Bank of America’s earns a 4.0-star rating from 4575 reviews, showing that the majority of banking clients are very satisfied with financial services.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

legit cash rewards stealing

Bank of America issued me a cash rewards card in 2011 when my credit score was low. I was using the card for over a year and made payments on time every month. Sept 2012 i sent over a pyment to pay out my balance. A week after the bank recieved my payment and my balance was piad they sent me a letter stating that they reviewd my account and they are closing my account. I called to have my Cash rewards sent to me and was told that when the account is closed the cash rewards can't be redeemed so i argued that how would anyone would know when the bank is going to close thier account.

So now i figured wow they can have all those ppl using thier CC and when BOA needs some cash will close few account and not paying thier cash rewards.

Thank you bank of america for stealing our money. Thank God i was able to pay off thier card and not give them any more of my hard earned $$

The complaint has been investigated and resolved to the customer’s satisfaction.

millward brown and decipher, inc false reward

Deceiving message about $20 Amazon reward for the Bank of America survey completing. Possible phishing site.

The survey's site: http://t2.ktrmr.com/surveyr.aspx?i.project=F646E&s=GEN24&id=1&chk=000&pid=plawRQymnQ&Seg=1&Mod=XX&BOAPid=21377990

The complaint has been investigated and resolved to the customer’s satisfaction.

stay away from these guys

After refinancing we were bought by Bank of America and like millions of people we hit a bump with our payment and asked if we could modify our mortgage, after a few months they agreed and a few more we signed the papers . As of now its been 17 months an thy say were still on trial although we have never missed a payment also we are ow sending in 2 checks instead of 1 one for the mortgage one for the escrow they say we fell behind..we now owe almost as much as we did before the problem and on our credit reports have been all but trashed.i thout we had bailed these big ole banks out now they treat us like crap shame b.o.a. shame.

health insurance/premiums

I just received my spouses 2013 Health Plan Review for BoA, and it is little to be desired. The largest bank in America of course has to justify all these new rules due to supposed increased costs at 9% annually. They are making it impossible for the average consumer to obtain health insurance! Just because the costs go up supposedly, does not mean it ALL has to be passed on to their employees. They are also trying to say they will reward you if you manage your healthcare via a screening and assessments, I do not need them to manage my health or have access to my health with the costs that are associated with it! Also, they make it IMPOSSIBLE to communicate/complain to them which is my right, they can ONLY speak to the employee even though dependents are affected as well! I am considering getting off my spouses insurance, and letting my spouse just get coverage for him and our children because that is a bit more cost effective, maybe Obamacare is a GOOD idea.

The complaint has been investigated and resolved to the customer’s satisfaction.

refinancing closing date

I applied for home refinancing April 06, 2012 with Bank of America. I was told the process would take around 6 weeks. I hand carried to the bank all necessary documents. My case was transferred to 4 different processors. I contacted my refinance officer and had my case expedited to a supervisor. It is now 5 months later and was told that my case is in review with the underwriters. Then I was told that there is a backlog with the underwriter and now my status is pending. i cannot get them to give me a closing date for this loan. I thought to seek refinancing with a different bank, but to start this process with a different bank would be fruitless. I reviewed other peoples complaints on the web and realized that these delays are with all of the banks. At this point all I can do is wait and keep contacting the bank for closing date. Hopefully these complaints find there way to the State of Florida attorney generals office.

The complaint has been investigated and resolved to the customer’s satisfaction.

How stupid of a person posting about a backlog at a bank.

bad and inefficient customer service

Ok, Bank of America officially sucks. I'm an international student who opened an account with bank of america because it seems so established.Boy, i was wrong. While on summer break in Singapore, BOA closed my account without any prior notice. When i called them about it, i was transferred a million times and every single time I called, they gave me different solutions. Guess what, none of them worked. It was as if those BOA staff are just making up solutions from their own imagination and they obviously don't know what they are talking about. I went through so much trouble( hours on the phone - a LOT of money wasted because I was calling from overseas), and countless visit to merrill lynch branch in Singapore, all to no avail. So I'm screwed, basically. I can't pay my tuition fees because BOA closed my account and wouldn't fix it. Thanks a lot BOA. I gave you money, but you gave me crap. Good job!

The complaint has been investigated and resolved to the customer’s satisfaction.

denied in cash back

From now on i hate additup and macys.com!

I find making purchases using your system absolutely nontransparent and prone to abuse! this is the only website (macys.com) i used who didn't make cash back on time first time and the second time they didn't make any cash back at all and explained it as a customer's fault though i'm as a customer follow all the rules and make purchase only using addit up links. and i haven't had any problem with the system before i purchased something from macys.com.

My additup history shows that i have never had any problems before "shady" practice of macys.com/additup.

From now on i stop using bank of america additup website and the credit card because it's very unreliable and customer-not-friendly system!

Macys.com sent me email with the new (even lower) price on men's shirts. i used their link to find out those prices and when i saw that the price was really lower i closed their link and went to additup website to make the final purchase.

The aditup link led me to the same prices and i didn't use any extra or special codes/coupons! i just added the shirts to the cart and placed the order. it was the regular purchase through the additup link! my previous purchases are the proof that i know how to use the system, i have never had any complaints before.

