Bank of America’s earns a 4.0-star rating from 4575 reviews, showing that the majority of banking clients are very satisfied with financial services.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

unethical behavior

There was Hurricane Matthew that hit Palm Coast, Fl. on October 7, 20016 and my home has suffered a lot of damage. My homeowner's insurance paid me approximately $76, 000+ in three separate checks for the damages I incurred. I held on to the checks for two weeks and finally tried to deposit the checks in person. The two small checks were accepted, but I was told that since the check was over $20, 000 it would have to go to your Simi Valley, Ca. bank for verification. Here is the problem: the check was made out to myself and my late husband and Bank of America. I tried explaining to the people at my local BofA that I do not have a mortgage and never did. The associate said that it does not matter as she said that it needs to go to your Calif. branch anyway because it was $20, 000. She instructed me to go the the UPS store across the street and to mail it overnight, costing me $43.00 to. Turns out that it should gone to your North Carolina branch. Still even after I mailed the check, I pursued the issue and later found someone who was diligent enough to check that I really did not have a mortgage, but I did have a line of credit that you did not close. I have asked this nice man to please call my homeowner's insurance to stop payment on the check and issue a new one as he sent him a copy of the release. Its no wonder a get a lot of solicitation thru email and the regular mail. I have a name of the person who I spoke with in 2008 to close the account.

Another issue is that my husband passed away June 21, 2004 and would you believe you have been sending my condolence letters. This is so disturbing because I personally went to my local bank then when he died. We have been banking with BofA for many, many years and I feel that my reputation has been so violated.

Another issue is that I get solicitations from you concerning "my" business. I never had a business in my life - I wish I did.

For the aggravation that I suffered, I believe I should be compensated for my troubles and I will leave this up to you to decipher.

Sincerely,

Linda C. Ramirez

non service and other issues

Hi, I started my account with the Maplewood Bank, in 1975. As the banks merged, I stayed as a customer. This year, has been so horrible dealing with Bank of America. I have several complaints. I will work my way backwards. The dates are estimated, because I did not write things down, thinking they would be addressed quickly. This week on Monday I checked my account and money was missing. Reason being. I had gone to the Dunellen branch in February. for several reasons. 1. I received an email from someone saying they were from Bank of America and needed my personnel information. 2. I also received a letter in the mail, asking for confirmation, that I was ordering checks to be delivered to my AL address, again looking for personnel information. I live in NJ. I took time to make copies and go to the bank, so you would be aware of these 2 issues. The lady who waited on me, said that they knew about the fellow who was sending the email. And I should go home and find the email and send it to your fraud department. I had the copies right there. The letter, I could make a complaint with the police if I wanted to. And after that I should shred them. 3. Also, I had 1 account that was over drawn, by 16.00 and such, due to fees. Reason being, it was a join account, with my brother, who I no longer talk to. That is also Bank of America's fault. No matter if I ask or my brother asked. The account never got closed. Until that day. 4. Also attached to the statement was my brother's accounts. I had moved, he had not. Someone went in and changed his stuff to come to my house. Reason, I know he didn't do it. He does not know where I moved to. 5. Then to make the day more wonderful. I went out and used you inside ATM machine. The machine ate my 2 checks. I was not aware that some ATMs only take single checks. 6. So then I went back into the branch. The same lady, gave me a ATM machine #. And dialed the phone and handed to me so I could sit on the phone for at least 20 minutes. I talked to the lady on the phone for about another 15 minutes. So I walked into the branch with 4 issues. When I left I had 5 issues. Terrible customer service. Any way, then I was given a temporary deposit to my account for my 2 checks that the machine took. So after a while I received a letter in the mail. (Feb14). That my checks could not be found and you were taking my money back. I called and spoke to a fellow, I don't remember his name. We went back and forth on the phone. I wanted to know why the checks were not found. He told me I needed to go to where I received the checks from and have them issue new checks. Unacceptable. So I wanted to talk to a manager. I was put on hold for awhile. Then the fellow came back said they were all busy, but they said they would check on the issue. The information you had, was it was 1 check and they didn't even have my name right. It was 2 checks. So he tells me, he fixed the issues, and they would look it over again. When I called this past Monday. After I saw my money was missing. The lady who answered the phone, said there was no record of any of the information I provided on my first call. She fixed the information. I see the money is back in my account today. So you must have figured out where the checks went. It would have been really, really nice is somebody would have called me . Now back to me and my brother not speaking anymore. My brother and his wife went to the Maplewood main branch for a mortgage. And met with Mr Murphy. It took them over 9 months to get a mortgage, every time we thought it was done, Mr Murphy asked for something else. I went and bought another house, and when I would go to your bank, people would ask me why I didn't get my mortgage with you. Dealing with your people has turned into a nightmare. We did have a Bank of America mortgage previously and we had no problems. I am beyond disappointed in your non-service. I don't have a lot of money, but like I said, I have been a customer a very long time. I am not sure I will be continue with you or not. One suggestion, I do have is that since, people on the phone can not give us their name. Can you assign them an id #, so when we have issues, we can give you that information.

