Bank of America’s earns a 4.0-star rating from 4575 reviews, showing that the majority of banking clients are very satisfied with financial services.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

driscrimination against minority.

Discrimination report against Bank Of America 02/16/2011. Crossroads Bellevue WA Branch Bank Of America. On Feb 16th 2011. I went to the bank to deposit my Payroll check the same way I have been doing for more the 2 years. I stopped at 15600 NE 8th st suite A9, Bellevue WA 98004. Bank Of America which has been my bank for 5 years. I went in and talked to...

Read full review of Bank of Americaracial discrimination.

Discrimination report that happened

The bank of America

In Kirkland WA.

Antonio r filho

9415 ne 40th st

Yarrow point WA 98004

[protected]

[protected] [protected]@yahoo.com

On May 15th 2009 I went to the bank of America in Kirkland WA to deposit my check of

1054.29 which I do weekly after I get my pay check. That Friday I went to the drive through

And talked to this lady called DONNA and she greeted me and after receiving my check she

Said that, because of the new policy she would put a hold on my check for 5 day because

My check was not a bank of America check. I was confused because I never had this kind

Of problem and a week before my wife had deposited the same amount and the same

US BANK kind of checks and had no problem. I told her that I would want the whole amount

Available right away and she repeated “NO YOU CAN’T “. Then I said I want to see the manager.

I went inside to see the manager and He told me the same thing. That I could not cash that

Check and that they would put a hold for 5 days on my check.

I went my way but I called the customer service of bank of America, and they told me that they

Never her that the bank was putting a hold on checks that were not from bank of America and

That I should go to any other bank and they should be able to help me. I went another bank of

America and they said that this is not a policy that BANK OF AMERICA adopts.

At that point I noticed that I just had been a victim of racial PROFILING and I had an idea.

My wife was home with my son and I called her and asked her to help me to deposit and cash

Some money. The only difference is that SHE IS WHITE and I thought that was the issue my

Skin called and probably the fact the I’m DARK SKIN MALE.

She came with me to the same Bank in Kirkland and went in the bank

With the same check BUT THIS TIME THEY DEPOSIT AND GAVE HER 375 CASH BACK.

There was never a question or about the check and it was the same Check that I tried

To deposit 55 minutes before. I talked to the manager and he got very defensive but

Never apologized to me and my Family.

I would like for someone to help me to get this story on the media either local

Or Nacional of HOW BANK OF AMERICA AFTER TAKING A BAILOUT FROM US

IS TREATING THE AMERICAN PEOLPLE. I do pay my taxes and I am an American citizen.

Thank you.

The complaint has been investigated and resolved to the customer’s satisfaction.

discrimination and racism.

Discrimination claim against Bank of America.

On January 5th 2011, I Antonio R Filho went to bank

Of America on 10555 NE 8th ST, Bellevue WA 98004.

I drove to the window of the building to make a deposit of

Payroll check in to my checking account. The teller advised

Me that my check would be on hold for 2 days before I could

Receive any funds into my account. I said that I would like to

Talk to the manager and she asked me to come inside the building.

Once I got inside the building I was helped by this lady called Gloria (Manager of that branch). She redirected me to

To talk to Mr. Brian S. Jones ( Senior Vice president).

He told me that my check of 1054.29 was too much money

And that check WOULD NOT HAVE IMEDIAT FUNDS AVAILIBLE TO ME THAT DAY. I tried to understand the

Problem but because this happened twice before with me I new that it was because of my SKIN COLLOR That he was

Not going to release the funds. I asked him to check my

Account history on that check for the fact that it was a PAYROLL CHECK that was deposited every week but

He asked me to go to another BANK.

I went home and asked my wife to come with the SAME CHECK and deposit it into our account. SHE HAD NO PROBLEM WHAT SO EVER WITH THE CHECK.

They gave her immediate funds to her but 2 hours before they

Said no to me.

This happened to me 3 times now and I’m tired

Of being discriminated by this bank. I am an American

And it does not matter if I’m not white and my wife is,

I still want immediate funds when I go to a back if that

Bank offers that to there customers.

Please help me to stop this from happening to anyone

Who might try to go to that bank or any other bank that

May be practicing this kind of discrimination.

Thank you.

Antonio r filho

9415 ne 40th st

Bellevue WA 98004

The complaint has been investigated and resolved to the customer’s satisfaction.

They have every right to purchase old debts and come after you for them. However Daniel Gordon is a terrible law firm. All they do is sue people, get default judgements then clean out your bank account. YOU NEED TO FIGHT them if they do this to you. This is an assembly line. One person in his office actually told me they were doing good for the economy. I guess crapping on the little guy while he is down is good. It's funny because we have bullying education in school but when you become an adult you get bullied whether it's the government or a low life cheeseball like gordon. Word of advice...NEVER ever EVER get a credit card again. If we want people to stop doing this we need to put the credit card companies in bankruptcy by not getting them in the first place.

not posting payments

I may be getting forclosed on by Bank of America because Bank of America Mortgage is not posting payments or they are posting payments ten to twenty days after they get them. I made a repayment plan with Bank of America in Januaty 2011. I was to pay $900.00 by 1-25-11, and I was to pay $1040.00 by the 25th for February through July 2011. I made an allotment. In the end of February, I called because by payment from [protected] was not posted. I was told that they were behind on posting and not to worry. On March 7th, Bank of America posted my 3-4-2011 payment. Where was my Feb 18 2011 payment? I called. I have this paymejnt set in an allotment. A treasury check is sent to this company. It will be 60 days before I can get a copy of the cleared check. Although they got my March4 2011 payment, they did not post my March 18 2011 payment.

I think this is a conspiracy and common practice of this company. On March 26, 2011 I had stopped the allotment and set up for my April 15 2011 payment. They charged me $20.00 fee to be taken on [protected]. They took it on Monday [protected]. So they have to hold my $1040.00 and run it on [protected].

This company does not care. I now have to look for a Mortgage attorney to help me with this mess. All because Bank of America is paying with payments. If anyone is having this same problem, let me know at [protected]@gmail.com

The complaint has been investigated and resolved to the customer’s satisfaction.

I am having a huge problem with BOA as well. They sent a letter saying we are three months behind on our payments. The didn't post a payment I made in April 2011, March 2011 or September 2011. I call every day and I get the same answer that they are researching it. I have faxed and emailed bank statements showing the payments and yet they have still not posted the payments. I escalated my complaint to the corporate office and once again I had to fax my bank statements then she said it had to be researched again. I just don't get it what needs to be researched when it clearly says it I made the payments. I just don't know what to do anymore. They clearly don't care.

accounts closed without notice and world points lost

we received a letter Saturday that our checking account with BOA was going to be put on restriction in 21 days and closed in 30 and that it was a business decision. We have been banking with BOA for over 10 years and have the worldpoints card and all of our mortgages with them. We pay off our card each month because we use it for everything to accumulate...

