that were unexpected, issues with online banking, or any other specific incidents related to Bank of America. Clearly describe the nature of the issue, including dates, locations, and any relevant transaction details. If you attempted to resolve the issue, outline the steps you took and the responses received from Bank of America. Explain how this issue has personally affected you, such as financial loss or stress.

5. Attaching supporting documents: Attach any relevant documents that support your complaint, such as correspondence, statements, or receipts. Be cautious not to include sensitive personal information like your social security number or full account numbers.

6. Filling optional fields: Use the 'Claimed Loss' field to quantify any financial losses you have incurred due to the issue. In the 'Desired Outcome' field, describe what resolution you are seeking from Bank of America, whether it be a refund, apology, or corrective action.

7. Review before submission: Carefully review your complaint for clarity, accuracy, and completeness. Ensure that all the information provided is true to your knowledge and that your desired outcome is reasonable and clearly stated.

8. Submission process: After reviewing your complaint, click on the 'Submit' button to officially file your complaint on ComplaintsBoard.com.

9. Post-Submission Actions: Keep an eye on your ComplaintsBoard.com account for any responses or updates regarding your complaint. Be prepared to engage in further communication if necessary to resolve your issue with Bank of America.

Overview of Bank of America complaint handling

-

Bank of America Contacts

-

Bank of America phone numbers+1 (800) 432-1000+1 (800) 432-1000Click up if you have successfully reached Bank of America by calling +1 (800) 432-1000 phone number 8 8 users reported that they have successfully reached Bank of America by calling +1 (800) 432-1000 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number 3 3 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number45%Confidence scoreEnglish+1 (800) 688-6086+1 (800) 688-6086Click up if you have successfully reached Bank of America by calling +1 (800) 688-6086 phone number 16 16 users reported that they have successfully reached Bank of America by calling +1 (800) 688-6086 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number 1 1 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number88%Confidence scoreSpanish+1 (315) 724-4022+1 (315) 724-4022Click up if you have successfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (315) 724-4022 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone numberInternational+1 (757) 677-4701+1 (757) 677-4701Click up if you have successfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (757) 677-4701 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone numberCredit Card Issues+1 (800) 214-6084+1 (800) 214-6084Click up if you have successfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (800) 214-6084 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone numberVice President Bank+1 (312) 992-6618+1 (312) 992-6618Click up if you have successfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (312) 992-6618 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number

-

Bank of America emailssupport@bankofamerica.com100%Confidence score: 100%Support

-

Bank of America address100 N Tryon St., Charlotte, New York, 28255, United States

-

Bank of America social media

-

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreNov 09, 2024

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreNov 09, 2024

Most discussed Bank of America complaints

pmi remove problemRecent comments about Bank of America company

ATM security firm illegal in nycOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.

I know someone who stopped paying his mortgage with Bank of America for 3 years, no sign of foreclosure so far. Pocket the money baby!

As i said before, maybe you didn't understand...THE BANK TOLD ME TO STOP PAYING... but i need not write anymore cause your not going to try to understand. Your trying to divide all of us that are united here in our cause to make the banks accountable for the lies they told us...I'M just saying!

why is it that the first question asked by some of these idiots is ? Did you pay your mortgage payment on time? well the answer is a resounding YES then the bank of america told me to stop making them, so being the person that i am i stopped that is when the s**t hit the fan. the bank lied while saying they were here to help they were really here to hurt. they were working on taking my house rather then helping me keep it. im sick of you people that know nothing about this making all these comments about how we are deadbeats... you know what i think... i think you just to selfish to care about anybody other then yourself. so please go live your useless life. I guess you think its ok to lie cheat and steal from the people who got you started in the first place...i bet your parents are proud of the person you turned out to be hahahahaha! NOT

oops, I meant that banks' underwriters were given GREEN, not red light, of course!