boa allowed scammer/money mule to take money from victims

This review is strictly about my experience with BOA as a non-customer US Army veteran. I wish I could give them no stars at all. I was getting a shipment for a friend from overseas. My shipping agent had a Bank of America checking account to accept payments. I made a total of 3 deposits (2 of them were over the counter with cash and my name was on both deposit slips), and 1 was a wire transfer to her checking account back in August 2015. Long story short, I never got my shipment by the end of August 2015 as promised by my shipping agent!

By the beginning of September 2015, I then learned that my shipping agent was actually working as a money mule for a scammer! I reported the entire situation along with all my evidence (withdrawn records from my bank, multiple emails, 2 police reports (Houston and Sarasota Police Departments) that their customer had been scamming me during August 2015. After she took my payments, she committed money laundering by sending my payments overseas! BOA Fraud department believed that I was the victim of fraud but they refused to reimburse my payments. Again, they kept saying that they would never let criminals open bank accounts with them but it was all a lie! I knew if they could put a crime alert on my shipping agent's account, at least I wouldn't have to suffer any financial loss.

I was extremely depressed over this whole thing all the way from August 2015 till today. I lost a total of $45K. That was my entire life savings.

Noted that I am a US Army veteran. I read about how BOA would always do something to help veterans, but I guess in this case, they don't care about making it right for me.

To those who are currently banking with BOA, do you really like to bank with someone who allows scammers/money mules to commit crimes ripping off others? Also, do you like the fact that BOA isn't truly giving helping hands to any veterans as they promise they would?

All my family members, relatives and good friends had left BOA after knowing my fraud story with BOA. Working in the real estate industry, I don't even bother referring any clients out to get home loans from BOA. Please do yourself a favor. Stay the heck away from BOA.

3/17/17, I just had a chat with Karen Thibeault. She is one of the executives of BOA. She pretty declined my request for my $45K.

reclining couch & chair.

Hello

The salesman at Renauds Furniture in Miramichi directed us to you for a solution since he says there is no warranty after 1 year. We Purchased this set almost 5 years ago and expected it to last many more years.

Both pieces are very worn and letting go at the seams. With only 2 of us here We were assured it was a high end good quality bonded leather, and just recently learned it may be sprayed with somethings?.

Very Disappointed! We expect the normal wear and tear but not this!

We have bought lazy boy over the years because of the reputation and also purchased a swivel chair from England furniture with no issues.

If we wanted cheap quality we would expect to, pay cheap $$ We paid over $2400 for two pieces. We sincerely hope you will quickly address and compensate or fix the oroblem ASAP. It is very bad looking and we simply can not afford to purchase another so soon! We hope you stand behind your reputation of great quality furniture. I am attaching pictures.

Thank you.