Read full review of Bank of America and 6 commentson-line employees using complaint board

TD577 Works for Bank of America! FYI, he is getting paid by the company to come on- line and try to confuse people with the facts about his banking industries corrupt practices. He will pop up on everyone's letter of complaint but only for Bank of America. This is his full time job. He is getting paid to make ignorant comments and to criticize people, he is a cooperate vulture at B of A, FYI to those who chose to dare write about his company. He is the opposite of what this website was created for (CONSUMERS.) The big cooperations have nothing better to do, since they are not helping consumers at all!

My favorite part is when you "confuse people with the facts…"

fraud, embezzlement, loan modification

Bank of America and BAC Home Loans is the most criminal banking organization on our planet. Their only goal is to destroy millions of lives not help them like they say on their website. This is misrepresentation and false advertising. Quite honestly, the whole banking system needs to be replaced. Many people are standing up and fighting these...

Read full review of Bank of America and 192 commentsmedallion guarantee

My wife went into our local BofA branch in West Islip, NY to have them provide a medallion guarantee (MG) of her signature. The MG is to be used to transfer the stock of her recently deceased father into her name. The MG is nothing more than a stamp from a bank acknowledging that her signature is correct, sort of like a notary. Since we have our accounts at BofA, and they have her signature on file, this is an easy thing to do. It's also a requirement of the bank. Unfortunately, she came across an idiot in customer service that refused to provide this basic service. She went back the next day with a death certificate, court letters and a note from our attorney. My wife was refused again. The woman was extremely rude. Everyone in the industry (including me) knows that this is no big deal and should be a service provided. The other thing we all know is that BofA is the worst client service bank on the planet. I worked for them and can attest to that. Let's all boycott this backwater institution.

rip off gouging

CUSTOMER RIP OFF Bank of America Rips off our company continuously with fees whenever they like, for monthly services, when you have done what they asked for.

Offering misrepresentation of services & fees for the services so they can collect fees for these services once the trial period has run out. This company is just a complete RIP OFF DO NOT DO BUSINSESS WITH BANK OF AMERICA THEY WILL TAKE YOUR MONEY WITHOUT RECOURSE.

DO NOT BANK WITH BANK OF AMERICA RIP OFF ARTISTS

BANK OF AMERICA CON-ARTISTS STEAL YOU FUNDS.

OBNOXIOUS BANK OF AMERICA RIPPS OFFS CUSTOMERS EVERY MONTH !

The complaint has been investigated and resolved to the customer’s satisfaction.

I too have been taken advantage of by Bank of America. I was late less than thirty days to renew my homeowners insurance. I renewed the insurance with Safeco and paid the entire year. Bank of America also renewed my insurance. They put six months coverage in my escrow account and upped my payments. Safeco insured my home for one hundred and fifty thousand dollars more than I owe on it. Bank of America insured my home for exactly what I owed on it and they charged me a little over double of what Safeco charged. Bank of America told me they already took their money and purchased SIX MONTHS insurance so they would not reimburse the fee. Bank of America also told me that my payment would drop in July 2011 after they recovered the SIX MONTH MANDITORY FEE. It's now August and I'm being billed for another six months. My payments din't go down.

I also received an offer for extra fire insurance from a company I never heard of before. I ignored the offer. The following month my bill went up fifteen dollars. I called Bank of America and was told a private insurance company said I gave them permission to add the insurance to my payment. Bank of America told me they could not cancel the insurance and I would be responsible to notify this insurance company if I wanted to make a change. After researching this insurance company I discovered that Bank of America owned it. Check under class act suits against Bank of America and make sure you are not also a victim.

boa sucks the big one

After 2 years of submitting a hardshipp letter along with all necessary paperwork needed they finally tell me they can't help me and my family. I have all the proof to show I have sent this crap 4 times in 2 years. Then they tried to stall and start asking us bogus questions. Asking us who else is renting from us? We don't have any rental property... If we did do you think we would be asking for help. They then ask how much social security are we recieving... Hello! Me and my husband are under the age of 50. I have never seen anyone ### around as much ar bank of america. My husband had been laid off for 2.5 years and barely getting back on his feet. Thank the lord he is the only that will be saving us from these crooks!

The complaint has been investigated and resolved to the customer’s satisfaction.

I was in your shoes about 21/2 years ago. I have tried to find ways to keep our home. When I had paid on our home, the company tells me that this is not the place to send your payments to and they have me send them into another city. Then I get phone calls saying that they haven't received their payments yet and I had to explain to them that we are having a hard time right now, my husband was either sick or out of work at the time. And I wasn't working, I had small children home then. So 2 1/2 years ago, we had to move out of our home, it was forclosed. I really wanted to find ways to keep that home to.

Rita

fraud / inability to close account

Two years ago I lost my debit card. Went to BOA branch and reported it they issued a new temp card.You would think BOA would put a stop on a lost card. I found out two years later when BOA called me detecting fraud. Over 20 fraudulent charges were posted the same day.To my surprise the charges were made on a card reported lost and should have been cancelled 2 yrs ago. I contacted BOA and reported the fraudulent charges some of which are reaccuring charges if not stopped would continue every month. The Fraud Dept assured i will get credited for these charges and no other charges could be made. A week later 15 more fraudulant charges were made to the same card. I could not see how they allowed this since the card suppose to have a stop on it.Called again got the same re assurance and 5 days later more fraudulent charges. Now they allowed the fraudulent persons to back date the bills and the charges still went through. Frustrated I decided to draw out the remaining money and close my account . Easier said than done. I closed my account.Then when BOA credited the fraudulent charges the account reopened without my permission. Guess what the fraudulent charges began again once the account re opened against my will. I again went to the bank complained and they closed the account again. They cant seemm to explain why my account remained active but went and closed it. I requested any credits to be sent to me by check. A week later BOA posted a credit to the closed account and re opened my account without my permission again.Like before once opened the fraudulent charges continued. Being totally frustrated I went to the bank compaining. A closed account should be closed period.Any activity to a closed account should be denied plain and simple. Not at Bank of America so if you have fraud to an account and close it is good chance it is not closed. Nothing in place to stop someone from crediting a $1 to your closed account re opening it and charge you a $100 or more in fraudulent charges a week later . Well so frustrated I contacted the OCC (Office of Currency Commisssioner). The site online and you get the form and file a complaint by mail. Not long after my complsaint was received, I got a call from someone at executive office of BOA. They tried to play stupid. When I asked how was charges made to a card reported lost 2 yrs ago and why i can not close my account where its truely dead they could not answer it. I responded when the OCC ask you that I am sure you need to give them a answer. The next day the problem was corrected. remember if you have a complaint like this against BOA submit the compaint to the OCC Office of Currency Commissioner that regulates banks.Hopefully with enough complaints submuitted the OCC will stop this Giant from doing what they want to the hard working citizens of the US.

