Jackson Hewitt’s earns a 1.5-star rating from 233 reviews, showing that the majority of tax filers are dissatisfied with tax preparation services.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

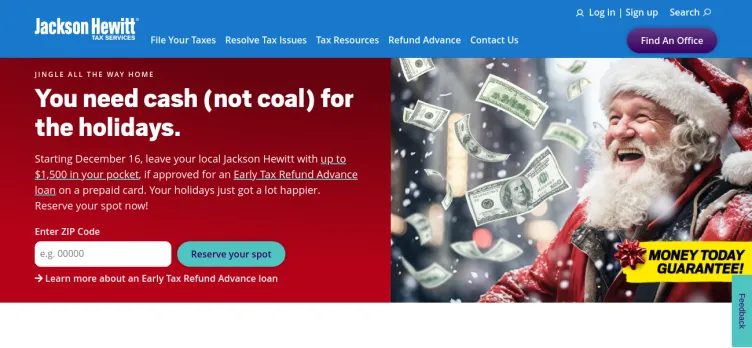

early refund loan

My complaint is concerning the early refund american express is temporely down and I was informed that they are not sure if it will take a few days. Well some of us that have limited income really count on using this service to help those who are unable to save up enough to buy christmas gifts . Of course im angry, disappointed .Ive run into so many issues more then I care to say and I still remained a loyal custmer but this takes the cake it sucks so close to christmas.

tax service

I filed taxes with Jackson Hewitt for the 2015 tax year. The lady who worked on my taxes cost me a $3090 error by inputting the wrong information on the interest paid on my home. This was corrected by Jackson Hewitt after many calls and complaints from me. I even had to drive 2 hours from where I live to meet someone from Jackson Hewitt to no avail. Moving...

Read full review of Jackson Hewittincome tax prep

I went into Jackson Hewitt and filed my joint return on 3/23/19. I paid for gold standard service. the tax prep person named April. completed my return had me and my wife sign and we paid over $500. after we paid via debt April let me know that she ran the payment for 49.95 more than she should of and would debit my account. It still has not been done and I...

Read full review of Jackson Hewitta sixty-five thousand dollar error

We had our taxes prepared by jackson-hewitt the year before in redmond, washington and decided to have them prepare our taxes again for 2018 but in a different office due to us traveling. Patricia ryan and I arranged an appointment in dalton, georgia, february 27, 2019. We met with jennifer baldwin, the tax accountant, who prepared pat's taxes first. Her receipt number is, gas 11857. After jennifer prepared pat's taxes she started to prepare mine. Jennifer shared with us that she is new and still learning a lot and that her boss cindy is here to assist her if she needs any help with anything. An hour later jennifer quoted me, "you owe $67, 000 for 2018." I said, "what!?" jennifer admitted it sounds like too much and possibly a mistake has been made. She then asked for cindy's assistance. Cindy said she found a $2, 000 (two thousand dollar) error which brings it down to $65, 000. I said "this can't be." her reply, "I wouldn't lie to you. I wouldn't make this up. I've been doing this for forty years and operate other offices. I canceled, decided not to file and contacted a tax attorney. Anderson-bradshaw tax consultant (joshua kronick, [protected]) prepared my taxes and found I owe the i.R. S. For 2018, $1, 589. This huge mistake cost us $2, 150 for attorney fees. Not only was cindy arrogant but showed no interest in going any further with my complaint.

tax preparation

I used JH online tax service on 2/13/19 and needed to file two state taxes because I had moved from WI to MI. Federal and MI taxes were filed online and submitted without issue. However, WI state form was incorrect. The service filed a WI form 1 but a 1NPR for part time resident was actually needed. Since the WI form could not be submitted electronically, I researched the prepartation. The prepared form 1 showed I owed $128 but after completing the 1NPR, I was due $292. I paid $36.95 prep fee for each state and $49.95 for federal. I would like a $36.95 refund for the incorrect preparation of WI tax form since I ended up having to do it myself.

tax service

On abril 15 I walk in to fill my tax return, i check with a lady and show her my tax papers which I have copies, she told me is ok, but in order to fill it with my wife she needs my wife and proper identification documents, I agree to come back later and I did wit my wife, because I have paper form (temporary driver license) because I was updating my...

