Bank of America’s earns a 4.0-star rating from 4575 reviews, showing that the majority of banking clients are very satisfied with financial services.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

business account closed by risk department

We opened a business account on May 27th with Bank of America and on May 28th they closed our account. When we called customer service, they would not or could not give us any information. We are a start up company and they did not tell us that the account was closed or will be closing. We found out by trying to deposit money the next day. The customer service rep stated I needed to go the branch to receive my money back. I went the branch on June 1st and they told me they could not release my funds after standing in a line for 30 minutes. I went to talk to the banker that opened our account and he stated the risk department needs to release my funds and I would have to wait another 30-45 minutes for him to be free. I told him that was unacceptable and they gave me the number for their risk department. After calling the risk department, they stated they sent my money in a cashiers check along with a letter. I should not have to go through all of this. I will never ever do business with Bank of America. Their customer service needs a lot of work.

business checking account closed

We opened a business account on May 27th with Bank of America and on May 28th they closed our account. When call customer service, they would not or could not give us any information. We are a start up company and they did not us that the account was closed or will be closing. We found out by trying to deposit money the next day. The customer service rep stated I needed to go the branch to receive my money back. I went the branch on June 1st and they told me they could not release my funds after standing in a line for 30 minutes. I went to talk to the banker that opened our account and he stated the risk department needs to release my funds and I would have to wait another 30-45 minutes for him to be free. I told him that was unacceptable and they gave me the number for their risk department. After calling the risk department, they stated they sent my money and a cashiers check along with a letter. I should have to go through all of this. I will never ever do business with Bank of America. Their customer service needs a lot of work.

You already posted this and have a response on the other posting.

mortgage modification

My father and I have been with Bank of America since it's inception and held two mortgages with them for our home. When our Home Equity line of credit reached "end of draw" it was time, after ten years time for them to start add-on the principal to our interest only mortgage. I knew this would happen but no one told us they were going to raise our payments from $266.00/mo to $835/mo! Then they raised our flood insurance another $100.00 a month raising our mortgages by $600.00 a month! I told them we could not afford this. I had medical issues and was wanting for my disability to come through and my father is a World War II veteran living on a small fixed income. First I received a letter talking about all the different ways they could modify our loan for those in hardship. They asked to apply for the modification they would need bank statements and income records. I did everything they asked. They denied us All forms of modification! I asked for their appeals department. They flat out turned us down again for All Forms of Modification. They told us to seek Federal government help. That's when I learned they were supposed to have sent us a "Modification Package" to fill out! Then they told us we did not prove we were in hardship. They never asked us for the "hardship" letter or our "Itemized list of home expenses"! How convenient for them! I wrote a ten page hardship letter. I sent every document that they asked for. They turned us down again denying us All forms of modification for our mortgage. Then I contacted my Senator. There was nothing he could do. Then I spoke with Bank of America 's attorneys when they thought we were going to sue them. When they realized we did not have the money to do this I no longer heard from their lawyers. They said to apply again. They turned us down again for All types of modification stating we had already had a Modification! I said if I had one I would not be calling you for one! They continue to deny us a Modification as well as a refinancing based on a fabricated deceptive falsified document which does not exist. It has been one year now and Five denials for a Modification later and they are "still investigating this matter". Their "Resolution Team Department" just called the other day, still refusing us a refinance as well as a Modification based on a "Modification" that we never had and asked me "Is there anything you want us to do?" I hesitated to say what I really wanted them to do...

To be fair here, you should have been prepared. 10 years is a long time and a lot of financial and inflation changes occur over the period of time. You knew that once the home equity ended you would be paying more, and that all that accrued interest would be applied. That in itself should have warned you that your payment would be much higher. It is too late to get sticker shock now.

No bank or mortgage lender is required to offer a modification to anyone. You have to request it. You also have to request the application for it. An application for a modification is a new loan application that you must qualify for, just like the previous ones you have done. It matters not how long you have been with any lender. It is the here and now that matters. We have been with BOA for 25 years, and there are some things we still do not qualify for.