The complaint has been investigated and resolved to the customer’s satisfaction.

cash deposit missing

Shirley,

Are you interested is going to small claims to file a complaint?

Recently I made a cash deposit at an atm at bank of america. I didn't have a deposit slip with me. I tried to

Go inside the bank to a live teller because it was cash. I know that I was on camera with $200.00 cash at that

Point. The live teller told me that they switched my account to ebanking (Meaning that I had to go to the

Atm to make the deposit because that was the type of account I had to only use the atm). She assured me

That this is done all the time and they never lose a cash deposit in the atm. So, I had to use the atm

Machine. I explained that I did not want to deposit cash into the atm. The live teller directed me to the atm

Machine outside. I was also told that I did not need a envelope for a cash deposit.

I went to the atm outside and proceeded to make the deposit for $200.00. The machine had two areas for

Deposits. One area for cash and one area for checks. I was not sure where to put the cash. I saw a location that

Said cash and I put the money there. Therefore, I did not put the cash in the correct place and I did not get a

Receipt. I put the cash in to area that said cash but I guess it was the cash output area and not the cash input

Area. I tried to get the money back from the incorrect slot. I was able to fish out $40.00 but I could not get

Back the $160.00. I immediately went back into the bank. I was very upset and I started crying. I had just got

Laid off and I could not afford to lose money. Deep down I knew that I would never see that money again.

I was told to call the customer service line and they said they would temporarily deposit the money in my

Account until the investigation was completed. I just got a letter from bank of america and I was told that

The cash was not found.

I asked several times for the bank to check their video cameras. I went to a live teller to make the deposit

Initially to put the cash in the account. They could plainly see me with the money.

I never heard back from customer service. I received a letter in the mail stating the investigation was over.

They would be charging my account.

So I had the case re-opened. I still haven't heard from customer service. And have never received any

Information detailing how they did their investigation. And my money has not been re-deposited in my

Account.

My theory is they have dis-honest employees.

Enough is enough. I feel like a lot of poor innocent people are being taken advantage of.

I am contacting an attorney tomorrow to see what my rights are.

Recently I made a cash deposit at an atm. I didn't have a deposit slip with me so I went into the branch to get

One. I wanted to go to a live teller as well. I went inside the bank to a live person teller because it was a cash

Deposit. I know that I was on camera with $200.00 cash at that point. The live person teller told me that bank

Of america had converted my account to ebanking (Meaning that I had to go to the atm to make the deposit

Because that was the type of account I had to only use the atm).

She assured me that I did not need a deposit slip or envelope to deposit cash into the atm and this is done all

The time and they never lose a cash deposit in the atm. So, I had to use the atm machine. I explained that i

Did notwant to deposit cash into the atm. I was told that I had to use the atm machine outside.

Well bank of america has new atm machines. I had not used this type of machine before.

I went to the atm outside and proceeded to make the deposit for $200.00. The machine had two areas for

Deposits. One area for cash and one area for checks. I was not sure where to put the cash. I saw a location that

Said cash and I put the money there. Therefore, I did not put the cash in the correct place and I did not get a

Receipt. I put the cash in to area that said cash but I guess it was the cash output area and not the cash input

Area. I tried to get the money back from the incorrect slot. I was able to fish out $40.00 but I could not get

Back the $160.00. I immediately went back into the bank. I was very upset and I started crying. I had just got

Laid off and I could not afford to lose money. Deep down I knew that I would never see that money again.

I was told to call the customer service line and they said they would temporarily deposit the money in my

Account until the investigation was completed. I just got a letter from bank of america and I was told that

The cash was not found.

I asked several times for the bank to check their video cameras. I went to a live teller to make the deposit

Initially to put the cash in the account. They could plainly see me with the money.

I never heard back from customer service. I received a letter in the mail stating the investigation was over.

They would be charging my account.

So I had the case re-opened. I still haven't heard from customer service. And have never received any

Information detailing how they did their investigation. And my money has not been re-deposited in my

Account.

My theory is they have dis-honest employees.

Enough is enough. I feel like a lot of poor innocent people are being taken advantage of.

I am contacting an attorney tomorrow to see what my rights are.

Sincerely

Arlene mcclain

Arlene k. Mcclain

11241 cherry st los alamitos, ca [protected]

The boeing company - ids division

Long beach, ca 90815

Phone: [protected]

Home: [protected]

You need to get your facts straight. It is called e-banking and that is the only way to use it it through the ATM.

Do you work at BOA?

charge

Dear sir, madam

My name is Ceyhan inci, i applied for loan on internet.I gave all my bank details to Loans Finder and i did not get any loan.Then i cancelled my application.And Loans Finder company set up direct debit two times from my account.I cancelled them either.But they settled again and took my account £ 67.00 (some peny) But we were not agree paying £ 67.00. So i need your help.How i can get my money back.If can you help me i will be very happy.

Kind Regards

Ceyhan inci

[protected]@yahoo.com

[protected]

employment

On 3/2/2011 I applied for a position for a Human Resource Manager for which I am more than qualified. I have 30 years of banking experience and 10 of those years were in Human Resources. In less than 8 hours, I received an email saying that I was not qualified. I am concerned that so many "decisions" are being made by computer programs, that companies are missing out on opportunities to hire the most qualified individuals. Are these programs designed to "screen out" candidates, rather than identified the more qualified candidates. Are these companies seeking to manage their expenses by hiring less experienced candidates? I would like to know how we are supposed to help fuel the growth of the economy, when we can not gain meaningful employment in roles that we are qualified and over qualified for.

The complaint has been investigated and resolved to the customer’s satisfaction.