But macys.com denies my right for cashback i was entitled according to the rules of the system. with the last purchase i feel abused because it's my second experience with macys.com and the first one was also not stress-free. i called to additup customer service about the delayed cashback from macys.com and only after that call the cashback was posted. but this time they didn't give anything and the most terrible part is they insist i used some other website link or promotion. it's unfair and shady!

Stand by your customers! improve the transparency of internet shopping because the situation i dealt with is looking like the bank and the retailer are in cahoots/conspiracy!

I can give you an example of fair practice retailers like homedepot.com, lowes.com, acehardware.com. they appreciate customers and honor their "little joy of the cashback". this is the real deal - to leave customer happy but not feeling dumped like me!

The complaint has been investigated and resolved to the customer’s satisfaction.

misleading information

Struggling with making home payments. At first I was doing good and giving more than required payment and was also able to refinance. In 2005 my husband died in accident and started having trouble making payments on time received letter for modification plan in 2010 and for 6 months giving partial payment not knowing had to pay remaining balance at end of six months which made things harder and started falling behind. At this time speaking to BOA case worker almost daily discussing options of modification plan and repayment plan. I was told had to give one month payment and the remaining behind balance divided by 5 months and at the same time asked me to fax modification plan information which I did. I send a 1200 cashiers check which was later returned telling me I never commuted to plan I was then told I could only do one modification plan or repayment plan. I really need help they keep giving me different information. I only owe 29, 000. From 120, 000.. Please help, been talking to them frequently and seems they don't want to help me rather take my house

The complaint has been investigated and resolved to the customer’s satisfaction.

over drafted

I got ripped off by Bank of America!

There is six $35 over drafted fees showing in my check account today, and i called them yesterday and asked about why is there so many over drafted fees and the guy told me because of some banking error and will refund all the fees for me and required me to call back the next day which is today, so i called again, and what they said today is totally different, they refused to refund the fees and the guy hang up on me twice! he couldn't explain the reason why i got charged for so many times, i had $250 deposited into my check account on Aug 21th and i transferred $160 into my saving and i got three over drafted fees that day for previous purchases by then my checking account was -$35.59 but my saving had $160 in it, then there is two more purchases $28.17 and $27.28, since i have over draft protection service, if my checking have not enough funds, it will automatically transfer funds from my saving to cover the debts but i still got over draft charges for that, and they hold all the money in my saving account, that guy told me because i transfer the money on Aug 21st 5:45 AM which is after the cut off time so my saving had not enough money to cover the purchases i made on Aug 21st, WTF? i thought the money was available on Aug 21st since i made the transfer in the morning of Aug21st, but that guy said it's after the cut off time which is 5PM, he didn't even know what hes saying @@ and his attitude was really bad! " WE WILL NOT GIVE YOU ANY REFUND TODAY!" and i said i totally understand and i just want you to explain all those fees and he hang up on me!

PS everytime i use my debit card i check the available balance first and make sure there is enough funds, this is being so ridiculous, i think they got addictive in getting sued.

The complaint has been investigated and resolved to the customer’s satisfaction.

erroneous default notice

BANK OF AMERICA

The nightmare began July 11, 2012 when we received a notice of intent to accelerate, which is basically a default notice from BOA

We recently signed a loan modification with the Department of Veterans Affairs which holds the note to our home. Bank of America is not the assignee of the note, but a servicing agent which the VA chose. At no time have we received a default notice from the VA. In fact we have been making timely mortgage payments to Bank of America since May 1, 2012 in accordance with the Loan Modification effective date and all checks have cleared.

Other veterans who have signed on may be receiving the same default notices.

We are extremely thankful and grateful for the opportunity extended by the VA to reduce our mortgage rate during these difficult economical times. We have been in full compliance with all terms of the note and mortgage held by the VA. Unfortunately, administrative and communication problems between VA and it's servicing agent BOA is a disservice to veterans causing undue hardship, erroneous default notices and negative credit report.

Regards.

Ianeta Kappel

stay away from these guys

I had been on my computer trying to get work from home, I received a letter in the mail with a certified check for 900.00 I to be a person to purchase $50.00 from Wal-Mart and write a summry of the services, then get a money wire sent to a person, then call the phone # given to let them know i had completed the job, and I would get another job. I spoke to the lady at the bank and she verified the check as being good. I didn't know that a few weeks later the money amount would be placed by bank of american on my bank of america credit card.

unjust bank overdraft fee's

So bank of amerika aprently randomly decided 3 days ago to change there overdraft policy, it use to be to get an overdraft the transaction had to be $10+ now its All transactions and the fee increased to 38.50. So because of this, 12 $0.10-$2 transactions that overdrafted my account by a total of about $9 is costing me $465.00. Like wtf? Are they aloud to...

Read full review of Bank of America and 6 commentsfalse information and poor customer support

After many failed attempts in trying to reach a conclusion on my matter, I decided it would be best to write a letter to express my dissapointment in your business and the people who represent it.

My name is Jason Burlin, and I have been a Bank of America customer for many years. My business finances, Laprom/Blush Moving is also run by your company. Recently, I have been having some issues with my account. I have called many times trying to discuss this situation with your representatives, but sadly they had no answers to my questions. The poor customer service and the lack of attention has drove me to this.