Read full review of Jackson Hewittselling of information

Ms. Elaine Smalls had her taxes done at a location on Boston Road, Bronx, New York. At that time it was not told to her exactly what she was signing and she signed a paper allowing Jackson Hewitt to sell her information. She would like something in writing stating that her information has been removed. Her case number is 52780 and we spoke to Princess.

tax prep.

Id like to make a complaint and incorrect information I was given when I filed my return. I'm paying 440.95 for my service I received. I wanted the refund advance witch was 49. Of that for the app. To get funds I was told my tax prep fees and the loan I received for 500 would be taken from my federal refund to pay for the tax service and yo repay my loan. I checked the state's where's my state return it said it was set to deposit [protected].$ witch was the amount I was set to get and the date arrived nothing the next day I had to contact an agent to see what had happened or if it was just taking a bit and the agent told me it was taken for repayment of the loan witch would of been ok if id been told the correct information at the office and another problem I feel is odd why would 339 be taken now instead of when my larger federal return was issued when the whole amount could be taken at once but now not only could I of used that 339 at the moment but I feel the need to watch more closely when funds are received for federal to make sure the correct amount is taken and not another mix up with information.

tax offices

I live in Gulfport, Ms. I was told on the phone they closed at 7pm so i get to the office on 25th and im told they closed at 5pm and was turned away. I then walked 2 hours to the next location at the Walmart on highway 49 Gulfport ms and was told they closed at 5pm and the location says 7pm and was sent away. So to be safe, I made an anointment online for today at 1pm and again walked 2 hours to the location to see a hand written sign that said closed.

customer service provided

This service provided for assistance afterwards was unprofessional and the staff was rude. The staff name was Lindsay or Linda at this location. I applied for early advance refund and was given American express card and told was approved and the money would be on the card in 30 minutes. Never received the money and when I called to try to get resolved the lady who answered the phone Lindsay was rude, never returned my call back and unprofessional. At the end of day I have to call several times to get answers and called Meta Bank who provides the loan and was told my application was denied because I didn't want to refund for $4200. Just very unprofessional and not reliable.

my taxes

i filed for my taxes in on of your office in ocala i was charged $500.00

i did not know it was going to cost me that much to file formy taxes that is outrageous nobody said anything to me i call your care team in vain i send mail to the office where i file and nobody bother to answer me and i am still waiting for somebody to talk to me

because i ve been reap off and i do think that isfairnt

help with irs audit

Jackson Hewitt has prepared my taxes for years. The IRS audited me for 2015 and 2016. I have sought the help of the office that prepared my tax return. She gives me the run around and doesn't answer my texts or calls. She doesn't show up for appointments she makes to meet with me. This has been going on for over a year. The tax return preparer is Kay Moore with Jackson Hewitt. I keep receiving letter from the IRS and I keep taking them to her office. I never get to meet with her.

Management

I worked at the Sturgis Michigan branch as a receptionist. The General and Assistant Managers are completely rude to their employees. I have a Facebook Messenger conversation that they verbally attacked me and cursed me out. I will NEVER work gor that company again! There was even a time when I was told I wasn't allowed to tell customers about a $200 promotion. They had to ask me personally because the company didn't want to have to pay the customers the money! Management all have attitudes towards employees. It's horrible!

preparation

I filed my taxex on April 23rd. No one recognized it was rejected until the 28th! I came in on the 28th to sign it again and it was already sent off to the wrong address because it was sent before being confirmed by me. I called my preparer and she hubg up on me told me i "better not throw her under the bus!" And said "there was nothing she could do. I still havebt received ny return its July 5th! I WANT MY PREP FEE BACK. Please contact me about that ASAP! THANKS

DONYELL WILSON

[protected]

william wayne ballard ii - tax year 2015 & 2016

Hello,

On 04/16/2018 your tax preparer, Tanya May, prepared my 2015, 2016, and 2017 tax returns. I received my 2017 refund since she filed electronically. I received a letter from the IRS requesting copies of all sources of income for 2015 and 2016. As such, I mailed the requested information to the IRS.