Of course you have no proof that decisions are made by "computer programs" nor that your other "concerns" are valid. If you are in HR then you do know sometimes a candidate may be not chosen right off the bat, is because they already have someone in mind. They still have to post the position.

short sale

Bank of America has gotten a bad rap with its short sale process and with good reason. Everywhere I go it seems people are having trouble on both ends of a short sale with BOA. My wife and I are no different. We have had a contract in with Bank of America to purchase a home since June 6, 2010. The home itself has been on the market since 2008 and only one other buyer has attempted to purchase the home prior to us. They got fed up with Bank of America and backed out of their contract after 6 plus months. As a buyer we have excellent credit, a buyer for our current home, and a lender ready to go. With the current economy and the threat of foreclosure this seems like a pretty simple deal. The issue at this point is a disagreement on the price. Back in September we were a week from settlement on an agreed upon price of 420K (based on BOAs appraisal of 500K). Sounds like a great deal. Our lender had a legitimate appraisal done on the house as is required and resulted in a market value of 375K. Obviously, the lender was not going to give us the loan for a house that is worth 45K less than the agreed upon price and 125K less than BOAs appraisal. Apparently, BOA does its appraisals based solely on comparative homes in the area and from across the country. Their Short Sale department is based in California (I am in Maryland) and they have never seen the house we are trying to buy. They have not had someone go to the house for the appraisal. This gives a very in accurate estimate of the true value of the home. The houses compared to the one we were attempting to buy were move in ready and not in distress. The home we are attempting to purchase has not been lived in for some time and is in complete disrepair. Walls are in desperate need of paint, carpet is completely soiled, the hard wood floors a heavily faded, meat was left in the refrigerator with the power off, the well pump is bad, and the list goes on. The house is not livable in its present condition. It is unfair for BOA to be unwilling to negotiate lower on the price when they have not done a legitimate appraisal of the home.

Short Sale Problem,

Short Sale Team,

I have a problem with the short sale ...

I put an offer to a house, in Arizona, Short Sale, I like to know WHY it takes 4 to 6 month, I think is too much, for Bank of America to gave us an answer, I have a very good credit, and I have the mortgage approved from Chase Bank, the delay will hurt everybody, the seller and me, the buyer. Why so slow?

I do have a negotiator, representative from the Bank of America, but is doing nothing ...

Please, review the process of the short sale on your side, and let me know what can I do on my side, to expedite the process.

Thank you, and I am waiting for a positive answer and fast result.

Sincerely

Miha Nana

On March 15, 2009, I made an offer on a short sale property. 75 days later, the listing agent emailed Bank Of America (who held the property) that the process was taking a long time as they had gotten the property finally released from bankruptcy in June 2009 and we wanted to proceed with negotiations. B of A negotiated a price for the property, I accepted the price. I signed the agreement of sale, B of A accepted the agreement of sale. In late August 2009, I was informed that the short sale agreement would expire on 8/31. We were still in the process of completing the mortgage approval process so we were able to get an extension from B of A. Ultimately, we agreed to close on the property on 9/15. When we got to the closing table, the title company was informed by the bankruptcy court that the property being sold was part of their assets and had not been released for sale. Bank of America had had supposedly had the property released from bankruptcy 3-4 months ago. They (B of A) have insisted that the property falls under their jurisdiction to sell. They are now going through the motions to approve whether to petition to get the property release from bankruptcy. They are unable to give any time frames. They have had this non performing asset on their books for over a year and had a serious buying in the waiting for 7 months. Meanwhile, they have failed to do their due diligence to sell the property.

Damage Resulting

I have given notice at my apartment that I am terminating the lease at the end of the month. I have to extend my lease but will be subjected to a lease break penalty if this gets resolved in less than 60 days. I rented a truck to move on 9/19. I have paid for the appraisal, earnest deposit, inspection. I took a full day off from work to go to the closing table. I have lost interest for 4 weeks on monies transferred from a high interest account to a lower interest checking account. I will not be within the time frame to apply for the $8000 first time home buyers tax credit if this drags on past October 15.

Due to a pending layoff, I proactively put my property up for sale in February and contacted my Bank of America mortgage department and began the short sale process. They first stated that they would not even consider my paperwork until I was at least 60 days late on the payments. I immediately stopped paying the mortgage per their request so that my paperwork would be shifted over to the short sale department. I immediately had multiple buyers submit offers for approval in early march for an amount extremely close to the payoff amount with Bank of America. My attorney immediately began receiving misinformation, blatant lies, run arounds, holding on the phone for several hours at a time, transfer of short sale analyst, lost paperwork, resubmit paperwork etc etc. Because of this, I lost 4 buyers over the first couple of months b/c they were just as frustrated as I was. When they finally got their act together they rejected one offer. they did not inform my attorney nor myself that they were rejecting the offer until I received a phone call asking me why my payment was late. We then submitted another offer which we are still waiting on an answer two weeks later. It now gets worse, I received a letter and very inaudible voicemail about calling them. The letter stated that they were starting foreclosure process...I tried calling today (similar story to my attorney), only to be transferred 4 times, cut off once, then they couldn't find my account on to be transferred to a department that doesn't even work on original Bank of America loans. No one is calling back either my attorney nor myself to get this place sold. I do not want a foreclosure as I worked very hard in being proactive about selling the place and keeping my credit intact.

By now, this process and passing the buck has gone on for over 9 months! My credit score was very high and I had hoped that this process would have moved faster...however, due to all of their "issues" my credit has now been ruined. Bank of America should be fined heavily and looked into their business practices as I as well as my attorney have the records to prove that we have been submitting the correct paperwork, contacting them etc etc.

Sorry about spelling or grammer, the following is my log. I am usually so made after dealing with them I can't think or write.

Bank of America

Sent short sale packet on 10/27

Called to confirm and was asked to send additional information on 10/30

(letter of non-employment, P and L statement, listing agreement, verification of buyer funds)

Was asked to send form authorizing release of information to Traci Kemnitz 11/17

Somewhere in here, B of A and Countrywide merged short sale operation and all hell broke loose. Called every day, was told data was supposed to be transferred from one system to another. To call back tomorrow. I did that for a week straight.

Was told on 11/23 they had none of the information I had sent to them. Re sent it all.

11/23 Keith re-took my information over the phone, told me to resend packet and would receive a call back in 5 days. Then talked to Miguel in short sale, he said they would not even receive information for 10 days and not to call back until then.

11/30 got collection call from Maria ext. 7518, Keith never put in information that he took over the phone, nor information that I had an offer pending and was requesting a short sale.

Maria re-took the information and told me this time it was entered.

Called back on 11/30 and automated system said more information would be available on Dec 9th.

Called back on 12/9 and spoke to Silverio, he told me information has been received and to call back on 12/13 to get the name of my negotiator.

Called back on 12/13 and Spoke to Ginger. No negotiator has been assigned. Purchase and sale agreement had been downloaded into system, but no other info. She said she took the necessary step to send it to a negotiator, which would take 10 business days to get one assigned. She said to call back the end of the month. She also said to fax the Authorization to release information form to [protected]. Evidently, I had faxed the authorization to the wrong fax number, even though I faxed it to the one they had as return fax number on the form.

12/16 Spoke to Shelly Graham and she said that a negotiator has not been assigned yet, but that we should have one any day now. However, once it is assigned, the negotiator has 10 business days for what is called "Phase I", review of file and offer. On January 4th we can call back and discuss Phase II, which is 30-45 calendar days of negotiations on price and offer, appraisal most likely. Then Phase III is another 10 business days to close.