It seems that the overdraft fees that keep appearing on my account are more of a scam than a mistake on my part. The past seven overdraft fees would have been avoided if your company had process them on time. It seems like you put the checks on hold for a couple days, then when the account is low; you charge them all at the same time. This action has resulted in over $500.00 in overdraft fees alone.

Every time there is a fee I quickly deposit into my account within 24 hours. Yet, it seems your company continues with the unethical method. Holding checks and processing them when the account is less than the total of the checks. This might not seem as a big deal to you, surely your representatives didn't take this serious.But, after we have requested to not process any checks or payments when the account is low to avoid over draft and a negative balance. This request has been made many times and each representative has assured me that this will be fixed. It has yet to be fixed.

This is my final request in hopes of resolving this issue. Please contact me as soon as possible, if not I will have no choice but to proceed with legal actions.

The complaint has been investigated and resolved to the customer’s satisfaction.

modification lies

I was given trial modification payments and completed them all the while Bank of America was still pursuing foreclosure on my home by taking me to court. They lost my last trial payment and at court, they "found " it and dismissed my foreclosure suit. I was instructed by their lawyer to call the bank every 7 to 14 days to check on the status. THIS was in January, I have gone through 4 account reps since this began in 2008! They now tell me that I am too far behind iin my payment to approve a modification! If they had not wasted all this time or accepted partial payment on my loan, I would not be in this situation. I am thoroughly disgusted and am afraid I will be homeless! Is there no help out there for homeowners?

Short sale is not a great option because if you sell the house for less than what the mortgage is worth, you will have a deficiency and the lender can win a deficiency judgement against you in court...unless you file for bankruptcy protection, that is.

.

If I were you, I'd look into the chain of title on your home. Millions of homes in the MERS system have clouded titles and if your chain of title is broken (any gaps in the chain) then you cannot legally be foreclosed on. I suggest you look into your local (and don't gag or anything) Occupy Your Home group. People need to start educating themselves about the housing crisis. Here is an article to get you started:

.

The Foreclosure Mess

http://www.ritholtz.com/blog/2010/10/the-foreclosure-mess/

and by the way... if it begins to look really grim, consider talking to BofA about a Short Sale. If you don't know what a Short Sale is, educate yourself; tons of info on the internet if you just search "Short Sale". Basically, it is an agreement between you and your mortgage servicer to list your house on the market for less than the amount owed. For example, if you owe $300k, the bank my agree to list it for $200k. When it sells, the balance is forgiven and your credit is preserved.

Until June, short sales were really a pain because they were taking six, sometimes eight months or more to close due to the banks slow response to approve the sale price. However, in June I believe a new law requires banks to respond within 30 days with an approval or denial of the sale price. I hope they are following this guideline but... we all know the big banks do what they want to do, don't they?

OK. Try this... Contact the HAMP (Home Affordable Modification Program) department within the Department of the Treasury. It is possible and probable to get a case opened in the HAMP department. If you get a case opened, a representative will be assigned to your case who will review some history of how BofA has handled/mishandled your modification. They will listen to your story and also request very specific and detailed electronic data from BofA. They were the only helpful agency in my three years of dealing with BofA.

Hoping the best for you.

line of credit

Bank of America, years ago, allowed an unauthorized user to access my line of credit. Doing so pushed debt onto my personal finances that did not belong their, and that I was unaware of. There were plans for use of the line, which also became unavailable. The person who was allowed to do this did not even put my name on the slip. The fraud was blatant.

When I first notified Bank of America about it, they sent me out some paperwork to fill out and return. I did so. The fraud department then gave me the run-around for a long time. After this, they started saying it was too late to make a claim, and that the fact that I paid on the account (to protect my credit score) was acceptance of the debt as my own. They refuse to work with me, in ANY measure, on this issue. I have made many attempts to mitigate the damage done, and have offered many potential resolutions.

The complaint has been investigated and resolved to the customer’s satisfaction.

As soon as you put money on your Line Of Credit. You agreed to the spending of your Line Of Credit Money. What you should have done, was call BOA when you first got your Line Of Credit statement that had the money used that you did not use.

$10,000 cashed in counterfeit check, no hold - boa transfers $10,000 from money market to cover their lost funds.

Concerning a joint account withe my daughter. Check was deposited in thee amount of $4, 900 at west lake park branch. Money was withdrawn in the amount of $4, 900 at the and olive banking center. Second check in amount of $4, 900 was deposited to same account at south lake union branch. Money was withdrawn in the amount of $4, 900 again at dexter horton branch. All transactions occurring on 6/29/12 in four different seattle branches within a matter of hours. Both checks were returned to bank as counterfeit. When funds were not available in joint savings account (Daughter/primary holder) bank of america transferred $9, 800.00 from my personal individual money market account to recoup lost funds on bank of americas behalf. Daughter was taken advantage of by predators in a scam to acquire funds. Used her to process deposits and withdrawls of fraudulent checks. I am told I am a "platinum privilege customer" with a good relationship with the bank and given special treatment. Ie: no hold is put on any checks deposited in my accounts linked to my name. All these transactions were made by my daughter on her account, my signature appears on none of these transactions. But because bank of america can go into teeir system and see theat I am a platinum premium customer, she was able to deposit and withdrawl fraudulent checks in thee amount of $9, 800 on tee same day. Suspicious activity was not noted by two separate tellers in two separate banks. I was not informed, notified, or called of such irregular activity. District manager of seattle states that because I am a platinum privilege customer the "right of offset" states money will be transferred from any of my accounts able to recoup the loss of money to bank of america. The joint account is not linked in the system to the money market as overdraft protection, but the money was transferred regardless.

