Bank of America’s earns a 4.0-star rating from 4575 reviews, showing that the majority of banking clients are very satisfied with financial services.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

closing documents

Hello, if anyone is listing or looking to sell a home and has a Countrywide Home Loans mortgage (now Bank of America) your sale may be in jeopardy, even if there are no issues with your contract or buyer.

The reason is that the ownership documentation required to close is borderline impossible to obtain from them. We have had a signed conract from an approved buyer and Countrywide is unable to find our stock certificate, proprietary lease, or lien. From what our lawyer said, this is commonplace as they have been a complete disaster since the acquisition.

The typical timeframe from doc request (at the time you sign a contract) is 6-8 weeks and then schedule a closing. If your buyer gets antsy, they can submit a 30 day notice and walk away. We are at that stage given it has been 11 weeks since we requested our documents with no indication from anyone at BofA as to when we should expect them.

Just think, the entire hard part is done (listing, price negotiation, selling, and buyer approval) to have bank that either:

1) Cant find your documents needed to close

2) doesnt care to find your docs

Our lawyer says that we can sue them for our mortgage if we lose our buyer which looks like it will happen. thats exactly what i wanted to do- spend my next few months in a lawsuit.

No wonder some people just wak away, this is just a heads up for anyone else in our situation as we have called into the highest levels of BofA and nobody there cares.

The complaint has been investigated and resolved to the customer’s satisfaction.

Telemarketing

I am frequently being interupped by phone telemarketers attempting to sell me Insurance to protect my identity. I have always asked them to stop calling and if I was interested I would not buy from a phone telemarketer. Today on SATURDAY morning I received another one of these calls. I have never been interupted on Saturday and was infuriated by this action. Please take my name off the list for telemarketers only call if my card has been comprimized.

Paula L. Hueber

The complaint has been investigated and resolved to the customer’s satisfaction.

Your complaint isn't going to reach FIA. I believe that as long as you have their card, they can call you. A friend of mine receives a similar call every day from her credit card company. Initiating a call and being nice may get you further than being "infuriated". Remember, you attract more flies with honey than vinegar ;]

modify loan

I been tried to remodify my loan with Country Wide/BOA for more than a year now and every time I called in they would tell me to call back in 2 to 3 months and all they would said was at the time " you're current and we cant help you". Alot of BOA employees in modify or retention dept. are very rude. Untill now I have not recieved my package like they said I would recieve in 45days. I had to waited for at least 30min and been transfer at least 3 times before I can get someone to talk to me about my loan. With the goverment loan and offer and had funded the Banks they're sure not in the hurry to help the people that try to keep up with their payments all these years and on time. I wish the goverment would do something more effectively for the Banks to do what they suppose to do with the goverment funds.

The complaint has been investigated and resolved to the customer’s satisfaction.

Since June of 2010 I have been in touch with BOA (my original loan was with Countrywide). They have NEVER contacted me, though I have called them at least 1x per week since June. August 7, 2010 I faxed paperwork required to BOA CEO line. Sept 19, 2010 I was finally contected with Loan Negoitatoer's Manager (Dandella Harris, negotiator is Rashimi Kumar) who told me that they had fedexed paperwork to me, but I had called several times and they showed that the paperwork was scheduled to go out but never did. When I spoke with a manager, I was told that it would take 6-8 months to get approved and that this would not stop foreclosure. I have been making payments as I could, payments have been partial to cover principal, insurance and taxes. I am on SSDI (and am scheduled to be re-evaluated in 2011. I receive $1655 per month. My mortgage was $980 and has gone up to $1020 because taxes went up. Yesterday I got a notice of intent to accelerate mortgage and they gave me until 10/20/2010 to pay $1750 or I would be indefault and accelerated payment in full would be due at that time. I payment was not received foreclosure proceedings would start (they also said that they would visit the property to see if I (or anyone)was living at address and if there were any damages, etc...). I have a ton of medical bills that have gone unpaid because I tried to make mortgage payment. This is a FHA loan at 7% interest.

I have done everything I can to not get to this point to no avail.

USMCNJ same thing with me. Loan balance went up $5000 so new mortage amount was $960. Interesting though, said I would not have to make any payments until Feb, but they accelerated interest and late fees. They told me I needed to earn more money, Duh, if that were to happen would not need loan mod, BUT, I am on SSDI and am not allowed to work. Filing a complaint with USADA (US Americans with Disabilites Act.)

The banks took the our money... not the govt's money and used it for investments and bonuses... not to reinvest it in us...

I to, was a victim of 6 months...

They denied me the 1st time (3months), then called me and said my case was going to reopen (another 3 months)... At the end of it, I had to pay back the rears I owed from the trial payment balances. $4000... and I received an intention of forclosure.

But here is the kicker, in order for them to start forclosure you have to be 3 months behind. I was only 2. So its no wonder why they are under investigation for forclosure fraud. The banks are not here to help, they are only in business to loan.

They have 1 excuse after another. I have only been making partial payments and even though have been trying to do the loan modification for the 2nd time faxed over reuired paperwork (1st time in August and again Sept. 19) have just been told that this will not stop foreclosure proceedings. Credit is totally ruined, am on SSDI so a $1020 payment is not possible

I too have contacted CEO office and they did connect me with people (sometimes though I was on hold for 20+minutes). But have been waiting for anykind of communication since June of 2010

I just got a mod through BOA...for the first 6 months I did the same as you...got nowhere, I complained to the office of the president and got results fast...I can get the info if you want. email me...ksriff99@gmail.com

employment offer

Here is a good one. I was laid off from my last job due to a corporate restructuring. So I had to file for unemployment. I applied to a job with B of A and went through 4 telephone interviews and a face to face interview and was offered the job. They sent me an offer letter, set a start date, and setup payroll and benefits. During my background check they saw that I once in the past worked for Countrywide and that someone had put in my employment file that I "was not elgible for rehire". Seeing that I left Countrywide on my own for a position with a better company I sent B of A a copy of my letter of resigination and a copy of my exit interview, which stated that it was a mutual split. The recruiter said this should clear it up and he would get back to me. After a month of calling and e-mailing I got no response. Finally I heard back from the recruiter that they decided to go with an internal candidate and that they were withdrawing my offer for employment. What sucked was that since I accepted a job I had to report this to the state and my unemployment benefits were stopped. I asked B of A to send me a letter stating that the offer was withdrawn so I could get my benefits reinstated and they refused. What was ironic is that since I did not get the job, and could not get my benefits back I had to default on my credit card debt that was with B of A. Great business practice they have, offering a job to someone who is on unemployment, then withdrawing it, causing them to default on debt owed to the same company that withdrew a job offer because I worked for a defunct Mortgage company prior to them acquiring them. I hope this sheads some light on the type of corporation this is and how we are wasting our tax dollars helping them screw the working class.