12/21 Recording I got, “ A work out negotiator is reviewing your request for assistance and collection activities have been temporarily been suspended during the review process we will complete and thorough examination of and analysis of your loan we may or may not need additional information from you but it is common you will not hear anything form us during the review period. We expect to have more information on Jan 18th 2010. Please do not Call us before then as that may delay the process but if we contact you make sure you respond promptly as failure to do see can cause your work out to be canceled.” I went through the process to speak with someone because I had received a phone call from someone with B of A last week, and got David on the phone. did. He told me no negotiator had been assigned. He also said when an automated message is generated it usually shows up on the file. That recorded message wasn’t showing up on my file. I asked him to make sure B of A was not in need of additional information from me at this time, as I was contacted by them last week, and had asked them to call me back, which they never did. He told me no additional information was needed. He said the file had went to shortsale on 12/14, they have 10 business days to assign a negotiator, until 12/29, if one isn’t assigned by 12/29 I am to call and request an escalation to assure a negotiator is assigned. He told me once a negotiator is assigned they have 20 business to work on the file before making a recommendation.

12/21. I called back later in the day to record the recorded message which I did. I then got nervous because verbiage was for a work out negotiator not a short sale negotiator so I went through the process to talk to Debbie. I read Debbie the message word for word, I will paraphrase her response. She told me to disregard that message. 90% of the time they are false. She had put in a request to her supervisor because numerous people had been calling in and requiring about incorrect messages. She told me never to obey the do not call time lines. She said that information is false, and in no way would calling in slow or delay the process. She reiterated what David had said, 10 days to assign a negotiator. I then told her what David had told me, to call back on 12/29 and request an escalation. She said that is correct.

Traci called me to tell me a negotiator had been assigned and they called her about ordering an appraisal.

1/5/09 Called and spoke to Johnson after being on hold for 25 minutes. Negotiator is Timothy Nickels, e-mail is timothy.nickels@bankofamerica.com. He was assigned on the 23rd. Johnson told me he has 10 business days to do something with the file. I should call on Friday to see what is going on. He also told me I could register and go to www.equator.com register, and could then track my account on-line. Number to call to register is [protected].

1/5/09 Called [protected] and spoke with Daniella. She asked me if I wanted to register with equator. I asked what it was. She told me it was a way to track my shortsale on line. I said okay. She asked a bunch of questions, and then sent an e-mail with login-information, and said I would have to downloan some information. Seems that I have to re-send all the information I have sent them twice. This really pissed me off. I told her I don’t want to start over for a third time. She told me I have to, if I don’t the process will get kicked out and I will have to start from scratch. She told me a negotiator wasn’t assigned and I was just beginning the process. I kept repeating that I just got off the phone with Johnson at B of A and was told Timothy Nickels was my negotiator and that he had 10 business days to get through phase 1 and that I should call in on Friday for an update. She said that was incorrect he had 20 business days. She told me I had to “download” all my information into equator, or at some point I would have to start from the beginning. I asked how long this equator thing had been going on, she said the beginning of December, I asked why was today the first I heard of it, she said certain files are chosen to move over at certain times. I told her I didn’t want to move it over, and she said “too late” she had already initiated the short sale in equator. Nothing I can do, but re-send all the information.

I then looked on the web. Need to re-send taxes, financials, plus Traci Kemnitz will have to re-send all the real-estate info. Remember this is the 3rd time. First info got lost in change over from Countrywide to B of A. 2nd info got lost in change over to equator. If process takes, 90 days and they have a changeover every 45, which puts you back at the beginning how will anything ever get done.

1/5/09. Looked at all the stuff I had to input, called [protected] to get another opinion. Got David this time. Told me unfortunately I would have to re-send all the info. I asked if he could just delete me from the system. He put me on hold to check. Came back and said he could, but eventually I would have to re-send it. Asked him if I would be starting from scratch. He said no, that this should not interfere with the process, and just need to get everything in by Saturday. I need to scan 30 pages of taxes, re-do financials, scan bank statements, pay stubs etc. I then asked him about time lines, since today I had received different answers, David stated, phase 1- 10 business days, phase 2-15 business days, phase 3 up to 35 business days.

Traci also called me today. Seems Timothy Nickels had called her this morning, told her to go to www.equator.com to register and then call him back. She had to input license information etc.etc. Was trying to call him back this afternoon.

1/5/09

Today is 50 business days, not counting 3 holidays, since I originally sent Bank of America 36 pages of documents. We are still not through phase 1! I have done everything asked of me in a very prompt manner, and still I get nowhere. Every person I talk to gives different answers and different time lines. These people should be in jail.

1/8/09

Put the required information in equator.

Then called. First, the message said the short sale has been denied. I went through the phone bank and got to Ivan. He said no update on the file. He said the appraisal looked good, and it just came in on the 7th, which is odd because I was told on the 5th they had it. He said timothy nickels had until jan 19th to do something with the file. I asked him if I should call or e-mail timothy or if I should wait to hear from him. He said it wouldn’t hurt to get a hold of him if I could.

11/12 Found a complaint at complaints board.com. that explained what other people went through trying to purchase a shortsale from B of A. Was almost the same thing I am going through. They had gotten a call from Cindy Repreza who is a custormor advocate, number is 1.800.669.2443 extension 3542, after they had written a letter to multiple Bank of America executives complaining about the horrible service. So a gave her a call and told her I had been referred to her and I needed help with a short sale. She total me she couldn’t help as this was an internal line, so I asked what to do to get help. She took my loan number and then asked if I had been in contact with Timothy Nickels, I told her we’ve tried, but haven’t heard back. So she said to call Timothy’s supervisor Chadd Grogg [protected], I passed that out to Traci, my realtor, and she called Chad and left a detailed message.

11/14/09 Traci got this e-mail from Brian Lorenc. Traci,

I received a follow up call from a friend of the borrower who originally escalated the file. I see the file has been moved into our short sale system equator. I see you have a task pending to be completed that was due by 01/09/2010. It is for you to upload your authorization on the account into the system. Once that task is completed you will be assigned more tasks to complete and the process will move forward. Let me know if you have any questions.

Thank you!

I hadn’t mentioned this earlier because it felt like such a long shot, but. The buyer says he knows the President of B of A. Who this is, I have no idea. He asked a few weeks ago if he could ask him for help. Traci said by all means, and sent him some of the documents that have been going back and forth. So maybe Brian is a result of that angle.

So Traci wrote him back: I did upload the authorization that day. This is very frustrating in that the authorization was sent to BofA twice in the last 2 months, and yet no one seems to have it. How is it that when I was calling in to get status reports they were speaking with me and acknowledged receipt of the authorization?