My daughter is not a platinum client.. Yet boa honored her "special" privilege.. On my behalf ? No hold on a counterfeit check.. And $10, 000 in cash. . Don't you think you would clear a counterfeit check before you let $10, 000 cash walk out the door...

I do not want to be a platinum privilege client... I feel more like platinum robbed !

The complaint has been investigated and resolved to the customer’s satisfaction.

fraud by bank of america

I have been fighting Bank of America to get a modification on my home here in San Francisco. Bank of America stated that they did not have the rights to give me a modification, that the investors had that right. BofA gave me the information regarding the investor after I insisted for 4 months to find out who it was and was finally told it was The Bank of New York. I contacted them and they e-mail me informing me that BofA indeed have the right to give me a modification/sale/of this property for they are the servicers.

Bank of America is now saying they can’t cause Bank of New York is the trustees. They are going back and forth with me on this thing. I am trying to keep my home and Bank of America is giving me all types of fraudulent information regarding my property. I just need to know who actually own my property and how I can get to them to negotiate a modification. Bank of America refuse to give me this information. It is not the Bank of New York, they said BofA can do it. they have all rights.

unauthorized payments

I had attempted to pay our mortgage on the Bank of America website. I then got a message reading unable to process payment at this time and to try later. I then decided to just send a check in the mail. Well, the check was cashed and they also withdrew a payment from the web that then caused me to overdraft in my checking account which caused me to pay over $200 in overdraft fees. I then called Bank of America completely irate and told them they need to correct it. They deposited the online transaction back and decided to cash the check again. How is that possible? I am so disgusted with this bank and the horrible costumer service. Something really needs to be done. I cannot wait to get rid of them.

The complaint has been investigated and resolved to the customer’s satisfaction.

loan modification declined

Aug 2008, Our American dream became a reality when our then 2 year old and 3 year old ran into our new home as if it had always been theirs. Late 2008, Mother-in-law moves in, with living, dental & medical expenses. 2009…I get a 15% paycut. My work hours change by more than 3 hours – we get daycare for kids. 2010, contact B of A for a loan modification and it takes them 3 months just to send the papers. After a couple of months being on a trial period which brought our mortgage from $3300 down to $2500. Our CRM, Amy (that’s what their called : Customer “Relations” Managers) was never clear on what was happening. I spoke to her at least once every 2 weeks. She tells me after 3 months that i'm one month behind, but im paying my mortgage every month over the phone with you I stated. Later I find out that B of A cashed my mortgage check, decided it was a partial payment (which it was not – we were on a trial payment base) and reissued a check to me. Oh wait, I never received a check. My CRM (Amy) wants me to check if the check was cashed. She could not even tell me if the check that was issued by B of A was cashed?! She made me do it. When I called back to advise we never received or cashed a check she said she would escalate the issue…3 weeks later she tells us a new check is in the mail. At the end of the trail payment she was never clear about terms, so I declined the modification and requested a new CRM. Here comes Jerardo Beltran….another CRM who didn’t even bother to look at our file. He told me that I would not have to pay a balloon payment unless I sold the house. When I was signing papers it said $136, 000 due on Aug 2041. I called him back, he said a supervisor was just walking by and will check with him. He came back to the phone and said “oh im sorry but you do have to pay that upfront in 2041. I was shocked since I was speaking to an expert. My husband and I decided we would go ahead and sign. Sign and have everything notarized (another $100). Jerardo tells us that we are declined because we declined the 1st loan modification. Again I told him we didn’t sign due to not understanding terms.

In June 2012, there is a event held by Bank of America. I call in sick and drive 3 hours to Fresno, Ca. I am sent back home that evening to sign more papers. I call in sick again on Tuesday June 12 and drive the 3 hour drive and submit everything but they don’t like the copies of my bank statement (which were printed from their office they had at the hotel where the event was held. I drive around looking for my chase bank and paid more fees to get copies. I submitted them and was told I should hear back from them by 6pm that evening. They were so assuring that all would be ok, since they had 2 managers. I checked everything before they submitted it to the underwriters that were sitting right there working on loans. Never got a call. I called every number. I googled and it referred me back to Jerardo. He tells me on Friday June 15 that I was declined for modification due to being current.

This is over 2 ½ years of going back and forth with different reps, supervisors and managers. I never got a response or callback. I have left countless messages for the CRM's, apparently they love playing tag. I've emailed them, and my email "read" notifications show that they have been opened yet they

have never responded. Jerardo would not even provide me with a email address. You don’t have to be a brain surgeon to get their email address.

Its first and last name @bankofamerica.com

Spoke to Hope line and there was nothing they can do. She (Mercedes) checked my credit report and Bank of America listed me as 11 months late and I owe a balance of over $35, 000.

Wasn’t I told that they declined to modification due to being current? My credit score is currently 566 due to their errors and mixups. Anyone have any suggestions? Please help. This is what I get for trying to work with them.