The complaint has been investigated and resolved to the customer’s satisfaction.

cancel of credit card used for overdraft protection

I had a mastercard account for over 30 years that was tied in with my checking account for overdraft protection. Bofa cancelled this card without my knowledge. On 1/14/2010 they cashed a check that did not have the funds to cover. Bofa charged me $35.00 overdraft fees. On 1/22/2010 they charged me another $35.00 extended overdraft fee. A total of $70.00 has been taken from me. This is unjust as had they not cancelled my card overdraft protection would have taken place at a lesser fee. Why is bofa allowed to cash checks that do not have the necessary funds then charge for doing so

The complaint has been investigated and resolved to the customer’s satisfaction.

loan acellerator

My loan was transferred to Bank of America when it acquired Countrywide. I signed up for a payment plan whereas I am paying each week of the year and along with the posting on a weekly basis I would gain a total of about 9 years. When I reviewed my statement on line I saw that even tough I am still paying weekly the posting is now done monthly. Not once was I ever told by letter of this change due to the fact that BOA system does not post weekly but monthly, so of course it took me 34 minutes on the phone to make them tell me that, and that nothing they can help me with. I feel ripped off especially since I was not given the choice to change to another lender and the fact that no letter went out spelling out this change. I am wondering if this is ground for a class action lawsuit as I am sure many americans are in the same situation. The money sits in a non bearing money account and they want me to believe that they are not using my and others schmokes like me accross the country and play with it for a month before it is posted! I would love to hear feedback if this web site offers it

The complaint has been investigated and resolved to the customer’s satisfaction.

I have my mortgage at Bank Of America. I made two payments in April. One payment was for April's payment, the other was for May. Bank of America applied my May payment to principle. I log in June 1st to make my payment, I could not make my payment because they are asking for a minimum of two payments. They are also showing me 30+ days late. I've been calling Bank Of America to correct this for the past two weeks, they keep telling me it will be corrected in 2 to 3 business days. Its been 3 weeks. Meanwhile, I am being reported as 30+ days late on my credit report. On the 15th of this month they are going to add another late fee. Its bad enough that I have been unemployed for over a year and I am doing what I can to keep current on my mortgage. AND.. I have a potential employer doing a background and credit check on me. I CAN'T have my mortgage showing late right now under any circumstance. I can't believe they jerk people around like this.

I was notified last night that I was late for my Oct. payment. I went into my personal checking to determine if a check was processed, and sure enough- it showed that it cleared before its due date so I called BOA that night and told them my situation. A lady on there told me that it will contact credit report agency by 6 pm today if they don't receive my fax. I had to call back today to see if they got the fax since I don't trust them to do anything right. Another person said that it takes 24-48 hours for a fax to get through which is stupid. It was their error that they screwed this up and could not help me to resolve this quickly. I spent so many hours and time to clean up their mistake and still have no assurances that they will fix this issue especially with the credit report agency. BOA always has poor service but it has gone beyond that. I couldn't get a direct answer who to call specifically rather than get this roundabout over and over again.

When my sister died in March, 2017, Bank of America mortgage called and asked to speak to her. I told them that she had passed away. I was trying to make funeral arrangements. Bank of America called again. I asked Bank of America to give me some time to sort through her financial documents. Bank of America called again. And again. I did everything in my power to stop the phone calls, but Bank of America kept calling, asking to speak to her. Bank of America continued to call and reduced me to tears because I had to explain to them at least a dozen times that she could not come to the phone because she was dead. There was nothing I could do to convince them that she was dead, and they should stop calling. Clearly, there was no internal communication within Bank of America, and absolutely no concern for the fact that she had died and her family was grieving. Now, they refuse to talk to me, as I am trying to retire the mortgage and terminate our business with Bank of America.

J & Th!sman - Don't worry about Turd-thats-stupid. He's a bitter troller that goes around only leaving negtive comments because either mommy didn't love him or some other pathetic self-loathing reason. Look at his profile history! Pathetic. Sad really. Someone need a hug Turd?

If a bank won't deal with you with honesty and with a logical presentation of the options they are offering, then how is a person supposed to make decisions about what to do? Well, I think they don't want us to be able to figure it out. They don't want to help us that is for sure. They don't want to forgive excessive fees and they don't want to extend the time of the loan. They don't want you to succeed. They don't care if you can't make payments that are more than 50% of your income and they don't care if you have a chronic illness that requires a lot of expense for treatment. They just don't care about anything but money - theirs. To hell with normal, everyday folk who want to work out a real plan to pay back what they owe. They push us into bankruptcy or having the house sold right out from under us. Greedy, lousy excuse for a business.