You know what the most dangerous thing of all is? A person who knows little about something! So, all those people who are trying to put the blame on homeowners for not paying their mortgages on time should educate themselves first before talking about this topic. Together with our government, those banks brought this colossal mess upon us. They knew from the start who can and who can't pay the mortgage, but their underwriters were given a red light to approve everyone knowing that soon, down the line many of these mortgages will default. As for borrowers/homeowners – do you really believe that anyone will sign their mortgage knowing that in a couple of years they will lose their house and all that cash they were sending to the black hole?! These financial products were packaged up and they sold like shares of stocks to “sophisticated investors” such as pension funds, endowment funds, and foreign banks. This moved the loans off the books of the large banks meaning they then had more reserves to lend and the process would start all over.

Do you realize that banks created (in the last 15years) financial products from bundled mortgage loans such as Collaterized Debt Obligations (CDO’s) and Structured Investment Vehicles (SIV’s)? These financial products were packaged up and they sold like shares of stocks to “sophisticated investors” such as pension funds, endowment funds, and foreign banks? This moved the loans off the books of the large banks meaning they then had more reserves to lend and the process would start all over.

They sold it to the investors knowing that many of these mortgages will default, and now investors are coming back to haunt them…Money is the only thing that can haunt Wall Street, everything else fall on deaf ears.

So, listen Bank of America -

WE ARE ALL JOHN WRIGHT AND WE ARE ALL FIGHTING BACK :)

Senka

Massachusetts

TD577 ...

What's sad about your post is the fact that it comes directly from the rhetorical tripe the media has been suckling from the banks and the corrupt politicians that are trying to demonize the average, hard working American. Your statements are wholly ignorant. Yes, you have no idea what you're talking about. The percentage of "deadbeats" you imply is MINUSCULE compared to the number of people that have been targeted ... and please understand the word "targeted" ... for the confiscation of the homes they are perfectly willing to pay for. If you had even a MODICUM of intelligence and researched even a MORSEL of the facts, you'd quickly discover that BANKS ... not ordinary, hard working citizens ... are wrought with GREED and PREDATORS preying on every victim they can get their hands on. But then, that kind of straight-forward logic would elude a propaganda mouthpiece like you ... not to imply a personal attack. The simple fact ... yes, fact ... is that you are simply wrong. No one wants a free ride, and if they do, fine and jail them. What people want is a level playing field, not criminals that run rampant through our Houses of Congress buying off elected officials, corrupting our courts with illegal fees acquired from false and illegal documentation, pumping hundreds of millions into Madison Avenue with outright lies of how wonderful they are. They are corrupt. They are criminals. And one day YOU will be their victim ... that is, if you don't wise up, fire more than five brain cells and join us.

Don S. - Pennsylvania

well mr smith i see your back...we the people want what is rightfully ours. and that happens to be our homes. i didnt buy a house i couldnt afford and i made my payments on time for 7 years, then economy hit a bump. the bank offered help, i called them they said we cant help you if your current so if you want our help you have to stop paying. which i did and they lied ! so screw you and your thoughtless dribble!

It sure does to mean I will be collecting a large check (wink).

.

With that being said, the reality is that when banks flooded the market with those bad loans, as a result of their fraud and their greed, it dropped down the value of everyone's homes. This would have devastating consequences on the economy. This would hurt my companies customer base, which had been in business for nearly 25 years. As a result, it would end up cutting my income nearly in half.

.

Hand out? The simple fact is that I have paid more taxes than anyone I know personally, which does not mean it is a handout. Even at 1% Bank of Defrauding America stood to make 450 million dollars, while just having it in their fat piggy hands. How about loaning it to the American people, instead of the very piggy banks that caused this mess in the first place? The simple fact is that if our government is in the business of handing our tax dollars to private banks, I would suggest that it is the banks government and not ours. That money should have gone to the American people, if it was going anywhere at all.

.