Here are some of the people im sending this email to: jerardo.[protected]@bankofamerica.com; GERARDO.[protected]@BANKOFAMERICA.COM; BELTRAN.[protected]@BANKOFAMERICA.COM; BELTRAN.[protected]@BANKOFAMERICA.COM; anna.[protected]@bankofamerica.com; jorge.[protected]@bankofamerica.com; [protected]@bankofamerica.com; mailto:[protected]@foxnews.com; [protected]@hud.gov; [protected]@housingrights.com; mark.harnishfeger; [protected]@echofairhousing.org; [protected]@acornhousing.org; [protected]@nidonline.org; [protected]@aol.com; [protected]@unitycouncil.org; [protected]@hmpadmin.com; [protected]@acgov.org; [protected]@usdoj.gov; [protected]@nhssv.org; [protected]@kamalaharris.org

I have contacted the following since I planted my gripe - Yes! I got a lawyer!

ARAG® – A global provider of legal solutions

400 Locust Street, Suite 480

Des Moines, IA 50309

[protected]

Fax [protected]

[protected]@araggroup.com

Our Global Mission

Since inception more than 75 years ago, ARAG has focused on a single goal – to help people protect their rights and assets by making quality legal services affordable to all. ARAG empowers individuals to protect their families, finances and future by providing outstanding service and meaningful relief for everyday legal issues.

[protected]@bankofamerica.com

http://www.helpwithmybank.gov/complaints/index-file-a-bank-complaint.html

Have been contacted by the following

Ralph S.

Consumer Advisor

Consumer Action

Complaint ID#: 437204

Business Name: BANK OF AMERICA

BBB of the Tri-Counties

P.O. Box 129

Santa Barbara, CA 93102

[protected]

[protected]@santabarbara.bbb.org

santabarbara.bbb.org

Hilda T. Cohen

Dispute Resolution Specialist

BBB Complaint Department

[protected]@charlotte.bbb.org

7/3...

Unfair and Deceptive Trade Practices are when the homeowner alleges that

the foreclosing party acted in such a way to render the mortgage agreement

void. This defense is typically used against the bank/lender. Examples of this

behavior include misrepresenting terms and conditions to the homeowner

or not providing important disclosures to the borrowers before they took on

the loan.

GOVERNMENT SOURCES FOR HELP

Seeking knowledgeable mortgage help can often prevent the foreclosure

process from occurring at all. When seeking legal assistance, search for

attorneys who have experience with foreclosure defense and /or bankruptcy

and are licensed in the state in which you reside and where the mortgaged real

estate is located.

The U.S Department of Housing and Urban Development (HUD) also has

officially approved counselors available for free or low cost, at both the national

and state levels:

http://portal.hud.gov/hudportal/HUD?src=/topics/avoiding_foreclosure/

workingwigfgthlenders

Additional information on current government relief programs:

http://portal.hud.gov/hudportal/HUD?src=/topics/avoiding_foreclosure

The Federal Trade Commission also provides information on mortgage

relief scams:

http://www.ftc.gov/bcp/edu/pubs/consumer/credit/cre42.shtm

ARAGLegalCenter

UPDATES**************************************************

6/27 - Recieved call from Social Media Dept BofA. - 6/27

6/28 - New CRM left voicemail

6/29 - I left voicemail for CRM

6/30 - Received call from another new CRM - she said she was the new crm assigned to me (I think in place of Jerardo. I advised her that I've been contacted by escalation. Can you believe she called me on a Saturday!

7/1 - email from [protected]@santabarbara.bbb.org

This is to let you know that we have sent your complaint to the company for a response, which is the first step in our complaint resolution procedure. We will notify you of the company's response as soon as we receive it, but please allow at least 14 days to hear from us. In the meantime, if the company should contact you directly, please let us know.

Thank you for using the Better Business Bureau.

7/1 - Forwarded letter to

Customer Assistance Unit

Regional Administrator of National Banks

Comptroller of the Currency

1301 McKinney Street, Suite 3450

Houston, TX [protected]

7/2 - Received call from a different rep from Social Media Department. Bank of America called back and left a voicemail.

7/3 - Received voicemail from Theresa b. - CRM.

I called Danny B. & Joe K. back and advised that I've left several voicmails.

Better Business Bureau (www.bbbonline.org): Complain about businesses.

Consumer Action (www.consumer-action.org/helpdesk): Call [protected]) or

send a webmail for advice and referrals. Access free, multilingual brochures.

Consumer Financial Protection Bureau (CFPB) (www.consumerfinance.gov):

Submit complaints about credit cards and other financial services.

Federal Trade Commission (www.ftc.gov): Submit complaints about unfair or

deceptive business practices, fraud, scams, credit reports and collections abuse.

*******************Letter Disputing Credit Reporting Agency Report*********************

This document creates a letter disputing one or more items that appear on your credit report received from a credit reporting agency (CRA). After the CRA reinvestigates your dispute, you will get a response and an updated report from the CRA. Experian shows that I am 11 months late on my mortgage with Bank of America & I owe Bank of America $35, 000

Financial Industry Regulatory Authority (FINRA)

(www.finra.org/Investors/ProtectYourself/p118628): Submit complaints about an

investment or financial advisor or brokerage under FINRA’s mediation program.

Help With My Bank (OCC) (www.helpwithmybank.gov): Submit complaints about

national banks (with “national association” or “NA” in the name).