I used to work for Bank of America in the mortgage operations department and let me tell you that you are by far not the first person this has happened to. I was disgusted on a daily basis at how horribly run the entire company is. I am honestly shocked that they are still in business. It only got worse after they bought Countrywide. They started making overtime MANDATORY at 8-16 hours per week and having mandatory Saturdays. What was funny to me is that... here is this company who already sucks at doing mortgages... Bank of America legacy (as they call it internally, referring to the original BOA prior to Countrywide merger) who already sucks at gaining market share. They can't seem to figure out why though so they just keep buying up other lenders and making them adapt to the "Bank of America way", which sucks to begin with. So they brag about their expansion although they did NOTHING to earn it except rape people in fees on their banking side so they would have enough money to keep buying out competitors. NOW here comes along their biggest competitor, COUNTRYWIDE in all kinds of financial ruins. Where as most logical minded folks would RUN from this sinking Titanic, BOA decided... LET'S BUY THIS HUNK OF CRAP! Then, as if they couldn't get any dumber, they retain MOST of the same upper management IDIOTS who drove Countrywide into the ground! I worked there for 3 years and to be honest I truly can't understand how they are still in business. The majority of their management structure is people who have NO mortgage background to begin with. As a mortgage professional for the past 9 years I can honestly say I love this business because it can truly be amazing when you deliver great products to great people and help them accomplish the America dream of home ownership. Unfortunately BOA has found the way to suck any possible joy out of this process in an effort to just close more and more loans... faster, cheaper more. That should be their company motto "faster cheaper more". Their sales force or "Loan officers" are ABSOLUTE idiots. They are mostly literate but not all of them. Honestly your BOA sales rep probably knows about as much about mortgages as you do as a first time applicant. They provide them no real training except how to take an application and to shove it into the system. I never once had a single loan officer ask me if I thought the applicants could actually afford the house they were buying. It was only just "how can we make this loan work?" Not that I can blame them because their income was largely based on how many loans they got shoved into the system, not how many of them actually closed or continues making their payments. Internally of course they used to "claim" that customer service was a high priority. Oddly enough 100% of our bonus was based on production and low QA errors so that the loans would be sellable on the secondary market. They tried to base it on customer service for a short period of time once however that didn't work out because literally NO ONE could hit the meager goal. That doesn't mean the employees were bad... it means the company isn't willing to slow their process down enough to allow people to do their jobs completely in order to actually satisfy the customer. They honestly just refuse to accept the reality that the faster you work, the more quality suffers. I tried pointing this out to my site leader once and she told me "we have to have both". As if she could redefine the laws of nature (that going faster leads to sloppier work) just by refusing to accept reality. It was absolutely maddening. I profusely sympathize with any non mangement level employee at BOA because we were all like battered wives and/or sweat shop laborers. I've been gone for over a year and I'm still on anti depressants. I worked there last year when they announced to all of us that because of the economic climate, they were not doing annual raises. I found that HILARIOUS since they suddenly found the money to repay their TARP funds and to pay Ken Lewis a couple million dollars. So here we were, the people on the bottom rung, holding that [censored]hole together, working "mandatory overtime" so they could cut our pay and still repay the government just in time for upper management to get nice fat bonuses. Even when I worked there I secretly wishes that the government would let them and all these other big banks just fail because they TRULY deserved it. Bank of America should have gone down in smoke with all of the other big banks and created an opportunity for the little man and local banks to make a come back. The political scare tactic worked though because they made everyone think there would have been another great depression. Little did anyone mention that the great depression was also sparked by severe droughts, hunger and disease which is what helped cripple the stock market which was much more heavily based on agriculture then. Long story short as long as there are still credit worthy people in the world and still some folks who have money, there will be lending. It just wouldn't be this HUGE "big box" model of lending we are so used to today where the end user "customer" means absolutely nothing. One thing I have learned from working at BOA is that the employees and customers mean nothing. The shareholders are the only ones with a voice and their voice is always the same... MORE PROFIT, LESS COST. Whatever happened to slow steady growth by delivering a quality product and earning repeat business? I guess that is just too slow for CEO's who want to make 30 million dollars a year and retire by the age of 50 as millionaires. For the life of me I can't figure out WHO in this entire country is worth paying more than the president of the United States. That may sound silly but honestly, what could one person possibly do to justify making millions and millions of dollars a year? Unless you have cured cancer or AIDS, or have single handidly rescued some third world country, there is NOTHING you could possibly do to be worth that much money. It is just pure old evil greed. The sad thing is that even if it would be possible for one person to create some type of cure for some type of disease, the drug companies would quickly buy they up and patent it for themselves anyways. I truly believe in capitalism however I also think the only way it can work is to allow it to fail when people get too greedy and unfortunately, we didn't let that happen. Now most of the people who have gotten rich based mostly on circumstance, can keep their money and keep sucking it from those of us who actually add value to society. We little people have to quit taking loans from these pigs and start becoming cash based like people used to be if we want to suffocate these greedy ###. I am almost 30 years old and have now paid off all of my debt except for my mortgage (which is now my #1 priority over the next 8 years) and once that is done I will never take another loan from these big companies again. If I can't buy something in cash I can't afford it and don't need it. I want my money to stay where it belongs... with ME! I went WAY off topic from your original compaint but short story made VERY long, I couldn't agree with you more.

Awful, awful, awful

I lost my job, and fell behind on my mortgage. I sent them $3415 via Western Union, to catch it up to current. Western Union has verified that the payment was received by Countrywide the next morning, but Countrywide denies ever receiving it. They now want me to send MORE money, almost $4600, or they are going to start foreclosure.

They refuse any proof from me that it was received (I have a letter from Western Union), and demand another payment. I have found cases on line where they do this all the time.

I filed a complaint with my state Attorney General, as well as the Commissioner of Banking. And if they try to sell my house at sherrif's sale, I am going to sue them. Look up this case - McPherson -v- Countrywide Home Loans. He is suing them for this very same thing.

The complaint has been investigated and resolved to the customer’s satisfaction.

Dirty Management

Listen up, I used to work at this company in Georgia. I know for a fact that the management in FIA Card Services is a bunch of lying and dirty crooks! I was told by MANY managers in the Ga office to set-up payments from customer's accounts, I also saw many employees just set-up payments without talking to customers. I am not sure what to do about them, My wife had a credit card with BofA (which is the parent compay of FIA) and they uped the interest rate to over 24% for no reason. We were never let on a payment and there was no promo for that card. We transfered the balance off that card and opened a credit card with my new bank and havnen't had any problems since. I wish I could tell the proper people about what goes on in that compay but I guess this will have to be my bullhorn.

The complaint has been investigated and resolved to the customer’s satisfaction.

will not assist their mortgage customers

We originally remortaged with countrywide who placed us into one of the now imfamous "unstable mortgages" that we will have a hard time maintaining as time goes on. Many have already lost their homes because of them. Bank of america took over our loan when they purchased countrywide last year. We are in a home mortgage situation where we now actually owe more then we originally mortgaged for from countrywide due to the type of mortgage we were offered. We did not realize at the time that this would be the situation and we signed papers without really understanding the consequences. We have been able to pay our mortgage payments thus far but we need to get into a more stable mortgage. When we call bank of america they do not want to assist us because we are not behind on our house payments.In other words, we have to be heading into forclosure before they will even discuss helping us. They want to make sure your credit and everything is ruined first, I guess. They claim they don't have to help us because they did not get any federal assistance to do so, which we know is a lie. This is a very corrupt bank that does not really care about anyone but themselves!