At the time I asked Ms. May why she was not including my W-2s and 1099s and she stated it was no longer required. Apparently she was incorrect. As of today the IRS website tells me my status is 'still being processed'. I've tried to call the IRS and cannot reach a person. I have called your Waxahachie, Texas office and they are closed.

At this stage I do not know if the faulty filing has triggered an IRS audit or not and I can't seem to find out.

I need help and I need help quickly. I put my trust in your preparer and paid for said services yet I fear that now attention to myself has been brought to the IRS because the source of income documents were not provided.

Please call me as soon as possible at [protected].

Respectfully,

William Wayne Ballard II

not filling all my w2's

Date: 01/18 to now

Jackson Hewitt did not file all my w2's and it caused me not to get my refund until june of 2018. They are stating that I should have filed an amended return with them. How ever the irs is stating they would not accept the amended return. Now Jackson Hewitt is stating because I did not come into the store to complain about this issue they will not refund it. I filed complaints online with them and by leaving voice mails. I work in the hours they are open and do not have time to waste waiting 4 hours to get one issue resolved when it should have not have happened. I am request a refund of my filing fees from them and the manger is very rude and condescending refuses to refund them.

mistakes on my tax returns

Toni the manager of the Hinesville, Georgia office completed my 2016 taxes. I filed taxes for 2017 and discovered the mistakes she made through another company. I contacted Toni via phone and she pulled up my taxes on the phone and noted her mistakes. She later sent me an email stating she had submitted paperwork for the return of my fees. I also went to Jackson Hewitt in NC to get my taxes amended. Now Toni is stating that there was no mistake made on my taxes. I'm still waiting on return of fees. I have proof of her email and my amended taxes.

2016 tax return

We have used Jackson Hewitt for many many years. We have had the same person "Bob" prepare our taxes for the past few years. This year he seemed forgetful, scattered and not competent. The other person in the office overheard and observed this and helped him. It seemed he was showing early signs of dementia.

We received a letter by the IRS that for 2016, one of our W2 forms was not included with the tax return filed.

Bob is the person that prepared our taxes. Upon going to the local office in Michigan City, IN. we were informed that Bob no longer works there. We were informed that she would bump this up to her supervisor. This was 6/5 and the $1400 was due to the IRS on 6/20.

Hearing nothing from the local JH, nor the supervisor, my husband went to the local office today and was told "the supervisor cannot help you", you need to call cooperate. Then the supervisor on the line said "and good luck with that".

We are requesting a total refund for the money we paid to have our taxes prepared which was almost 400.00. Also we are expecting JH to pay for the penalties and interest that have been accrued.

In closing, we are very disappointed with the service we have received. We feel this is totally unacceptable.

Sincerely,

Dr. Patricia Hart

[protected]

We have been using Jackson Hewitt for several years. We have used "Bob" for the past several years. Unfortunately this year when Bob prepared our taxes he was very forgetful, scattered, forgot how to enter data, could not work the printer. The other person in the office overheard and was witness to his behavior so she assisted him. His behavior was very concerning and my husband and I decided not to use him any longer.

We received a letter from the IRS regarding our 2016 tax return. Bob forgot to add one of our W2 forms, resulting in owing an addition 1400 to the IRS. On June 5th we took the letter to the local JH office where we go (Michigan City IN office) and was told "Bob " no longer works there. We explained the situation, requesting JH pay the penalities and interest, and also we are expecting a full refund for the price of JH preparing our taxes in 2016 which was $400. We were told that they had to bump this up to their supervisor, and we would receive a call back quickly with a resolution. The money was due to IRS on June 20.

Today as we have heard nothing from JH, my husband went to the office. We were told that the supervisor could not help us and we were advised to call coorporate. The person locally called the supervisor and my husband was told by the supervisor to call coorporate but "good luck with that".

We are very disappointed with the service we have received. We are requesting JH pay the interest and the penalties as well as giving us a 100% refund on the charge for tax preparation in 2016.