Anita & Brian King

[protected]

[protected]@nb. sympatico.ca

mortgage servicing - wrongful foreclosure

For anyone fighting a wrongful foreclosure you really need to read this book (Chain of title by david dayen) ! We are not connected to the author in any way, but this book explains exactly what the problem is, and why most homeowners (Especially in florida) have no chance of winning their cases. We have been fighting a wrongful foreclosure since march of 2010 (Beginning with our original loan from countrywide mortgage) , making our payments to the servicers (Bac home loans servicing, bank of america n. A. , and currently, nationstar mortgage) , via certified check every month - only to have them returned to us for the past seven years! All of our returned payments are in a bank account (And have not been touched during the seven year period). We are scheduled to go to court at the end of april but have been told by our attorney that we will need to be prepared to pay the entire note in-full or to walk away from our investment home. Why? Because the majority of judges don't want to hear the details from your defense attorney and they automatically rule for the bank/servicer (Because it is easier). We have spent close to $35, 000.00 in legal fees paid to attorneys to fight this, but after reading this book we now understand that in most cases, attorneys don't even get the chance to defend their clients because the issue is way too complicated and the judges just don't want to spend the time to drill down to find out where the errors occurred on a borrowers account (Especially if the loan has been sold and/or servicers have changed during the foreclosure process). I am over simplifying the issues, but that is really the bottom line here. Read this book before you spend a bunch of money on hiring an attorney to defend your foreclosure case (Especially in florida). This problem with the servicers has been brought to the federal level and even the feds decided to sweep it under the rug by settling with the banks, instead of prosecuting them for mortgage fraud. Leaving all of the homeowners/borrowers paying the ultimate price for the bank/servicers wrong-doing.

Many of these issues posted here (Lender placed insurance, excessive late fees, inspection fees, lost paperwork for modifications, etc. ) are not new issues! And when you do your research online, you will see that many of the defenses that people/homeowners and foreclosure defense attorneys have used are being rejected by the judges/courts. Educate yourselves! I know this sounds crazy, but it's true! Read this book and research the issue online. You will clearly see that very few of you have any real chance of saving your homes - because the entire system is setup to support the lenders & servicers - not the homeowners/borrowers! And if you think filing a complaint with any of the government consumer protection agencies will make a difference... Think again... It's all been done already and garners little results for the common folk on main street! Educate yourself - you will not believe what you read - but it is all true. We know because we have been living it for the past several years!

service on ira account

I am very upset concerning the lack of knowledge and service that my bank representative had during a IRA transaction last year, to the point of considering termination of all my accounts with Bank of America and selling of my BAC stock. The transaction that took place was the terminating of my father's IRA accounts to move the funds into his estate. It is true that I should have know or at least considered looking for advise, but I have always considered those acting as representatives of the bank to be knowledgeable about banking business. What happened is my sister and I, as my father's personal representatives, closed his 4 IRA accounts without the knowledge that this would result in a huge tax bill. And that there was a solution in moving the money into an " inherited IRA", which would avoided taxes right away. Plus, it was an opportunity for the bank to maintain the funds within Bank of America. I can assure you that of the 6 heirs, at least 5 would have left the funds at Bank of America. The fact that your banking representative while consulting with the legal department about closing the account with two personal representatives never even suggested this option to us, doesn't speak very highly about those people representing the bank and looking out for the banks interest as well. I can not even express my disappointment and lack of trust with Bank of America at this point.

impolite staff

I am very disappointed with Bank of America and especially with their service! These people should be ashamed of themselves!

My friend from Germany arrived to visit me and he went to Bank of America because he needed some banking service. I was busy that day and wasn't able to go with him.