Legal Aid: Legal Services Corporation Directory (www.lsc.gov): Find legal assistance

for low-income individuals and families.

National Association of Attorneys Generals (AGs) (www.naag.org): Find your

state AG’s office to make a complaint of fraud or unfair business practices.

National Association for Community Mediation (www.nafcm.org): Find a local

mediation organization.

National Association of Consumer Advocates (www.naca.net): Search by location

and specialty to find a consumer attorney.

Securities and Exchange Commission (SEC) (www.sec.gov): Submit investment

related complaints.

Consumer Action Handbook (www.usa.gov/topics/consumer.shtml): Get this free

resource for helping you complain effectively

Complaint Submitted

Thank you for contacting the FTC. Your complaint has been entered into Consumer Sentinel, a secure online database available to thousands of civil and criminal law enforcement agencies worldwide. Your reference number is:3x4x9x9x

cc as of 7/3/2012:

dan.b.[protected]@bankofamerica.com; crystal.[protected]@bankofamerica.com; michael.[protected]@bankofamerica.com; brandie.[protected]@bankofamerica.com; pamela.[protected]@bankofamerica.com; natalia.[protected]@bankofamerica.com; jimmy.[protected]@bankofamerica.com; deborah3.[protected]@bankofamerica.com; irene.[protected]@bankofamerica.com; yvonne.[protected]@bankofamerica.com; carlos.marcelo.[protected]@bankofamerica.com; zachery.[protected]@bankofamerica.com; sandra.[protected]@bankofamerica.com; [protected]@bankofamerica.com; kim.[protected]@bankofamerica.com; brian.t.[protected]@bankofamerica.com; shaun.[protected]@bankofamerica.com; loretta.[protected]@bankofamerica.com; ken.[protected]@bankofamerica.com; jacquelyn.[protected]@bankofamerica.com; matthew.j.[protected]@bankofamerica.com; daniel.[protected]@bankofamerica.com; minerva.[protected]@bankofamerica.com; jeremy.[protected]@bankofamerica.com; shaun.[protected]@bankofamerica.com; irene.[protected]@bankofamerica.com; deborah3.[protected]@bankofamerica.com

ADDITIONAL INFO FROM 2011.******************************************

Date: Mon, 10 Jan 2011 17:30:52 -0500

Subject: GreenPath Debt Solutions - Budget Summary from GreenPath

To: gia.[protected]@gmail.com, nita.[protected]@gmail.com

It was a pleasure speaking with you today. Attached is a summary of the conversation we had in addition to a summary of your budget.

Please contact us at [protected] if you need additional information or assistance.

Sincerely,

GreenPath Debt Solutions

An affiliate of the Homeownership Preservation Foundation

The attachment is in Adobe Acrobat format. Many computers will recognize this format and open it automatically when you click on the document. If you do not have this software, you can download a free copy by going to the following internet address:

If you continue to have problems, please contact GreenPath Debt Solutions Customer Care at [protected].

On Sat, Mar 12, 2011 at 5:16 PM, NITA Sandhu ; nita.sandhu682gmail.com wrote:

>>

>> Hello Elizabeth,

>>

>> Thank you for your assistance. Since we spoke...we did recieve the loan modification papers from

>> Bank of America. We sent them end of January and after many attempts found out that they had

>> recieved our paperwork. Meanwhile we also recieved a letter from Bank of America that we

>> needed to provide additional paperwork. Again after many attempts i came to know that

>> the name of our case worker is Christian at [protected]. He advised he is our negotiater.

>> He also said that our paperwork had been recieved in early Feb. and it was forwarded to

>> the underwriter. I have heard many stories of denial...our financial sitution is getting worse.

>> My friend said she submitted her paperwork 3 times and it took over 2years...she had

>> submitted exactly the same paperwork all three times. I want to make sure they

>> take us seriously. Can you please advise on the next steps or schedule a

>> conference call with Christian?

>>

>> Thank you in advance

>> Nita Sahota

>>

>> On Sat, Mar 12, 2011 at 10:30 AM, wrote:

>>>

>>> GreenPath is committed to helping you achieve your financial goals!

>>>

>>> Please review the attached document. If you have any questions, please let us know.

>>>

>>> Kind Regards,

>>>

>>> GreenPath Debt Solutions

>>>

>>> The attachment is in Adobe Acrobat format. Many computers will recognize this format and open it automatically when you click on the document. If you do not have this software, you can download a free copy by going to the following internet address:

*****************************************THIS IS FROM A TV NEWS STATION ********************************

On Friday, January 7, 2011, NITA Sandhu wrote:

>> Hello

>>

>> I would greatly appreciate if you could assist me in this issue.

>> We have been trying to get our loan modification thru Bank of America since sept. Each time i call they say a packet will be sent out..which has never arrived. i have now been told to wait till mid jan for a package. Today i had to take the last $1000 from a cd account and put it into my checking to pay off bills. I have been on short term disability since sept. our current interest rate is %5 and our payments are $3200.00. we also have an additional family member that has permanently moved in with us. she has no insurance so her medical bills have to be paid in cash...we have worked very hard to keep our credit in good standing...any assistance would be greatly appreciated. I dont understand why Bank of America cant even send out a packet...please help us keep our home...we have already lost much time in going back and forth with the bank..

>> thank you in advance for your much needed assistance.