Sincerely,

Dr. Patricia Hart

[protected]

my amended return

Thanks service I am complainin about us my amended tax return, , I am unaware of my surroundings and feel thereaten and held without explanation of my amended, , not only I paid 125 in cash to get my return back of 324, , I checked back with the URS and I don owe anything but to my school, how ever, the lady from West webb Ave if Burlington NC, gave my a fake number, to get information in my return. This was February 27, 2018, an it is now June 7, 2018, of no return and want my money an a clear explanation if what is going on on my behalf with this tax preparer and file a claim.

I filed in February 2018, it's now June 7 2018, I paid 125, to get a return if 324. Was not aware if my surroundings and felt threatened or was not given thorough knowledge if what procedures where be taken out of me.. not only that I was also unaware of the w2 that came in late..I will like to file a complain to receive my money or a refund of what I paid it was ild it will come to me and it didn't..

hawaii state tax return

Jackson Hewitt in Honolulu Hawaii did my return but the [censored] did not fill out the part time resident for hawaii correctly I went there numerous times to get it fixed, they finally did an amended return but they did not print the SCH AMD that is needed for my amended return, we filed that amended return in February and it still is not processed because the preparer did not include that and I am having to go through hoops to get this fixed; I have tried calling the Pearl City office but all the phone does is ring busy; I need my money and they should have to pay me interest because they screwed up. Do they even train these people to do the Hawaii State tax returns at all? It is a nightmare and here it is freaking June! I cannot get through to the year round office; and I need help with these [censored].

Jackson Hewitt Reviews 0

If you represent Jackson Hewitt, take charge of your business profile by claiming it and stay informed about any new reviews or complaints submitted.

About Jackson Hewitt

Here is a comprehensive guide on how to file a complaint against Jackson Hewitt on ComplaintsBoard.com:

1. Log in or Create an Account:

- If you already have an account on ComplaintsBoard.com, log in using your credentials. If not, create a new account to proceed.

2. Navigating to the Complaint Form:

- Locate and click on the 'File a Complaint' button on the ComplaintsBoard.com website. You can find this button at the top right corner of the website.

3. Writing the Title:

- Summarize the main issue you have with Jackson Hewitt in the 'Complaint Title' section.

4. Detailing the Experience:

- Provide detailed information about your experience with Jackson Hewitt. Mention key areas such as any transactions, steps taken to resolve the issue, the nature of the problem, and the personal impact it had on you.

5. Attaching Supporting Documents:

- Attach any relevant supporting documents to strengthen your complaint. Avoid including sensitive personal data in these documents.

6. Filling Optional Fields:

- Use the 'Claimed Loss' field to state any financial losses incurred and the 'Desired Outcome' field to specify the resolution you are seeking.

7. Review Before Submission:

- Review your complaint for clarity, accuracy, and completeness before submitting it to ensure all necessary details are included.

8. Submission Process:

- Click the 'Submit' button to submit your complaint to ComplaintsBoard.com.

9. Post-Submission Actions:

- Regularly check for any responses or updates related to your complaint on ComplaintsBoard.com to stay informed about the progress.

Follow these steps to effectively file a complaint against Jackson Hewitt on ComplaintsBoard.com.

Overview of Jackson Hewitt complaint handling

-

Jackson Hewitt Contacts

-

Jackson Hewitt phone numbers+1 (800) 234-1040+1 (800) 234-1040Click up if you have successfully reached Jackson Hewitt by calling +1 (800) 234-1040 phone number 0 0 users reported that they have successfully reached Jackson Hewitt by calling +1 (800) 234-1040 phone number Click down if you have unsuccessfully reached Jackson Hewitt by calling +1 (800) 234-1040 phone number 0 0 users reported that they have UNsuccessfully reached Jackson Hewitt by calling +1 (800) 234-1040 phone number

-

Jackson Hewitt emailsprivacy@jhnet.zendesk.com100%Confidence score: 100%Support

-

Jackson Hewitt address501 N. Cattlemen Road, Suite 300, Sarasota, Florida, 34232, United States

-

Jackson Hewitt social media

-

Checked and verified by Laura This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreOct 06, 2024

Checked and verified by Laura This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreOct 06, 2024 - View all Jackson Hewitt contacts

Most discussed complaints

2022 tax refundRecent comments about Jackson Hewitt company

2022 tax refundOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.

We have received your comment. Thank you!