It is not bad customer service to deny a customer something they do not qualify for. You are going to have to figure out a way to either refinance or apply to a new lender to move your mortgage. Some private lenders can do things that banking institutions can not.

mortgage and foreclosure fraud

My husband passed and house title was under his name only.I had to send paperwork to have title transfer to my name 3 months before foreclosure, I never recieved letter stating next step to set mortgage assistance. I called many times, I was hung up on! Lied to no further paperwork needed at which time I was notified that house was up for foreclosure and illegally evicitied things were put outside and then damaged by thunderstorms, it was bad enough husband had just died. He even died there at home. Oh, boy it rained on July 1, 2014everything and anything I had left was ruined. I suffered a very bad depression, humiliation, freedom because of my I don't care anymore attitude due to the pain and suffering I endured. I still suffer from the depression of Bank of Americas unethical, unprofessional, and breech of several contracts. Has left a very bad scar in heart. I finally come forward and set this complaint and hopes of one day I will have redemption of my home...if not maybe we can bring these people / monsters down were no one will suffer as I did... In loving memory of PONCIANO GARCIA lll

JPKY, regardless of whether it was Christmas or not, you are disabled or not, your home could not go into foreclosure unless you were at the minimum 6 months behind on your house payment. All the rest of your complaint is unjustified. You are to blame for your house payment.

Bank of America can do whatever they want too people who can't afford an attorney, and my husband and myself are living proof! Two days before Christmas 2012, Bank of America DEMANDED $22, 000 OR THEY WOULD START FORECLOSURE ON OUR HOME! I'm currently disabled and been through 14 surgeries since 2011, so we didn't have money for an attorney, so my husband took our life savings too pay Bank Of American and stop the second attempt of robo signing that Bank of American has threatened us with, after our mortgage was sold to them by COUNTRYWIDE HOME LOANS! In addition, crooks in Louisville, Kentucky got ahold of all our private information after the Data Breech that happened with a former employee of Countrywide Home Loans, and just before our mortgages were purchased by Bank of America in 2009, so we are paying Lloyd an McDaniel in Louisville, Kentucky $300 a month, and have been for years now, and NOT A SINGLE PENNY OF THE MONTHLY $300 HAS WENT TOWARDS OUR SECOND MORTGAGE BALANCE THAT WAS UNDER $50, 000 UNTIL Lloyd and McDaniel in Louisville added another $20, 000 too our second mortgage, just because they could! HOW DOES THIS HAPPEN? WHY DO CROOKS GET AWAY WITH STEALING FROM THE POOR AND DISABLED IN AMERICA? jamiep@twc.com

If you were paying the mortgage after your husband passed, how was it being foreclosed on? If you did not pay the mortgage, then the bank has every right to foreclose. It is really not up to the bank now to put the house in your name. It is up to the court to do so with the probate judge once all heirs and credit lenders have come forward with their claims. Once the person designated by your husband's will as executor, or the person designated by the courts has submitted all documentation for distribution of the contents of the will, then the bank can do the changes. Pretty much, when a judge says the house is yours, the bank will allow the change. Unless the mortgage is in arrears. Then the bank can submit to the court it's intention to foreclose. It is not fraud. It is the law, and the bank will follow it. You must also.

an imposter phone call

I received a call at my house in San Diego, California on February 29, 2016 at 1:49 p.m. from the phone number [protected], which is from somewhere in Florida. The person, a man, represented himself as an agent with the IRS and informed me that the IRS was taking legal action against us regarding our house, and I needed to respond to the recorded message immediately due to the seriousness of the actions being brought against us. I returned the call right away to get the details, and the man who answered said "officer Williams, IRS." I started telling him who I was and why I was calling, but he hung up on me. When I called back several times, only once was it answered, and the same person just said hello, then hung up right away. I haven't been able to reach anyone at that number since that call, and now when I call that number, the phone rings twice and then switches to a busy signal. The reason I'm telling you all of this is that my caller ID identified the original 1:49 p.m. call as having been made from a phone at Bank of America. I followed up the incident by calling BOA and they said there was no record of any action being taken against us as far as they knew. If it's possible to track down the person who made that call, that is what I would like to do. My home phone number is [protected], and my name is Morris Ritchie. Thank you for any assistance you are able to provide.