>> nita s

>>

>> On Fri, Jan 7, 2011 at 10:11 AM, ABC7 7 ON YOUR SIDE wrote:

>>>

>>> Dear ABC7 Viewer,

>>>

>>> Thank you for contacting 7 On Your Side at ABC7 News in the San

>>> Francisco Bay Area. We appreciate you taking the time to share your

>>> experience with us. Because we read and respond to each and every

>>> email, it may take a couple of days for us to research and get back to

>>> you. If we can assist you with your consumer complaint it may take up

>>> to three weeks. We appreciate your patience and will reply to you as

>>> quickly as possible.

>>>

>>>

>>> If you have written to us from outside the Bay Area, you should

>>> contact the 7 On Your Side team in your area for assistance. We have

>>> included a list of other stations with consumer teams which may be

>>> able to help.

>>>

>>>

>>> Thanks again for writing and for watching ABC7 News and 7 On Your Side.

>>>

>>>

>>> 7 ON YOUR SIDE STATIONS OUTSIDE THE SAN FRANCISCO BAY AREA:

>>>

>>>

>>> ARKANSAS

>>> Monday-Thursday 10am-12pm

>>> [protected]

>>> [protected]@katv.com

>>>

>>>

>>>

>>>

>>>

>>> CHICAGO

>>> http://abclocal.go.com/wls/news/wls_contactform.html

>>> http://abclocal.go.com/wls/news/iteam/IT_contactform.html

>>> 312-750-7news

>>> Abc I Team

>>> 190 North State Street

>>> Chicago, IL 60601

>>>

>>>

>>>

>>>

>>>

>>> DETROIT - WXYZ

>>> [protected]

>>> http://web.wxyz.com/forms/call-for-action-send.html

>>>

>>>

>>>

>>>

>>>

>>> EVANSTON, ILLINOIS – WTVW

>>> [protected]@wtvw.com

>>> Phone: [protected] x 700

>>> Mail: 7 On Your Side Investigator

>>> 477 Carpenter Street

>>> Evansville, IN 47708

>>>

>>>

>>>

>>>

>>>

>>> LOS ANGELES

>>> KABC – Does not have a “7 On Your Side” consumer team, but do have a

>>> consumer reporter -- Ric Romero)

>>> ABC7 Broadcast Center

>>> 500 Circle Seven Drive

>>> Glendale, CA 91201

>>> (818) 863.7777

>>> http://www.abclocal.go.com/kabc/story?section=stationinfo&id=1642694

>>>

>>>

>>>

>>>

>>>

>>> NEW YORK - WABC

>>> http://abclocal.go.com/wabc/features/WABC_7side_emailform2.html

>>> [protected]

>>>

>>>

>>>

>>> VIRGINIA

>>> WJLA – 7 On Your Side

>>> 1100 Wilson Blvd.

>>> Arlington, VA 22209

>>> [protected] or [protected]

>>

>>>

7/5 ******************************************

received a call from another CRM advising she was from the offices of CEO & President. (nicole)

after speaking to her for more than an hour...I called back and left vm for Casey, Joe K & Danny B -

what is happening, who really is my contact, what steps do i need to take now?

The call from Nicole sounded like we were starting all over on a loan modification. I asked if my credit was going to be fixed and late fees will be refunded and if they are gong to go back and give me the loan mod from the first time i filed for a loan mod. since the bank had misrepresented so much info to me. She will check on it... advised i will rcve a call on monday morning, 7/9.

The complaint has been investigated and resolved to the customer’s satisfaction.

cancelled credit card and ruined my credit rating

I have had 3 checking accounts and a credit card at B of A for years. I have had 2 of the bank accounts on electronic statements, and at their constant online prompting, clicked to have the 3rd bank account converted to electronic statements - which go to an email account I don't check often. Without my knowledge or awareness, they also suppressed my printed credit card statements. I pay all my bills off my statements, so I didn't notice that I hadn't gotten statements from them in a couple of months. I got a notice from a different credit card company that they were lowing my credit limit due to a delinquency from B of A. I called B of A customer service and they said I had an overdue balance - even though I hadn't received any telephone or written notifications. I immediately paid the outstanding balance including the late fees. And then when I called in to reinstate the card, they advised me that my card was closed for delinquency, it had been noted on my credit reports, and my request to open a new account was denied. All this while I have on average over $5, 000 in deposits on my accounts! I asked them to send in a retraction to the credit bureaus and they said it was too late - they couldn't change the delinquency and closed account notices. As a result, it has seriously damaged my credit rating which I maintain with great zeal! There needs to be a way to prevent this from happening - such as a written and phone notification before closing accounts and destroying credit when online notification systems go awry. I have appealed to several B of A representatives on the phone and gotten nowhere. I am now preparing to close all my B of A accounts and move them to a more responsive bank - after more than 20 years as a customer.

The complaint has been investigated and resolved to the customer’s satisfaction.

lol Nonnie

The Lidman Foundation, LOL thats not good. I would go with the 2 cent troll

gatortracks is a my3cents troll

Once AGAIN gatortracks! Everyone is not as fortunate as you!

So you asked for email statements knowing you do not check your email and it is somehow their fault you did not pay your bills?

Bank of America Reviews 0

If you represent Bank of America, take charge of your business profile by claiming it and stay informed about any new reviews or complaints submitted.