Bank employee refused to provide service to my German friend because his English was not so good. Bank employee said that he was not able to understand my friend and refused to communicate. I'll repeat that again - you Bank of America should be ashamed. Just think about what will my friend tell about your service when he comes back to Germany. He will say how rude and impolite he was treated! And by the way, his English was not that bad and it's easy to understand him. I'm disgusted to be a client of this joke bank!

teller, assistance with withdrawal and payment

On 02-22-17 I go into a BOA to perform a cash withdrawl. Need I remind you my husband had just deposited $1900 cash in my account and he banks with BOA also. I go to the teller to get the money and she says "the funds are still processing and will be available after 12am but you can call customer service and increase your ATM withdrawal limit to 1500 and take it out there". The tellers words are very contradicting as I am not lame and know that cash is available right away and my balance shows over 1900 available. The teller goes on further to say you can speak with the bank manager. I approach Tha manager by the name of Alex only to be told more lies. He says to me oh the teller is on a different system, let me have your cards (id and debit card) he then pulls my account info and my available balance shows over 1900 accessible for withdrawal. Alex goes on to say oh cash transaction can be voided thats why it says processing. I tell him who do you think you are talking too my husband always put money in my account: look at my accout history thos is nothing new and the money is available. At this point it began to rain and I proceed to my car in the rain to call customer service. When the rep gets on the phone she says I need to update some information because your info has not been updated in a while. I said to het that's a flat out lie because I just openef a credit card 4 months ago with you and nothing had changed. I Sherry the rep you do not have to lie...you have the information in front of you and what you are doing is puting my name and info on a log as if I am embezzling dirty money or laundering of some sort. I furthet tell her I work in a place that operates similar to a bank and there are measures that we take as well so I am not stupid so fo not lie to me because you can't update a social or date of birth as this will stay the same. Afterwards she verified mu funds were available and did know why the bank was denying me my money and telling me to go to the ATM. I proceeded back into the bank in the rain and made them aware that customer service is on the line and see that my money is available now. The manager Alex faking like there is something needing an override so I can access my funds. It took over an hour for me to get my money. For the lack of honesty and customer service I was treated as if I was a criminal and my integrity challenged. If it was not for my husband banking with BOA I would not have an account with them. I banked with them many years ago and terminated the relationship becauae of similar issues. The moral at the branch is unwelcoming and biased.

service members civil relief act (scra)

I have been Active Duty Military for over 17 years but only a Bank of America customer for a few years. I recently applied for a reduced interest rate as one of the benefits under the SCRA and was denied because I did not have the credit card before I went on active duty. I joined the military when I was 19 years old and didn't have any credit cards. Bank of America is the only credit card company that denied my claim. I would like Bank of America to change their policy regarding the SCRA.

online external transfer - no fee charge, false information by cc

Hi

I am a new account holder in BOA, I wanted to transfer money from my BOA account to my wells fargo account. before transferring I just wanted to confirm there will be no fee charge for online transfer.

on 01/09/2017 I called BOA customer care number and ask them how tomake transfer and made sure there will be no fee charge as on screen it was forced to select fast delivery 3, 1, Immediate.

I reconfirm that lady, that i dint want any fast transfer, but why i need to select this? She confirmed that there was a system problem & due to some reason it is showing fee need to select. In case fee charge you can call us back & we will return it.

today 01/11/2017 I checked my account ending with 8578 there was fee charge of $3. Though amount is not transferred to my another account yet (this may be other bank issue). I call & ask customer care to cancel the fee .

I surprise to listen they said its legal fee & has to be charged hence will not cancel.

This is how BOA customer care people cheat their customers. why one executive says there will no charge & another says its legal and fee is correctly charge.

It's not about a small amount, its about the authenticity of the customer care group. it seem "Bank of America " do not hire authenticate people who have full correct information.

This is the way Bank of America cheat their customer & fetch money in terms of fee . they don't tell in advance that fee is charge and after all done they say fee is legal.