By putting your phone number and email on the internet, you just gave every potential scammer a way to continue to harass you. The easiest way to handle these people, is hang up on them.

For the past 6 weeks, I have been receiving calls from [protected] asking for a James Michael Suggs who has an acct with Bank of America. The caller ask "Is the James Michael Suggs. If yes press 1 if no press 2, etc" I advised with option 2 I was not the person. They have called three times a day, everyday including Sunday: early morning, noon and in the evening. I stopped by the Bank of America office and they advised me to talk with this dept. Please help me if you can. My email address: minervafreeman1004@gmail.com. My phone number is [protected]. Please response to me.

Minerva D. Freeman

mortgage servicing

On 6/21/2013 Bank of America committed identity theft, theft, and fraud while processing the HAMP modification they offered us. Our account was illegally sold in an acquisition sale to NationStar Mortgage on 8/31/2013. Due to the nature of the sale BofA needs to meet with us in person to discuss a resolution. Details of complaint are uploaded below

It is not illegal for a bank to sell your mortgage to another lender. Banks, car lots, credit card companies, etc do it all the time. Just as you have the right to get a credit card from Visa to pay off a Mastercard, so too do they have the right to do so. It is called a free marketplace.

not informing me of hidden fees and unknown merchant charges

My name is Gabriel A. Oliver Vazquez, I've beed defrauded by this bank in numerous occasions with hidden fees on transactions in which they never inform me and I know nothing about. Got charged 2 times an amount of $35.00 in this month alone because a unknown merchant kept charging my Savings account and they never informed me of this. They indicated that was my responsibility to be aware and to do not give information to unknown merchants. What kind of bank does not inform you of this and how are they just gonna let this slide without informing me in any way or blocking this unknown merchant continuous charges . They additionally charged me $30.00 because I called customer service to stop a payment that VW credit placed twice on my Regular eBanking account in which the customer service personnel never informed me on a $30.00 charge to stop this payment at all. All of this in 2 weeks... a total of $100.00 pretty much stolen from me... This to me is unbelievable. This is not the first time they do this and it's getting to a point that its personally affecting me. What kind of credibility and moral standing does this institution represent.

Excessive overdraft charges and extended overdraft charges

ON JANUARY 11, A ACH for auto insurance was presented to my account I allowed the draft to be returned by not covering the funds and accepting the overdraft fee of $36. My pay roll was deposited on the 14th and once again the ACH came through for coverage. There was not enough to cover the ACH so I did not worry and thought because BOA had seen in the past that when I have large amounts to come against the account I cover them that day with funds from outside. This time the ACH was paid leaving a deficit on the account and every other small transaction which will total 5 after my insurance premiums come against the account leaving me with an outstanding negative balance of about $600 which will increase in 5 days due to the fact that I will not get paid until the end of this month. Way to go BOA, just rip me off and make money for yourself. These transactions were not handled to accommodate my as the account holder and the ACH was not a mortgage payment, so no priority should have been given. Poor customer service and greed is the issue here. Look at yourselves.

scam about winning $3.5 million dollars.

Two men called today telling us that we had won $3.5 million dollars as a second place prize in a contest. The money was supposed to be being held by Bank of America. The names given us by those who called were Mike Jenson and a Mr. Lewis. They called us from [protected] and [protected]. We want to report this scam to Bank of America. They told u...

Read full review of Bank of America and 4 commentscashiers check return

On Dec 2015 I deposited a $2300.00 teller check to my saving account in bank of America located on chain bridge road in McLean Vi and as soon as deposited I saw the money is in my account accessible to spend, after 5 day's I checked my account and I saw that the money is in my account so I believed the check is ok, then I paid $2000.00 to some one with...