I will be in a meeting from 10-11 am this morning. As soon as I'm done I'll do it again. I want Bank of America to be aware that they have an offer in front of them that is $75, 000 and $50, 000 higher than the most recent sales in Caldera Springs, and that the buyer has plenty of other opportunities out there. I urge Bank of America to answer this offer immediately and get this transaction closed.

Brian responded: Traci,

I do apologize for the inconvenience for you. I see you accepted the request to be the agent on the deal on 01/05/2010, but I don't see the authorization was loaded into the system. If you have trouble with it this afternoon please let me now. Also, after you upload it let me know as well and I will verify it is loaded into the system for you.

Thank you!

So this does look promising. Traci has been talking to B of A for months on my behalf. The Authorization Document looks like it has been through a war zone, it has been faxed and scanned so many times. I logged onto equator and tried to upload while Traci was in her meeting and couldn’t find an area I could upload it to.

I should mention that at this point I have twice written both of my Oregon Senators and my Representative asking for something to be done. I also complained to the Federal Trade Commission [protected] and the Federal Regulator Office of Comptroller of Currency [protected]. Traci was dead on when she told Bank of America that was a screaming deal and they need to take it. Property values continue to plummet. If they move too slow this deal will be gone. These are costs departments so the banks don’t want to take on more employees to speed up the process, but by going slow they are actually costing themselves more money as the values continue to fall. First sent them Docs. on 10/27/09, today is 1/14/10 and we are not through phase one. Two things are the most frustrating. Constantly having to re-send documents and getting a different answer to the same question every time you ask. How long does phase 1 take? 10 – 20 – 30 days. I would like to see the training program for these folks answering calls, do they even have one.

1/14/10

Traci uploaded the Authorization form and wrote Brian that it was done and asked what we may expect for a timeline, response “Traci,

I see the authorization is being reviewed and was loaded into the system. Once it is accepted you will have more tasks assigned. Your next tasks will be to load the offer and other supporting documents. Equator is a task driven system and all tasks must be completed before the file gets submitted. All new short sales will go through this system and we are in the process of moving all existing files into this system. You can continue to reach out to me for help on the tasks to help push a task along if it goes past due.

Thank you!

Not what I was hoping for. Seems we are starting from scratch after 2.5 months.

I should also mention that I had been logging in to equator everyday, as the have a little message box once you log in that is how they are suppose to “communicate” with you, and I do use that term loosely, no where did it ever say info was messing, it showed everything they requested was entered as needed.

I am a home owner that is completely frustrated, angry and upset. Due to hardships such as divorce and my ex-husband being unemployed for several years, and this horrible housing market and economy I have been forced to due a short sale. I am an educated nurse, single mother of 2 young boys that is trying to do the best for her family. I can not afford the mortgage that I currently have on my own income. I have been in the middle of a short sale up until recently. I had buyer that wanted the house but are now about to back out because of Bank of America. My pay off amount on my house is roughly 236-237, 000. The buyers original offer was 235, 000. The bank counter offered at 248, 000 which is MORE than what is needed for my payoff! The buyers could not accept the offer and submitted and offer of 240, 000. More than what is needed for my payoff amt. This time bank of america re-countered at 259, 000 which is even higher than the first counter offer and even higher than what is needed for my payoff. This seems illegal to me! How are they allowed to make more money than what is needed on my payoff? I do not owe any money on my HELOC. No other leins. The buyers then offered 242, 000 and bank of america declined their offer and then closed my case. I am now being told that because I got accepted with a Haffa government program which will help me from owing any balance or difference from what is usually a lesser amt from the buyers than what I owe the bank that they can now not speak to me because my case is closed/denied. But in this case if they accepted the buyers amount they would be getting more than what I owe the bank. Seriously is this legal? Please Help ASAP!

Jennifer Ott- (jennifer.ott1@comcast.net)

Bank of America is holding onto houses that they are suppose to be selling. I predict that in a few years, it will come out that they had some kind of scam going so they could make money off the houses they had on short sale. They accepted my offer on a house early November 2010 and gave me a deadline of Jan. 21st. They wanted to move up the closing to late December but I was waiting for a settlement to come in and wouldn't be ready then. They went back to the January date. I had to scramble with the bank and paperwork to be ready to close on Jan. 21st and I was ready. Two days before the closing date, my realtor found out that BoA wiped out my file - accidently. Yeah right! All information was re-entered by the negoiator and we wait - still. My loan has expired and I'm thinking from reading all these complaints that I should just pull out of the sale. However we love this house adn I hate to admit defeat to a crook like BoA.

Its too bad that nothing can be done about this but the government already today us that we deserve being screwed when they gave this bank our hard earned tax money to bail them out. Who will be bailing us out when they manage to take all our money? The government - Yeah, right!

They have no control of their own short sale process. They are preventing agents (me) from conducting business. Consumers are beaten up in the meantime. Shame on them!

The Equator system has just simplified the submission of documents to Bank of America. No more having to fax repeatedly documents because B of A claims that they did not receive them. It has not sped up B of A's cumbersome short sale process. While most of the larger lenders are now closing short sales in 6 to 8 weeks Bank of America is still taking 4 to 5 months or longer. Their processing is slow, negtiators are changed in the middle of the offer negotiations, negotiators do not communicate with the real estate agents or sellers and do not respond to emails or phone messages, you have to call for updates or you know nothing. The only thing that has really changed is that with the Equator system they cannot claim that they did not received your documents as they are there uploaded into the Equator system for those involved to see. Until Bank of America changes its entire system of processing these short sales they are going to continue to be inept in the short sale department. Maybe they would just rather foreclose as short sale a property? I will say that when you call now to the short sale department those handling these calls are very professional and nice and much more informative. Unfortunately they just manning the phones and are not the ones processing the short sale which is where Bank of America fails miserably, their so called negotiators in the Equator system do not respond to emails and their voice mail is always full. The term negotiator is meaningless they negotiate nothing. We have now and have had several short sale offers for Bank of America, the 3 that are currently being processed in Equator have been processing for from 2 to 5 months with no approval yet. We had 4 buyers back out due to B of A taking so long and just one closed, it took over 7 months to bring to closing.

My story is exactly the same except BOA gave us a counter offer on our short sale...which we accepted and they auctioned teh house out from under us...No auctioneer ever showed us although they calimed they sent one and teh deed is being transferred back to BOA! Anyone interested in a class action lawsuit? My email is magik01301 @ yahoo.com

Visit This Link... Judge Blasts Bad Bank!

http://www.nypost.com/p/news/local/judge_kos_mortgage_to_slap_bank_28ZS1oW8Y58z6gu1AQbWMI

A judge awards a couple their house free and clear after a bank does shady things to them.

sold customer information

I am so sorry to write this letter in rage. Can you believe Bank of American sold customer information? If I have not suffered this bad thing, I won’t believe. But, it is true; Bank of American has sold my information to National Union Fire Insurance Co. of Pittsburgh, PA! I never use my card on the internet, how can this bad company got my information and charges my money? When I report the fraud of National Union Fire Insurance Co. to bank of American, I still think you are innocent! But, unfortunately, today when I search on the website, I find that I am not the only person suffer this scam! And I recalled that there is an insurance company, named himself as bank of American insurance company, called me several times in 2010. Oh, Bank of American, you not only sold my information but also your own “fame”.