I guess, we will have no choice but to give them back a house that is worth a whole lot less then what it was purchased for, when we are willing to try to work out something with them to continue to pay them on a reasonable mortgage modification. Anyone else have this problem with bank of america? I see they were involved in a class action last year that involved people in the same situation as us who lost their homes. Why do you have to lose your home and everything in order to get help? My son is also with bank of america and after two years of trying to get them to help him he finally put the house up for a "short sale". Now they both lose! What kind of idiots are running this bank? Would it make sense to try to help people out and keep them in their home rather then be taking in all the homes that are getting forclosed on? Or instead of accepting short sales, allow people to stay in their homes for a decreased mortgage amount? Whats the difference?! Most people who are selling by short sale don't really want to move - they just can't afford the higher mortgage payment anymore! This is a very uncaring bank!

The complaint has been investigated and resolved to the customer’s satisfaction.

If you are trying to do a loan modification with Bank of AMerica prepare to spend at least 12 months and still not even have an answer yeah or neah. They are absolutely one of the worst banks to work with. They have so many 3rd party groups working for them that they don't know what each other is doing. You will either wait 6 months to finally have a package mailed to you once you have been pre-qualified and then when you finally get a package then you will get 3 or four from different places. A lot of the people working there don't even know what they are doing. You can call in for a status update on your Modification process 4 times in the same day and get four different answers. Be prepared to fax in the same documents almost weekly because even though it is within the same bank they do not share docs within different departments. Good luck

I had a Country Wide loan, then B of A took over and then some. My new payment went up $400 a month and I now get several tax supplement bills for an extra $500-700, I HAVE AN IMPOUNDED ACCOUNT. For two years prior to this bank everything was fine. I camped out with NACA, with no luck on a modification in two cities, but funny enough, even the teenagers I spoke with at these events couldn't explain the mysterious new raised payments & extra taxes. And showed no interest in finding out or asking anyone within

B of A!

Oh yeah, watch out for the "Late Charge Pyramiding" it's illegal per FCC. THEY DO IT! If you don't understand it look it up.

Honestly I would balme any one for getting a refinance with a company that does "High Risk " loans just to get away those frigging Idioats at Bank of America!

Hoooray for you sock it to those jerk offs!

I think BOA sucks! I think they should shut them down, they harrass people, everythig the person wrote was true, I cannot the a company that is responsible for a persons home is allowed to conduct business in such a crude hateful way. This is horrible business and needs to be stopped! Bank of america needs to get knocked down in the dirt and never to get to the point it is at now! Obama should have never bailed out those ungracious Idiots, but just at who the Idiots are who elected him! I suppose these ingorant arstes that elected him wanted to feel what it was like to play "Deliverance" and really take up the kiester!

203k loan

I purchased a home on a 203k Streamline loan this loan was then purchased by BOA Home loans. i recieved the first half of the funds for the intial startup. on 10/18/09 i faxed in my letter of completion and it is now almost 4 months later and no one can tell me why my final check has not been sent. i have spoken to numerous reps as well as Kia the supervisor. I was on hold for 20 minutes and then they hung up on me, no one returns my calls. I am at my wits end with the terrible service. everyone i speak to says my check should have been mailed they can't figure out why it was not. yet to date nothing has been done to take care of this matter.

The complaint has been investigated and resolved to the customer’s satisfaction.

We used another bank for our 203k loan. Received our 1st disbursement @ closing. Money was set aside for the final disbursement @ attorney's office. We closed June 28, 2010 and our construction was completed by July 15th. Bank of America bought our home loan within that 1st two weeks. We had to wait 2 weeks for it to show up on their system. We faxed final documents and they say they never received them. We emailed them to a rep there that was kind enough to give me his email address. Then, they lined up an Inspector to go out and check the property. Two weeks later when we called they said they had to find another Inspector. This took another 2 weeks. We are now into mid-September and still no check. We have paid all of our contractors out of pocket to keep from being sued. When we called them as how to handle this, they said get a paid receipt. When we sent the receipt in on September 10th, you guessed it! that added another 7 to 10 business days to the final process because they have to review the file again.

I done business with Bank of America for 15 years and plan to move my business and personal accounts from them because of this.

If we ever get this loan completed we will probably look for refinancing elsewhere.

Unfortunately, Bank of America is now buying up 80% of the loans on the market today (this was told to me by our loan officer).

I am fed up!

Run and run fast from these 203K loans especially by Bank of America. They have horrible communication and do not care whether the home owner is going to be sued or not due to lack of payment to the contractors. Inform your contractors that the process will at least be a few months after the work is done for the final payment to come. My contractors started at the beginning of May and done by the beginning of July. Took from my closing date at the of April until the beginning of June to get the initial dispursement after one contractor was already completed. Promised by supervisors 2 weeks ago that the checks would go out within a few days. And what do you know, nothing came. Then was even given tracking numbers for the final disbursements checks and again, nothing. They are now investigating the problem. I don't want it investigated. I want it done, completed and over with. I am to the point of being willing to eat closing costs again to go to another bank just to get the hell away from Bank of America.

I am a General Contractor that had the misfortune of getting involved with 4 of these 203K loans. All 4 came in at the same time or after the first one I would have never done another one. Everyone of them the first check was 90 days after closing, so here are people that per there contract they have to move in to there home but can not get supplies or materials to start. Then the worst part is after completing the work, invoicing, owner returning final forms and having the final inspection by the appraiser ALL for took another 90 days to get paid on. One of them a supplier filed a lien since they had not been paid due to Bank of America taking so long to pay. Since a lien was filed BofA would not release the final check to pay them because of the lien that had been filed for non payment. I can really start to make your head hurt. EVERYONE PLEASE WARN ALL FRIENDS AND FAMILY NOT TO GET INVOLVED IN A 203K LOAN!

There have been numerous complaints about "Bank Of America" on this website, and also on /link removed/ My friend has her townhouse mortgage from "Bank Of America", and she just refinanced her townhouse to get a lower interest rate. When she mentioned that her mortgage company was "Bank Of America", my heart sank. I hope that Deb realizes what kind of a company she's dealing with. Let the buyer beware!