Regards

Dhanashree Kanade

[protected]/[protected]

bank of america has now made it impossible to report fraud giving carte blanche to fraudsters

You call them to report fraud and they tell you that you have to call their fraud reporting number between Monday-Friday 9:00-5:00 (as if fraud only happens between Monday-Friday 9:00-5:00), meanwhile people are having a field day using your debit card. Then when you call the fraud number, no one actually ever picks up meaning criminals are being given carte blanche to rip off all Bank of America customers. How can a company like this even exist? Meanwhile, the law (Dodd Frank), states that it's illegal for banks that are too big to fail (like Bank of America) to be allowed to exist. So what's happening? Has the whole world gone crazy? If fraud's no longer illegal and the laws aren't going to be enforced, then another financial meltdown is right around the corner. You don't have to be Nostradamus to see this one coming.

lies

i had interview with this company and was told by the manager at the end of the interview that i got the job and he will be moving forward with me and to expect a call from my recruiter. same day was told the manager changed his mind i never in my whole life was told i got a job and then lied to and told something else hours later . i would never apply for a position again with this company very untasteful to lie to people about a job you never were going to hire them for in the first place

Until paperwork is signed, you are not guaranteed any particular position. Even still, you may still lose said position after signed paperwork for any reason if the state you reside has at-will employment. It is possible that they accepted you under circumstances that changed.

customer service

I am very disappointment in the costumer service provided. Talking to a Supervisor was a complete wast of time because they did not even help with the situation. I was charged a fee twice and charged a supposedly fee for protection on fee which was ridiculous and help for nothing ! Worst costumer service ever with no help provided to solve this issue charging a fee twice ! what was the point of speaking to a supervisor if they DO NOT provide no help! AT ALL! been banking with BOA for a long time and this costumer service i just got was the worst Ive ever had ! I will take this to all Media ! POOORRR Costumer Service and to top it off from a supervisor!

restricted orphans court guardianship account

I opened an Estate Bank Account in 2013 for my Granddaughter with a court Order restricted bank account for withdrawals only. This account is a Orphans Court Restricted bank account. Recently on 11/4/2016 an unauthorized withdrawal in the amount of 20k was withdrawn from the account without my consent or knowledge. The person closed the account and took all the money in the account. Bank of America has not notify me of this incident and has stated it is not check Fraud. What is it when someone takes property insured by a Federal Bank in someone else name without their name on the account and no signature card. I am still the Guardian of the account in the Orphans Court who has original jurisdiction to authorize court ordered withdrawals.

scam of someone using your name

I received a call stating that they were calling from the bank of America and they told me that they had a check for me. They told me that I had won 5, 000.00 from the publishing clearing house and they would need to deposit it into my back account. They also stated that they would need my account number because the only way I could get the money because of security they would need my account number. I told them that because of security reason, I could not give them my account number. I just want you to know that there is a scam out there with your name on it. The number they used: 718.514.6095.

Thank you

Weida Allen

false account made by the bank

No date on BoA notification.

No Client number (I am not)

For 2 years now I've gotten a letter from BoA "Bank of America Annual Error Resolution Notice" about a charge card that I do not have, and have never had. I've tried calling, multiple times, to the phone number on the letter and they have never answered the call. I just finished waiting for 45 minutes on hold--no one answered. It seems that BoA manufactures false credit card information about people who do not have dealings with them.

Resolution: have BoA notify me, in writing (paper), of their error, acknowledging I have never applied for nor received a credit card from them.

my account was fraud and shown evidence still nothing

Bank of America closed my account and sent me to early warning services. Early Warning gave me information to fill out. I did fill out and I did provided facts and evidence to back up what did happen with my account. I received a letter from Bank of America stating that I will stay on Earning Warning and ChexSystems. I am very upset and can not believe the evidence I sent was over looked and it stops me from getting a banking account anywhere. I even called Bank of America when I found out my account was over drawn and talked to the fraud department and they said nothing they can do to help me. I thought I was doing a secret shopper job. I believed it was was for Money Gram. Never once thought it was a scam.