Read full review of Bank of Americaclaims dept.

I was scammed by a fake tech support company-"Ayogi Support". B of A said I had to provide proof that I was scammed because the scammer provided B of A with a bogus electronic contract with my name on it stating that I agreed to pay Ayogi $149.99 plus a foreign charge! B of A denied my claim and believed the scammer! I talked to the claims department by phone and convinced them to reopen my case. A couple days later I provided proof in print that this company scams people. Mine happened to be in connection with Netflix. I researched the internet and found an article stating that Ayogi support was a known scammer. I faxed the article to B of A, plus provided B of A the site address so they could confirm this. Then I got a letter from B of A saying my claim was once again denied because the evidence wasn't submitted in the required time frame. I faxed it all in right away! B of A said I should contact the scammer to see if I could get my money back! Seriously? None of this is making any sense to me. I am thinking I am slipping through the cracks of their system. I have been a preferred customer since the 70's and they would rather lose me as a customer over $149.99+. None of this makes sense. I will be going to US Bank. I didn't realize B of A had such a bad reputation. I thought they protected their client's money. I was wrong! I am also checking into suing B of A. It isn't the amount of money, it is the PRINCIPLE! As long as these internet scammers get away with this, the more they will keep doing what they do.

customer service

I needed to change my name after getting divorced and add my daughter-in-law to an account that my son and I were on. I can't believe how difficult Bank of America made it. First I went to an office while I was 45 minutes away from my hometown and they stated that I have to call customer service for a form or I have to go to my local branch. Why if you are...

Read full review of Bank of Americaproperty claims department

Chronology of contact with Property Claims Department *September 19, 2015: Check for Recoverable Depreciation received from our Insurance Company (ASI Lloyds) dated 9/17/2015 *September 23, 2015: All forms needed by Property Claims and the check sent by overnight priority mail sent to Property Claims Dept, Simi Valley, CA *September 24, 2015: Received and signed for at Property Claims Dept with confirmation done by me using tracking number *October 8, 2015: Call placed to and spoke with representative who transferred me to Sherry, an Escalation Manager because of us not know that we had to call for an inspection to be done. Sherry stated that the schedule for inspection had been requested and that we would receive a call from someone in 24-48 hours. *October 14, 2015: No call from anyone re: scheduling an inspection. Call placed and spoke with a Michael (I believe that was his name). He informed that request to schedule an inspection had not been submitted by Sherry. The request was submitted by this young man and he also filed a complaint on our behalf regarding the issue. He also told me we would receive a call in 48-72 hours. I explained to him about being told the 24-48 hour window and was told that “We don’t ever do anything that fast.” *October 19, 2015: Call received to schedule inspection on October 21, 2015 at 9am. *October 21, 2015: Inspector here and once inspection done, my husband (John) signed the form stating inspection done. *October 29, 2015: Call received from Karen. Call returned (not sure who I spoke with). I was told that the W-9 for the contractor was out of date and a new one needed to be submitted in order to process the claim. I contacted the contractor, received an updated W-9 and faxed it from my work. *November 2, 2015: Missed call from Property Claims *November 3, 2015: Call placed to Property Claims. I was as told by William that W-9 submitted and it was waiting for vendor number to be issued. *November 5, 2015: Call received from Property Claims stating that W-9 was rejected by IRS due to SSN did not match name on form. Call then placed to contractor. Conference call placed again to Property Claims with contractor. I did not get name of representative. Contractor fixed issue with W-9 (last number was typed too close to line and was not clear) and faxed new form to Property Claims. *November 6, 2015: Voicemail received to call Property Claims. Call returned and now being told by a person named Wei (?) that Contractor license expired (it wasn’t when this whole thing started). After talking to this person for 18 min, we were placed on hold for an Escalation manager. After being on hold for 7 ½ minutes, we were talking to Lucretia. After several minutes talking to her, she placed us on a brief hold to contact the contractor to have current license faxed directly to her-no answer so call to contractor on his cell to have him contact office to answer phone incase not answering d/t unknown #). @ 46 minutes into call, called the office number again and spoke with Daphne-office manager. We were told at this time that the funds would be released and sent to us overnight. Daphne had hung up so she could fax current license. Awaiting Fax-placed on hold at 52:40 and returned to line @ 59 minutes stating had not received fax yet and placed us on hold again. At 1 hour and 6 minutes, Lucretia returned to the line stating that fax had been received and document was being uploaded to our account. 1 hour 12 minutes, placed on hold again. 1 hour 19 minutes: Lucretia returned to line stating that request for disbursement of check done and would be sent overnight but because of it being Friday, we would not receive it until Monday. At 1 hour 24 minutes, we were told that everything was submitted and check would be received Monday, November 9, 2015. *November 9, 2015: Call placed to Property Claims dept to obtain tracking number. Spoke with Dena who informed me that a tracking number had not been issued yet because check had not been cut to be sent. Request to speak to Escalation Manager Lucretia. After being on hold for several minutes, I was told that Lucretia was not available. I then requested to speak to a manager. Was transferred to Andy. I was told that a request for disbursement had been submitted but check not issued yet. I explained to Andy what had been done last Friday and he just kept apologizing. Admittedly, I blew up and told him we were tired of apologies, sympathy and empathy. And I hung up on him. With much assistance from Daphne, we were able to get in touch with Lucretia (on a conference call) who informed us that her request had been submitted but not received by the appropriate department until Friday afternoon, and that the check would be issued today and sent over night and we would receive it Thursday or Friday. I asked for an explanation as to why it would take 3 days for an overnight and she stated because of the holiday on Wednesday (Veterans Day). I told her that I didn’t understand how they could claim to send it overnight but it take 2-3 days. I requested a tracking number and she stated that one had not been assigned yet, but that she would call me back when one was issued. She also stated that she had submitted a request for the interest that has been accruing on this to be sent to us as well. Daphne stated she was going to “bow out” of call at this point and when she hung up, Lucretia and I were disconnected. (this all took place during the 11 o’clock hour) **At the time of this documentation, 1:20pm, I have not heard back from Lucretia re: the tracking number.