As one of biggest bank in US, please cherish your reputation!

Please give me a fair answer!

The complaint has been investigated and resolved to the customer’s satisfaction.

I have several home loans through Bank of America, it is not uncommon for my payments to not post to my account . . . not once did this happend but 3 times and after the last one that took 2 months to resolved, they still charged me late fees and it has showed up on my credit report. It takes numerous phone calls to get to the proper department that needs to handle this type of issue but no matter what the issue they can never give you their direct contact information to call them back directly. They say they put "notes in the account" . . . . they don't, you spend a lot of time each time you call to explain the problem over and over to everyone you speak with, an in most cases they never forward you to the right department and you end up calling back several times.

The lastest issue was online my account balances were all the same for all the mortages, when I called they told me I did not have any loans with them . . . hahahaha, ok wipe my mortgages out and send me the deeds! One represenative even told me I need to contact my local 911 district for help. Good grief so incompetent and of course I couldn't submit a complaint becuase I have not real name or contact information to give on this customer care person I spoke with because they can not give this out because of "corporate" guidelines.

It has been over one month since I put in my dispute an no one has contacted or via mail, email or phone. Once this is resolved I am refinancing all my loans and will pass the word onto all my family, friends and strangers on the street to stay clear of BOA!

We filed chapter 7 and bank of america is still trying to collect! Now they are calling our family members! STAY FAR FAR AWAY from Bank of America

Recived a e-mail from Bank of American requsting all of my personal information.I did not respond to the e-mail, just wanted you to know of the attempted scam of me and your bank which I have (NO ACCOUNTS WITH>)Has this been prevesiouly been reported by anyone else?Could not forward the e-mail to you. so sorry.

Sorry, Bank not Bamk. Keyboard trouble.

First of all it is Bank of America, not Bamk of American. Second, check your grammar.

No response Claim

I filed a complain for a car accident with minor damages and after two months

many phone calls no response from anybody in that company I have been reach to the Claim department many times even to the supervisors no response

if someone have had same issues I need an advice, I don't how that company can be a insurance company, I have check in the web and many people have had same problems.

I filed a complain for a car accident with minor damages and after two months

many phone calls no response from anybody in that company I have been reaching to the Claim department many times even to the supervisors with no response.

if someone have had same issues I need an advice, I don't know how that company can be an insurance company, I have checked in the web and many people have had same problems.

The complaint has been investigated and resolved to the customer’s satisfaction.

I've had similar experience, poor customer service, no restive from claims department, everyone just ignored me, hangs up on me. Ive faxed my documents over 5 times and still they are not available for review, one of the agents in the claims department have me a wrong fax number, every time I call their number I have to wait for up to half an hour to get through to customer service rep then, i get some ridiculous excuse, or get transfered to a superviser s voicemail who never returns my calls.

If someone had any advice how to deal with this company, let me know. My insurance company suggested I contact commissioner for consumer affairs and file a complaint, their#[protected], I haven't done that yet, does anyone have any success with this approach?

While parked and unoccupied on the street, my car as hit by someone insured by Country-wide Insurance. The accident happened during the first week of January. Tomorrow marks the first week of June and my claim is still unresolved. What's worse is now I am being forced to cover over $1, 400 worth of costs associated with the accident. This is all because Country-wide is an bureaucratic, unethical, unreliable company... and I feel taken advantage of.

Despite several calls and e-mails to the Company, sometimes daily and and if not daily always several times per week what should have been a straightforward issue has become a costly nightmare. I was proactive about resolving this issue. I went out of my way to ensure they received every piece of paperwork. I checked, double checked and tripled checked on every aspect of the appraisal/release process... but, as it turns out not only was I the victim of their insured's negligence I was also the victim of their terrible management practices. Country-wide is an awful company and the consumer pays the price

i agree omg i just changed from statefarm, atleast someone answer the phone, i have the automatic service my payments never go through, i make them on time.is their fault, they didnt accept my payment and charge me a 15 dollar fee what and then im trying to explain my situation ..well guess what i cant always leave a message if i do get someone to answer me, well they no nothing or even better cannot help me.

Contact your agent, depending on the claim, it could take some time to investigate. You should've received a form to fill out regarding the incident that took place. Also you posted this 3 times.

hundreds in overdraft fees

Recently, I was charged around $700 in overdraft fees from my Bank of America Checking account. The problem originally started when i made an accounting error and left my checking account with insufficient funds. I did not realize this, and used my debit card for my normal spending (many small items such as gum, drinks, etc). I used the card around 25 times and was not notified once that there was insuffient funds to cover the amounts. Therefore, i was charged around $30 every transaction. It was only when i checked my online statement that i found this out. I promptly called Bank of America to try to get my money back, however they would not budge. I asked why they would let me keep charging small items on a card when the account did not have enough funds (although i knew the answer was so that they could keep charging fees and making money). I remember reading somewhere that they made around 40% of their banking profits on overdraft fees alone, now I believe it. I have been a member with Bank of America for over 10 years and cannot believe what they are doing is not illegal. Also they raised the rates of 2 of my "fixed rate credit cards" for no reason other then "they did not like my payback habits" (although i was never late)

Shame on you Bank of America.

I did NOT have overdraft protection. B of A just keep letting me use my debit card then charging a non sufficient fund fee.

The complaint has been investigated and resolved to the customer’s satisfaction.

I really like there Accessories. I purchased a vase for $18.00 Which I never would spend that much money, but I fell in love with it. It was in a rod-iron stand and had the coolest colored glass. I had it for a year before I put live cherry blooms in it with water of course. The vase was painted on the inside and I had not idea. It pealed off in chunks right away. I still have the receipt and to it back to the store. They said I was not to put water in ti. The label said no suck thing and it was labeled as a vase! Hello, what vase is not to be used for flowers? I should have been specified on it not to put water in it. They told me "too bad". I have not purchased anything there since. It was my favorite store.

peach blosoms in it.

I stick with credit unions as well, I have found them to be a lot nicer than "chains". There were things you could have done to prevent this, like put a block on the card to not be overdrawn (in other words that card would have been rejected if you tried to use it once the account was negative). It might be something to look into once you get this mess fixed.

online banking

I have had bank of america for almost a year now. I have always had enough money to cover all my transactions. Until I get my tax money of 9, 000 dollars & now I start having issues with bank of america. I always keep track of my online banking I have had a transaction pending for about a week. Then they finally go and process the amount & put my account a...