Foreclosure in error

We have two home financed with Countrywide/BAC -- both have been paid electronically, on-time, for the life of the mortgage. The payments have the account number on the check.

Last September they started crediting both payments to one account, and nothing to the other account. I received a letter that we were about to be foreclosed, and two days later, a process server delivered the papers to my door. At the same time, I began receiving letters from people wanting to by my home, and attorneys wanting to represent me in my foreclosure.

I called BAC/Countrywide - they were snitty, but finally did look into the situation, and admitted the error of their commission.

The foreclosure sued me and my homeowners association, and has been posted in the local newspaper.

I have been humiliated and I'm furious.

They quickly discovered their error and say they will rectify this. I've sent them a certified letter, demanding they issue a retraction and letter, as well as a notarized letter to each of the three credit bureaus.

I'm told I will have to sue them to get them to rectify the situation - otherwise, if I should ever need my credit, I'm screwed. It will impact the rates I'm charged, if indeed I can even get credit.

The complaint has been investigated and resolved to the customer’s satisfaction.

I am having a similar problem, Just one house, but they started sending my payments to an account called "Other Unapplied", then in November the phone calls started. 3 or 4 a week, quite rude.

That made me start looking deeper, I have been prepaying my principle, and I see money being syphoned off. $60 In february, then another $40 in May, then $360 in October last year.

I will be filing a suit in about 10 days if its not all resolved

re-ordering of processing transactions

Used debit card for 4 small transactions over a period of several days. They appeared as pending. I tracked remaining funds but miscalculated by less than $6 when a check was presented for over $100. The transactions were rearranged, largest to smallest and posted on the same day. Of course the last transaction I did for $100 was posted first, creating 4 NSF charges. This snowballed as I deposited funds to cover these charges as others were being posted. My available funds couldn't keep up with the rearranging of all my transactions and additional fees piled on and in a period of 3 weeks, accrued $560 in NSF charges. Granted, I made an error one ONE transaction but does that justify rearranging the transactions to maximize their profits at the risk of my financial ruin? I researched and discovered this is a common practice of BOA as well as other large banks to maximize their profits. It is one of the many issues currently being looked at by our government but as we all know, any real changes or reform on Wall Street has been a long time coming and will not happen overnight. There is a committee formed by a legal firm looking into filing a class action suit against BOA for these practices. Log on to www.bank-overdraft.com and post your name and complaint. The more cases their are, the sooner we can proceed.

The complaint has been investigated and resolved to the customer’s satisfaction.

By the way, if anyone is interested, I am with Centennial Bank in Arkansas.

I am with a different bank, but they have just done the same thing to us, and it's outrageous! They took things from my account that had already actually posted (not pending) several days ago and rearranged them to look as though they hadn't posted yet, and then posted a $500 check that had just been cashed as if it happened before all the other transactions! They keep giving me the run around and telling me there is nothing they can do. They won't even look into it, or acknowledge the obvious mistakes I have tried to point out to them. This should be illegal and it sucks that we basically have no protection from this! Yet, you can't really get by wiothout having a checking account these days.

holding our mortgage payment

I would like to file a complaint against Bank of America. We have contacted them numerous times to apply payments that were made on our mortgage. We have over $5000 that is being held in suspense on a mortgage with an $861 monthly payment. This started when we opted to make weekly payments last year on our account. The payments were not applied correctly and we were charged late fees. We could not get anyone to resolve the matter, so we reverted to the regular monthly payment. Since then they have held all of the payments in suspense and have reported that we are in arrears on the mortgage. We have made several more contacts to Bank of America to have this situation resolved, but to no avail. We are in the process of selling this property and now fear that when the mortgage is paid off, that Bank of America will collect hundreds of dollars of late fees and interest that are not justified. In addition, this situation is affecting our credit rating. We would like assistance in dealing with the bank. Surely there must be laws to protect us in this matter.

We have followed and official complaint with the Office of the Comptroller of the Currencey. I urge any other consumers who have experience this outrage to file a complaint.

The complaint has been investigated and resolved to the customer’s satisfaction.

BofA made an alleged $38 BILLION in overage fees. This bank should be investigated as they are pure evil and the "higher ups" (with low brow attitudes) who work for them, opportunists!

mortgage hassles

Hi, I am haveing the run around with B of A. I have 2 mortgages with BofA.. In Oct., 2009 I wrote I cheq for both Loans, wilth BOTH loan #s on the cheq. It was applied to one mortgage.

I got a call late October from a cdebt collector, stating my account was deliquent. On calling B of A, I was told that the entire amount was applied to ONE mortgage.I was assured that this was corrected . This was Oct. 26th. On Oct., 28th something unexplained happened, even Bof A cant explain. My payment was REVERSED with no trace of where it went to.

Thus showing that one of my mortgages did not get a payment in October. My Nov payment was applied to Oct, Dec payment to Nov, and Jan to Dec, hence still 1 month late and paying late fees.

Talking to Bof A, you get a new person each time. On Jan 6th., had a manager that I talked to, and she asked me to call her Jan 15th, to see if rectified. Left her 6 messages since then, no response...My phone # [protected] for details. Please help me...Thank you Ash Sharma

The complaint has been investigated and resolved to the customer’s satisfaction.

I can totally relate. BOA has auctually lost payments that I made to the Bank for my mortgage and said I auctually never made them. I am trying to find a lawyer right now to help me get out of this mess! BOA states that to reinstate my loan that I nned to make the lost payments and their legal fees. This is all after I faxed them all of the documentation from my main bank " Chase " showing I made these payments! This Bank is BAD NEWS !