holding of voided funds now 4 days

AAA VOIDED a debit charge for me in the amount of $1257.00 on 10/31/15 at 4pm. Today is 11/3/15, all debits & credits have finished processing with the exception of the VOIDED transaction. Transactions that I purchased yesterday on 11/3 are done. Money they owe my account, still have not posted. They are holding this money to long. AAA voided this out and advised me to demand Bank of America release my funds. We need a class action lawsuit!

mortgages

Short version, needed to get out of the Mortgage. They offered me a Deed In Lieu. Then they denied it because an unknown third party had filled the backyard with junk. Denied my short sale for same reason. I live in TN, I cannot afford on a widow's pension to fly to CA to unload garbage. The day after the short sale fell thru, the garbage disappeared. But since they had denied me, I couldn't do the Deed In Lieu again. So they foreclosed. I called Legal Aide but even with the free lawyer, I would still have to fly out. Did they hear I was POOR? Now, they are trying to double dip. They finally sold my Mortgage BUT will still collect from the foreclosure sale! My short sale would have netted them within $5K of what was owed. But now, with the foreclosure sale, they stand to NET $75K off of a $35K debt! All I want is for them to take the house back and do what ever they want with it and get it off my credit report which is what the Deed In Lieu was suppose to do. Why do they want this on my record anyway? It's no skin off their nose if my credit score is 0 or 750. I don't get it. Why can't I just have my Deed In Lieu? *BTW, the backyard is full again. The community service officer (there are no actual cops in the town as funds were spent on a concert series.) keeps me informed. Mainly, cuz it stinks and there are rats. But it's not my problem. And someone stole my greenhouse while they were there. And I know no one is going to help. I've gotten "smart" answers from everyone involved as to why they can double dip. But when they ruin your credit, and they will, then you'll know too. Customer #[protected]