home loan refinance

Around the end of August, I received a card in the mail from BOA soliciting a Home Loan Refinance. As a result, I reached out to BOA as I was interested. The Mortgage Loan officer was awesome. He took our information and explained everything...how the process would go, the estimated amount and closing date. Soon after, we began to receive tons of documents to sign...we complied. After a review of our banking account w/ BOA, we received a call questioning a check for $107. We complied. We then were requested to provide proof to support said check. We complied. Now...fast forward to 4 days from estimated closing date...we were told that the underwriter is requesting additional information (i.e. our tax returns) to determine additional risk from said check of $107. Where is the risk may I ask?...we have a credit score of 747 and 758. We have had 4 BOA home mortgages...3 current and one paid in full. We have sufficient income and have demonstrated the ability to pay debt and we have been excellent in regards to payments on rotating credit. But for some reason, the underwriter is focusing on a small business that requires rental of a small office space with very little overhead cost. At this point, I feel as if the underwriter is fishing or red lining us. While I understand an underwriters responsibility is to manage risk...I ask again, where is the risk? What have I mentioned or has the underwriter seen that states we are a risk? I have been honest and have complied through this ordeal but I guess it hard to believe that someone can run a small business/share office space and manage w/ little overhead and still be a low risk. I am pretty confident that another bank or mortgage company will be happy to take business from BOA and will provide a lower interest rate.

about my account being closed when I just recently opened it

I opened my account on 8/19/16 and today is 8/23/16 all I did was just deposited a I think four checks in the 750.00 and one was 700.00 and now they are saying since I deposited money into my account that the checks our no good or suspicious and that they are closing my account and the savings account that I just opened two days ago and deposited 50.00 dollars to open it but the lady told me that it was only 25.00 to open so where did the other 25 go and I can't get a straight answer from anyone they keep telling me to call [protected] and press option number 2 when option number 2 say close accounts and all the guy can tell me is that it's a business decision I took The money out of my pocket to open this account and just for a few deposits that gives them the Right to just close out any accounts that they feel like over a fn business decision I think that it bull s**** if someone anyone can give me a solution to this please send me a message or text me at [protected] immediately please and thank you

Mike Max

loan modification/short sale/pre-foreclosure

Initially in Dec 2015, my husband and I started dealing with Bank of America to request a loan modification. We were denied, of course, so we were forced to put our home up for sale. During all of this we had job loss, had to relocate for work, and forced to rent. With denial of loan modification, we put the house up for sale, found buyers right away, completed forms and actually approved for a short-sale May 2016 with same buyers, only to receive Pre-Foreclosure forms yesterday from my realtor authorized represent us for the short-sale. Any advice regarding if this is legal or not? We have been trying and cooperating with the bank to avoid foreclosure and try to save our credit so we can purchase another home in the future, however, I feel BoA is intentionally devastating my credit. Appreciate any and all input.

Bank of America Reviews 0

If you represent Bank of America, take charge of your business profile by claiming it and stay informed about any new reviews or complaints submitted.

About Bank of America

One of the key strengths of Bank of America is its commitment to innovation and technology. The bank has invested heavily in digital platforms and mobile banking, making it easier than ever for customers to manage their finances on the go. With features like mobile check deposit, online bill pay, and real-time account alerts, Bank of America is at the forefront of the digital banking revolution.

In addition to its digital offerings, Bank of America also has a strong network of physical branches and ATMs. With thousands of locations across the country, customers can easily access their accounts and get help from knowledgeable staff members whenever they need it.

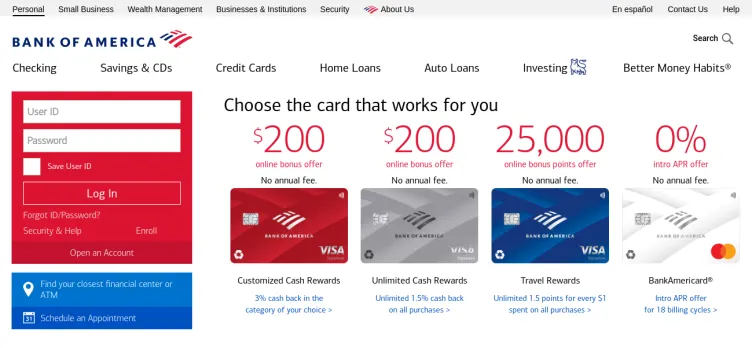

Another key advantage of Bank of America is its wide range of financial products and services. From checking and savings accounts to credit cards, loans, and investment products, the bank offers something for everyone. Whether you're looking to save for the future, buy a home, or invest in the stock market, Bank of America has the tools and resources you need to achieve your financial goals.