Brian

mortgage division

I have a mortgage which was purchased byBank of America in August, 2009. Original mortgage was by Taylor Bean of Ocala, Fl. August, 2008. In March of 2009 Taylor Bean had decided I did not have home owners insurance. So when they paid the Real Estate Taxes they took out a policy for $2600. I caught this end of May called Taylor Bean, kept the rep on the phone and faxed a copy of the home owners policy showing that the policy was paid at time of purchase of the home August 2008-August 2009. Oh Ms Vanwinkle we will fix this. So sorry. Well in August the bill still showed that amount out of my escrow, which was causing escrow shortage. I also received a letter from Bank of America saying welcome we have purchased your mortgage. It has been a nightmare. My payment had went up from $1532 a month to over $1800. Can't afford this So I have been paying what I was paying Taylor Bean every month. In September I faxed them info on the insurance problem. I was told it could take 120 days. Well in October I noticed on my escrow from Bank of America they had replaced the amount due on Real Estate taxes from $2500 to over $5000. They couldn't explain where that came from. I called them 3 different times and gave them the correct amount $2600. In Sept I spoke with a guy name Tim Kzencki who was in the process of doing an FHA streamline loan Never got any paper work from him. I assume he no longer works there. Spoke to a guy in the refinance dept. in November. and he was rude. Basically Ms. Vanwinkle there is nothing we can do to help you. We just service the loans. You have to be with us for a year and even if we did you would have to bring $4000 to the table. There is nothing we can do. Then I finally talked to a gal in escrow a couple of weeks ago named Tabitha who actually other than the folks in India that call and see when you are paying that was nice. And actually acted like she wanted to help. She put in 2 works orders to reinvestigate things. Last week I was told that my December payment was not paid in full, which it was, but the problem was my August payment wasn't showing up, so I faxed them a copy of my payment made to Taylor Bean for the payment. What more do I have to do. You know as a tax payer, my and your money bailed them out and paid their ceo millions of dollars in bonuses, which should have never happened. So technically, we as tax payers are part owners of Bank of America. I will not lose my home. In my opinion, those ceos should take those bonuses that they don't even need and use the money to help people who are losing their homes. Gee would that not be a noble thing to do. But no F the American people. Sorry about the F word, but just seems appropriate. Thanks for listening.

The complaint has been investigated and resolved to the customer’s satisfaction.

hold on payroll check

On jan o9-2010 i opened a account with this bank and cashed my payroll check no prblem. I have my temp atm card and permant card on the way. on jan 13 2010 i made a deposit in to ther atm at 19:33 hrs is said that $104.49 is Available on that $1000.00 is on hold untill jan 21 2010. on jan 14th i call the bank and the said to have my pay roll office call...

Read full review of Bank of Americaunauthorized ach transaction

Bank of America did a $600. unauthorized ACH withdrawal from my bank account. This occurred on 1-8-10 and has caused my bank account to be severely overdrawn with a total of $148. in NSF fees so far. I have been fighting with Bank of America for 3 days to return the money to my account and pay the NSF fees. Even though Bank of America admits they made the unauthorized withdrawal, which as far as I am concerned is a fraudulent transaction, their process to return the money to my account can take up to 72 business hours. January 18th is a banking holiday, so I'm looking at first seeing my money sometime around the 20th. That translates to 12 days of my bank account being wiped out as a result of Bank of America's "error". Reimbursement of the NSF fees can take up to 4-6 weeks. What is even more revolting is when I went to my bank to see what they could do and the bank manager said she sees this type of thing all the time with Bank of America. Is Bank of America running a scam and processing fraudulent transactions so they can make interest money off of their customers money?

The complaint has been investigated and resolved to the customer’s satisfaction.

Blame.

People are unbelievable. They don't want to pay obligations and blaim a bank when money is deducted. Smh

i am not agree as of july, august chargefrom my acount, wich they got $207.60

i am not autorizing get from my acount to get as of july.august credit back my acount wich is $207 16

I put a stop payment for ACH in the amount of $80 and $168. They told me that it would cost me $30 in which I paid. they said although it is 2 transactions for same company not to worry. 3 days later $168 was taken from my account along with a NSF of $35. I then called the claims dept. and said to file a complaint and that they were sorry for this should have not happened but in the meantime they would credit my account the $30 in which I did. 2 days later $80 was taken from my account. I am filing a complaint tomorrow but since when does BOA return funds that allowed to be taken out of account when I signed a waiver not to have an overdraft policy in the first place and paid for a stop payment fee. Claims department also told me that that they are not suppose to tell customers that a ACH stop payment is not guarenteed but yet they will not tell you that at time receiving there $30 fee.

gkenigmatic, the bank claims that this impossible. The say nothing can be done with the transaction while it is processing. I was litterally on the phone all day yesterday and made no progress, the situations is still not resolved.

I am curious if anyone was successful with a lawsuite, my ACH was for $555 and I too have made every attempt to resolve this staying on the phone all day today, now being told that the transaction is in processing even though my account is overdrawn because of it, which means they cannot stop payment or move forward with the dispute until it actually "posts to my account"...go figure another way to earn od fees from a mistake on their part. Is there no accountability anywhere in the banking or credit card industry? Because of these types of mistakes my small business is barely hanging on...

So sick of this...

JFair, I am interested in the class action suit. BOA Credit Card keeps taking my full CC balance from my checking account balance to pay off my full balance on my credit card (even if the money isn't there). I switched to minimum payment over the phone and they did it again! The second time I recorded the phone call (notified them as well that the call was being recorded) and they stated that they would reimburse my account... But they never did. We are talking about a $5, 000 dollar unauthorized ACH. They have a done it twice and it has over drawn my checking account to pay the credit card account.

http://www.gregorygarver.com/boa-credit-card-rip-off.html

I have banked with Bank of America for years and they are pretty good; however their credit card department is awful in my opinion. It has been over a week and they have not returned my money. I was forced to file an unauthorized ACH. Next step is court...

I just had a strange situation occur in which my B of A credit card transferred $100. to my personal checking account called (Overdraft Protection) in which the amount was not enough, therefore being hit with the $35. overdraft fee any way. I canceled this so called service almost a year ago and have not seen a transfer from my credit card to my checking account since August of 2009 until a few days ago. Meanwhile, since August of 09, I have accumulated at least a couple of $35. overdraft charges a month from my checking account with no so called (Overdraft Protection) from my credit card. "Very fishy!" I am currently waiting an explanation from an investigation that they are doing at this time. If this has happened to anyone else, I would appreciate hearing about it.

I had the exact same thing happen to me, and it's been 8 days. They still have yet to refund it and keep telling me they are working on it. I have no idea why the FDIC regulations don't apply to them. I'm filing a class action suit if you are interested please contact me.

Failure to resolve Dispute

Fia Card Services has fail to resolve my dispute

in a Timely manner. I had a Scammer/Fraud change.