They took our home too. In 2010, a representative advised my husband to stop paying his mortgage in order to get the modification. Before, I knew it his house was in foreclosure and Samuel White on his back. He had just sunk every penny into renovating it and BOA took it right from him with $70, 000 equity. We were escorted out by a Sheriff on our twins boys fourth birthday to live in an area where a murder would occur nightly just around the corner r up the street. Even though my name was not on the house, my credit score went from 720 down to 502. We could not help ourselves legally then and still fighting to regain financial independence. I feel your pain and wish more had been done to protect us and that what was taken will be returned 1000 fold.

wire transfer

Recently I got scammed and transferred money from my BOA account to Account name :Imran Hoosein Account # [protected] Zip code # 27025 Routing number # [protected] Bank name # BANK OF AMERICA Address: Richmond, VA 23261 Made two transactions: $ 1468.84 and $ 155.20 = $ 1623.44 The bank refused to help as once a wire transfer is done they can't do anthing. They even refused to give any other information of the account holder. Anamika

claim/fraud department

On 10/9/15, I called the Fraud dept and was on hold for at least one hour, while driving in rainy traffic (thank goodness for Bluetooth). Once someone finally picked up, she couldn't do anything because the system wasn't working properly and she had to re-boot her computer. She asked for a call back number and said she would call me right back. Well, that didn't happen. I called back on 10/10/15, after holding for approximately 30 minutes, an operator (not from USA-I couldn't understand a word he was telling me) finally picked up. I told him about fraudulent charges. He was able to assist me with some of the ones that were already processed. When I began telling him about other past fraudulent charges that I needed to make a claim on, he hung up the line...I guess he was through with me. Now that the fraudulent charges that were processing are all cleared, I want to get a claim in for those...I have been waiting on hold for a good 45 min now. It is currently, 10/14/15, 7:48pm est. I thought that maybe i needed to call at night instead of during the afternoon...it is not any better. This is the most ridiculous thing! Their customer service is horrible! I have all of my money in this bank and am seriously considering taking everything out and going with a financial institution that takes care of their customers immediately! So aggravating!

redeeming elite rewards points

I went on the the Elite Rewards website to redeem my points for a gift card that I was promised by Bank of America. I received notifications by mail from Bank Of America that I had until Oct. 31, 2015 to redeem my 4, 000 points. Conveniently, September 29, 2015 the Elite Rewards program deleted $25.00 Gift Cards from their program without any notification to customers that earned the gift cards and increased the amount of points to earn any gift cards under 7, 300 points ($50.00 gift cards and up). When will a class action law suit begin. Sign me up!

scam

Important payment wire notification valued $10.5m! important payment wire notification valued $10.5m! Actions bank of america ([protected]@pivit.Net. Au) add to contacts 4:15 pm keep this message at the top of your inbox [protected]@pivit.Net. Au bank of america 3181 steinway st astoria ny 11103 from the desktop of mr moore carrick e-mail:[protected]@aol.com date:[protected] it is my modest obligation to write you this letter as regards the authorization of your owed payment through our most respected financial institution (Bank of america). I am mr moore carrick, the chief executive officer, foreign operations department bank of america, the british government in conjunction with us government, world bank, united nations organization on foreign payment matters has empowered my bank after much consultation and consideration to handle all foreign payments and release them to their appropriate beneficiaries with the help of a representative from federal reserve bank of new york. As the newly appointed/accredited international paying bank, we have been instructed by the world governing body together with the committee on international debt reconciliation department to release your overdue funds with immediate effect; with this exclusive vide transaction no. : wha/eur/202, password: 339331, pin code: 78569, having received these vital payment numbers, you are instantly qualified to receive and confirm your payment with us within the next 96hrs. Be informed that we have verified your payment file as directed to us and your name is next on the list of our outstanding fund beneficiaries to receive their payment. Be advised that because of too many funds beneficiaries, you are entitled to receive the sum of ($10.5m) only, as to enable us pay other eligible beneficiaries. To facilitate with the process of this transaction, please kindly re-confirm the following information below: 1) your full name: 2) your full address: 3) your contact telephone and fax no: 3) your profession, age and marital status: 4) any valid form of your identification/driven license: 5) bank name: 6) bank address: 7) account name: 8) account number: 9) swift code: 10) routing number: as soon as we receive the above mentioned information, your payment will be processed and released to you without any further delay. This notification email should be your confidential property to avoid impersonators claiming your fund. You are required to provide the above information for your transfer to take place through bank to bank transfer directly from bank of america. We look forward to serving you better. Mr moore carrick chief executive officer, bank of america (Copyright © 2015 bank of america) © 2015 microsoft terms privacy & cookies developers english (United states)