I worked hard and paid on time for nearly 5 years, which implies that I did not buy a house that I could not afford. The housing market and economy has always been a game of musical chairs, but this time when the music stopped playing, these fat bankers were already sitting down. This is because they simply cheated, while we were all playing by the rules. This is when I had enough, and that is when I became I AM JOHN WRIGHT AND I AM FIGHTING BACK! It is also why I have brought 25 law firms together to sue Bank of Abusing America. A lawsuit that can be better described as "The American People Vs. Bank of America."

.

http://www.youtube.com/watch?v=PoOJMr7OJ0s&feature=player_embedded

.

The only one who got a handout was Bank of Defrauding America.

.

My name is John Wright AND I AM FIGHTING THE LARGEST BANK IN THE WORLD!

.

John Wright

piggybankblog.com

If it walks like a piggy, talks like a piggy, by golly it’s a PIGGY!

.

WHERE IS MY LOAN MODIFICATION BANK OF DESTROYING AMERICA!

.

BofA and it’s CEO Brian Moynihan reminds me of that song by John Lennon and George Harrison titled "Piggies" I invite you to listen to this song on youtube and see if it appropriately fits.

.

http://www.youtube.com/watch?v=ovD9rTzs2q4&feature=player_embedded

.

Have you seen the little piggies

Crawling in the dirt

And for all the little piggies

Life is getting worse

Always having dirt to play around in.

.

Have you seen the bigger piggies

In their starched white shirts

You will find the bigger piggies

Stirring up the dirt

Always have clean shirts to play around in.

.

In their ties with all their backing

They don't care what goes on around

In their eyes there's something lacking

What they need's a damn good whacking.

.

Everywhere there's lots of piggies

Living piggy lives

You can see them out for dinner

With their piggy wives

Clutching forks and knives to eat their bacon.

.

When I filed my lawsuit against Bank of America, myself and Brookstone Law Firm thought of the many others out there in the same situation. It was then that we decided to educate the public on what these piggy banks are doing, as well as unite us all together as one voice. Please help me turn this David vs. Goliath modification process, into a Goliath vs. Goliath.

.

Please stand with me and Brookstone Law firm and send an email to Bank of America that states that we will no longer tolerate their potentially illegal, fraudulent, irregular and abusive business methods. - http://www.brookstone-law.com/

.

So please send your email directly to Bank of America and include the following:

.

1. Your name

2. Your complaint concerning your experience with Bank of America.

3. Please end your email “I support John Wright vs. BofA Lawsuit!”

4. Please send a copy of your email to piggybankblog@earthlink.net

5. Please send your email to BofA CEO Brian Moynihan:

brian.t.moynihan@bankofamerica.com

.

If you would like to join my piggybankblog "Elite Blogger Hit Team", please do not even hesitate to contact me at piggybankblog@earthlink.net. The elite team involves leaving comments on certain pre-decided Bank of Destroying America comment sections on articles, blogs and other various online sites.

.

Please help me spread this youtube around, which is an announcement of my Lawsuit. It will drive Bank of Abusing America absolutely crazy to see it all over the internet:

.

http://www.youtube.com/watch?v=PoOJMr7OJ0s&feature=player_embedded

.

I HAVE HAD ENOUGH AND I AM FIGHTING BACK!

.

Divided we might have fell America. UNITED WE MUST STAND!

.

Let's Roll!

.

John Wright

piggybankblog.com

The same thing happened to us. Except they said they did not receive our first 3 payments on time, but when we ask for a copy of all the payments received there they were, just placed in different areas like fees and such. Bank of America then went in and said that they put all payments where they were suspose to be, yea on 1 day so still looked like payments were not made on time. We did our MOD in June and did not no were were denied until March, no letter to inform us, no call, not anything. I had to call to find out what was going on. Then they did a loan modification whithout us knowing about it and gave us around 6 days to come up with a large sum of money. No way we could, and they knew it. Yes something needs to be done and to everyone cheated by Bank of America I wish them good luck.