I called to inform them and they sent me the forms.

I filled the forms out and returned. A week Later they send More forms. I again filled out the forms. A week

Later they sent me more forms. For Third time i sent

in forms and i continue to wait for them to resolve my dispute. When i call i get excuses and nonsense form these people. Please dont do business with this company and wish me good luck in my situation.

The complaint has been investigated and resolved to the customer’s satisfaction.

altering transaction dates to create overdrafts

Two months go Bank of America took $270 in overdraft fees when I was showing a positive balance. When I called them on this they reluctantly refunded the fees and informed me that 2 more were inbound that morning which a supervisor had to intercept. Last month when I was hit with three more fees I wasn't as lucky. I was overdrawn by $15 and deposited the money the next day. But I was too late. Because the deposit was made on a Saturday it didn't count. My purchases were made on a Thursday and Friday. 3 of them in the neighborhood of about $20 and a 4th for around $60. By keeping transactions in the "pending" purgatory they can clear the in any way they choose. The $60 transaction was cleared first (even though it was the last) so that the other three wouldn't clear and they got 3 overdraft fees instead of one.

I told Customer Service to remove the Overdraft Protection from my account. That if there wasn't enough money in my account when I used my debit card then just decline the transaction. Things were fine until about a week after Christmas. What they did (and are still doing) is such a convoluted mess that I have no idea how to sort it out. On three different days I transferred money from my savings to checking to cover purchases I was going to make. Two or three days after I made the 3rd transfer all 3 disappeared and were replaced by something called a "Misc. Adjustment" with that day's date, effectively taking away the funds I put there so that my purchases hadn't been covered and costing me a slew of overdraft charges. The strangest thing yet is that everyday, transactions would be rearranged from the day before and costing me even more in overdraft fees.

To date they are showing that I am over $1500 overdrawn with the lion's share of this being their overdraft fees. The way everything has been rearranged in their records doesn't even come close to the true dates, and it seems to change everyday! . I also have a deposit of $250 that's completely vanished. And you what? I don't know what to do about this.

Yeah, I'm pretty tired of stupid too. So let me explain it so even you can understand it. On three different days I transferred funds from SAVINGS to CHECKING for purchases I would be making THAT day. Are you still with me? I made my purchases with my check card and they were all approved. I checked my online account each day and my 3 money transfers were all there. But my PURCHASES were still PENDING. They shouldn't have been. The money was sitting there in the clear and in plain sight! Now stay with me, this might get complicated for you. On the FOURTH day all 3 money transfers I had made had vanished, but were replaced by a single transaction that equaled the total of the 3 money transfers. The problem was it had THAT DAY'S DATE and my purchases had moved out of the "pending" section to the "paid" section but with the PREVIOUS DAY'S DATE as the transaction date! So, all those purchases I had covered now qualified for the coveted Overdraft Protection Fee. Now, would someone please explain to me how I spent money I didn't have? Oh, I wound up doing so later. When my monthly automatic payments for little things like the phone and gas came in and there wasn't enough moneyin the account because Bank of America took it...to the tune of nearly $400. Remember, it's $35 per item regardless of the amount of purchase. And, of course, my autopayments got Overdraft fees of their own. It has now snowballed into a huge mess and I've filed a complaint with the BBB and Federal regulators.

If you're going to comment on someone's post, you should at least know what you're talking about.

The complaint has been investigated and resolved to the customer’s satisfaction.

I know what you are talking about and Bank of America is ridiculous. I had a payment go through on the wrong date and I saw that it was happening, so I went to put cash in. I had an item pending on the 21st, deposited cash to cover everything on the 21st, and then on the 22nd they showed the item as going through on the 20th. They deny any knowledge of pending on the 21st. They DO change dates. The person commenting is ridiculous. There are shady practices going on... think about it!

NON - PERFORMANCE

SHORT SALE NIGHTMARE...

21 LONG MONTHS ( TWENTY ONE MONTHS )

I HAVE LOGGED IN AS OF TODAY 320 PHONE CALLS

HOW LONG DOES A SHORT SALE TAKE ?

HERE'S SOME NAMES OF NEGOTIATORS AND THEIR MANAGERS THAT I HAVE DEALT WITH. ( soooo far )

JAMES GILL

PATRICIA ANGEL

MARK ZIKRY

ANTHONY MARTINEZ

JOHN CARNAHAN

CRYSTAL POELKING

ROCIO VALENZUELA

CHARLES WILLIAMS

LOU ESTRADA

DAVIN BANKS

LESLIE HILL

JOEL DAVIDSON

DONALD HUGHES

KATIE TAYLOR

MELISSA RAMEREZ

RHONDA BURKETT

MARICELA VIRAMONTES

THIS IN MY OPINION ...IS ABSOLUTELY PATHETIC !

DOES ANYONE FROM THIS COMPANY CARE ?

I WOULD LOVE TO FIND OUT ... TO WHOM ARE THE BANKS ARE ACCOUNTABLE ?

( any comments appreciated to : [protected]@AOL.COM )

The complaint has been investigated and resolved to the customer’s satisfaction.

Bank of America Reviews 0

If you represent Bank of America, take charge of your business profile by claiming it and stay informed about any new reviews or complaints submitted.

About Bank of America

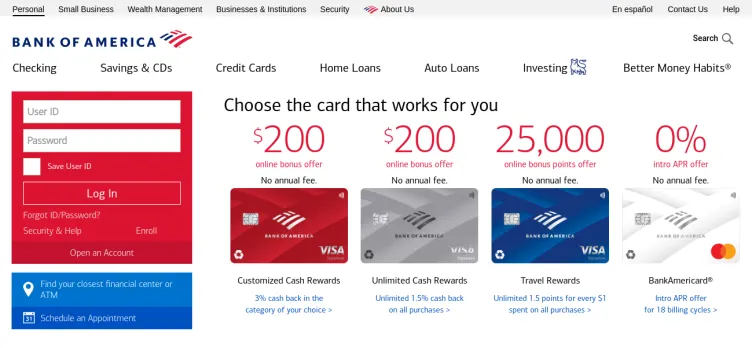

One of the key strengths of Bank of America is its commitment to innovation and technology. The bank has invested heavily in digital platforms and mobile banking, making it easier than ever for customers to manage their finances on the go. With features like mobile check deposit, online bill pay, and real-time account alerts, Bank of America is at the forefront of the digital banking revolution.