About Bank of America

One of the key strengths of Bank of America is its commitment to innovation and technology. The bank has invested heavily in digital platforms and mobile banking, making it easier than ever for customers to manage their finances on the go. With features like mobile check deposit, online bill pay, and real-time account alerts, Bank of America is at the forefront of the digital banking revolution.

In addition to its digital offerings, Bank of America also has a strong network of physical branches and ATMs. With thousands of locations across the country, customers can easily access their accounts and get help from knowledgeable staff members whenever they need it.

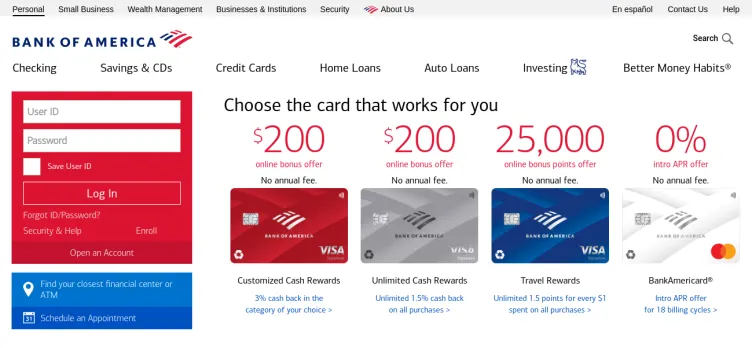

Another key advantage of Bank of America is its wide range of financial products and services. From checking and savings accounts to credit cards, loans, and investment products, the bank offers something for everyone. Whether you're looking to save for the future, buy a home, or invest in the stock market, Bank of America has the tools and resources you need to achieve your financial goals.

Overall, Bank of America is a trusted and reliable financial institution that has been serving customers for over a century. With its commitment to innovation, technology, and customer service, the bank is well-positioned to continue to meet the evolving needs of its customers for many years to come.

1. Log in or create an account: Ensure you are logged in to your ComplaintsBoard.com account to proceed. If you do not have an account, please register by providing the necessary information and verifying your email address.

2. Navigating to the complaint form: Once logged in, locate the 'File a Complaint' button situated at the top right corner of the website and click on it to access the complaint form.

3. Writing the title: In the 'Complaint Title' field, concisely summarize the main issue you have encountered with Bank of America. Make it specific and clear, such as "Unauthorized Overdraft Fees" or "Difficulty with Mortgage Loan Modification".

4. Detailing the experience: In the complaint description, provide a detailed account of your experience. Include key areas such as customer service interactions, problems with account management, loan servicing, fees or charges that were unexpected, issues with online banking, or any other specific incidents related to Bank of America. Clearly describe the nature of the issue, including dates, locations, and any relevant transaction details. If you attempted to resolve the issue, outline the steps you took and the responses received from Bank of America. Explain how this issue has personally affected you, such as financial loss or stress.

5. Attaching supporting documents: Attach any relevant documents that support your complaint, such as correspondence, statements, or receipts. Be cautious not to include sensitive personal information like your social security number or full account numbers.

6. Filling optional fields: Use the 'Claimed Loss' field to quantify any financial losses you have incurred due to the issue. In the 'Desired Outcome' field, describe what resolution you are seeking from Bank of America, whether it be a refund, apology, or corrective action.

7. Review before submission: Carefully review your complaint for clarity, accuracy, and completeness. Ensure that all the information provided is true to your knowledge and that your desired outcome is reasonable and clearly stated.

8. Submission process: After reviewing your complaint, click on the 'Submit' button to officially file your complaint on ComplaintsBoard.com.

9. Post-Submission Actions: Keep an eye on your ComplaintsBoard.com account for any responses or updates regarding your complaint. Be prepared to engage in further communication if necessary to resolve your issue with Bank of America.

Overview of Bank of America complaint handling

-

Bank of America Contacts

-

Bank of America phone numbers+1 (800) 432-1000+1 (800) 432-1000Click up if you have successfully reached Bank of America by calling +1 (800) 432-1000 phone number 8 8 users reported that they have successfully reached Bank of America by calling +1 (800) 432-1000 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number 3 3 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number45%Confidence scoreEnglish+1 (800) 688-6086+1 (800) 688-6086Click up if you have successfully reached Bank of America by calling +1 (800) 688-6086 phone number 16 16 users reported that they have successfully reached Bank of America by calling +1 (800) 688-6086 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number 1 1 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number88%Confidence scoreSpanish+1 (315) 724-4022+1 (315) 724-4022Click up if you have successfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (315) 724-4022 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone numberInternational+1 (757) 677-4701+1 (757) 677-4701Click up if you have successfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (757) 677-4701 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone numberCredit Card Issues+1 (800) 214-6084+1 (800) 214-6084Click up if you have successfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (800) 214-6084 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone numberVice President Bank+1 (312) 992-6618+1 (312) 992-6618Click up if you have successfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (312) 992-6618 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number

-

Bank of America emailssupport@bankofamerica.com100%Confidence score: 100%Support

-

Bank of America address100 N Tryon St., Charlotte, New York, 28255, United States

-

Bank of America social media

-

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreNov 09, 2024

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreNov 09, 2024

Most discussed complaints

pmi remove problemRecent comments about Bank of America company

ATM security firm illegal in nycOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.