lender fraud-judge

I am involved in a mortgage fraud my home is being taking away. Many teachers in the City of Chicago that worked for CPS is facing this same problem.

Which is B A pay on the taxes after you paid and refuse to accept mortgage payments. Keep some payments return some and just try your funds up.

Seterus is now a partner with B A alone with fannie mae, lawyers and Judges that sit on the bench in cook county court.

All politicians' know what is happening even the Department of Justice and I heard Bank of America is too big to do anything about this.

I am a superior teacher, black lady, that taught students to become professionals and go to work in the field of manufacturing, Arch-design..

Bank of America Reviews 0

If you represent Bank of America, take charge of your business profile by claiming it and stay informed about any new reviews or complaints submitted.

About Bank of America

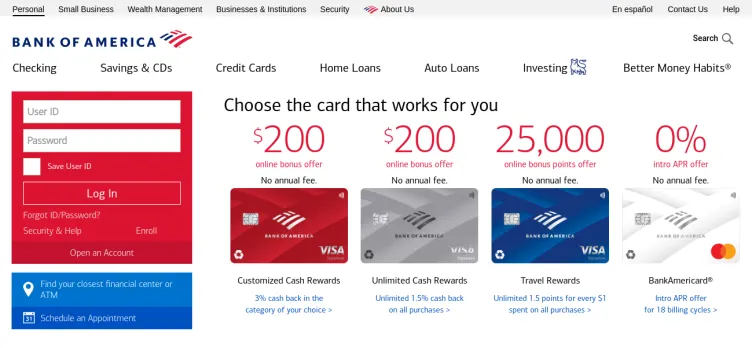

One of the key strengths of Bank of America is its commitment to innovation and technology. The bank has invested heavily in digital platforms and mobile banking, making it easier than ever for customers to manage their finances on the go. With features like mobile check deposit, online bill pay, and real-time account alerts, Bank of America is at the forefront of the digital banking revolution.

In addition to its digital offerings, Bank of America also has a strong network of physical branches and ATMs. With thousands of locations across the country, customers can easily access their accounts and get help from knowledgeable staff members whenever they need it.

Another key advantage of Bank of America is its wide range of financial products and services. From checking and savings accounts to credit cards, loans, and investment products, the bank offers something for everyone. Whether you're looking to save for the future, buy a home, or invest in the stock market, Bank of America has the tools and resources you need to achieve your financial goals.

Overall, Bank of America is a trusted and reliable financial institution that has been serving customers for over a century. With its commitment to innovation, technology, and customer service, the bank is well-positioned to continue to meet the evolving needs of its customers for many years to come.

1. Log in or create an account: Ensure you are logged in to your ComplaintsBoard.com account to proceed. If you do not have an account, please register by providing the necessary information and verifying your email address.

2. Navigating to the complaint form: Once logged in, locate the 'File a Complaint' button situated at the top right corner of the website and click on it to access the complaint form.

3. Writing the title: In the 'Complaint Title' field, concisely summarize the main issue you have encountered with Bank of America. Make it specific and clear, such as "Unauthorized Overdraft Fees" or "Difficulty with Mortgage Loan Modification".