Overall, Bank of America is a trusted and reliable financial institution that has been serving customers for over a century. With its commitment to innovation, technology, and customer service, the bank is well-positioned to continue to meet the evolving needs of its customers for many years to come.

1. Log in or create an account: Ensure you are logged in to your ComplaintsBoard.com account to proceed. If you do not have an account, please register by providing the necessary information and verifying your email address.

2. Navigating to the complaint form: Once logged in, locate the 'File a Complaint' button situated at the top right corner of the website and click on it to access the complaint form.

3. Writing the title: In the 'Complaint Title' field, concisely summarize the main issue you have encountered with Bank of America. Make it specific and clear, such as "Unauthorized Overdraft Fees" or "Difficulty with Mortgage Loan Modification".

4. Detailing the experience: In the complaint description, provide a detailed account of your experience. Include key areas such as customer service interactions, problems with account management, loan servicing, fees or charges that were unexpected, issues with online banking, or any other specific incidents related to Bank of America. Clearly describe the nature of the issue, including dates, locations, and any relevant transaction details. If you attempted to resolve the issue, outline the steps you took and the responses received from Bank of America. Explain how this issue has personally affected you, such as financial loss or stress.

5. Attaching supporting documents: Attach any relevant documents that support your complaint, such as correspondence, statements, or receipts. Be cautious not to include sensitive personal information like your social security number or full account numbers.

6. Filling optional fields: Use the 'Claimed Loss' field to quantify any financial losses you have incurred due to the issue. In the 'Desired Outcome' field, describe what resolution you are seeking from Bank of America, whether it be a refund, apology, or corrective action.

7. Review before submission: Carefully review your complaint for clarity, accuracy, and completeness. Ensure that all the information provided is true to your knowledge and that your desired outcome is reasonable and clearly stated.

8. Submission process: After reviewing your complaint, click on the 'Submit' button to officially file your complaint on ComplaintsBoard.com.

9. Post-Submission Actions: Keep an eye on your ComplaintsBoard.com account for any responses or updates regarding your complaint. Be prepared to engage in further communication if necessary to resolve your issue with Bank of America.

Overview of Bank of America complaint handling

-

Bank of America Contacts

-

Bank of America phone numbers+1 (800) 432-1000+1 (800) 432-1000Click up if you have successfully reached Bank of America by calling +1 (800) 432-1000 phone number 8 8 users reported that they have successfully reached Bank of America by calling +1 (800) 432-1000 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number 3 3 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number45%Confidence scoreEnglish+1 (800) 688-6086+1 (800) 688-6086Click up if you have successfully reached Bank of America by calling +1 (800) 688-6086 phone number 16 16 users reported that they have successfully reached Bank of America by calling +1 (800) 688-6086 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number 1 1 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number88%Confidence scoreSpanish+1 (315) 724-4022+1 (315) 724-4022Click up if you have successfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (315) 724-4022 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone numberInternational+1 (757) 677-4701+1 (757) 677-4701Click up if you have successfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (757) 677-4701 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone numberCredit Card Issues+1 (800) 214-6084+1 (800) 214-6084Click up if you have successfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (800) 214-6084 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone numberVice President Bank+1 (312) 992-6618+1 (312) 992-6618Click up if you have successfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (312) 992-6618 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number

-

Bank of America emailssupport@bankofamerica.com100%Confidence score: 100%Support

-

Bank of America address100 N Tryon St., Charlotte, New York, 28255, United States

-

Bank of America social media

-

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreNov 09, 2024

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreNov 09, 2024

Most discussed complaints

pmi remove problemRecent comments about Bank of America company

ATM security firm illegal in nycOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.