In addition to its digital offerings, Bank of America also has a strong network of physical branches and ATMs. With thousands of locations across the country, customers can easily access their accounts and get help from knowledgeable staff members whenever they need it.

Another key advantage of Bank of America is its wide range of financial products and services. From checking and savings accounts to credit cards, loans, and investment products, the bank offers something for everyone. Whether you're looking to save for the future, buy a home, or invest in the stock market, Bank of America has the tools and resources you need to achieve your financial goals.

Overall, Bank of America is a trusted and reliable financial institution that has been serving customers for over a century. With its commitment to innovation, technology, and customer service, the bank is well-positioned to continue to meet the evolving needs of its customers for many years to come.

1. Log in or create an account: Ensure you are logged in to your ComplaintsBoard.com account to proceed. If you do not have an account, please register by providing the necessary information and verifying your email address.

2. Navigating to the complaint form: Once logged in, locate the 'File a Complaint' button situated at the top right corner of the website and click on it to access the complaint form.

3. Writing the title: In the 'Complaint Title' field, concisely summarize the main issue you have encountered with Bank of America. Make it specific and clear, such as "Unauthorized Overdraft Fees" or "Difficulty with Mortgage Loan Modification".

4. Detailing the experience: In the complaint description, provide a detailed account of your experience. Include key areas such as customer service interactions, problems with account management, loan servicing, fees or charges that were unexpected, issues with online banking, or any other specific incidents related to Bank of America. Clearly describe the nature of the issue, including dates, locations, and any relevant transaction details. If you attempted to resolve the issue, outline the steps you took and the responses received from Bank of America. Explain how this issue has personally affected you, such as financial loss or stress.

5. Attaching supporting documents: Attach any relevant documents that support your complaint, such as correspondence, statements, or receipts. Be cautious not to include sensitive personal information like your social security number or full account numbers.

6. Filling optional fields: Use the 'Claimed Loss' field to quantify any financial losses you have incurred due to the issue. In the 'Desired Outcome' field, describe what resolution you are seeking from Bank of America, whether it be a refund, apology, or corrective action.

7. Review before submission: Carefully review your complaint for clarity, accuracy, and completeness. Ensure that all the information provided is true to your knowledge and that your desired outcome is reasonable and clearly stated.

8. Submission process: After reviewing your complaint, click on the 'Submit' button to officially file your complaint on ComplaintsBoard.com.

9. Post-Submission Actions: Keep an eye on your ComplaintsBoard.com account for any responses or updates regarding your complaint. Be prepared to engage in further communication if necessary to resolve your issue with Bank of America.

Overview of Bank of America complaint handling

-

Bank of America Contacts

-

Bank of America phone numbers+1 (800) 432-1000+1 (800) 432-1000Click up if you have successfully reached Bank of America by calling +1 (800) 432-1000 phone number 8 8 users reported that they have successfully reached Bank of America by calling +1 (800) 432-1000 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number 3 3 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number45%Confidence scoreEnglish+1 (800) 688-6086+1 (800) 688-6086Click up if you have successfully reached Bank of America by calling +1 (800) 688-6086 phone number 16 16 users reported that they have successfully reached Bank of America by calling +1 (800) 688-6086 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number 1 1 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number88%Confidence scoreSpanish+1 (315) 724-4022+1 (315) 724-4022Click up if you have successfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (315) 724-4022 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone numberInternational+1 (757) 677-4701+1 (757) 677-4701Click up if you have successfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (757) 677-4701 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone numberCredit Card Issues+1 (800) 214-6084+1 (800) 214-6084Click up if you have successfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (800) 214-6084 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone numberVice President Bank+1 (312) 992-6618+1 (312) 992-6618Click up if you have successfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (312) 992-6618 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number

-

Bank of America emailssupport@bankofamerica.com100%Confidence score: 100%Support

-

Bank of America address100 N Tryon St., Charlotte, New York, 28255, United States

-

Bank of America social media

-

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreNov 09, 2024

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreNov 09, 2024

Most discussed complaints

pmi remove problemRecent comments about Bank of America company

ATM security firm illegal in nycOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.

I HAVE A HOME LOAN WITH FORMER CONTRY WIDE HOME LOAS:NOW BANK OF AMERICA. ABOUT 2 MONTH AGO, BANK OF AMERICA OFFERS CALL ME TO TELL ME THAT: I WAS PRE-QUALIFIED FOR THE OBAMA PROGRAM(MHAP) THAT I SHOULD TAKE ADVANTAGE OF IT. 3 DAYS LATER I RECEIVED THE FULL PACKAGE FILLOUT AND SEND BACK TO THEM IN THE SPECIFIED TIME THEY TELL ME, INCLUDING ALL THE DOCUMENTS THAT I SHOULD INCLUDE, INCLUDING MY FIRST OF 3 TRIAL PAYMENTS. AS FOLLOWS: 11/01/09, 12/01/09 AND 1/01/10. THEY RECEIVED MY FIRT PAYMENT AND DOCUMENTATION ON 10/26/09. BUT THEY NEVER CHANGE A SALE DATE ON MY HOME POSTED FOR 11/13/09. THAT DAY COME ON AND BANK OF AMERICA SOLD MY HOME. AFTER ALL DOCUMENTATION AND FIRST PAYMENT WAS SUMITED. SINCE THAT DAY I HAVE TALK TO SO MANY DIFFERENT PEOPLE IN DIFFERENT DEPTS.OF BANK OF AMERICA, TO FIND ONLY CONFUSION AND IGNORANT PEOPLE THAT THEY TELL ME DIFFERENT STORIES, PROMISES TO FIX THE PROBLEM, WITHOUT RESULTS UNTIL TODAY. YESTERDAY 11/09/09, I RECEIVE THE EVICTION LETTER FROM THE LAW OFFICE THAT WAS IN CHARGE OF SELLING MY HOME, IN COMPLETE VIOLATION OF "THE MAKING HOME AFFORABLE PROGRAM" IF ANYBODY KNOWS HOW TO GET HELP LET ME KNOW: JORGEALASCANOAS@AOL.COM