4. Detailing the experience: In the complaint description, provide a detailed account of your experience. Include key areas such as customer service interactions, problems with account management, loan servicing, fees or charges that were unexpected, issues with online banking, or any other specific incidents related to Bank of America. Clearly describe the nature of the issue, including dates, locations, and any relevant transaction details. If you attempted to resolve the issue, outline the steps you took and the responses received from Bank of America. Explain how this issue has personally affected you, such as financial loss or stress.

5. Attaching supporting documents: Attach any relevant documents that support your complaint, such as correspondence, statements, or receipts. Be cautious not to include sensitive personal information like your social security number or full account numbers.

6. Filling optional fields: Use the 'Claimed Loss' field to quantify any financial losses you have incurred due to the issue. In the 'Desired Outcome' field, describe what resolution you are seeking from Bank of America, whether it be a refund, apology, or corrective action.

7. Review before submission: Carefully review your complaint for clarity, accuracy, and completeness. Ensure that all the information provided is true to your knowledge and that your desired outcome is reasonable and clearly stated.

8. Submission process: After reviewing your complaint, click on the 'Submit' button to officially file your complaint on ComplaintsBoard.com.

9. Post-Submission Actions: Keep an eye on your ComplaintsBoard.com account for any responses or updates regarding your complaint. Be prepared to engage in further communication if necessary to resolve your issue with Bank of America.

Overview of Bank of America complaint handling

-

Bank of America Contacts

-

Bank of America phone numbers+1 (800) 432-1000+1 (800) 432-1000Click up if you have successfully reached Bank of America by calling +1 (800) 432-1000 phone number 8 8 users reported that they have successfully reached Bank of America by calling +1 (800) 432-1000 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number 3 3 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number45%Confidence scoreEnglish+1 (800) 688-6086+1 (800) 688-6086Click up if you have successfully reached Bank of America by calling +1 (800) 688-6086 phone number 16 16 users reported that they have successfully reached Bank of America by calling +1 (800) 688-6086 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number 1 1 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number88%Confidence scoreSpanish+1 (315) 724-4022+1 (315) 724-4022Click up if you have successfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (315) 724-4022 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone numberInternational+1 (757) 677-4701+1 (757) 677-4701Click up if you have successfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (757) 677-4701 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone numberCredit Card Issues+1 (800) 214-6084+1 (800) 214-6084Click up if you have successfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (800) 214-6084 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone numberVice President Bank+1 (312) 992-6618+1 (312) 992-6618Click up if you have successfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (312) 992-6618 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number

-

Bank of America emailssupport@bankofamerica.com100%Confidence score: 100%Support

-

Bank of America address100 N Tryon St., Charlotte, New York, 28255, United States

-

Bank of America social media

-

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreNov 09, 2024

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreNov 09, 2024

Most discussed Bank of America complaints

pmi remove problemRecent comments about Bank of America company

ATM security firm illegal in nycOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.

My business account was closed the next day as well without any explaining. Everything was provided and was approved and even the representatives I spoke to was very helpful with the process but when I got the letter for sending in for the authorized signers, i also got 3 letters stating each account was closed. Not acceptable at all. If there was an issue they shouldve told me during the application stage before the account was approved. They would not give any information but basically read the same script that they can, with or without notice, close an account/end an relationship with the business. I just took my business else where because ive noticed it to be a common thing to happen with BoA. Wells Fargo was very helpful and would let me know of any blockage that would hender the application from being approved.

Did you give them your business plan, along with all legal documents pertaining to your business: copy of your business license, certification (incorporation or LLC, DBA) etc when you opened the account? Was your initial deposit made in cash or by cashier check? Was there anything unusual about your business or business name? Normally a business account would not be closed unless they could not verify the documentation. The anti-money laundering law is very strict, and every bank will do the same. Banks are in the business to make money, so for them to close an account they just opened something must have red flagged. You need to find out what it was otherwise you will have the same issue with any bank you try to use.