Read full review of Bank of America and 2 commentskeeps delaying closing

I signed up for a mortgage loan through Bank of America. 1 day before closing Bank of America came back with a minor paperwork issue which delayed the closing by a week. In the meantime, I had to go back to my landlord requesting an extension on my lease, have the utilities turned back on for a week and then pay a penalty to the seller as well. As if that was not enough, 2 days before the rescheduled date for closing - Bank of America called me at 6 in the evening and told me to increase the coverage on the flood insurance (even though the existing coverage exceeded the loan amount). By then, I had already packed my stuff and had the movers coming in the next day. Despite all this Bank of America refused to apologize and suggested that we move the closing date again. Not only that - these guys were downright rude - "instead of arguing with us, you should call the insurance company right away" (as if it is my fault that they waited till 6 pm to call). I am left with no words for this organization. I would rather stab myself in the eye with a needle than go with these guys again for a mortgage loan. Stay away from the

Bank of America Reviews 0

If you represent Bank of America, take charge of your business profile by claiming it and stay informed about any new reviews or complaints submitted.

About Bank of America

One of the key strengths of Bank of America is its commitment to innovation and technology. The bank has invested heavily in digital platforms and mobile banking, making it easier than ever for customers to manage their finances on the go. With features like mobile check deposit, online bill pay, and real-time account alerts, Bank of America is at the forefront of the digital banking revolution.

In addition to its digital offerings, Bank of America also has a strong network of physical branches and ATMs. With thousands of locations across the country, customers can easily access their accounts and get help from knowledgeable staff members whenever they need it.

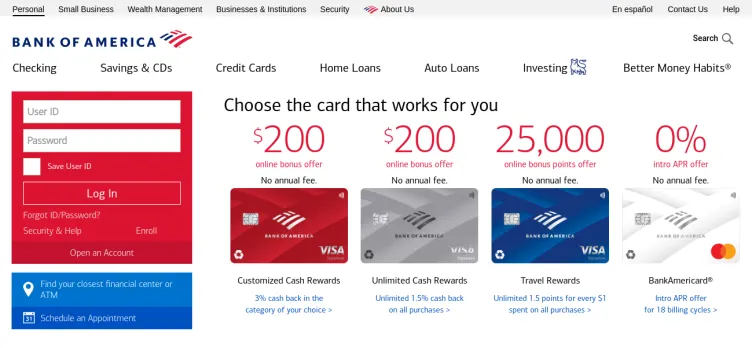

Another key advantage of Bank of America is its wide range of financial products and services. From checking and savings accounts to credit cards, loans, and investment products, the bank offers something for everyone. Whether you're looking to save for the future, buy a home, or invest in the stock market, Bank of America has the tools and resources you need to achieve your financial goals.

Overall, Bank of America is a trusted and reliable financial institution that has been serving customers for over a century. With its commitment to innovation, technology, and customer service, the bank is well-positioned to continue to meet the evolving needs of its customers for many years to come.

1. Log in or create an account: Ensure you are logged in to your ComplaintsBoard.com account to proceed. If you do not have an account, please register by providing the necessary information and verifying your email address.

2. Navigating to the complaint form: Once logged in, locate the 'File a Complaint' button situated at the top right corner of the website and click on it to access the complaint form.

3. Writing the title: In the 'Complaint Title' field, concisely summarize the main issue you have encountered with Bank of America. Make it specific and clear, such as "Unauthorized Overdraft Fees" or "Difficulty with Mortgage Loan Modification".

4. Detailing the experience: In the complaint description, provide a detailed account of your experience. Include key areas such as customer service interactions, problems with account management, loan servicing, fees or charges that were unexpected, issues with online banking, or any other specific incidents related to Bank of America. Clearly describe the nature of the issue, including dates, locations, and any relevant transaction details. If you attempted to resolve the issue, outline the steps you took and the responses received from Bank of America. Explain how this issue has personally affected you, such as financial loss or stress.

5. Attaching supporting documents: Attach any relevant documents that support your complaint, such as correspondence, statements, or receipts. Be cautious not to include sensitive personal information like your social security number or full account numbers.

6. Filling optional fields: Use the 'Claimed Loss' field to quantify any financial losses you have incurred due to the issue. In the 'Desired Outcome' field, describe what resolution you are seeking from Bank of America, whether it be a refund, apology, or corrective action.

7. Review before submission: Carefully review your complaint for clarity, accuracy, and completeness. Ensure that all the information provided is true to your knowledge and that your desired outcome is reasonable and clearly stated.

8. Submission process: After reviewing your complaint, click on the 'Submit' button to officially file your complaint on ComplaintsBoard.com.

9. Post-Submission Actions: Keep an eye on your ComplaintsBoard.com account for any responses or updates regarding your complaint. Be prepared to engage in further communication if necessary to resolve your issue with Bank of America.

Overview of Bank of America complaint handling

-

Bank of America Contacts

-

Bank of America phone numbers+1 (800) 432-1000+1 (800) 432-1000Click up if you have successfully reached Bank of America by calling +1 (800) 432-1000 phone number 8 8 users reported that they have successfully reached Bank of America by calling +1 (800) 432-1000 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number 3 3 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number45%Confidence scoreEnglish+1 (800) 688-6086+1 (800) 688-6086Click up if you have successfully reached Bank of America by calling +1 (800) 688-6086 phone number 16 16 users reported that they have successfully reached Bank of America by calling +1 (800) 688-6086 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number 1 1 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number88%Confidence scoreSpanish+1 (315) 724-4022+1 (315) 724-4022Click up if you have successfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (315) 724-4022 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone numberInternational+1 (757) 677-4701+1 (757) 677-4701Click up if you have successfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (757) 677-4701 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone numberCredit Card Issues+1 (800) 214-6084+1 (800) 214-6084Click up if you have successfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (800) 214-6084 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone numberVice President Bank+1 (312) 992-6618+1 (312) 992-6618Click up if you have successfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (312) 992-6618 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number

-

Bank of America emailssupport@bankofamerica.com100%Confidence score: 100%Support

-

Bank of America address100 N Tryon St., Charlotte, New York, 28255, United States

-

Bank of America social media

-

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreNov 09, 2024

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreNov 09, 2024

Most discussed complaints

pmi remove problemRecent comments about Bank of America company

ATM security firm illegal in nycOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.

Don't get over yourself

Bank of America agreed to pay $335M in damages because of racial profiling. They tacked on higher interest rates for non-whites than whites. It might not happen all the time, but it does still happen.

Validation article: http://www.dailymail.co.uk/news/article-2077485/Bank-America-pays-335m-damages-charging-minorities-higher-rates.html